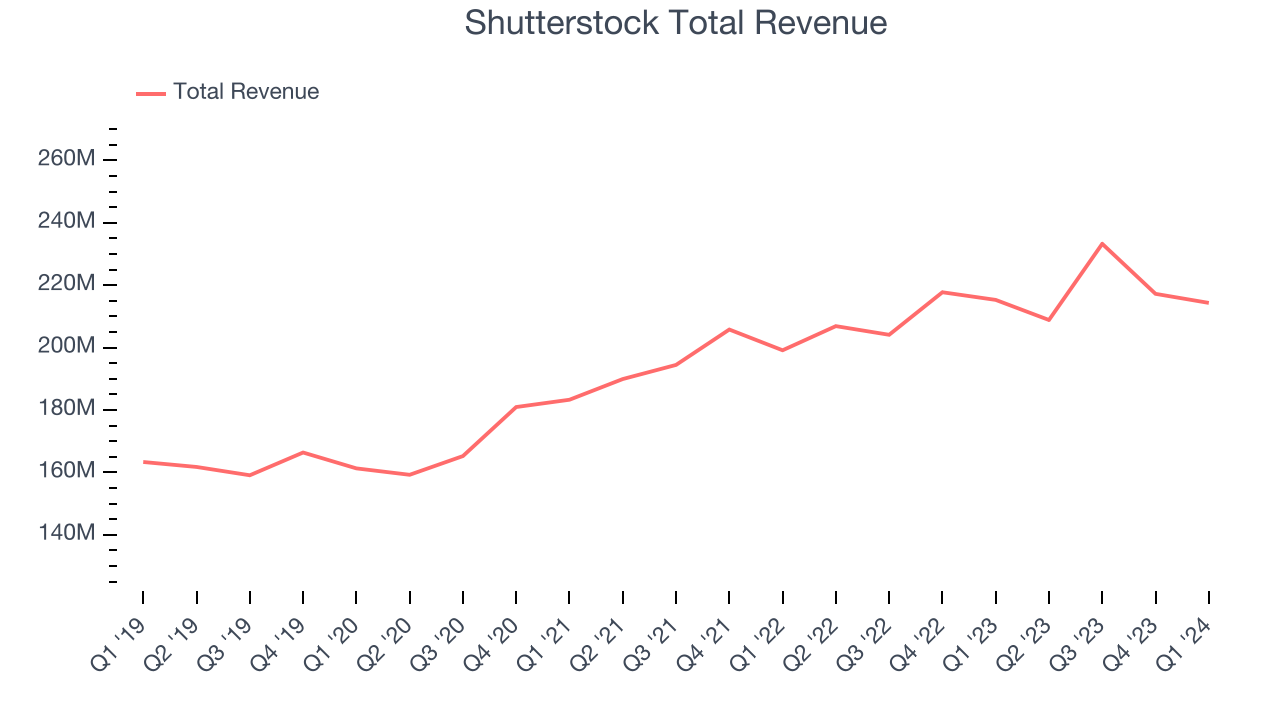

Stock photography and footage provider Shutterstock (NYSE:SSTK) reported Q1 CY2024 results topping analysts' expectations, with revenue flat year on year at $214.3 million. The company's full-year revenue guidance of $929.5 million at the midpoint also came in 6.5% above analysts' estimates. It made a non-GAAP profit of $1.13 per share, down from its profit of $1.29 per share in the same quarter last year.

Shutterstock (SSTK) Q1 CY2024 Highlights:

- Revenue: $214.3 million vs analyst estimates of $208.5 million (2.8% beat)

- EPS (non-GAAP): $1.13 vs analyst estimates of $0.99 (13.8% beat)

- The company lifted its revenue guidance for the full year from $875 million to $929.5 million at the midpoint, a 6.2% increase

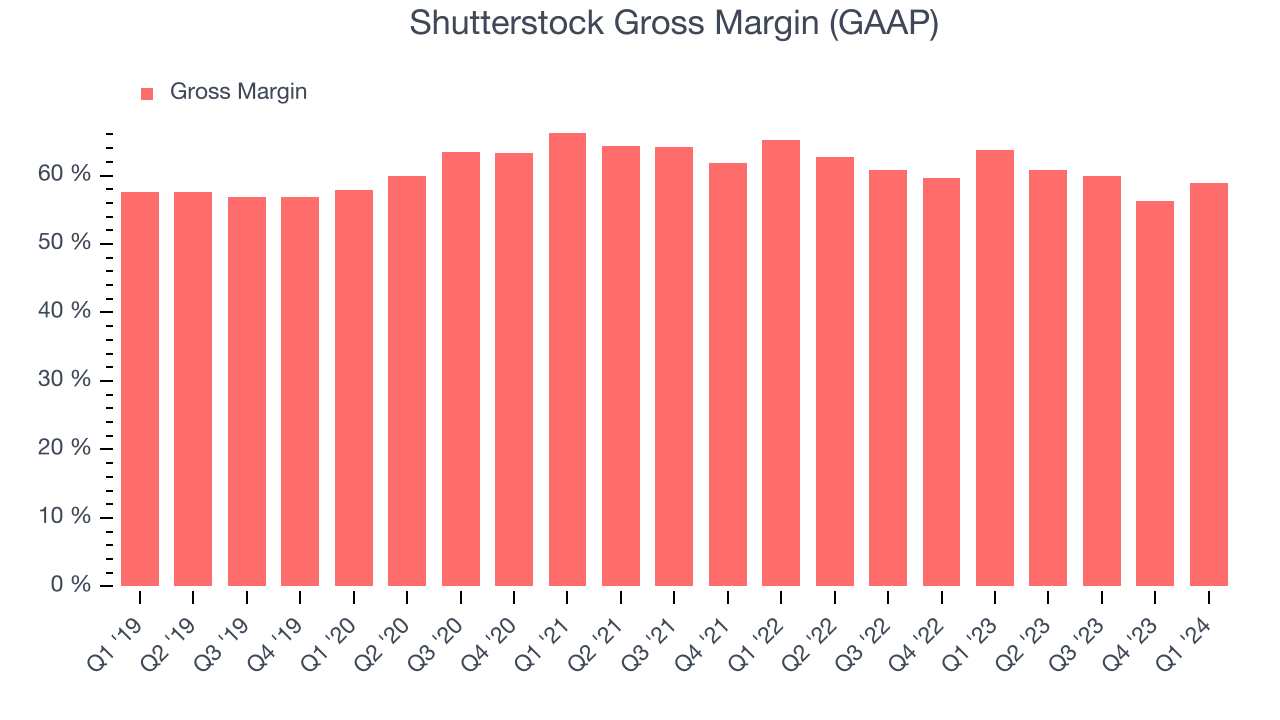

- Gross Margin (GAAP): 58.8%, down from 63.7% in the same quarter last year

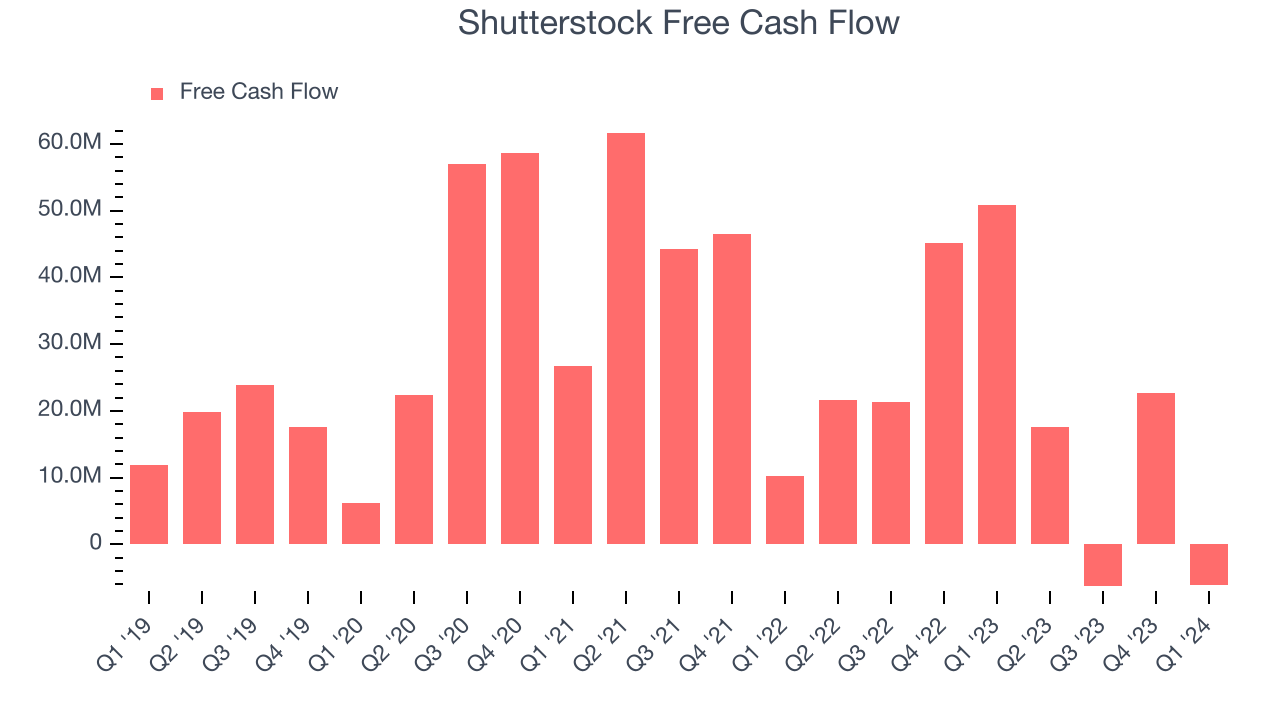

- Free Cash Flow was -$6.16 million, down from $22.65 million in the previous quarter

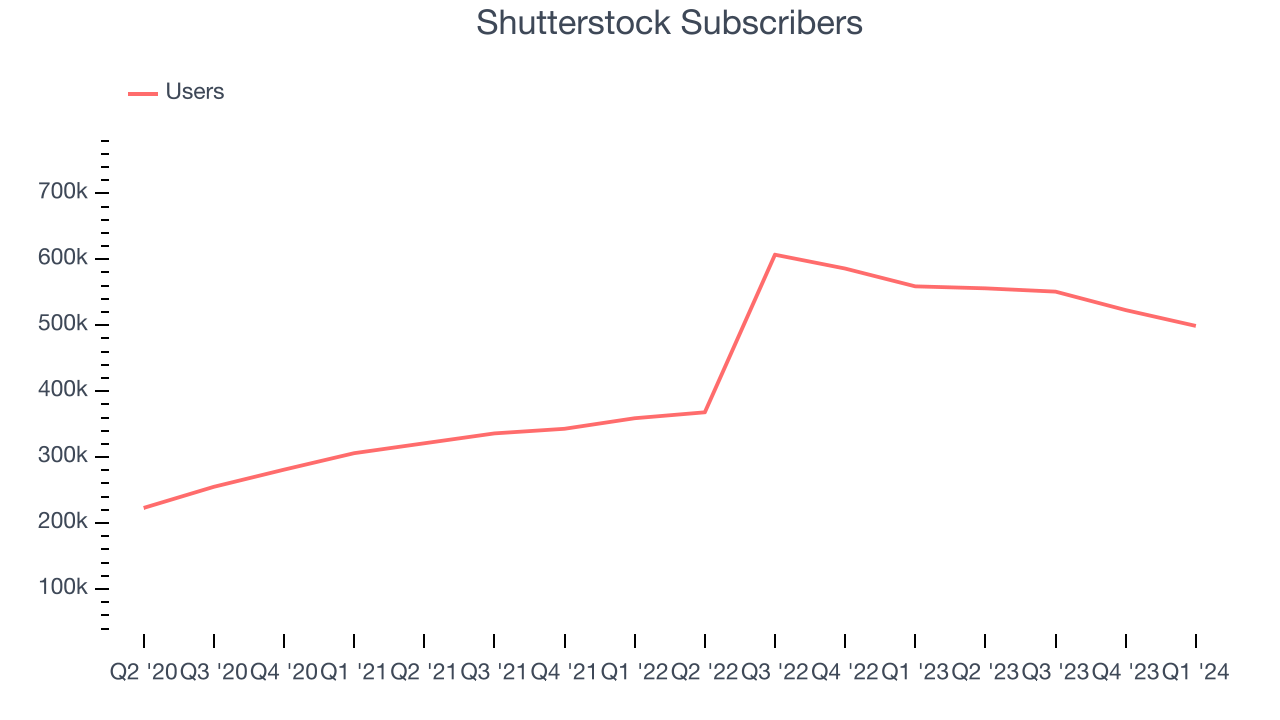

- Subscribers: 499,000, down 60,000 year on year

- Market Capitalization: $1.51 billion

Originally featuring a library that included many of founder Jon Oringer’s photos, Shutterstock (NYSE:SSTK) is now a digital platform where customers can license and use hundreds of millions of pieces of content.

This vast collection of digital content includes photos, videos, and music that customers can use in their projects ranging from advertising campaigns to editorial to personal art projects. Contributors to Shutterstock's library include professionals and hobbyists alike. Contributors are compensated based on the type of license purchased by the customer, with royalties ranging from teens percentages to nearly half of the sale price. The more popular an asset, the higher the royalty percentage.

Shutterstock solves the need for high-quality visual content without legal worries. “A picture is worth a thousand words” is a good way to understand how important visuals are. However, using any good image or video on the internet can be dangerous since a user may not have legal rights. Shutterstock’s content comes with licensing rights so users can sleep easy and know that they are legally protected from copyright or trademark infringement.

Shutterstock generates revenue by selling digital content and the associated licenses to it. Customers can choose from a variety of licensing options depending on their needs, such as standard or extended licenses for images or footage, or subscription plans that provide access to a certain number of downloads per month.

Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

Competitors offering visual content include Adobe (NYSE:ADBE), Getty Images (NYSE:GETY), and Alphabet (NASDAQ:GOOGL).Sales Growth

Shutterstock's revenue growth over the last three years has been unremarkable, averaging 8.5% annually. This quarter, Shutterstock beat analysts' estimates but reported a year on year revenue decline of 0.4%.

Ahead of the earnings results, analysts were projecting sales to grow 0.8% over the next 12 months.

Usage Growth

As an online marketplace, Shutterstock generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

Over the last two years, Shutterstock's users, a key performance metric for the company, grew 30.3% annually to 499,000. This is among the fastest growth rates of any consumer internet company, indicating that users are excited about its offerings.

Unfortunately, Shutterstock's users decreased by 60,000 in Q1, a 10.7% drop since last year.

Pricing Power

A company's gross profit margin has a major impact on its ability to exert pricing power, develop new products, and invest in marketing. These factors may ultimately determine the winner in a competitive market, making it a critical metric to track for the long-term investor.

Shutterstock's gross profit margin, which tells us how much money the company gets to keep after covering the base cost of its products and services, came in at 58.8% this quarter, down 4.8 percentage points year on year.

For online marketplaces like Shutterstock, these aforementioned costs typically include payment processing, hosting, and bandwidth fees in addition to the costs necessary to onboard buyers and sellers, such as identity verification. After paying for these expenses, Shutterstock had $0.59 for every $1 in revenue to invest in marketing, talent, and the development of new products and services.

Despite declining over the last 12 months, Shutterstock's average gross margins of 59% are still around that of a typical consumer internet business. These unit economics suggest that Shutterstock has a decent business model and competitive products and services mixed with some potential pricing pressure.

User Acquisition Efficiency

Unlike enterprise software that's typically sold by dedicated sales teams, consumer internet businesses like Shutterstock grow from a combination of product virality, paid advertisement, and incentives.

Shutterstock is efficient at acquiring new users, spending 43.4% of its gross profit on sales and marketing expenses over the last year. This level of efficiency indicates relatively solid competitive positioning, giving Shutterstock the freedom to invest its resources into new growth initiatives.

Profitability & Free Cash Flow

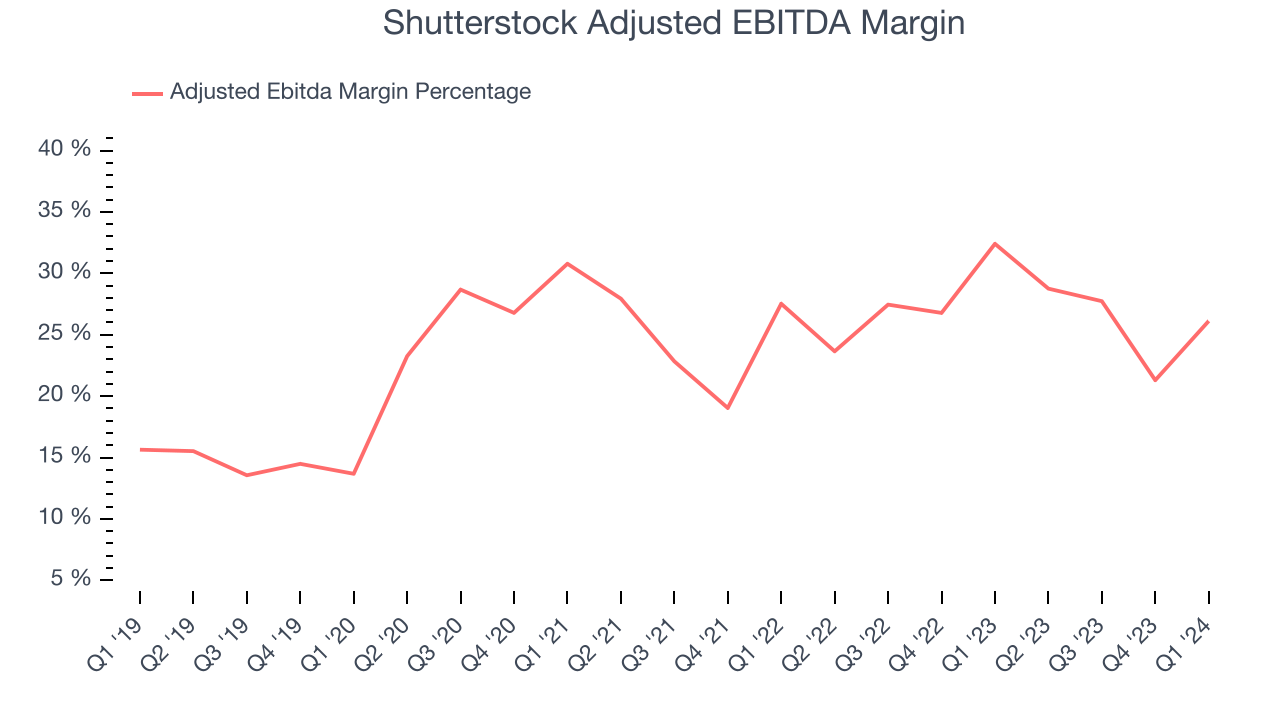

Investors frequently analyze operating income to understand a business's core profitability. Similar to operating income, adjusted EBITDA is the most common profitability metric for consumer internet companies because it removes various one-time or non-cash expenses, offering a more normalized view of a company's profit potential.

Shutterstock's EBITDA was $55.98 million this quarter, translating into a 26.1% margin. Additionally, Shutterstock has demonstrated extremely high profitability over the last four quarters, with average EBITDA margins of 26%.

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Shutterstock burned through $6.16 million in Q1, with cash flow turning negative year on year.

Shutterstock has generated $27.78 million in free cash flow over the last 12 months, or 3.2% of revenue. This FCF margin stems from its asset-lite business model and enables it to reinvest in its business without depending on the capital markets.

Key Takeaways from Shutterstock's Q1 Results

We were glad Shutterstock's revenue topped Wall Street's estimates as its revenue per downloaded image slightly outperformed. Despite the beat, we note its revenue growth was quite weak. Its number of users also declined, missing analysts' projections. On the bright side, its full-year revenue, EBITDA, and EPS guidance blew past expectations.

On April 22, the Board declared a dividend of $0.30 per share, payable on June 13, 2024 to stockholders as of May 30, 2024. The company also announced it would acquire Envato for $245 million today, a provider of digital creative assets and templates.

Overall, this quarter's results could have been better but its outlook was great. The stock is flat after reporting and currently trades at $42.44 per share.

Is Now The Time?

When considering an investment in Shutterstock, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

Although we have other favorites, we understand the arguments that Shutterstock isn't a bad business. Although its revenue growth has been a little slower over the last three years with analysts expecting growth to slow from here, its growth in users has been strong.

At the moment, Shutterstock trades at 8.4x next 12 months EV-to-EBITDA. In the end, beauty is in the eye of the beholder. While Shutterstock wouldn't be our first pick, if you like the business, the shares are trading at a pretty interesting price right now.

Wall Street analysts covering the company had a one-year price target of $57.80 per share right before these results (compared to the current share price of $42.44).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.