Website and ecommerce tools provider Squarespace (NYSE:SQSP) reported results in line with analyst expectations in Q4 FY2021 quarter, with revenue up 20.3% year on year to $207.4 million. However, guidance for the next quarter was less impressive, coming in at $204 million at the midpoint, being 5.85% below analyst estimates. Squarespace made a GAAP loss of $17.2 million, down on its profit of $4.26 million, in the same quarter last year.

Is now the time to buy Squarespace? Access our full analysis of the earnings results here, it's free.

Squarespace (SQSP) Q4 FY2021 Highlights:

- Revenue: $207.4 million vs analyst estimates of $205.9 million (small beat)

- EPS (GAAP): -$0.18

- Revenue guidance for Q1 2022 is $204 million at the midpoint, below analyst estimates of $216.6 million

- Management's revenue guidance for upcoming financial year 2022 is $870 million at the midpoint, missing analyst estimates by 6.84% and predicting 10.9% growth (vs 26.5% in FY2021)

- Free cash flow of $10.7 million, down 76.1% from previous quarter

- Gross Margin (GAAP): 83.6%, down from 84.8% same quarter last year

"2021 was an incredible year for Squarespace that exceeded our guidance, as we delivered record revenue and total unique subscriptions," said Anthony Casalena, Founder and CEO of Squarespace.

Founded in New York City in 2003, Squarespace (NYSE:SQSP) is a platform for small businesses and creators to build their digital presences online.

While e-commerce has been around for over two decades and enjoyed meaningful growth, its overall penetration of retail still remains low. Only around $1 in every $5 spent on retail purchases comes from digital orders, leaving over 80% of the retail market still ripe for online disruption. It is these large swathes of the retail where e-commerce has not yet taken hold that drives the demand for various e-commerce software solutions.

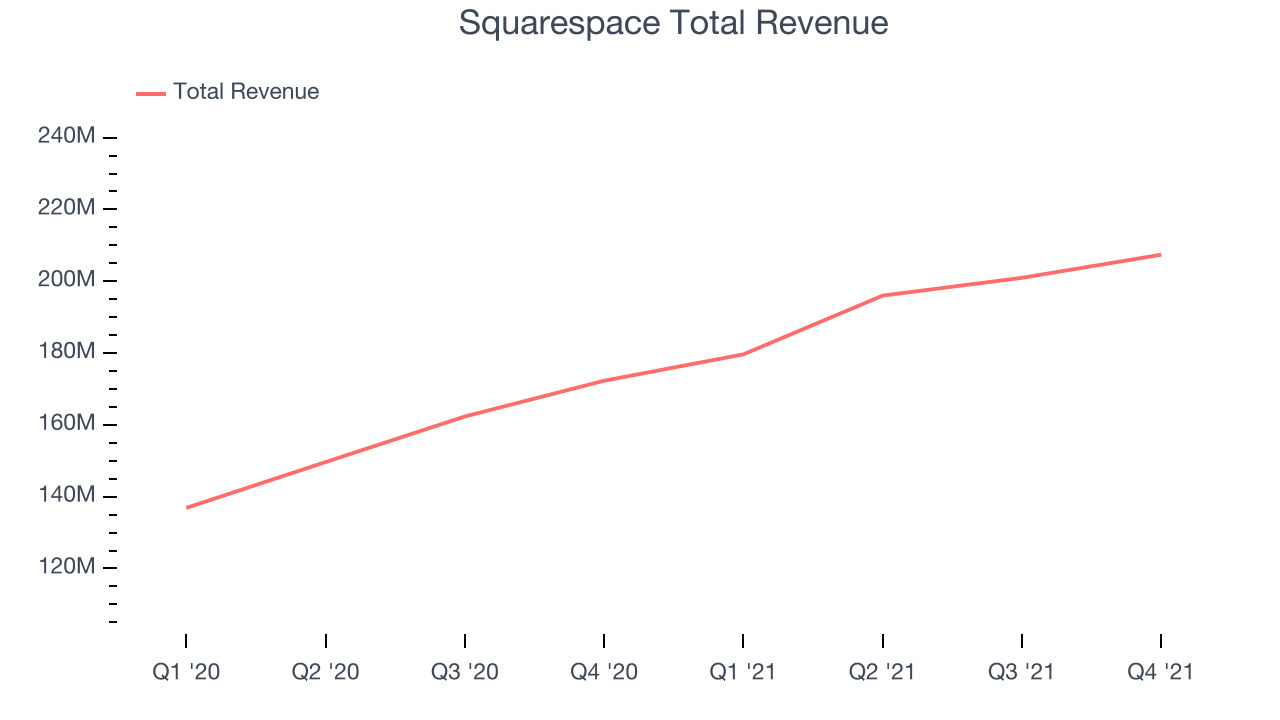

Sales Growth

As you can see below, Squarespace's revenue growth has been strong over the last year, growing from quarterly revenue of $172.3 million, to $207.4 million.

This quarter, Squarespace's quarterly revenue was once again up a very solid 20.3% year on year. On top of that, revenue increased $6.43 million quarter on quarter, a very strong improvement on the $4.95 million increase in Q3 2021, which shows acceleration of growth, and is great to see.

Guidance for the next quarter indicates Squarespace is expecting revenue to grow 13.5% year on year to $204 million, slowing down from the 31.2% year-over-year increase in revenue the company had recorded in the same quarter last year. For the upcoming financial year management expects revenue to be $870 million at the midpoint, growing 10.9% compared to 26.5% increase in FY2021.

There are others doing even better than Squarespace. Founded by ex-Google engineers, a small company making software for banks has been growing revenue 90% year on year and is already up more than 150% since the IPO last December. You can find it on our platform for free.

Key Takeaways from Squarespace's Q4 Results

With a market capitalization of $3.15 billion Squarespace is among smaller companies, but its more than $234.7 million in cash and positive free cash flow over the last twelve months give us confidence that Squarespace has the resources it needs to pursue a high growth business strategy.

We struggled to find many strong positives in these results. On the other hand, it was unfortunate to see that Squarespace's revenue guidance for the full year miss analyst's expectations and the revenue guidance for next year indicates quite a significant slowdown in growth. Overall, this quarter's results could have been better. The company is down 11.8% on the results and currently trades at $20 per share.

Squarespace may have had a tough quarter, but does that actually create an opportunity to invest right now? It is important that you take into account its valuation and business qualities, as well as what happened in the latest quarter. We look at that in our actionable report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.