Beer, wine, and spirits company Constellation Brands (NYSE:STZ) reported Q1 CY2024 results beating Wall Street analysts' expectations, with revenue up 7.1% year on year to $2.14 billion. It made a non-GAAP profit of $2.26 per share, improving from its profit of $1.98 per share in the same quarter last year.

Constellation Brands (STZ) Q1 CY2024 Highlights:

- Revenue: $2.14 billion vs analyst estimates of $2.09 billion (2.1% beat)

- EPS (non-GAAP): $2.26 vs analyst estimates of $2.09 (8% beat)

- EPS (non-GAAP) guidance for the upcoming full year: $13.65 vs analyst estimates of $13.43 (1.6% beat)

- Gross Margin (GAAP): 48.6%, in line with the same quarter last year

- Free Cash Flow of $76 million, down 80.8% from the previous quarter

- Organic Revenue was up 7% year on year

- Market Capitalization: $48.43 billion

With a presence in more than 100 countries, Constellation Brands (NYSE:STZ) is a globally renowned producer and marketer of beer, wine, and spirits.

The company was founded in 1945 by Marvin Sands, originally selling bulk wine to bottlers in the eastern United States. Since then, it’s evolved into a beverage industry powerhouse by acquiring numerous brands.

Today, Constellation Brands boasts a diverse and impressive portfolio of labels including Corona Extra and Modelo Especial in beer, Kim Crawford and Meiomi in wine, and Svedka Vodka and Casa Noble Tequila in spirits. These brands cater to various consumer tastes and preferences, providing a broad spectrum of high-quality options.

Beyond its core brands, Constellation Brands is recognized for pioneering new trends and categories, such as premium imported beers, craft spirits, and ready-to-drink cocktails. It was also the first Fortune 500 company and major alcoholic beverage maker to invest in a marijuana business (Canopy Growth in 2017), a bold move speaking to the company’s corporate culture.

The company places a strong emphasis on premiumization, offering high-quality products that often command higher price points. Given its sheer size, Constellation Brands has a robust global presence, and this extensive reach enables it to tap into diverse international markets and cater to a wide range of consumer tastes, making it a recognized and trusted name worldwide.

Beverages and Alcohol

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the explosion of alcoholic craft beer drinks or the steady decline of non-alcoholic sugary sodas. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Competitors include Anheuser-Busch Inbev (NYSE:BUD), Boston Beer (NYSE:SAM), and Molson Coors (NYSE:TAP) along with international companies such as Asahi, Carlsberg, and Heineken.Sales Growth

Constellation Brands is one of the larger consumer staples companies and benefits from a well-known brand, giving it customer mindshare and influence over purchasing decisions.

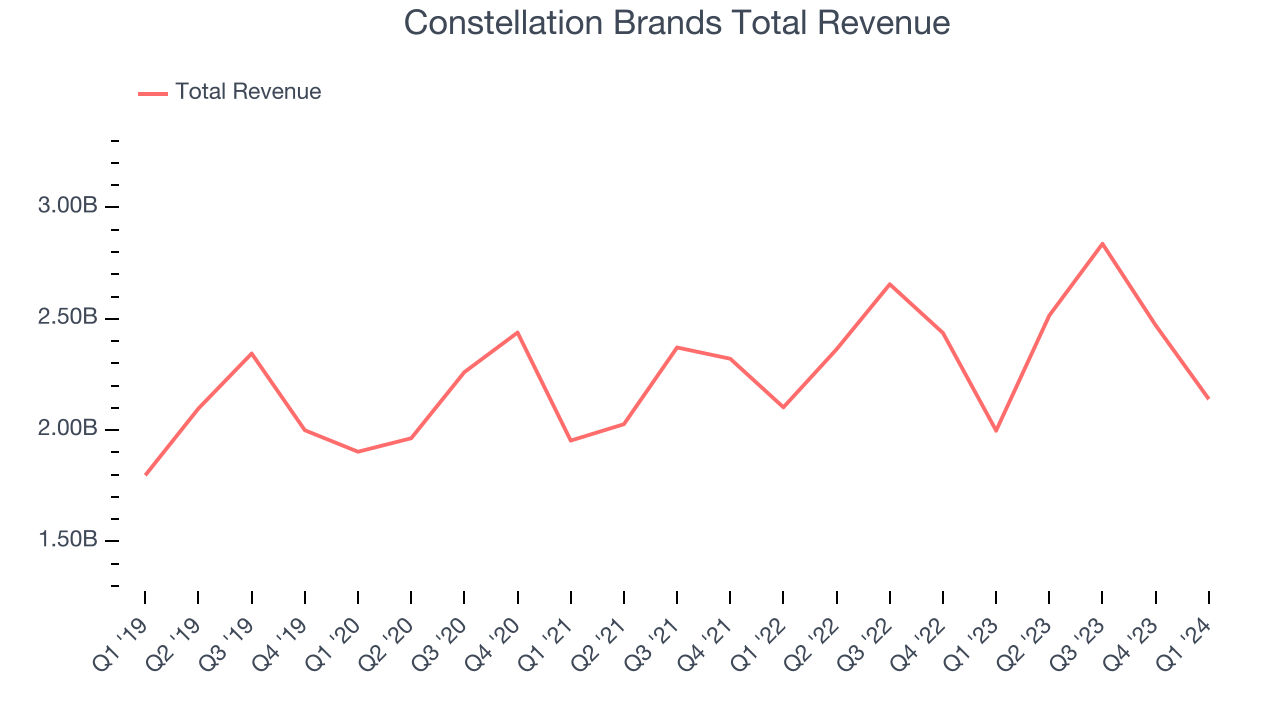

As you can see below, the company's annualized revenue growth rate of 5% over the last three years was weak for a consumer staples business.

This quarter, Constellation Brands reported solid year-on-year revenue growth of 7.1%, and its $2.14 billion in revenue outperformed Wall Street's estimates by 2.1%. Looking ahead, Wall Street expects sales to grow 5.9% over the next 12 months, a deceleration from this quarter.

Organic Revenue Growth

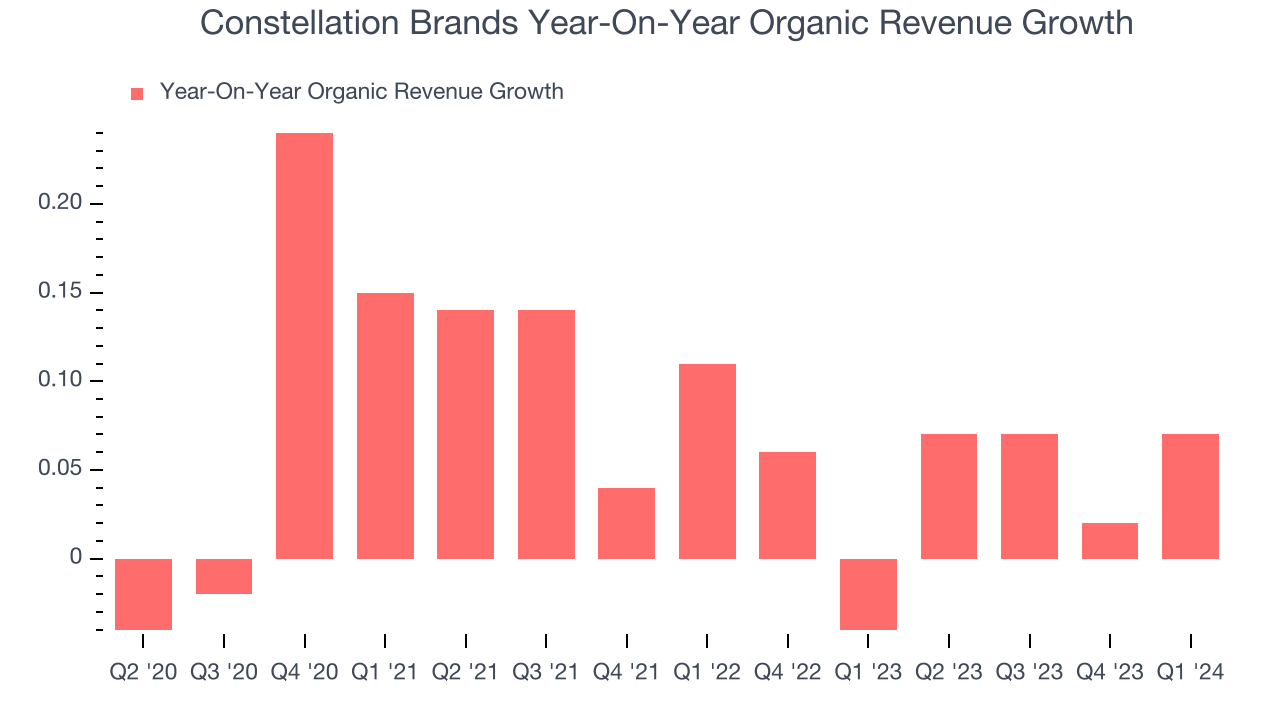

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business's performance excluding the impacts of foreign currency fluctuations and one-time events such as mergers, acquisitions, and divestitures.

The demand for Constellation Brands's products has generally risen over the last two years but lagged behind the broader sector. On average, the company's organic sales have grown by 4.2% year on year.

In the latest quarter, Constellation Brands's organic sales rose 7% year on year. This growth was a well-appreciated turnaround from the 4% year-on-year decline it posted 12 months ago, showing the business is regaining momentum.

Gross Margin & Pricing Power

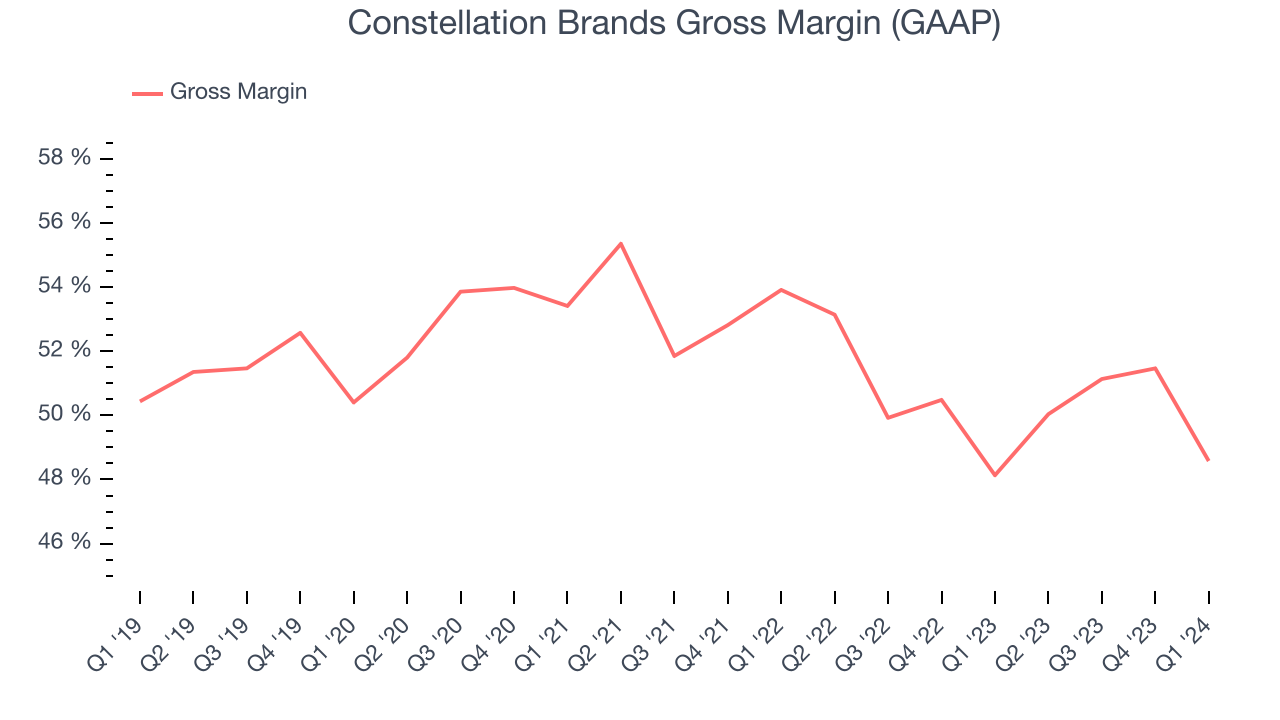

This quarter, Constellation Brands's gross profit margin was 48.6%, in line with the same quarter last year. That means for every $1 in revenue, $0.51 went towards paying for raw materials, production of goods, and distribution expenses.

Constellation Brands has great unit economics for a consumer staples company, giving it ample room to invest in areas such as marketing and talent to grow its brand. As you can see above, it's averaged an impressive 50.4% gross margin over the last eight quarters. Its margin has also been consistent over the last year, suggesting it has stable input costs (such as raw materials).

Operating Margin

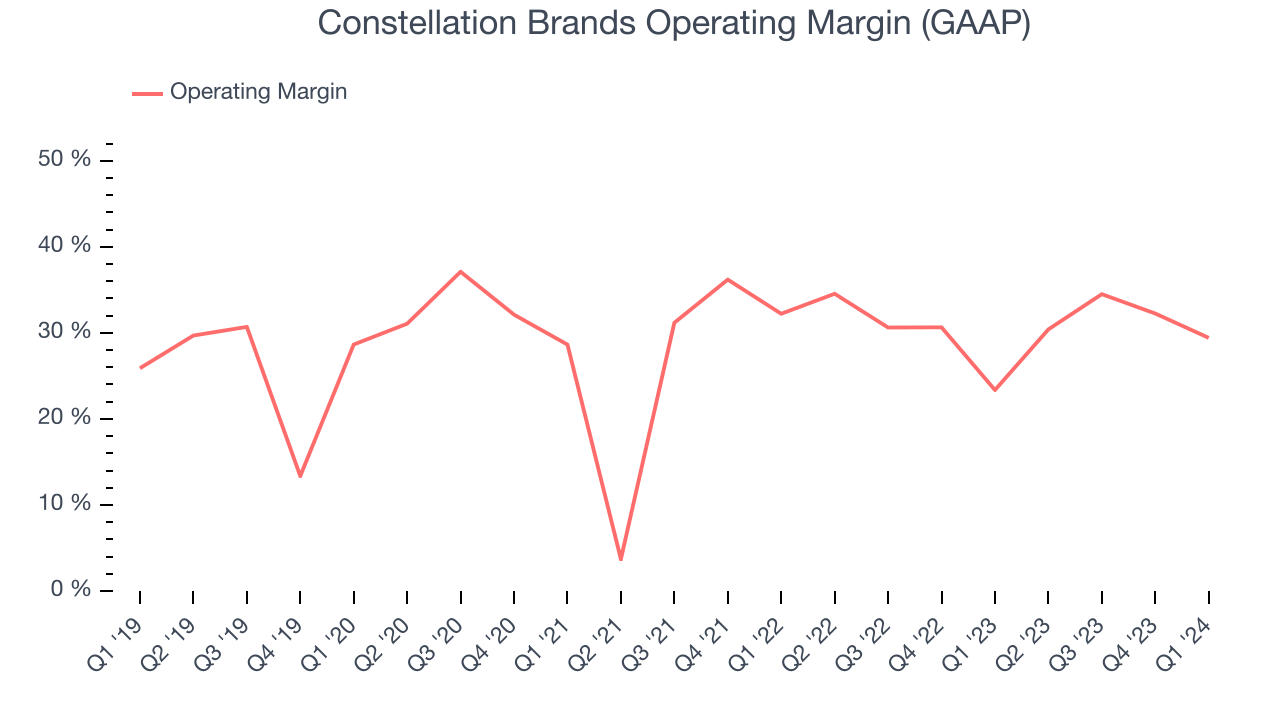

Operating margin is an important measure of profitability accounting for key expenses such as marketing and advertising, IT systems, wages, and other administrative costs.

This quarter, Constellation Brands generated an operating profit margin of 29.4%, up 6.1 percentage points year on year. This increase was encouraging, and we can infer Constellation Brands was more efficient with its expenses because its operating margin expanded more than its gross margin.

Zooming out, Constellation Brands has been a well-oiled machine over the last two years. It's demonstrated elite profitability for a consumer staples business, boasting an average operating margin of 31%. On top of that, its margin has risen by 1.7 percentage points on average over the last year, showing the company is improving its fundamentals.

Zooming out, Constellation Brands has been a well-oiled machine over the last two years. It's demonstrated elite profitability for a consumer staples business, boasting an average operating margin of 31%. On top of that, its margin has risen by 1.7 percentage points on average over the last year, showing the company is improving its fundamentals. EPS

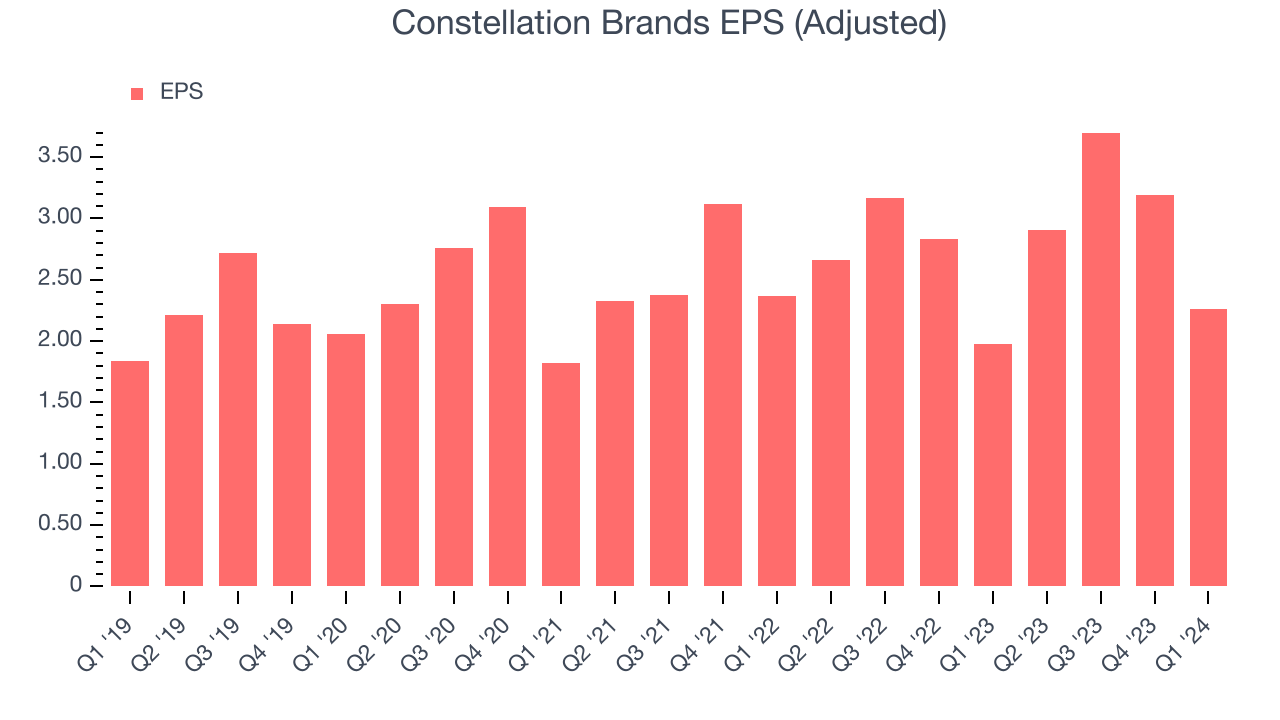

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

In Q1, Constellation Brands reported EPS at $2.26, up from $1.98 in the same quarter a year ago. This print beat Wall Street's estimates by 8%.

Between FY2021 and FY2024, Constellation Brands's EPS grew 21%, translating into a decent 6.5% compounded annual growth rate.

Wall Street expects the company to continue growing earnings over the next 12 months, with analysts projecting an average 10.7% year-on-year increase in EPS.

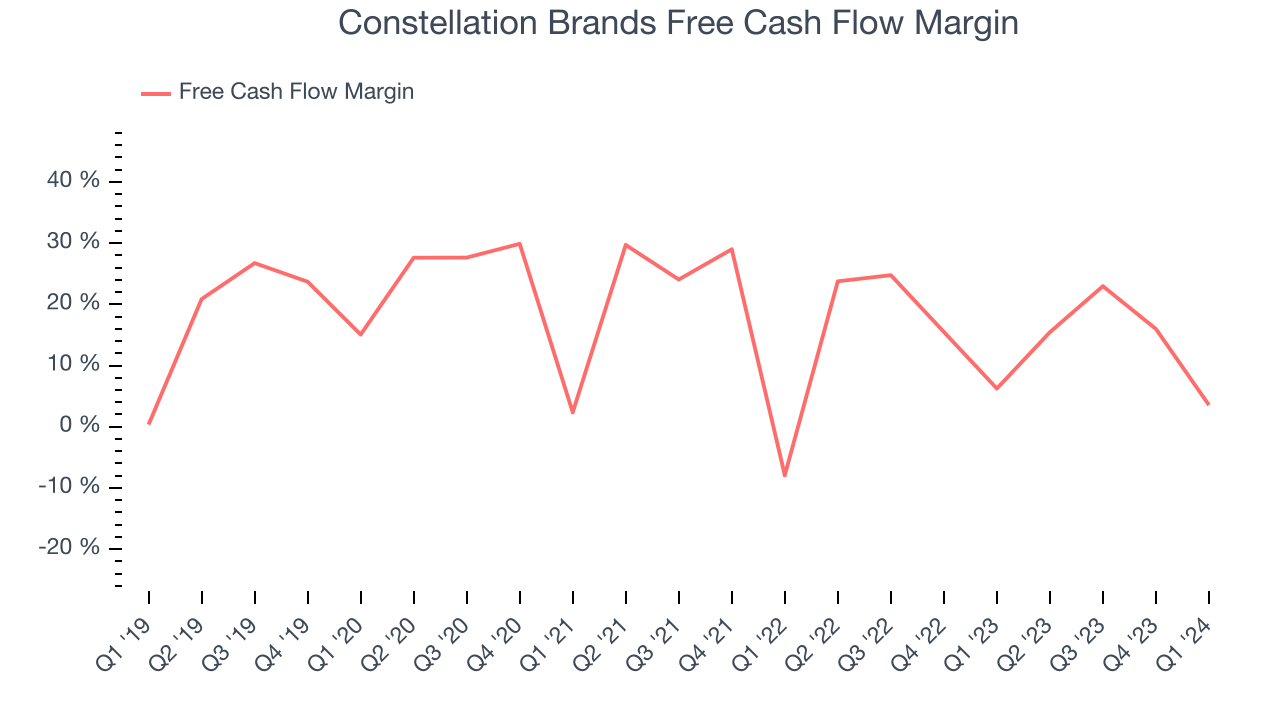

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Constellation Brands's free cash flow came in at $76 million in Q1, down 39.1% year on year. This result represents a 3.6% margin.

Over the last eight quarters, Constellation Brands has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining a robust cash balance. The company's free cash flow margin has been among the best in the consumer staples sector, averaging 16.6%. However, its margin has averaged year-on-year declines of 3 percentage points over the last 12 months. If this trend continues, it could signal that the business is becoming slightly more capital-intensive.

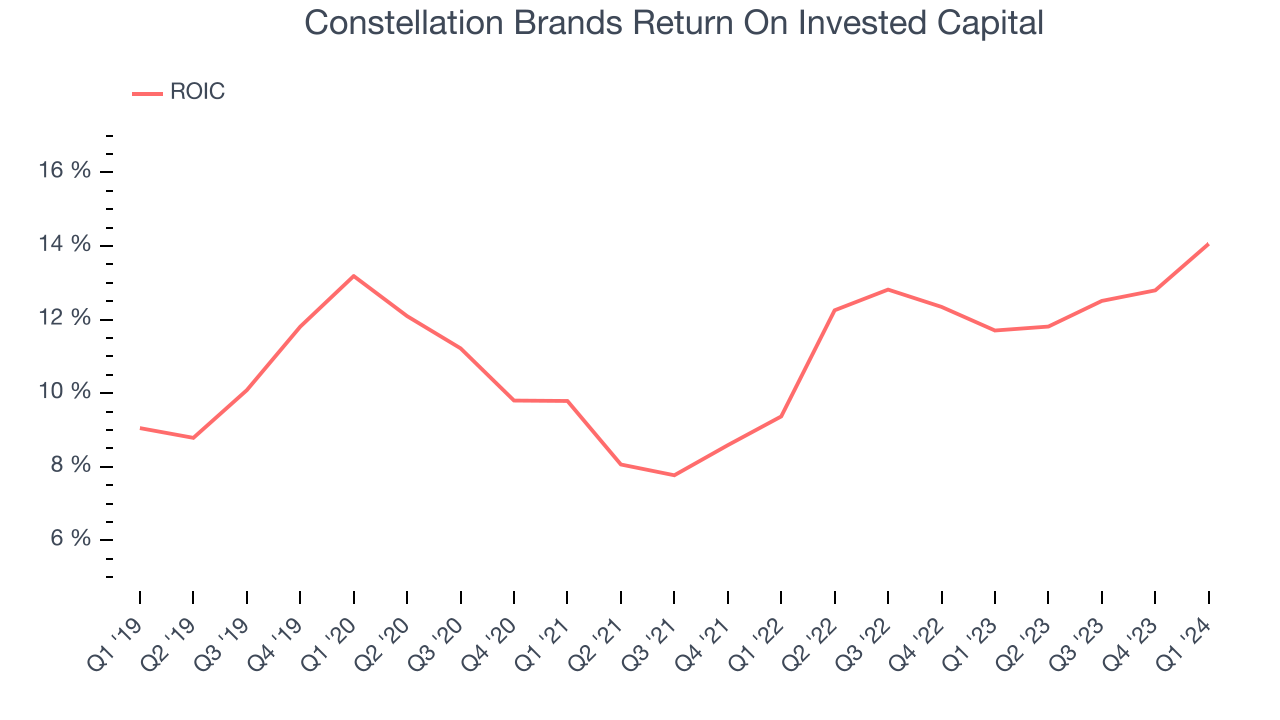

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Constellation Brands's five-year average ROIC was 11.6%, slightly better than the broader sector. Just as you’d like your investment dollars to generate returns, Constellation Brands's invested capital has produced decent profits.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last few years, Constellation Brands's ROIC averaged 1.4 percentage point increases. This is a good sign, and if the company's returns keep rising, there's a chance it could evolve into an investable business.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is seperate from short-term stock price volatility, which we are much less bothered by.

Constellation Brands reported $152.4 million of cash and $11.88 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $3.67 billion of EBITDA over the last 12 months, we view Constellation Brands's 3.2x net-debt-to-EBITDA ratio as safe. We also see its $435.4 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Constellation Brands's Q1 Results

We liked that Constellation Brands' organic revenue growth beat led to higher-than-expected revenue. EPS also beat in the quarter, and EPS guidance for the full year was slightly ahead of Wall Street analysts' expectations. Zooming out, we think this was a solid quarter, showing that the company is staying on track. The stock is up 1.2% after reporting and currently trades at $268 per share.

Is Now The Time?

Constellation Brands may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We have other favorites, but we understand the arguments that Constellation Brands isn't a bad business. Although its revenue growth has been a little slower over the last three years, its impressive operating margins show it has a highly efficient business model.

Constellation Brands's price-to-earnings ratio based on the next 12 months is 19.8x. We don't really see a big opportunity in the stock at the moment, but in the end, beauty is in the eye of the beholder. If you like Constellation Brands, it seems to be trading at a reasonable price.

Wall Street analysts covering the company had a one-year price target of $293.56 per share right before these results (compared to the current share price of $268).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.