Household products company Spectrum Brands (NYSE:SPB) beat analysts' expectations in Q1 FY2024, with revenue down 3% year on year to $692.2 million. It made a non-GAAP profit of $0.78 per share, improving from its loss of $0.32 per share in the same quarter last year.

Spectrum Brands (SPB) Q1 FY2024 Highlights:

- Revenue: $692.2 million vs analyst estimates of $673.4 million (2.8% beat)

- EPS (non-GAAP): $0.78 vs analyst estimates of $0.39 (102% beat)

- Maintaining previous guidance for 2024

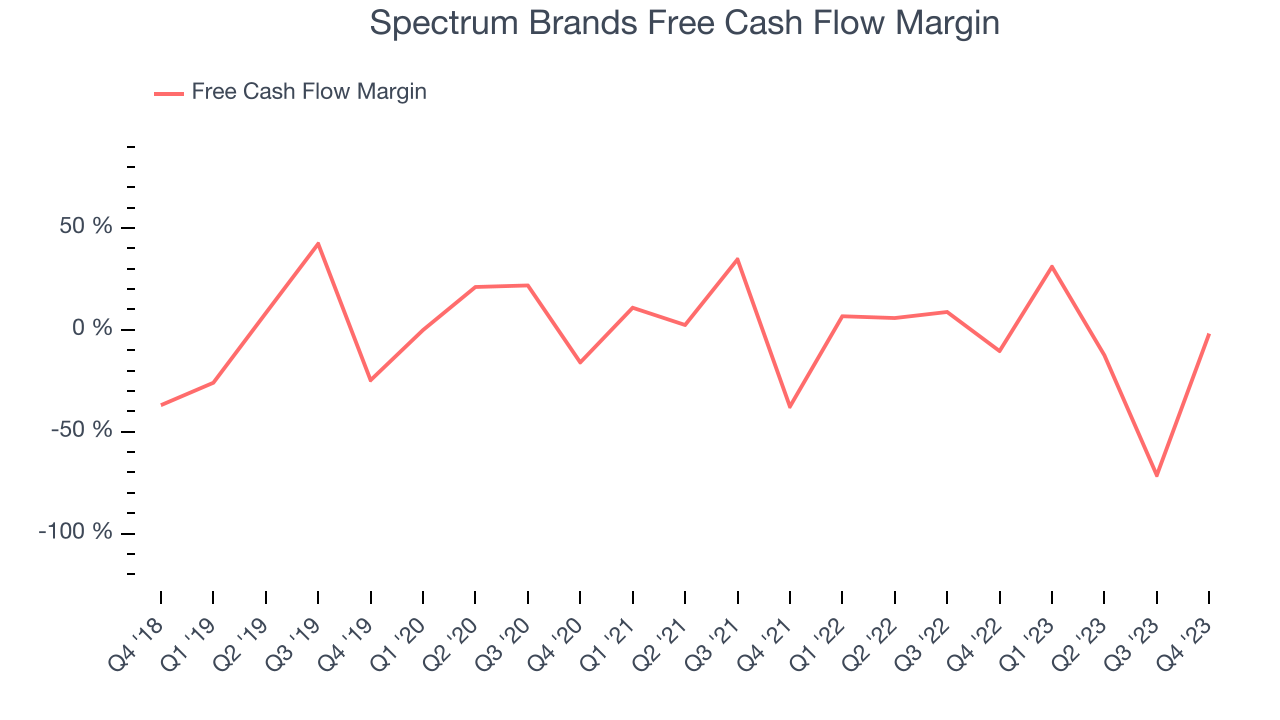

- Free Cash Flow was -$12.7 million compared to -$528.7 million in the previous quarter

- Gross Margin (GAAP): 35.4%, up from 28.4% in the same quarter last year

- Organic Revenue was down 4.6% year on year

- Market Capitalization: $2.82 billion

A leader in multiple consumer product categories, Spectrum Brands (NYSE:SPB) is a diversified company with a portfolio of trusted brands spanning home appliances, garden care, personal care, and pet care.

The company’s history traces back to the early 20th century when it was originally founded as the "U.S. Electrical Manufacturing Company" in 1906, playing a key role in the development of the first electrically lit Christmas tree lights. In 1955, it changed its name to Rayovac Corporation and merged with Spectrum Brands in 2005 to form the company we know today.

Spectrum Brands’s portfolio was largely built up via acquisitions and now includes household names such as Black + Decker in home appliances, Spectracide in lawn and garden care, Nature's Miracle in pet care, and Remington in personal care. The company continues to be quite acquisitive and seeks to buy complementary brands, allowing it to enter new markets, benefit from synergies, and adapt to changing consumer preferences.

Spectrum Brands has a global footprint and its products are available in North America, Europe, Latin America, and other select markets, making it a significant player in the global consumer goods industry. It sells its products through various channels, including e-commerce and retail partnerships with companies like Best Buy and The Home Depot.

Household Products

Household products companies engage in the manufacturing, distribution, and sale of goods that maintain and enhance the home environment. This includes cleaning supplies, home improvement tools, kitchenware, small appliances, and home decor items. Companies within this sector must focus on product quality, innovation, and cost efficiency to remain competitive. Household products stocks are generally stable investments, as many of the industry's products are essential for a comfortable and functional living space. Recently, there's been a growing emphasis on eco-friendly and sustainable offerings, reflecting the evolving consumer preferences for environmentally conscious options.

Competitors include General Electric (NYSE:GE) in home appliances, Central Garden & Pet (NASDAQGS:CENT) in pet care, Scotts Miracle-Gro (NYSE:SMG) in lawn and garden care, and Procter & Gamble (NYSE:PG) in personal care.Sales Growth

Spectrum Brands carries some recognizable brands and products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the other hand, Spectrum Brands can still achieve high growth rates because its revenue base is not yet monstrous.

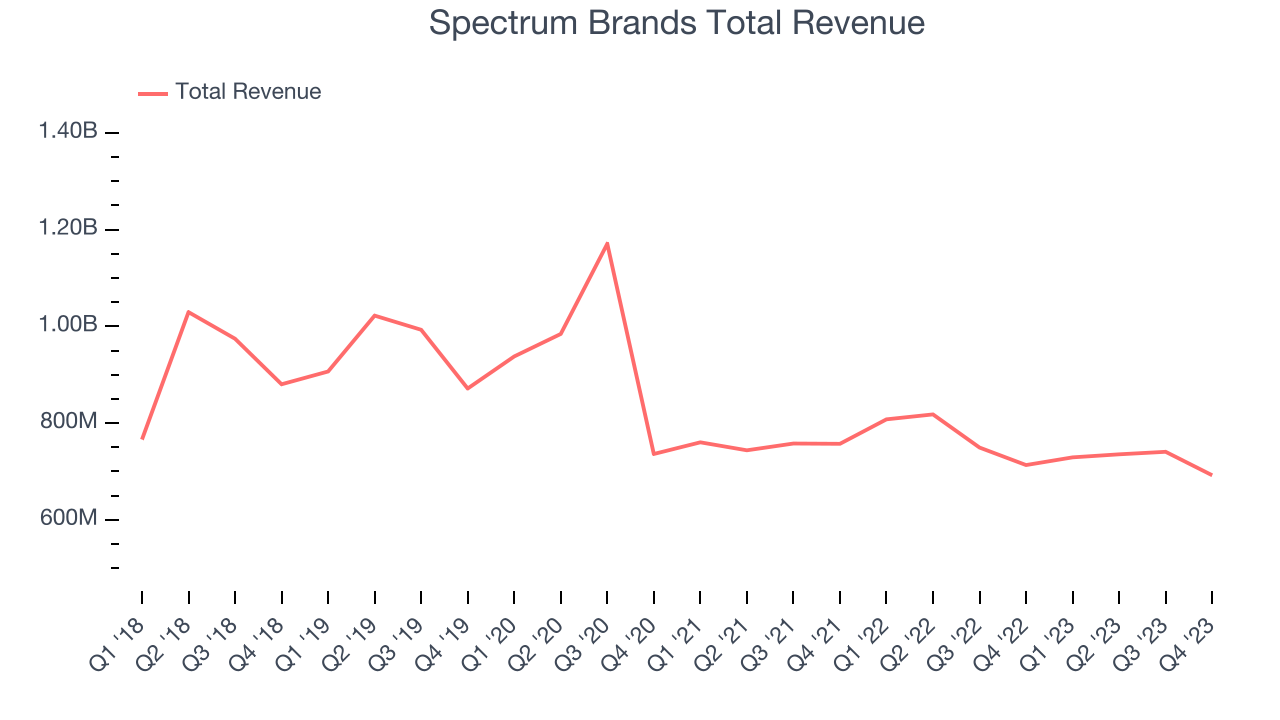

As you can see below, the company's revenue has declined over the last three years, dropping 8.9% annually. This is among the worst in the consumer staples industry, where demand is typically stable.

This quarter, Spectrum Brands's revenue fell 3% year on year to $692.2 million but beat Wall Street's estimates by 2.8%. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months.

Gross Margin & Pricing Power

Gross profit margins tell us how much money a company gets to keep after paying for the direct costs of the goods it sells.

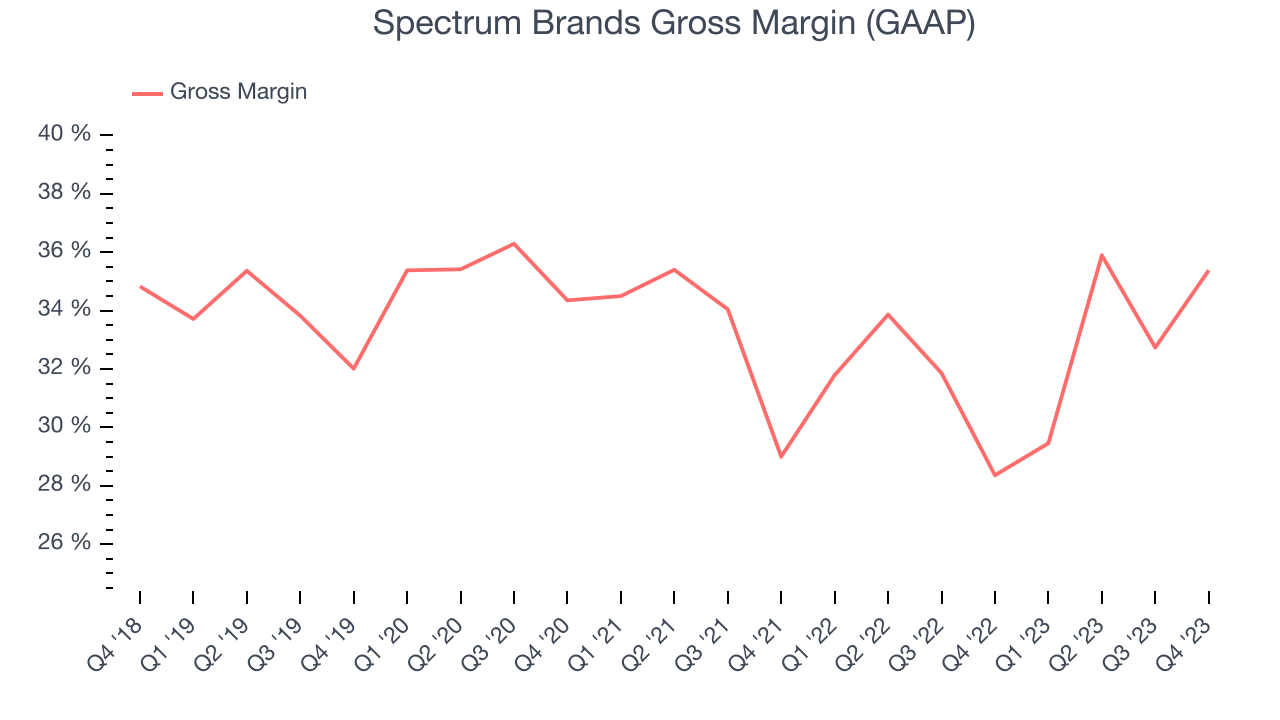

Spectrum Brands's gross profit margin came in at 35.4% this quarter, up 7 percentage points year on year. That means for every $1 in revenue, $0.65 went towards paying for raw materials, production of goods, and distribution expenses.

Spectrum Brands's unit economics are higher than the typical consumer staples company, giving it the flexibility to invest in areas such as marketing and talent to reach more consumers. As you can see above, it's averaged a decent 32.4% gross margin over the last eight quarters. Its margin has also been trending up over the last 12 months, averaging 6.5% year-on-year increases each quarter. If this trend continues, it could suggest a less competitive environment where the company has better pricing power and more favorable input costs (such as raw materials).

Operating Margin

Operating margin is a key profitability metric for companies because it accounts for all expenses enabling a business to operate smoothly, including marketing and advertising, IT systems, wages, and other administrative costs.

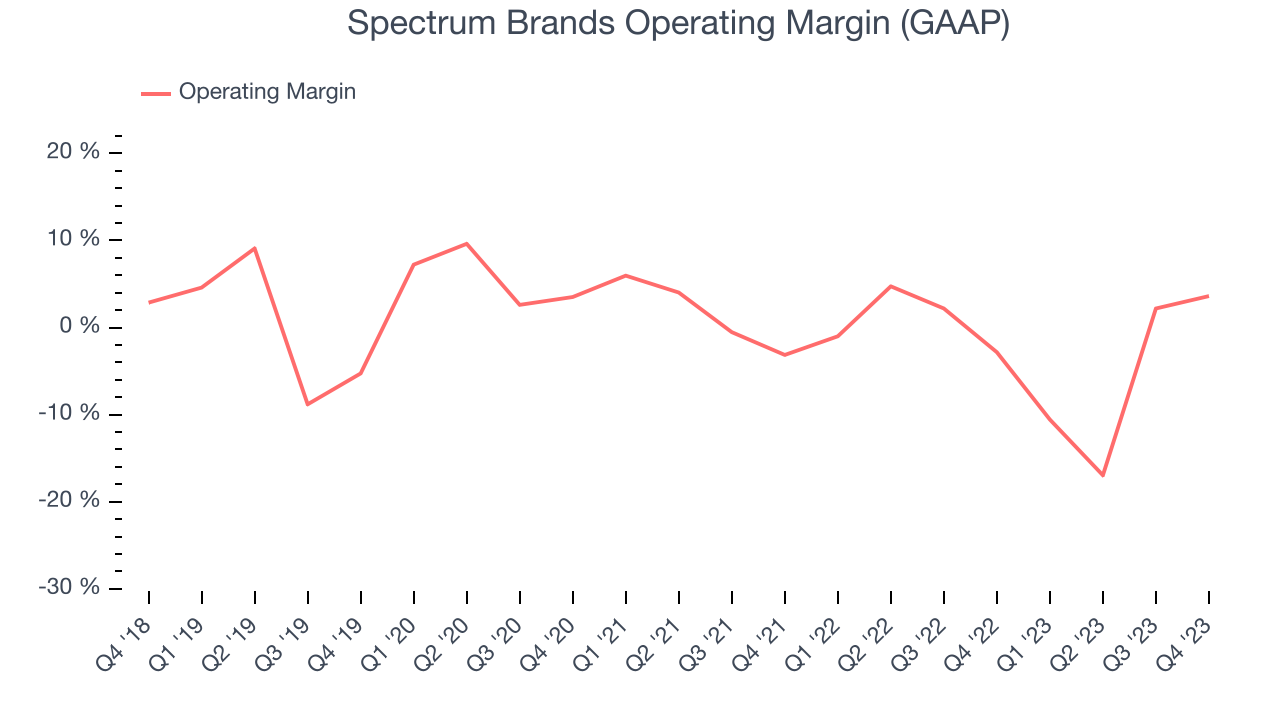

In Q1, Spectrum Brands generated an operating profit margin of 3.6%, up 6.4 percentage points year on year. This increase was encouraging, and we can infer Spectrum Brands had stronger pricing power and lower raw materials/transportation costs because its gross margin expanded more than its operating margin.

Although Spectrum Brands was profitable this quarter from an operational perspective, it's generally struggled when zooming out. Its high expenses have contributed to an average operating margin of negative 2.3% over the last two years. This performance isn't ideal as unprofitable publicly traded companies are a minority in the consumer staples sector given its stability. On top of that, Spectrum Brands's margin has declined by 6.4 percentage points on average over the last year. This shows the company is heading in the wrong direction, and investors are likely hoping for better results in the future.

Although Spectrum Brands was profitable this quarter from an operational perspective, it's generally struggled when zooming out. Its high expenses have contributed to an average operating margin of negative 2.3% over the last two years. This performance isn't ideal as unprofitable publicly traded companies are a minority in the consumer staples sector given its stability. On top of that, Spectrum Brands's margin has declined by 6.4 percentage points on average over the last year. This shows the company is heading in the wrong direction, and investors are likely hoping for better results in the future.EPS

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

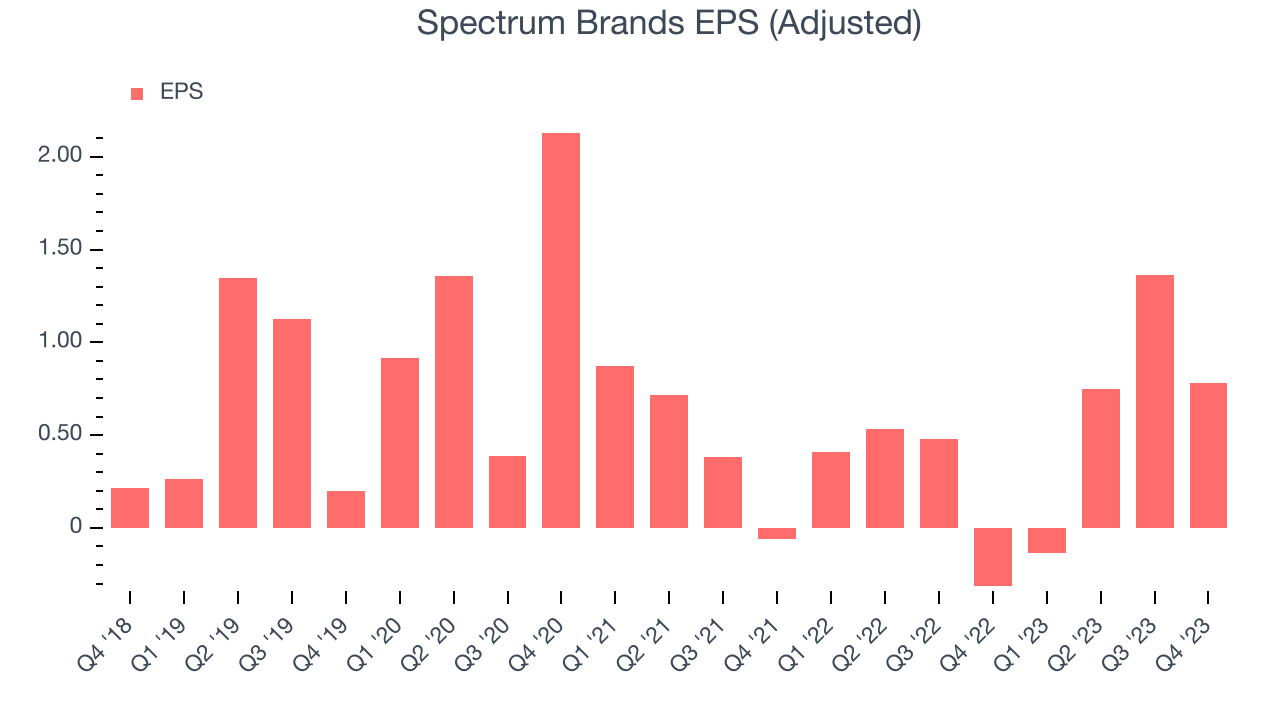

In Q1, Spectrum Brands reported EPS at $0.78, up from negative $0.32 in the same quarter a year ago. This print easily cleared Wall Street's estimates, and shareholders should be content with the results.

Between FY2021 and FY2024, Spectrum Brands's EPS dropped 42.4%, translating into 16.8% annualized declines. We tend to steer our readers away from companies with falling EPS, especially in the consumer staples sector, where shrinking earnings could imply changing secular trends or consumer preferences. If there's no earnings growth, it's difficult to build confidence in a business's underlying fundamentals, leaving a low margin of safety around the company's valuation (making the stock susceptible to large downward swings).

On the bright side, Wall Street expects the company's earnings to grow over the next 12 months, with analysts projecting an average 40.9% year-on-year increase in EPS.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Spectrum Brands burned through $12.7 million of cash in Q1, representing a negative 1.8% free cash flow margin. The company increased its cash burn by 82.9% year on year.

Over the last two years, Spectrum Brands's demanding reinvestment strategy and failure to generate organic revenue growth have drained company resources. Its free cash flow margin has been among the worst in the consumer staples sector, averaging negative 5.5%. Furthermore, its margin has averaged year-on-year declines of 17.1 percentage points over the last 12 months. Its cash profitability could drop even further as Spectrum Brands may try to stimulate organic growth through more investments. We've no doubt shareholders would like to see an improvement soon.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Spectrum Brands's five-year average ROIC was 0.3%, somewhat low compared to the best consumer staples companies that consistently pump out 20%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, over the last two years, Spectrum Brands's ROIC has averaged a 4.6 percentage point decrease each year. In conjunction with its already low returns, these declines suggest the company's profitable business opportunities are few and far between.

Key Takeaways from Spectrum Brands's Q1 Results

We were impressed by how Spectrum Brands beat on all key line items such as revenue, adjusted EBITDA, operating income, and EPS. While a raise of full year guidance would have been icing on the cake, the company's maintenance of its previous outlook shows that Spectrum Brands is staying on track. Zooming out, we think this was a very solid quarter that should have shareholders pleased. The stock is flat after reporting and currently trades at $79.97 per share.

Is Now The Time?

Spectrum Brands may have had a good quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Spectrum Brands, we'll be cheering from the sidelines. Its revenue has declined over the last three years, but at least growth is expected to increase in the short term. And while its projected EPS growth for the next year implies the company's fundamentals will improve, the downside is its declining EPS over the last three years makes it hard to trust. On top of that, its relatively low ROIC suggests it has struggled to grow profits historically.

Spectrum Brands's price-to-earnings ratio based on the next 12 months is 20.6x. While we've no doubt one can find things to like about Spectrum Brands, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $84.13 per share right before these results (compared to the current share price of $79.97).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.