Sensor manufacturer Sensata Technology (NYSE:ST) reported Q3 FY2022 results that beat analyst expectations, with revenue up 7.07% year on year to $1.01 billion. The company expects that next quarter's revenue would be around $1 billion, which is the midpoint of the guidance range. That was in roughly line with analyst expectations. Sensata Technologies made a GAAP profit of $140.2 million, improving on its profit of $84.9 million, in the same quarter last year.

Is now the time to buy Sensata Technologies? Access our full analysis of the earnings results here, it's free.

Sensata Technologies (ST) Q3 FY2022 Highlights:

- Revenue: $1.01 billion vs analyst estimates of $1 billion (1.21% beat)

- EPS (non-GAAP): $0.85 vs analyst expectations of $0.85 (small miss)

- Revenue guidance for Q4 2022 is $1 billion at the midpoint, roughly in line with what analysts were expecting

- Free cash flow of $57.4 million, roughly flat from previous quarter

- Inventory Days Outstanding: 89, up from 87 previous quarter

- Gross Margin (GAAP): 31.7%, down from 33.8% same quarter last year

"Sensata delivered solid third quarter financial results due to strong market outgrowth of 650 basis points, improving markets, and growth from M&A despite increased foreign exchange and inventory headwinds compared to the prior-year quarter,” said Jeff Cote, CEO and President of Sensata.

Originally a temperature sensor control maker and part of Texas Instruments for 60 years, before eventually being spun out, Sensata Technology Holdings (NYSE: ST) is a leading supplier of analog sensors used in industrial and transportation applications, best known for its dominant position in the tire pressure monitoring systems in cars.

Demand for analog chips is generally linked to the overall level of economic growth, as analog chips serve as the building blocks of most electronic goods and equipment. Unlike digital chip designers, analog chip makers tend to produce the majority of their own chips, as analog chip production does not require expensive leading edge nodes. Less dependent on major secular growth drivers, analog product cycles are much longer, often 5-7 years.

Sales Growth

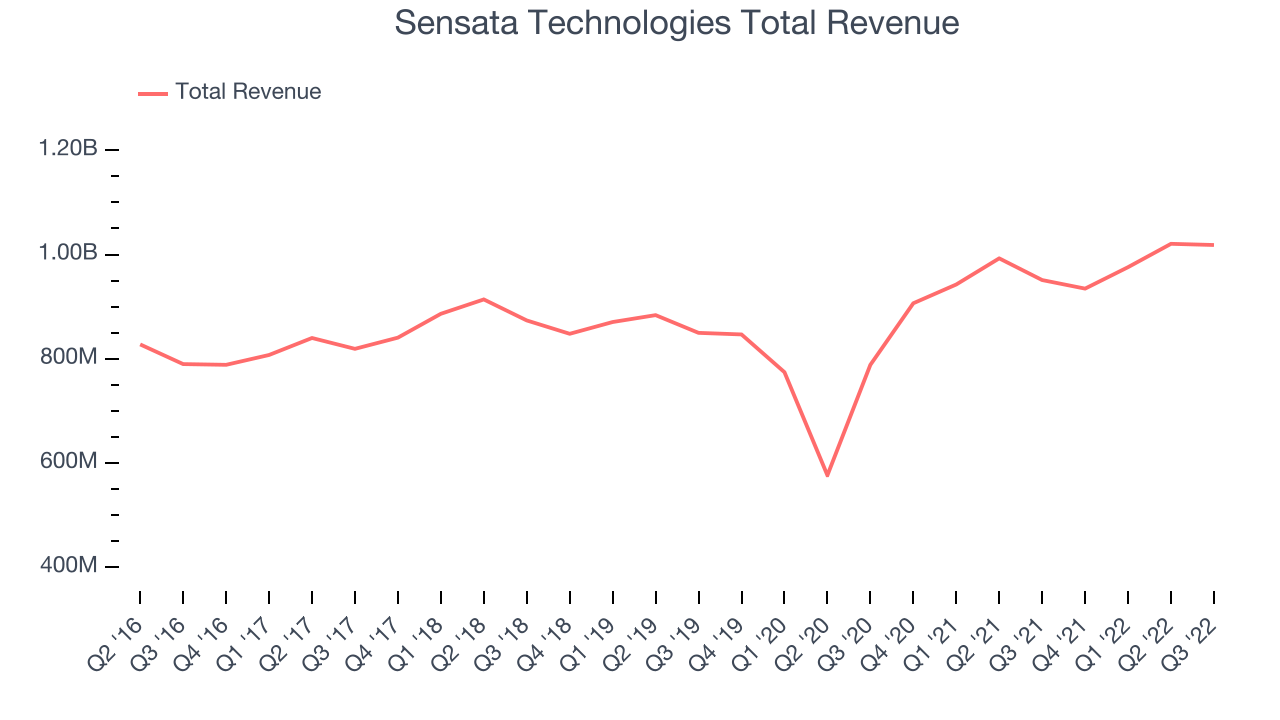

Sensata Technologies's revenue growth over the last three years has been on the slower side, averaging 7.07% annually. And as you can see below, last year has been even less strong, with quarterly revenue growing from $951 million to $1.01 billion. Semiconductors are a cyclical industry and long-term investors should be prepared for periods of high growth, followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

While Sensata Technologies beat analysts' revenue estimates, this was another quarter with 7% revenue growth. This marks 8 straight quarters of revenue growth, which means the current upcycle has had a good run, as a typical upcycle tends to be 8-10 quarters.

However, Sensata Technologies believes the growth is set to continue, and is guiding for revenue to grow 6.99% YoY next quarter, and Wall St analysts are estimating growth 4.23% over the next twelve months.

In volatile times like these we look for robust businesses with strong pricing power. Unknown to most investors, this company is one of the highest-quality software companies in the world, and their software products have been the default standard in critical industries for decades. The result is an impressive business that is up an incredible 18,152% since the IPO. You can find it on our platform for free.

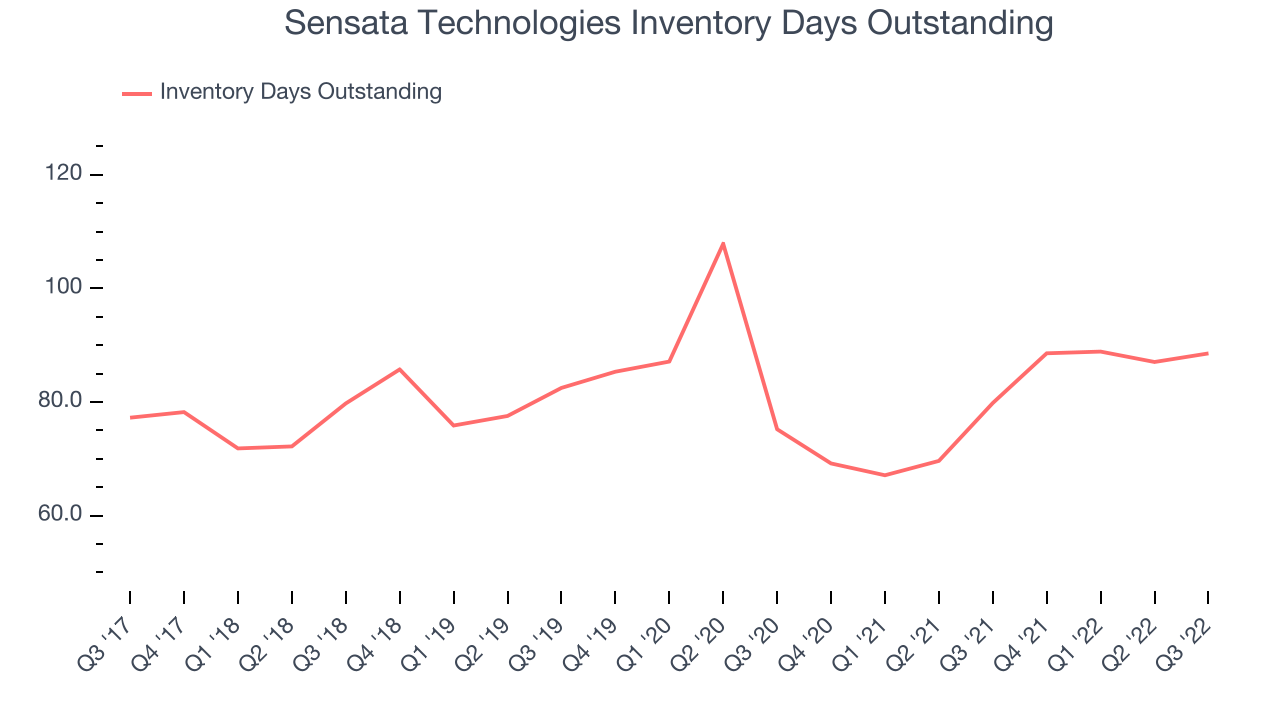

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) are an important metric for chipmakers, as it reflects the capital intensity of the business and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise the company may have to downsize production.

This quarter, Sensata Technologies’s inventory days came in at 89, 8 days above the five year average, suggesting that that inventory has grown to higher levels than what we used to see in the past.

Key Takeaways from Sensata Technologies's Q3 Results

With a market capitalization of $6.46 billion Sensata Technologies is among smaller companies, but its more than $1.1 billion in cash and positive free cash flow over the last twelve months put it in a very strong position to invest in growth.

Sensata Technologies topped analysts’ revenue expectations this quarter, even if just narrowly. That feature of these results really stood out as a positive. On the other hand, it was less good to see that the revenue growth was slow and gross margin deteriorated. Overall, this quarter's results were not the best we've seen from Sensata Technologies. The company is flat on the results and currently trades at $41.62 per share.

Sensata Technologies may have had a tough quarter, but does that actually create an opportunity to invest right now? It is important that you take into account its valuation and business qualities, as well as what happened in the latest quarter. We look at that in our actionable report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.