Earnings results often give us a good indication what direction the company will take in the months ahead. With Q3 now behind us, let’s have a look at Squarespace (NYSE:SQSP) and its peers.

While e-commerce has been around for over two decades and enjoyed meaningful growth, its overall penetration of retail still remains low. Only around $1 in every $5 spent on retail purchases comes from digital orders, leaving over 80% of the retail market still ripe for online disruption. It is these large swathes of the retail where e-commerce has not yet taken hold that drives the demand for various e-commerce software solutions.

The 4 e-commerce software stocks we track reported a decent Q3; on average, revenues beat analyst consensus estimates by 3.33%, while on average next quarter revenue guidance was 0.1% above consensus. Tech stocks have had a rocky start in 2022 and e-commerce SaaS stocks have not been spared, with share price down 24.2% since earnings, on average.

Squarespace (NYSE:SQSP)

Founded in New York City in 2003, Squarespace (NYSE:SQSP) is a platform for small businesses and creators to build their digital presences online.

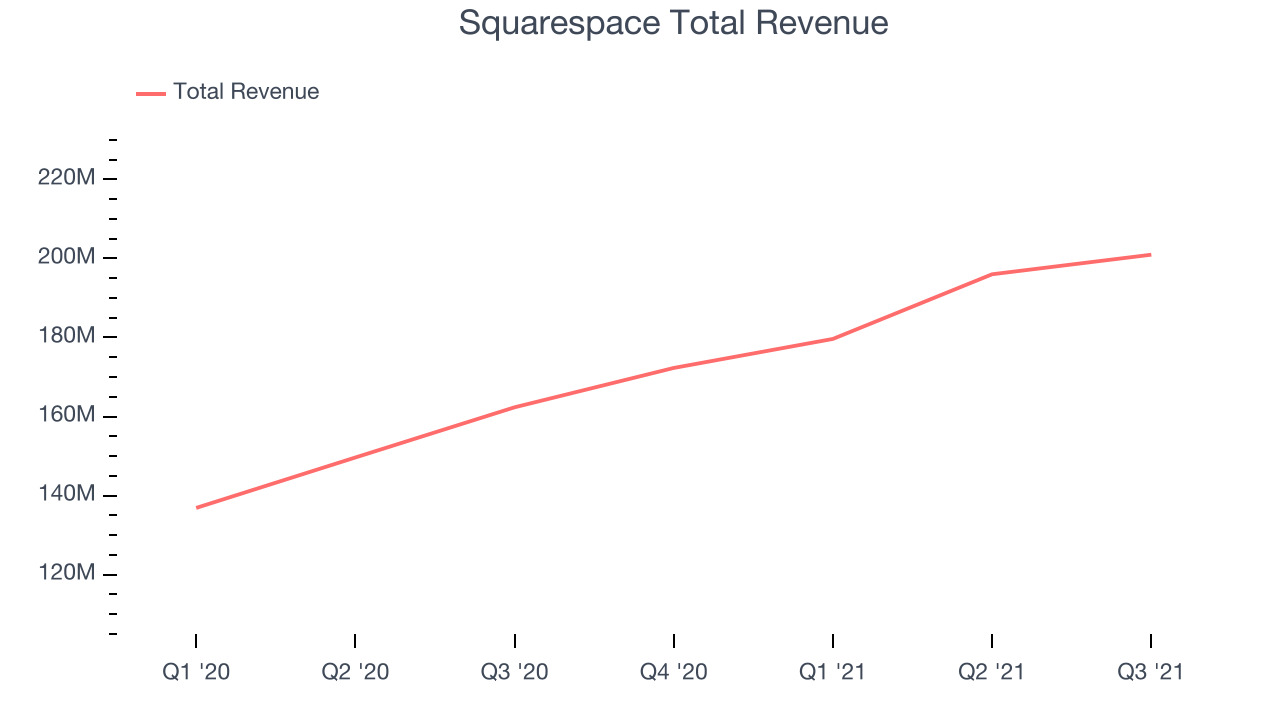

Squarespace reported revenues of $200.9 million, up 23.7% year on year, beating analyst expectations by 1.53%. It was a weaker quarter for the company, with a decent beat of analyst estimates but an underwhelming revenue guidance for the next quarter.

"Squarespace had another outstanding quarter as we continued to achieve strong revenue growth and introduce new solutions that give our millions of customers around the world the competitive advantages they need to succeed," said Anthony Casalena, Founder & CEO of Squarespace.

Squarespace delivered the smallest earnings surprise of the whole group. The stock is down 37.7% since the results and currently trades at $28.83.

Is now the time to buy Squarespace? Access our full analysis of the earnings results here, it's free.

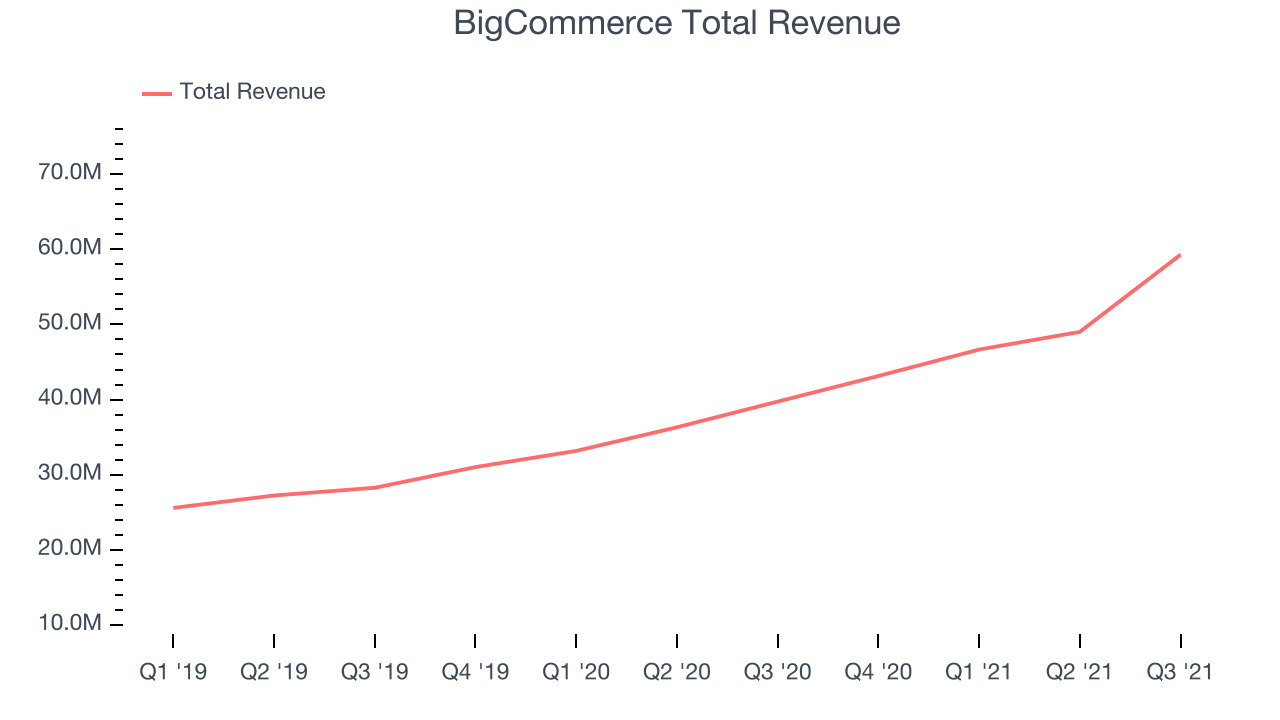

Best Q3: BigCommerce (NASDAQ:BIGC)

Founded in Sydney, Australia in 2009 by Mitchell Harper and Eddie Machaalani, BigCommerce (NASDAQ:BIGC) provides software for businesses to easily create online stores.

BigCommerce reported revenues of $59.2 million, up 49.2% year on year, beating analyst expectations by 8.09%. It was a very strong quarter for the company, with accelerating growth in large customers and an exceptional revenue growth.

BigCommerce delivered the strongest analyst estimates beat, fastest revenue growth, and highest full year guidance raise among its peers. The company added 1,392 enterprise customers paying more than $2,000 annually to a total of 12,378. The stock is down 37.1% since the results and currently trades at $28.80.

Is now the time to buy BigCommerce? Access our full analysis of the earnings results here, it's free.

Slowest Q3: GoDaddy (NYSE:GDDY)

Founded by Bob Parsons after selling his first company to Intuit, GoDaddy (NYSE:GDDY) provides small and mid-sized businesses with the ability to buy a web domain and tools to create and manage a website.

GoDaddy reported revenues of $964 million, up 14.1% year on year, beating analyst expectations by 1.92%. It was an OK quarter for the company, with sales and guidance roughly in line with what analysts were expecting.

GoDaddy had the slowest revenue growth in the group. The stock is up 11.5% since the results and currently trades at $75.04.

Read our full analysis of GoDaddy's results here.

Wix (NASDAQ:WIX)

Founded in 2006 in Tel Aviv, Wix.com (NASDAQ:WIX) offers a free and easy to operate website building platform.

Wix reported revenues of $320.7 million, up 26.2% year on year, beating analyst expectations by 1.77%. It was an OK quarter for the company, with declining gross margin and guidance narrowly missing what analysts were expecting.

Wix had the weakest full year guidance update among the peers. The stock is down 33.5% since the results and currently trades at $131.83.

Read our full, actionable report on Wix here, it's free.

The author has no position in any of the stocks mentioned