Household products company Spectrum Brands (NYSE:SPB) announced better-than-expected results in Q1 FY2024, with revenue down 3% year on year to $692.2 million. It made a non-GAAP profit of $0.78 per share, improving from its loss of $0.32 per share in the same quarter last year.

Is now the time to buy Spectrum Brands? Find out by accessing our full research report, it's free.

Spectrum Brands (SPB) Q1 FY2024 Highlights:

- Revenue: $692.2 million vs analyst estimates of $673.4 million (2.8% beat)

- EPS (non-GAAP): $0.78 vs analyst estimates of $0.39 (102% beat)

- Maintaining previous guidance for 2024

- Free Cash Flow was -$12.7 million compared to -$528.7 million in the previous quarter

- Gross Margin (GAAP): 35.4%, up from 28.4% in the same quarter last year

- Organic Revenue was down 4.6% year on year

- Market Capitalization: $2.82 billion

“The first quarter of fiscal 24 is an indication that the investments we are making in our people are paying off. Our operations have a very effective sales and operations planning process behind them now, with rigorous rhythm, cadence, and accountability. This is driving much better factory production performance, better operations in our distribution centers leading to higher fill rates and higher customer service levels to our retail partners. We are continuing to focus on fewer, bigger, better innovations and on our commercial operations through added investments in sales and marketing as we seek to restore revenue growth,“ said David Maura, Chairman and Chief Executive Officer of Spectrum Brands.

A leader in multiple consumer product categories, Spectrum Brands (NYSE:SPB) is a diversified company with a portfolio of trusted brands spanning home appliances, garden care, personal care, and pet care.

Household Products

Household products companies engage in the manufacturing, distribution, and sale of goods that maintain and enhance the home environment. This includes cleaning supplies, home improvement tools, kitchenware, small appliances, and home decor items. Companies within this sector must focus on product quality, innovation, and cost efficiency to remain competitive. Household products stocks are generally stable investments, as many of the industry's products are essential for a comfortable and functional living space. Recently, there's been a growing emphasis on eco-friendly and sustainable offerings, reflecting the evolving consumer preferences for environmentally conscious options.

Sales Growth

Spectrum Brands carries some recognizable brands and products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the other hand, Spectrum Brands can still achieve high growth rates because its revenue base is not yet monstrous.

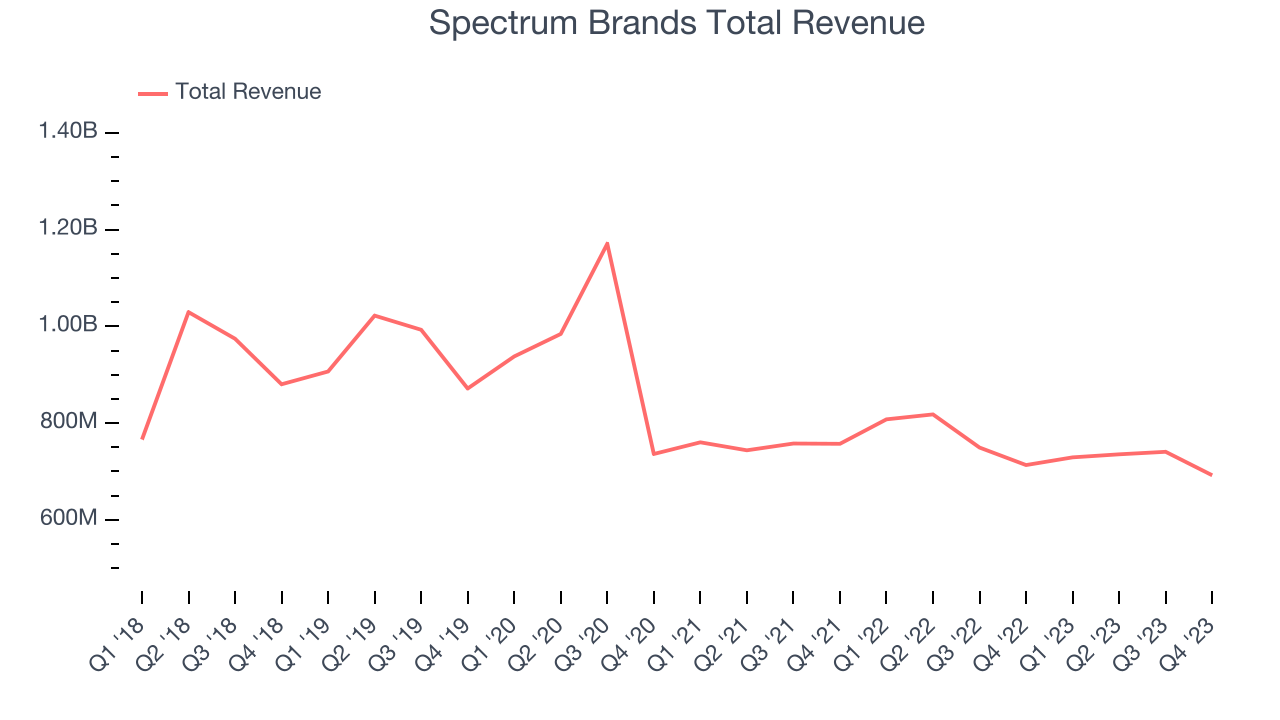

As you can see below, the company's revenue has declined over the last three years, dropping 8.9% annually. This is among the worst in the consumer staples industry, where demand is typically stable.

This quarter, Spectrum Brands's revenue fell 3% year on year to $692.2 million but beat Wall Street's estimates by 2.8%. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

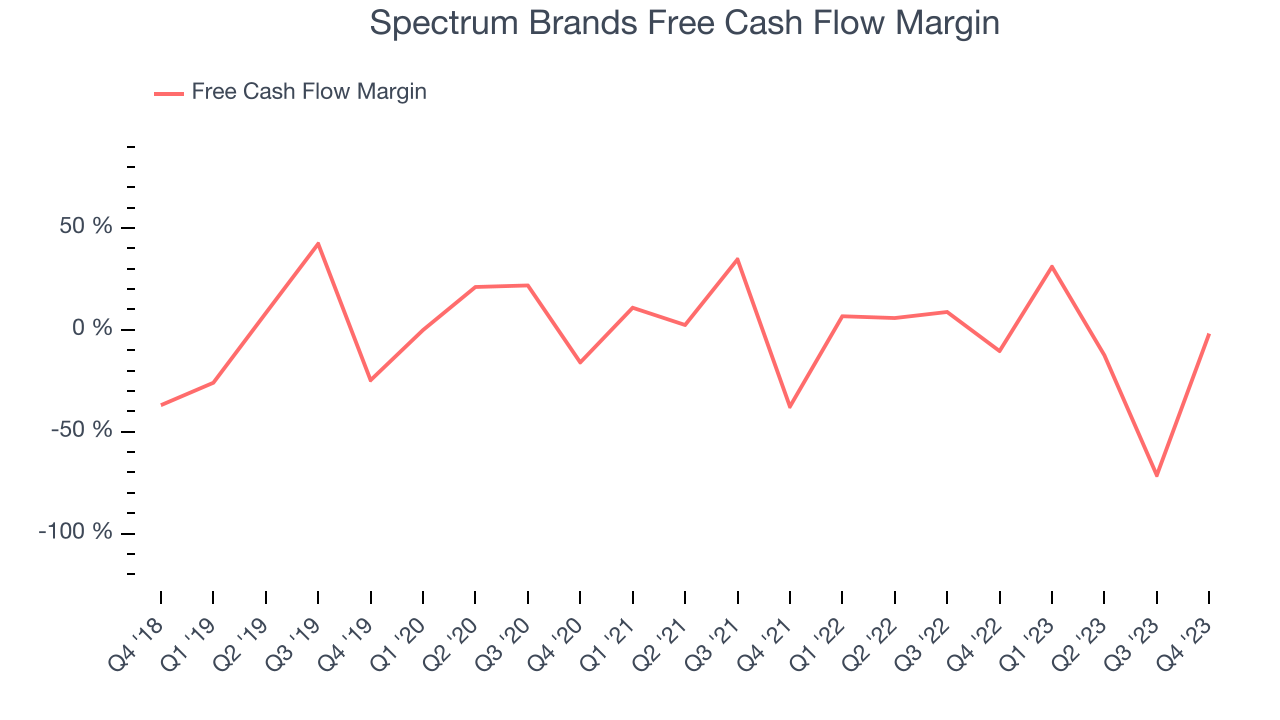

Spectrum Brands burned through $12.7 million of cash in Q1, representing a negative 1.8% free cash flow margin. The company increased its cash burn by 82.9% year on year.

Over the last two years, Spectrum Brands's demanding reinvestment strategy and failure to generate organic revenue growth have drained company resources. Its free cash flow margin has been among the worst in the consumer staples sector, averaging negative 5.5%. Furthermore, its margin has averaged year-on-year declines of 17.1 percentage points over the last 12 months. Its cash profitability could drop even further as Spectrum Brands may try to stimulate organic growth through more investments. We've no doubt shareholders would like to see an improvement soon.

Key Takeaways from Spectrum Brands's Q1 Results

We were impressed by how Spectrum Brands beat on all key line items such as revenue, adjusted EBITDA, operating income, and EPS. While a raise of full year guidance would have been icing on the cake, the company's maintenance of its previous outlook shows that Spectrum Brands is staying on track. Zooming out, we think this was a very solid quarter that should have shareholders pleased. The stock is flat after reporting and currently trades at $79.97 per share.

Spectrum Brands may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.