Data warehouse-as-a-service Snowflake (NYSE:SNOW) reported Q4 FY2024 results exceeding Wall Street analysts' expectations, with revenue up 31.5% year on year to $774.7 million. It made a non-GAAP profit of $0.35 per share, improving from its profit of $0.13 per share in the same quarter last year.

Snowflake (SNOW) Q4 FY2024 Highlights:

- Revenue: $774.7 million vs analyst estimates of $759.6 million (2% beat)

- EPS (non-GAAP): $0.35 vs analyst estimates of $0.18 ($0.17 beat)

- Product Revenue Guidance for Q1 2025 is $747.5 million at the midpoint (vs analysts' estimates of $770.1 million)

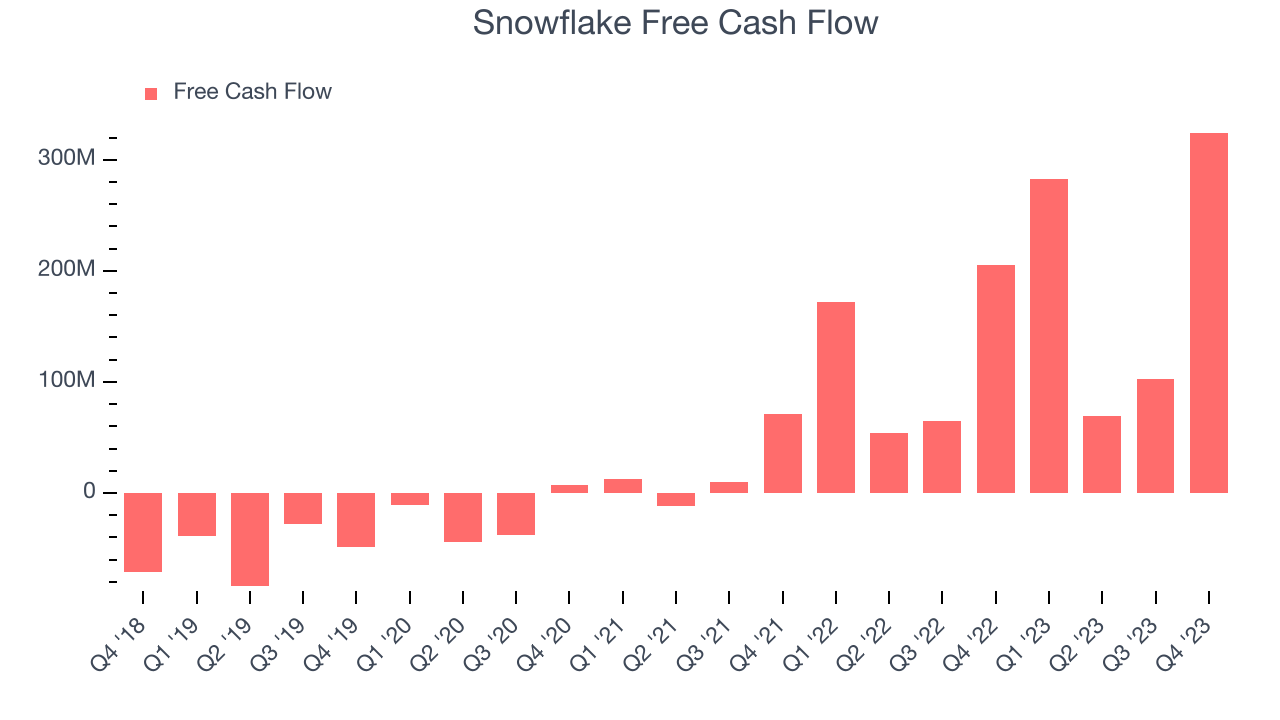

- Free Cash Flow of $324.5 million, up from $102.3 million in the previous quarter

- Net Revenue Retention Rate: 131%, down from 135% in the previous quarter

- Gross Margin (GAAP): 68.8%, up from 65.1% in the same quarter last year

- Market Capitalization: $77.07 billion

Founded in 2013 by three French engineers who spent decades working for Oracle, Snowflake (NYSE:SNOW) provides a data warehouse-as-a-service in the cloud that allows companies to store large amounts of data and analyze it in real time.

The amount of data generated and collected by companies has exploded and so has the need to analyze it, but it is still often stored in incompatible formats, spread across many different types of storages, and with increasing complexity, slow to analyze. Traditional on-premise data warehouses turned out to be quite inefficient, requiring large computing power to deal with the peak demand which not only laid idle large blocks of time, but actually still struggled when a number of requests arrived at the same time.

Snowflake’s cloud platform separates the storage and analysis making it significantly faster, cheaper and easier for their customers to answer data questions, often replacing a number of different systems at once.

Data Storage

Data is the lifeblood of the internet and software in general, and the amount of data created is accelerating. As a result, the importance of storing the data in scalable and efficient formats continues to rise, especially as its diversity and associated use cases expand from analyzing simple, structured datasets to high-scale processing of unstructured data such as images, audio, and video.

Snowflake’s cloud innovation has played a significant role in its market visibility given the level of competition in a market that includes Teradata (NYSE:TDC), Cloudera (NYSE:CLDR), and cloud service providers such as Microsoft (NASDAQ:MSFT), Google, and Amazon (NASDAQ:AMZN).

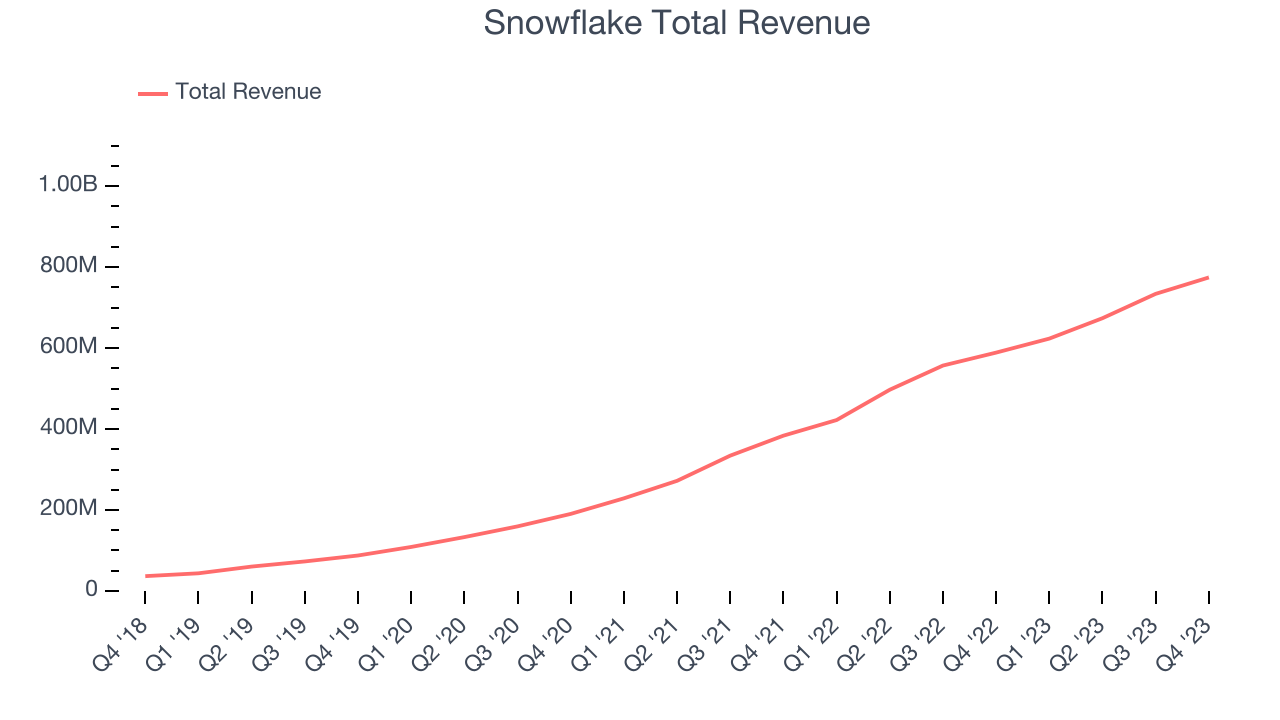

Sales Growth

As you can see below, Snowflake's revenue growth has been exceptional over the last two years, growing from $383.8 million in Q4 FY2022 to $774.7 million this quarter.

Unsurprisingly, this was another great quarter for Snowflake with revenue up 31.5% year on year. However, its growth did slow down compared to last quarter as the company's revenue increased by just $40.53 million in Q4 compared to $60.16 million in Q3 2024. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Product revenue guidance for Q1 2025 came in at $747.5 million at the midpoint, missing analyst estimates.

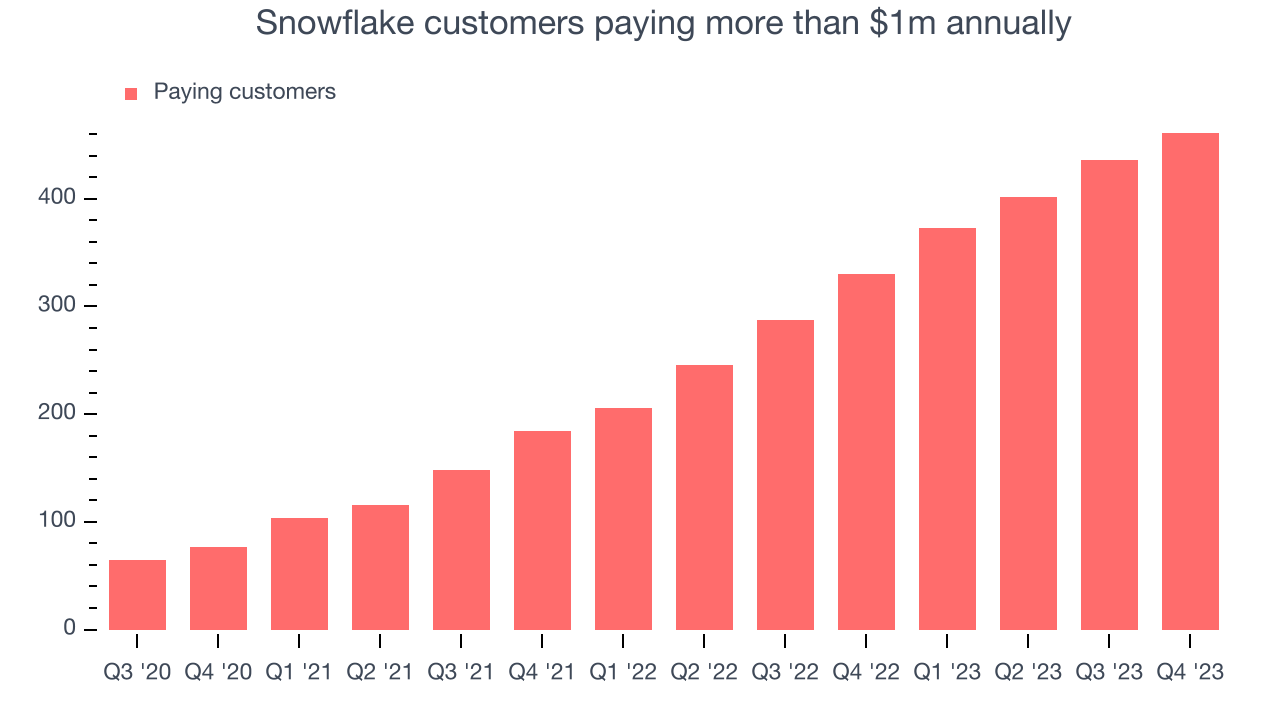

Large Customers Growth

This quarter, Snowflake reported 461 enterprise customers paying more than $1m annually, an increase of 25 from the previous quarter. That's a bit fewer contract wins than last quarter and quite a bit below what we've typically observed over the past four quarters, suggesting that its sales momentum with large customers is slowing.

Product Success

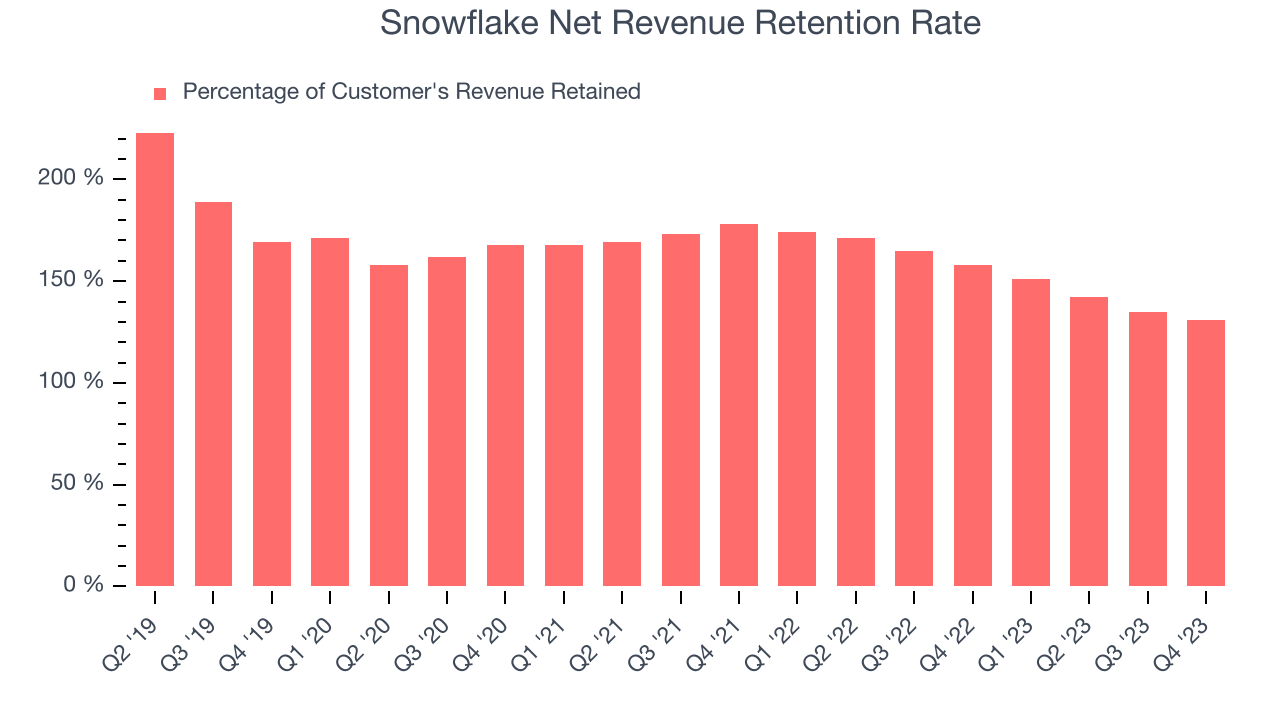

One of the best parts about the software-as-a-service business model (and a reason why SaaS companies trade at such high valuation multiples) is that customers typically spend more on a company's products and services over time.

Snowflake's net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 131% in Q4. This means that even if Snowflake didn't win any new customers over the last 12 months, it would've grown its revenue by 31%.

Despite falling over the last year, Snowflake still has an excellent net retention rate. This data point proves that the company sells useful products, and we can see that its customers are satisfied and increasing usage over time.

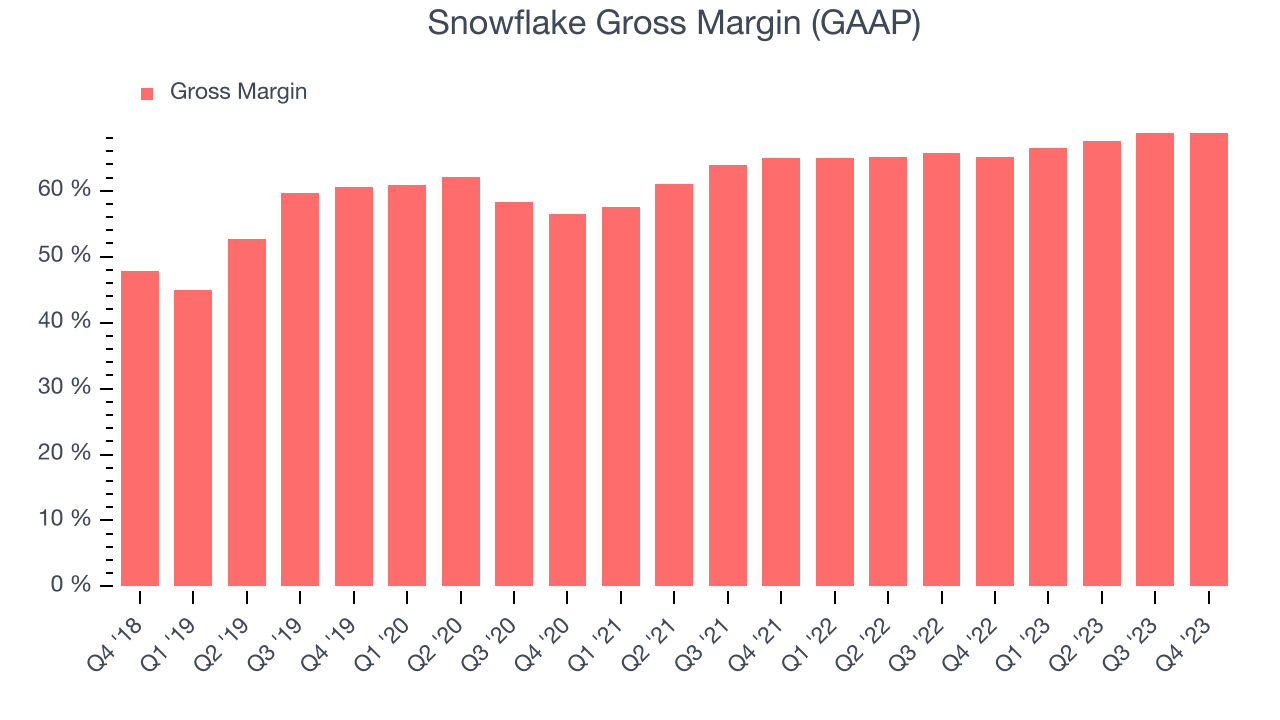

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Snowflake's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 68.8% in Q4.

That means that for every $1 in revenue the company had $0.69 left to spend on developing new products, sales and marketing, and general administrative overhead. Despite trending up over the last year, Snowflake's gross margin is poor for a SaaS business. We have no doubt that shareholders would like to see its improvements continue.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Snowflake's free cash flow came in at $324.5 million in Q4, up 58.1% year on year.

Snowflake has generated $778.9 million in free cash flow over the last 12 months, an eye-popping 27.8% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Key Takeaways from Snowflake's Q4 Results

Snowflake delivered strong free cash flow, while still growing revenue at 30%+, which is certainly an impressive feat. On the other hand, its net revenue retention declined again and product guidance for Q1 missed analysts' estimates. Overall, this quarter's results seemed mixed. The market reacted negatively to the news of CEO Frank Slootman retirin and the stock is down 22.2% after reporting, trading at $178.9 per share.

Is Now The Time?

When considering an investment in Snowflake, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

There are several reasons why we think Snowflake is a great business. While we'd expect growth rates to moderate from here, its . Additionally, its customers are increasing their spending quite quickly, suggesting they love the product, and its bountiful generation of free cash flow empowers it to invest in growth initiatives.

There's no doubt that the market is optimistic about Snowflake's growth prospects, as its price-to-sales ratio based on the next 12 months of 21.0x would suggest. And looking at the tech landscape today, Snowflake's qualities really stand out. We are big fans at this price, even more so considering the company is actually trading at a multiple .

Wall Street analysts covering the company had a one-year price target of $235.50 per share right before these results (compared to the current share price of $178.90), implying they saw upside in buying Snowflake in the short term.

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.