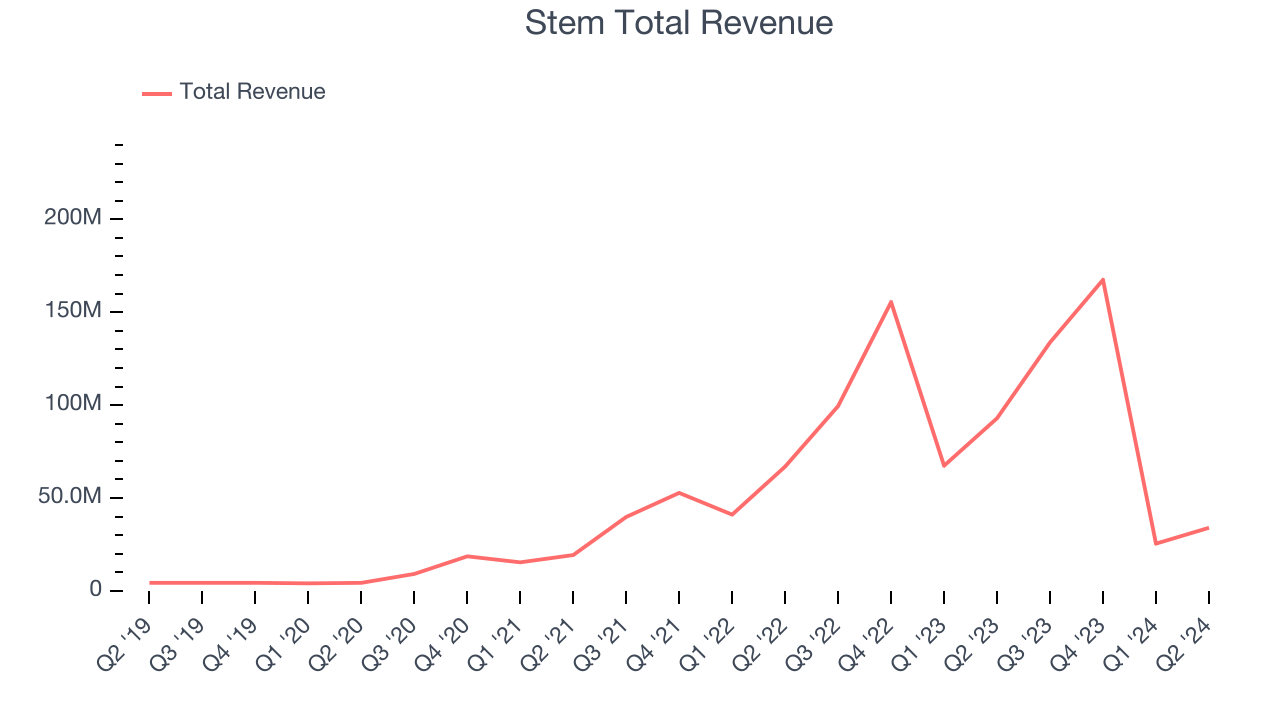

AI-driven clean energy solutions provider Stem (NYSE:STEM) missed analysts' expectations in Q2 CY2024, with revenue down 63.4% year on year to $34 million. The company's full-year revenue guidance of $235 million at the midpoint also came in 60.8% below analysts' estimates. It made a GAAP loss of $3.59 per share, down from its profit of $0.12 per share in the same quarter last year.

Is now the time to buy Stem? Find out by accessing our full research report, it's free.

Stem (STEM) Q2 CY2024 Highlights:

- Revenue: $34 million vs analyst estimates of $64.06 million (46.9% miss)

- EPS: -$3.59 vs analyst estimates of -$0.22 (-$3.37 miss)

- The company dropped its revenue guidance for the full year from $617 million to $235 million at the midpoint, a 61.9% decrease

- Gross Margin (GAAP): 27.6%, up from 12.8% in the same quarter last year

- Adjusted EBITDA Margin: -33.3%, down from -10.2% in the same quarter last year

- Free Cash Flow was -$14.92 million compared to -$4.20 million in the previous quarter

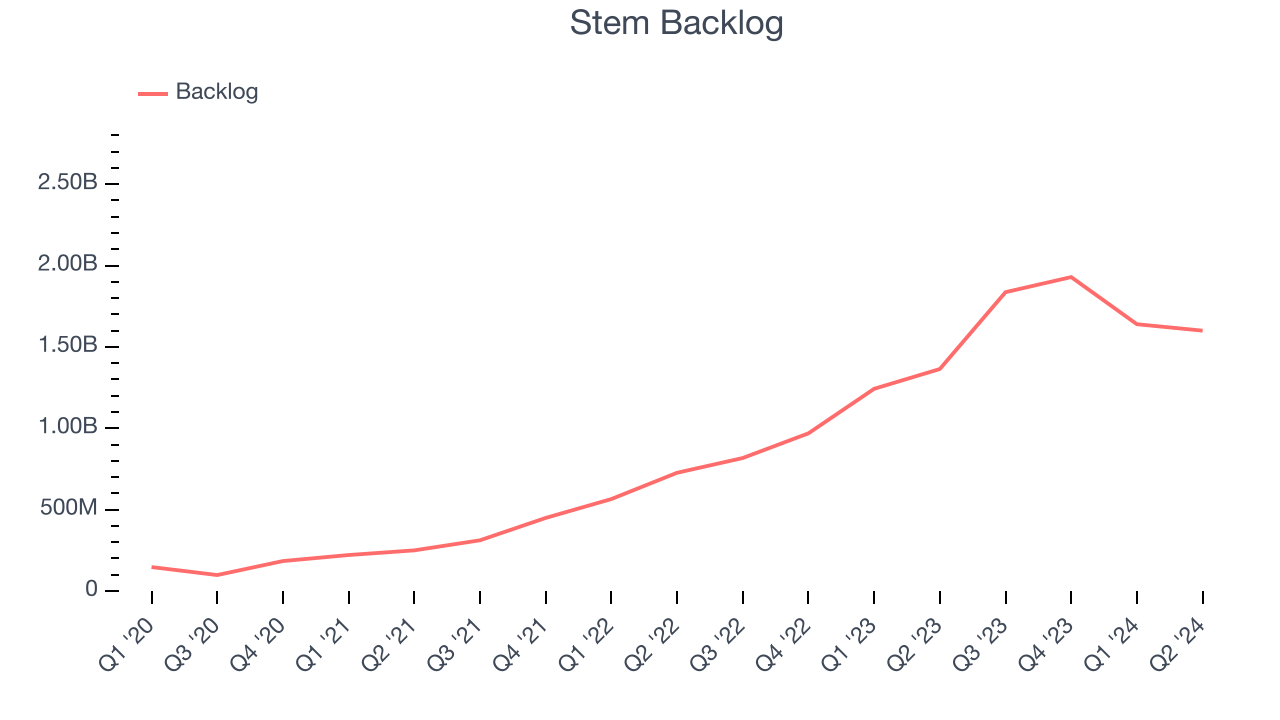

- Backlog: $1.6 billion at quarter end, up 17.3% year on year

- Market Capitalization: $160.3 million

“Our financial performance during the second quarter was a disappointment,” said John Carrington, CEO of Stem.

Focusing on clean energy, Stem (NYSE:STEM) has developed from a battery storage startup to an AI-driven energy management company.

Renewable Energy

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

Sales Growth

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, Stem's 46.6% annualized revenue growth over the last five years was incredible. This shows it expanded quickly, a useful starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Stem's annualized revenue growth of 34.1% over the last two years is below its five-year trend, but we still think the results were good and suggest demand was strong.

Stem also reports its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Stem's backlog reached $1.6 billion in the latest quarter and averaged 94.8% year-on-year growth over the last two years. Because this number is better than its revenue growth, we can see the company accumulated more orders than it could fulfill and deferred revenue to the future. This could imply elevated demand for Stem's products and services but raises concerns about capacity constraints.

This quarter, Stem missed Wall Street's estimates and reported a rather uninspiring 63.4% year-on-year revenue decline, generating $34 million of revenue. Looking ahead, Wall Street expects sales to grow 107% over the next 12 months, an acceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

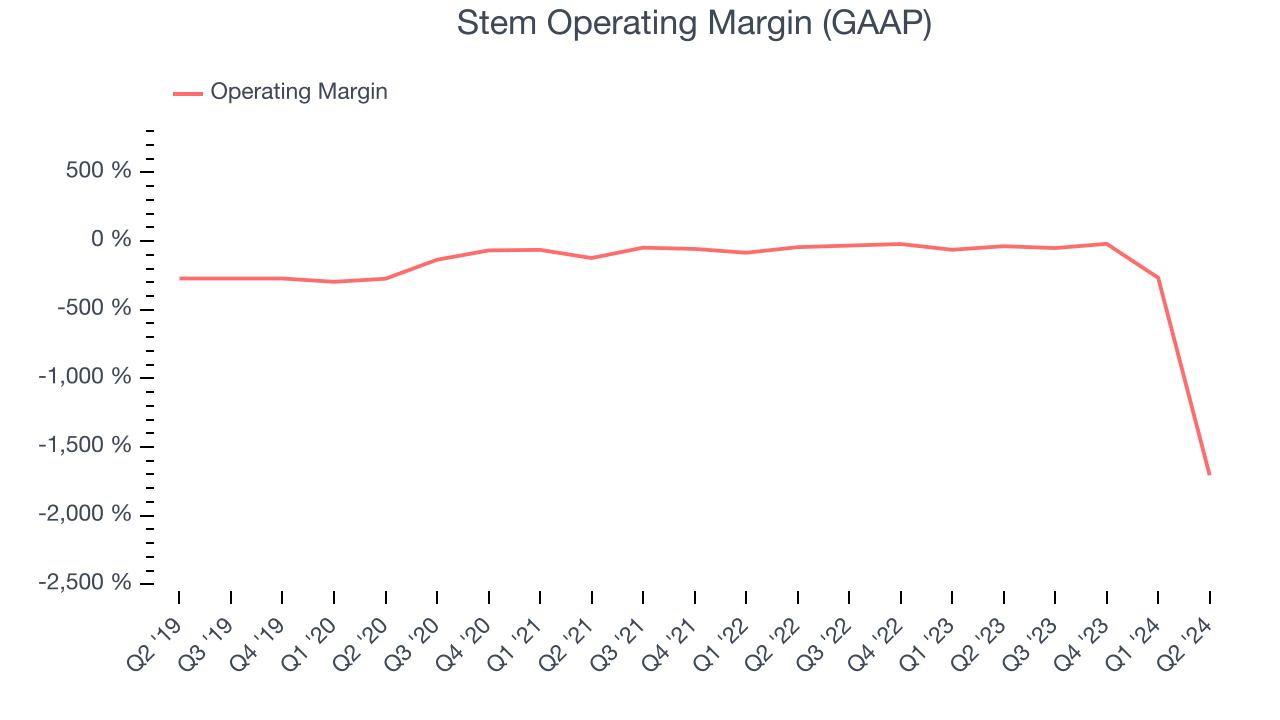

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It's also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Unprofitable industrials companies require extra attention because they could get caught swimming naked if the tide goes out. It's hard to trust that Stem can endure a full cycle as its high expenses have contributed to an average operating margin of negative 106% over the last five years. This result isn't too surprising given its low gross margin as a starting point.

On the bright side, Stem's annual operating margin rose by 70.9 percentage points over the last five years, as its sales growth gave it immense operating leverage. Still, it will take much more for the company to reach long-term profitability.

This quarter, Stem generated an operating profit margin of negative 1,705%, down 1,668 percentage points year on year. Conversely, the company's gross margin actually rose, so we can assume its recent inefficiencies were driven by increased operating expenses like sales, marketing, R&D, and administrative overhead.

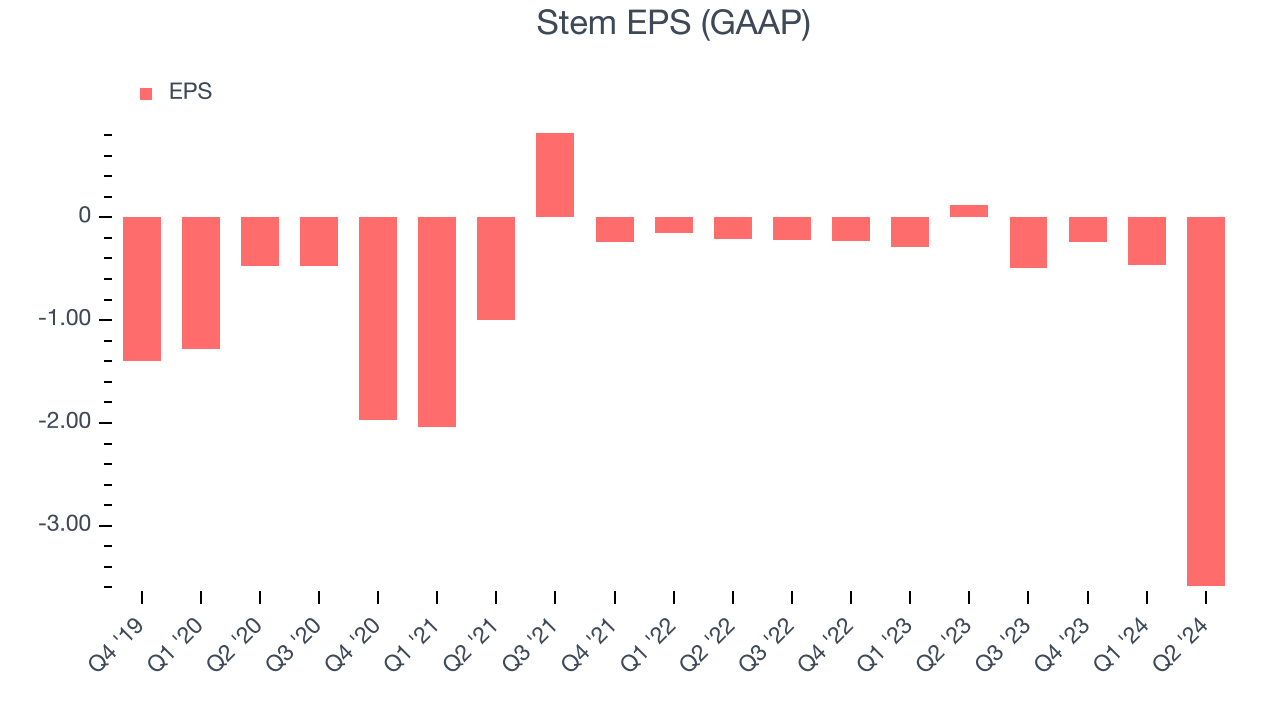

EPS

We track the long-term growth in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Stem's earnings losses deepened over the last four years as its EPS dropped 8% annually. We'll keep a close eye on the company as diminishing earnings could imply changing secular trends and preferences.

Like with revenue, we also analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business. Sadly for Stem, its EPS declined by 383% annually over the last two years while its revenue grew 34.1%. This tells us the company became less profitable on a per-share basis as it expanded.

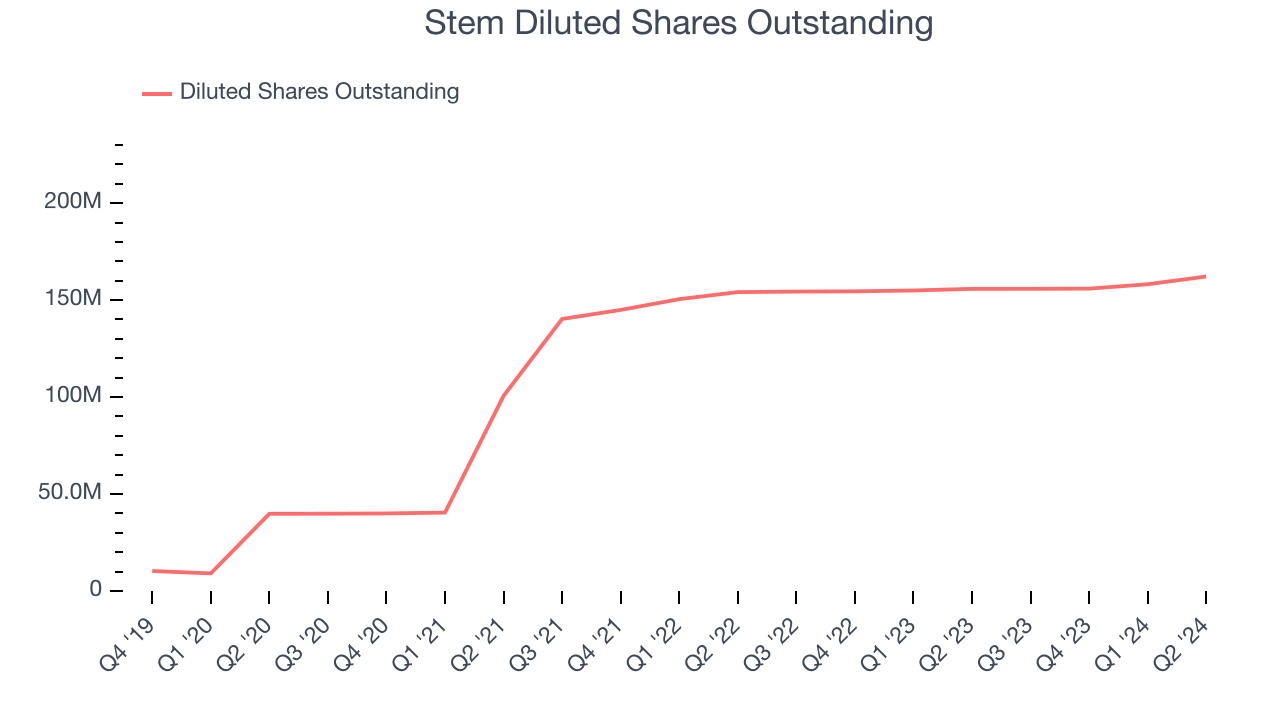

We can take a deeper look into Stem's earnings to better understand the drivers of its performance. Stem's operating margin has declined 1,660.9 percentage points over the last two years while its share count has grown 5.2%. This means the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q2, Stem reported EPS at negative $3.59, down from $0.12 in the same quarter last year. This print missed analysts' estimates. Over the next 12 months, Wall Street is optimistic. Analysts are projecting Stem's EPS of negative $4.79 in the last year to reach break even.

Key Takeaways from Stem's Q2 Results

This was quite a bad quarter. Revenue and EBITDA both missed. Its full-year revenue guidance was lowered by a large amount and missed. Adjusted EBITDA was also lowered by a lot and missed. The stock traded down 25.8% to $0.74 immediately following the results.

Stem may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.