Data warehouse-as-a-service Snowflake (NYSE:SNOW) reported results ahead of analysts' expectations in Q2 FY2024, with revenue up 35.5% year on year to $674 million. The company reconfirmed its revenue and operating margin guidance for the full year. Snowflake made a GAAP loss of $227.3 million, down from its loss of $222.8 million in the same quarter last year.

Is now the time to buy Snowflake? Find out by accessing our full research report, it's free.

Snowflake (SNOW) Q2 FY2024 Highlights:

- Revenue: $674 million vs analyst estimates of $662.3 million (1.77% beat)

- EPS (non-GAAP): $0.22 vs analyst estimates of $0.10 ($0.12 beat)

- Product Revenue Guidance for Q3 2024 is $672.5 million at the midpoint

- Net Revenue Retention Rate: 142%, down from 151% in the previous quarter

- Gross Margin (GAAP): 67.6%, up from 65.2% in the same quarter last year

“During Q2, product revenue grew 37% year-over-year to $640 million. Our non-GAAP adjusted free cash flow was $88 million, representing 50% year-over-year growth,” said Frank Slootman, Chairman and CEO, Snowflake.

Founded in 2013 by three French engineers who spent decades working for Oracle, Snowflake (NYSE:SNOW) provides a data warehouse-as-a-service in the cloud that allows companies to store large amounts of data and analyze it in real time.

Data is the lifeblood of the internet and software in general, and the amount of data created is growing at an accelerating pace. Likewise, the importance of storing the data in scalable and efficient formats continues to rise, especially as the diversity of the data and associated use cases expand from analyzing simple, structured data to high-scale processing of unstructured data, images, audio and video.

Sales Growth

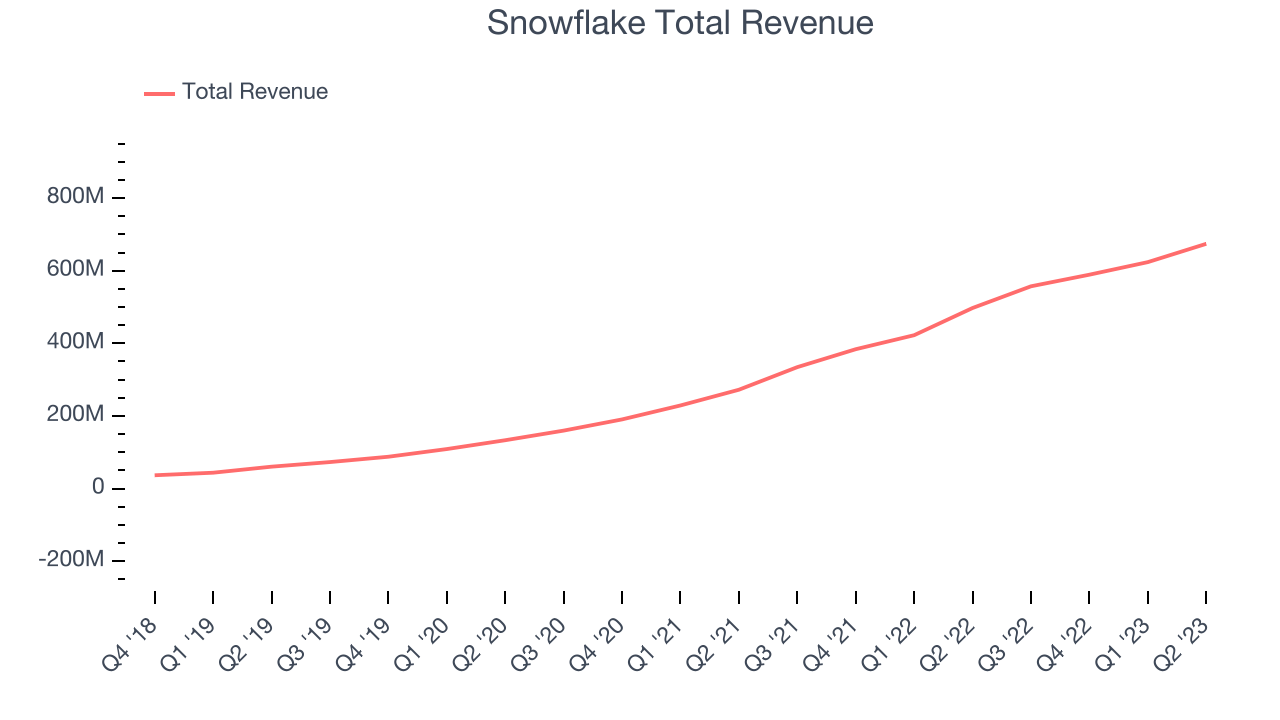

As you can see below, Snowflake's revenue growth has been incredible over the last two years, growing from $272.2 million in Q2 FY2022 to $674 million this quarter.

Unsurprisingly, this was another great quarter for Snowflake with revenue up 35.5% year on year. On top of that, its revenue increased $50.4 million quarter on quarter, a very strong improvement from the $34.6 million increase in Q1 2024. This is a sign of re-acceleration of growth and great to see.

Looking ahead, analysts covering the company were expecting sales to grow 29.4% over the next 12 months before the earnings results announcement.

The pandemic fundamentally changed several consumer habits. There is a founder-led company that is massively benefiting from this shift. The business has grown astonishingly fast, with 40%+ free cash flow margins. Its fundamentals are undoubtedly best-in-class. Still, the total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

Large Customers Growth

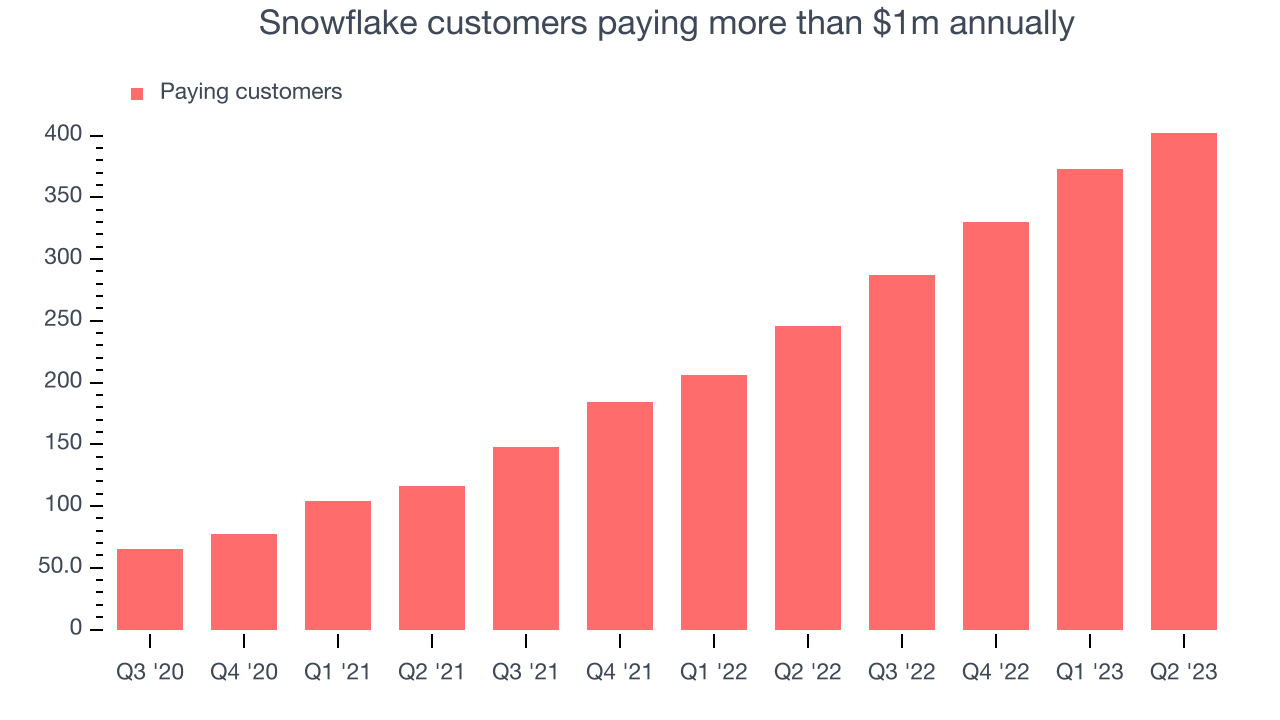

This quarter, Snowflake reported 402 enterprise customers paying more than $1m annually, an increase of 29 from the previous quarter. That's a bit fewer contract wins than last quarter but about the same as what we've typically seen over the last year, suggesting that the company still has decent sales momentum despite the weaker quarter.

Key Takeaways from Snowflake's Q2 Results

With a market capitalization of $49.7 billion, a $3.75 billion cash balance, and positive free cash flow over the last 12 months, we're confident that Snowflake has the resources needed to pursue a high-growth business strategy.

It was great to see Snowflake improve its gross margin this quarter. We were also happy that its revenue narrowly outperformed Wall Street's estimates, driven by better-than-expected net revenue retention and an increase in Forbes Global 2000 customers. On the other hand, its net revenue retention did fall (despite beating estimates). Overall, the results could have been better. The stock is flat after reporting and currently trades at $154.31 per share.

Snowflake may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned in this report.