Content production and distribution company Sphere Entertainment (NYSE:SPHR) fell short of analysts' expectations in Q1 CY2024, with revenue up 98.2% year on year to $321.3 million. It made a GAAP loss of $1.33 per share, improving from its loss of $1.64 per share in the same quarter last year.

Is now the time to buy Sphere Entertainment? Find out by accessing our full research report, it's free.

Sphere Entertainment (SPHR) Q1 CY2024 Highlights:

- Revenue: $321.3 million vs analyst estimates of $324.7 million (1% miss)

- EPS: -$1.33 vs analyst estimates of -$0.19 (-$1.14 miss)

- Gross Margin (GAAP): 52.1%, up from -29.6% in the same quarter last year

- Market Capitalization: $1.45 billion

Executive Chairman and CEO James L. Dolan said, "With the second consecutive quarter of robust revenues and positive adjusted operating income at the Sphere segment, our early results continue to demonstrate Sphere's potential to disrupt the traditional venue model. We are encouraged by the demand for this new medium and remain confident in our future growth opportunities. "

Famous for its viral Las Vegas Sphere venue, Sphere Entertainment (NYSE:SPHR) hosts live entertainment events and distributes content across various media platforms.

Leisure Facilities

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

Sales Growth

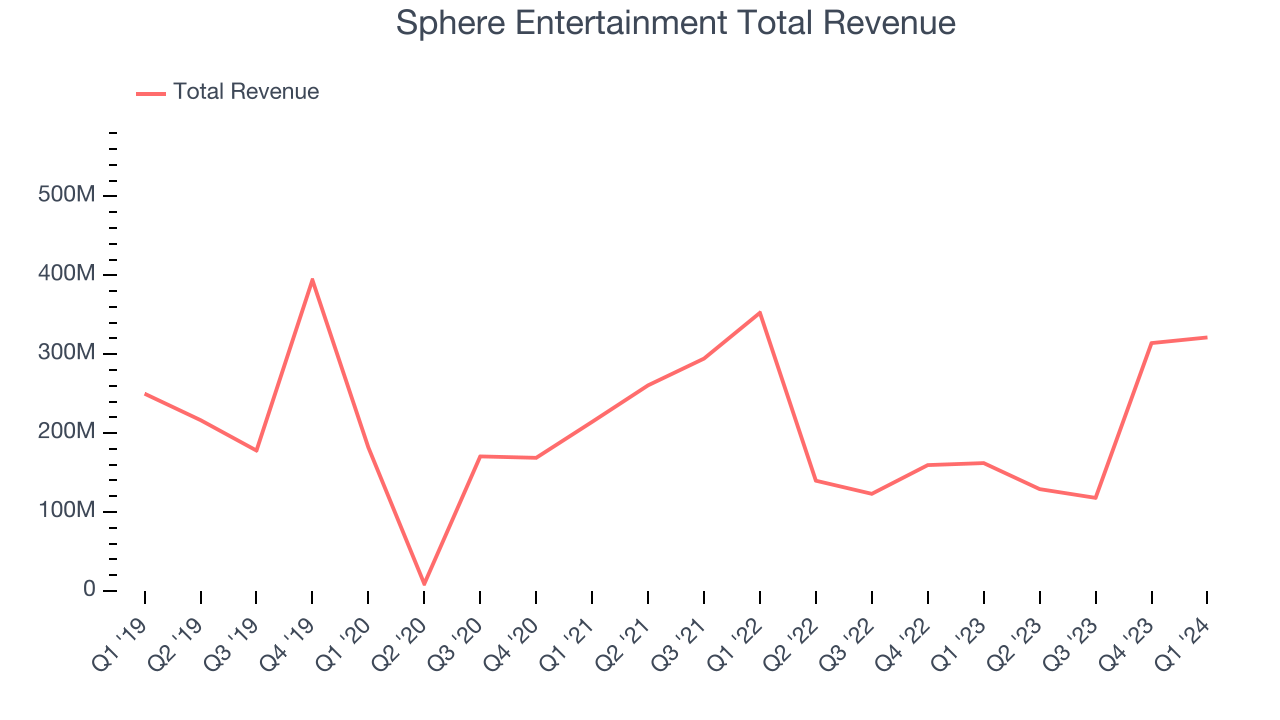

A company’s long-term performance can give signals about its business quality. Any business can put up a good quarter or two, but many enduring ones muster years of growth. Sphere Entertainment's annualized revenue growth rate of 3.3% over the last five years was weak for a consumer discretionary business.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Sphere Entertainment's annualized revenue growth of 51% over the last two years is above its five-year trend, suggesting some bright spots.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Sphere Entertainment's annualized revenue growth of 51% over the last two years is above its five-year trend, suggesting some bright spots.

We can dig even further into the company's revenue dynamics by analyzing its most important segments, Sphere and MSG Networks, which are 53% and 47% of revenue. Over the last two years, Sphere Entertainment's Sphere revenue (live events and advertising) averaged 13,305% year-on-year growth. On the other hand, its MSG Networks revenue (content distribution) averaged 8% declines.

This quarter, Sphere Entertainment achieved a magnificent 98.2% year-on-year revenue growth rate, but its $321.3 million of revenue fell short of Wall Street's lofty estimates. Looking ahead, Wall Street expects sales to grow 29.7% over the next 12 months, a deceleration from this quarter.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

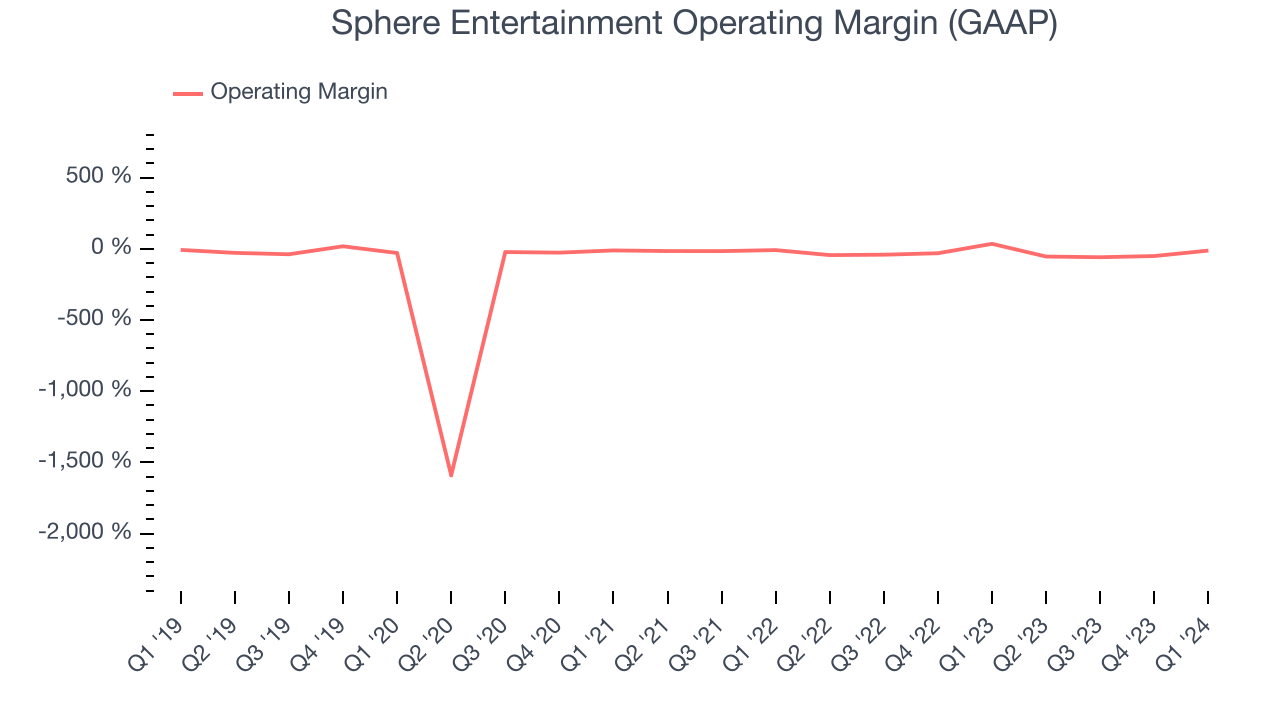

Operating Margin

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Given the consumer discretionary industry's volatile demand characteristics, unprofitable companies should be scrutinized. Over the last two years, Sphere Entertainment's high expenses have contributed to an average operating margin of negative 30.4%.

In Q1, Sphere Entertainment generated an operating profit margin of negative 12.6%, down 47.5 percentage points year on year.

Over the next 12 months, Wall Street expects Sphere Entertainment to shrink its losses but remain unprofitable. Analysts are expecting the company’s LTM operating margin of negative 38.5% to rise to negative 18.6%.Key Takeaways from Sphere Entertainment's Q1 Results

We struggled to find many strong positives in these results. Both its revenue and operating margin missed. The stock is flat after reporting and currently trades at $41.4 per share.

So should you invest in Sphere Entertainment right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.