Data warehouse-as-a-service Snowflake (NYSE:SNOW) announced better-than-expected results in Q1 CY2024, with revenue up 32.9% year on year to $828.7 million. It made a non-GAAP profit of $0.14 per share, down from its profit of $0.15 per share in the same quarter last year.

Is now the time to buy Snowflake? Find out by accessing our full research report, it's free.

Snowflake (SNOW) Q1 CY2024 Highlights:

- Revenue: $828.7 million vs analyst estimates of $785.9 million (5.4% beat)

- EPS (non-GAAP): $0.14 vs analyst expectations of $0.17 (19.7% miss)

- Product Revenue Guidance for Q2 CY2024 is $807.5 million at the midpoint

- Gross Margin (GAAP): 67.1%, up from 66.4% in the same quarter last year

- Free Cash Flow of $331.5 million, similar to the previous quarter

- Net Revenue Retention Rate: 128%, down from 131% in the previous quarter

- Remaining Performance Obligations: $5.0 billion, up 46% year on year

- Market Capitalization: $54.34 billion

“We finished our first quarter with strong performance across many of our key metrics,” said Sridhar Ramaswamy, CEO, Snowflake.

Founded in 2013 by three French engineers who spent decades working for Oracle, Snowflake (NYSE:SNOW) provides a data warehouse-as-a-service in the cloud that allows companies to store large amounts of data and analyze it in real time.

Data Storage

Data is the lifeblood of the internet and software in general, and the amount of data created is accelerating. As a result, the importance of storing the data in scalable and efficient formats continues to rise, especially as its diversity and associated use cases expand from analyzing simple, structured datasets to high-scale processing of unstructured data such as images, audio, and video.

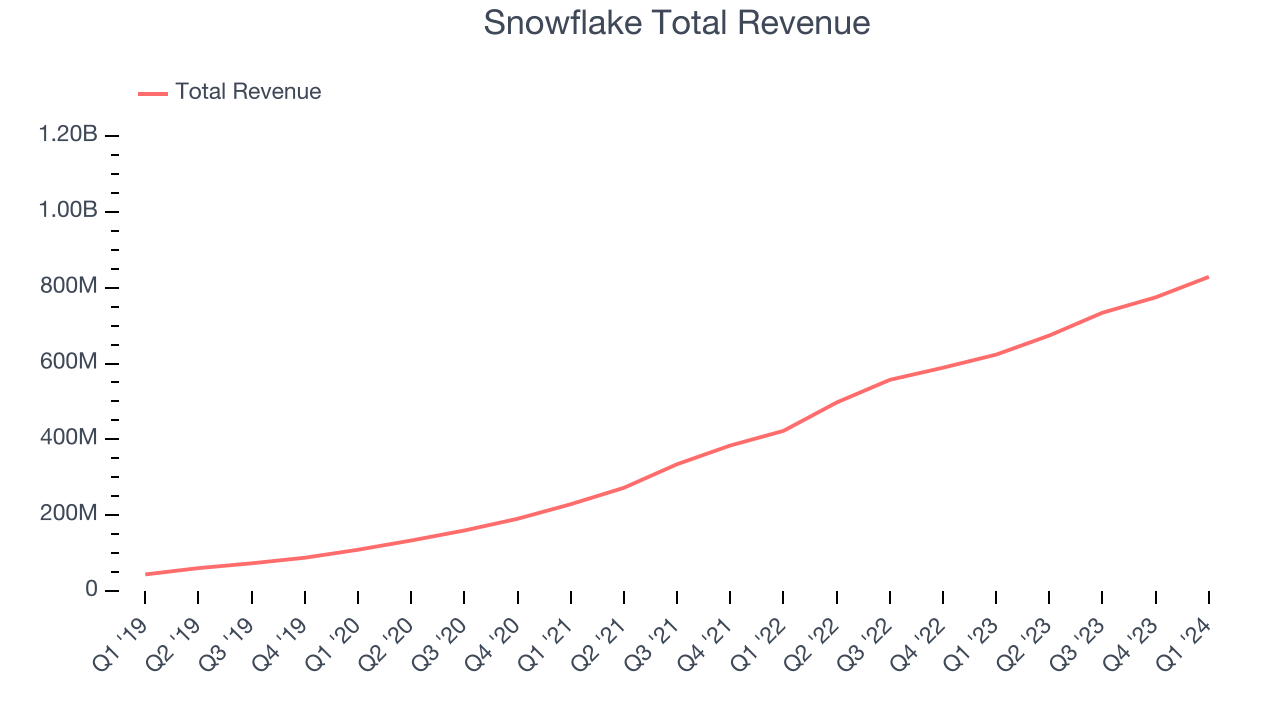

Sales Growth

As you can see below, Snowflake's revenue growth has been incredible over the last three years, growing from $228.9 million in Q1 2022 to $828.7 million this quarter.

Unsurprisingly, this was another great quarter for Snowflake with revenue up 32.9% year on year. On top of that, its revenue increased $54.01 million quarter on quarter, a very strong improvement from the $40.53 million increase in Q4 CY2023. This is a sign of acceleration of growth and great to see.

Looking ahead, analysts covering the company were expecting sales to grow 19.8% over the next 12 months before the earnings results announcement.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

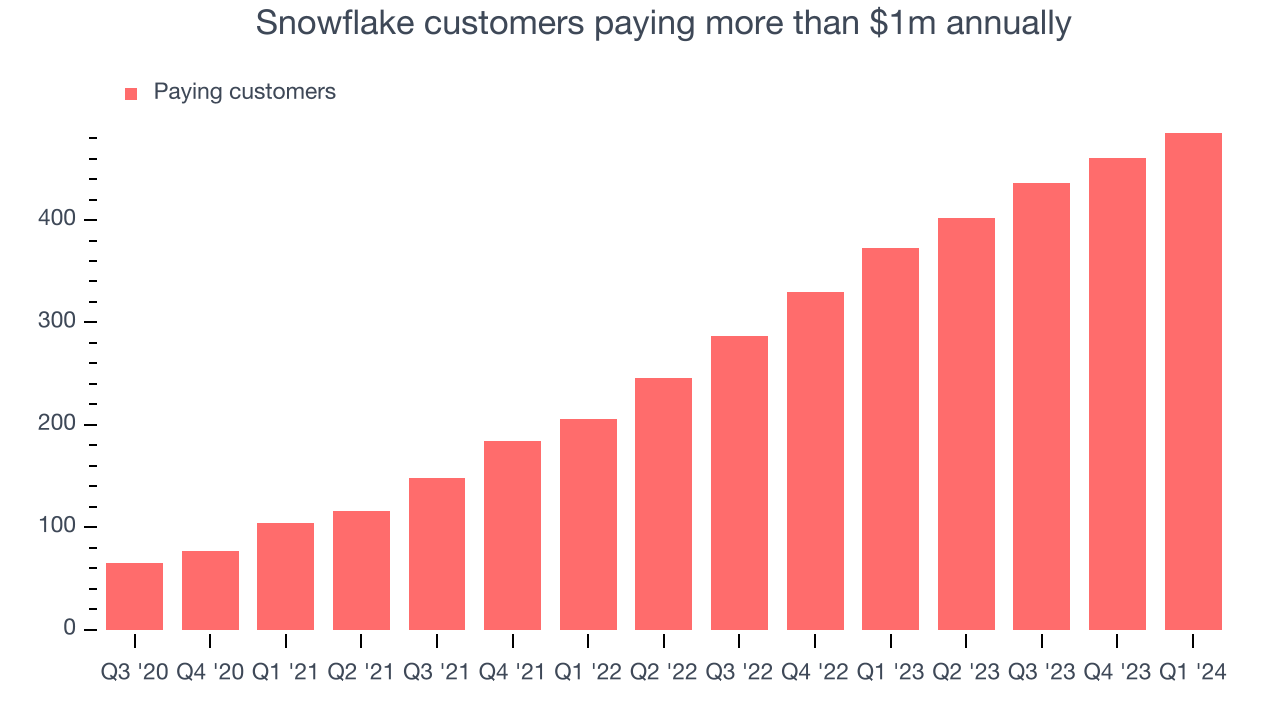

Large Customers Growth

This quarter, Snowflake reported 485 enterprise customers paying more than $1m annually, an increase of 24 from the previous quarter. That's in line with the number of contracts wins in the last quarter but quite a bit below what we've typically observed over the last year, suggesting that the sales slowdown we observed in the last quarter could continue.

Key Takeaways from Snowflake's Q1 Results

We enjoyed seeing Snowflake exceed analysts' revenue, net revenue retention, and RPO expectations this quarter. It also added more new customers than anticipated. These factors are sending the stock price up, especially because market sentiment was negative going into the quarter; there was high uncertainty regarding demand after last quarter's results because the company changed its CEO and issued weak guidance. The company's updated full-year guidance easily cleared analysts' estimates, calming fears of a softer spending environment. Overall, this was a good quarter for Snowflake. The stock is up 7.3% after reporting and currently trades at $175.17 per share.

So should you invest in Snowflake right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.