Website and ecommerce tools provider Squarespace (NYSE:SQSP) reported Q1 CY2024 results topping analysts' expectations, with revenue up 18.6% year on year to $281.1 million. Guidance for next quarter's revenue was also better than expected at $292.5 million at the midpoint, 1% above analysts' estimates. It made a GAAP loss of $0 per share, down from its profit of $0 per share in the same quarter last year.

Squarespace (SQSP) Q1 CY2024 Highlights:

- Revenue: $281.1 million vs analyst estimates of $276.3 million (1.7% beat)

- EPS: $0 vs analyst estimates of -$0.07 ($0.07 beat)

- Revenue Guidance for Q2 CY2024 is $292.5 million at the midpoint, above analyst estimates of $289.5 million

- The company lifted its revenue guidance for the full year from $1.18 billion to $1.20 billion at the midpoint, a 1.7% increase (also lifted free cash flow guidance for the same period)

- Gross Margin (GAAP): 71.3%, down from 81.9% in the same quarter last year

- Free Cash Flow of $81.83 million, up 43% from the previous quarter

- Annual Recurring Revenue: $1.12 billion at quarter end, up 12.8% year on year

- Market Capitalization: $4.87 billion

Founded in New York City in 2003, Squarespace (NYSE:SQSP) is a platform for small businesses and creators to build their digital presences online.

Today, only slightly more than half of US small and midsize businesses have an online presence, and for many that do, they are outdated and lack modern functionality. It has long been difficult and expensive for small businesses or entrepreneurs to build and manage websites and online stores, let alone manage online marketing activities.

With Squarespace, entrepreneurs and small businesses can create a website or online store quickly with little to no technical skill for less than a few hundred dollars per year. Although there are many website builders and e-commerce platforms in the market, Squarespace has differentiated itself in two key ways. The first is a heavy focus on design, its website templates are generally more curated and polished than its rivals. Second, by creating an all-in-one platform that has functionality ranging from basic websites to more complex ecommerce sites, Squarespace can facilitate many different types of online businesses: product, services, content, and subscription. Over time, Squarespace has been growing out the range of its commerce capabilities through integrations with other vendors like Quickbooks (for tax management) and with acquisitions like Tock, which added the ability to book reservations for restaurant and hospitality businesses.

E-commerce Software

While e-commerce has been around for over two decades and enjoyed meaningful growth, its overall penetration of retail still remains low. Only around $1 in every $5 spent on retail purchases comes from digital orders, leaving over 80% of the retail market still ripe for online disruption. It is these large swathes of the retail where e-commerce has not yet taken hold that drives the demand for various e-commerce software solutions.

Squarespace’s main competitors are Wix (NASDAQ: WIX), GoDaddy (NYSE: GDDY), and Shopify (NYSE:SHOP).

Sales Growth

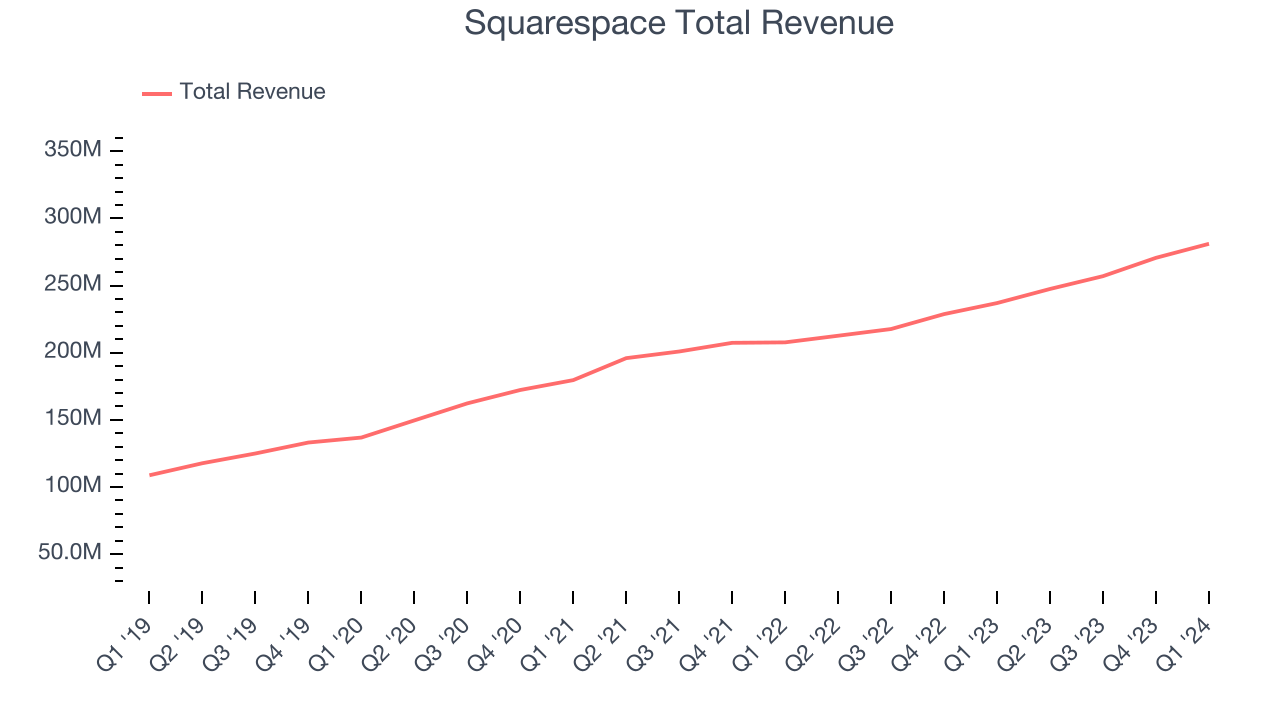

As you can see below, Squarespace's revenue growth has been mediocre over the last three years, growing from $179.6 million in Q1 2021 to $281.1 million this quarter.

This quarter, Squarespace's quarterly revenue was once again up 18.6% year on year. However, its growth did slow down compared to last quarter as the company's revenue increased by just $10.43 million in Q1 compared to $13.66 million in Q4 CY2023. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that Squarespace is expecting revenue to grow 18.2% year on year to $292.5 million, improving on the 16.4% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 16.2% over the next 12 months before the earnings results announcement.

Profitability

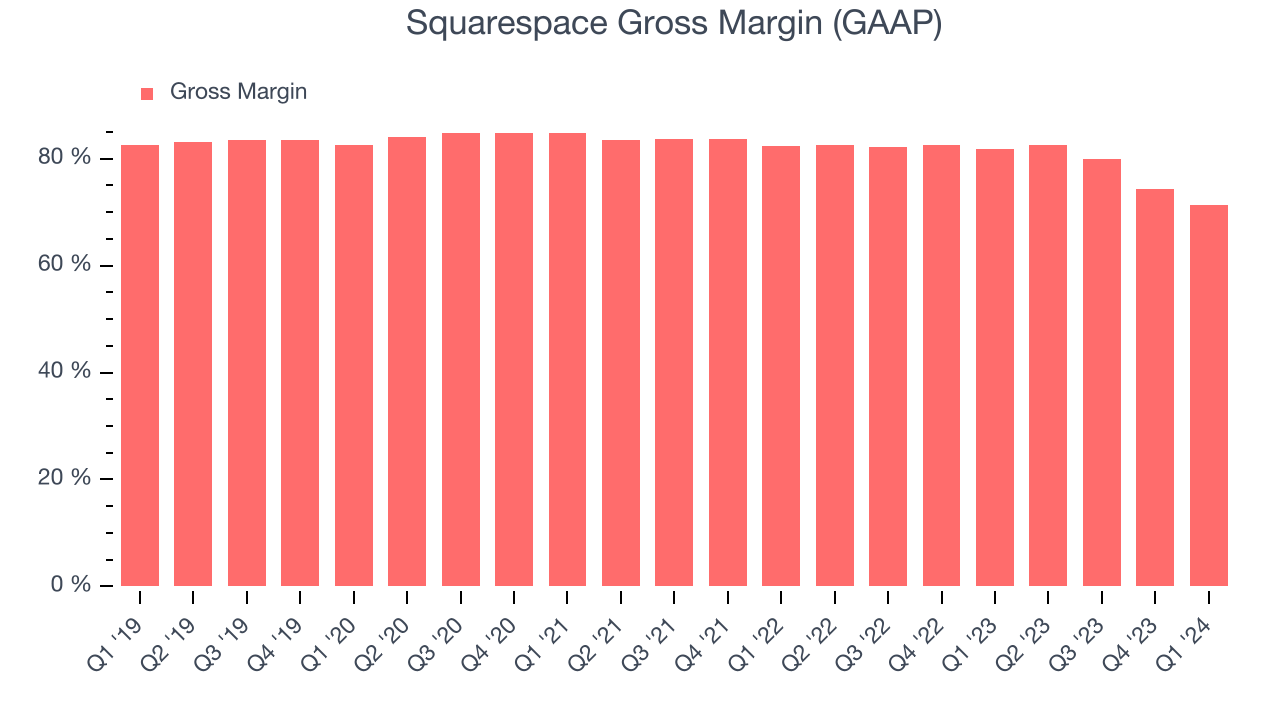

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Squarespace's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 71.3% in Q1.

That means that for every $1 in revenue the company had $0.71 left to spend on developing new products, sales and marketing, and general administrative overhead. Squarespace's gross margin is lower than that of a typical SaaS businesses and its deterioration over the last year isn't doing it any favors. Gross margin has a major impact on a company’s ability to develop new products and invest in marketing, which may ultimately determine the winner in a competitive market. This makes it a critical metric to track for the long-term investor.

Cash Is King

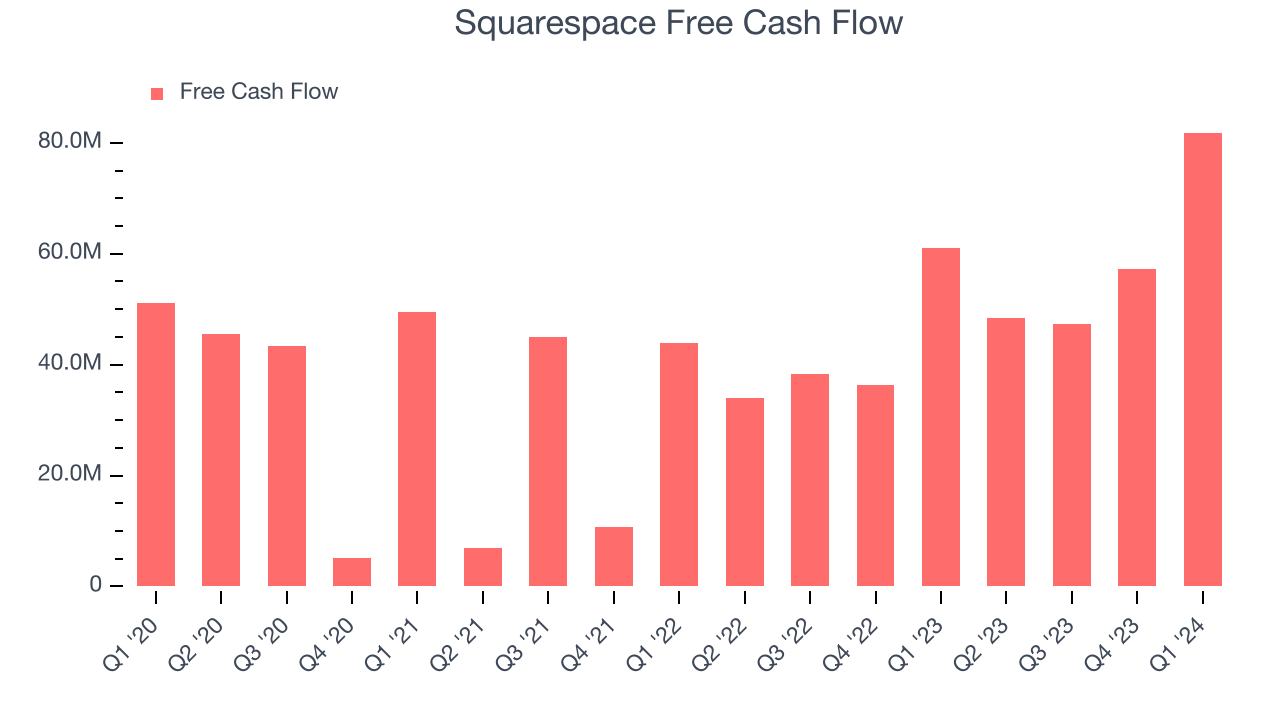

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Squarespace's free cash flow came in at $81.83 million in Q1, up 34% year on year.

Squarespace has generated $234.9 million in free cash flow over the last 12 months, an impressive 22.2% of revenue. This high FCF margin stems from its asset-lite business model and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a cash cushion.

Key Takeaways from Squarespace's Q1 Results

It was good to see Squarespace provide full-year revenue guidance topping analysts' expectations, even if just slightly. We were also happy its revenue narrowly outperformed Wall Street's estimates. On the other hand, its gross margin declined and its ARR (annual recurring revenue) missed Wall Street's estimates. Overall, this was a solid quarter for Squarespace with a few blemishes. The stock is flat after reporting and currently trades at $35.44 per share.

Is Now The Time?

When considering an investment in Squarespace, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We think Squarespace is a good business. Although its revenue growth has been a little slower over the last three years with analysts expecting growth to slow from here, its bountiful generation of free cash flow empowers it to invest in growth initiatives.

Squarespace's price-to-sales ratio based on the next 12 months is 4.1x, suggesting the market is expecting slower growth relative to the hottest software stocks. There are definitely a lot of things to like about Squarespace, and looking at the tech landscape right now, it seems to be trading at a pretty compelling price.

Wall Street analysts covering the company had a one-year price target of $38.47 right before these results (compared to the current share price of $35.44), implying they see short-term upside potential in Squarespace.

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.