Data and analytics software provider Teradata (NYSE:TDC) reported results in line with analysts' expectations in Q1 CY2024, with revenue down 2.3% year on year to $465 million. It made a non-GAAP profit of $0.57 per share, down from its profit of $0.61 per share in the same quarter last year.

Teradata (TDC) Q1 CY2024 Highlights:

- Revenue: $465 million vs analyst estimates of $463.9 million (small beat)

- ARR: $1,480 million vs analyst estimates of $1,504 million (1.6% miss)

- EPS (non-GAAP): $0.57 vs analyst estimates of $0.55 (3% beat)

- Maintained full year guidance for ARR growth, revenue growth, and EPS (non-GAAP)

- Gross Margin (GAAP): 61.1%, down from 63.4% in the same quarter last year

- Free Cash Flow of $21 million, down 87.5% from the previous quarter

- Annual Recurring Revenue: $1.48 billion at quarter end, down 1.7% year on year

- Market Capitalization: $3.64 billion

Part of point-of-sale and ATM company NCR from 1991 to 2007, Teradata (NYSE:TDC) offers a software-as-service platform that helps organizations manage their data across multiple storages and analyze it.

The customer problem that Teradata addresses is the challenge of managing large and growing amounts of data in a secure and scalable manner. With the oftentimes exponential growth of enterprise data, businesses need a reliable and scalable platform to collect, manage, and analyze data to gain insights and make good business decisions.

Teradata offers a range of software, hardware, and services so organizations can collect, store, analyze, and manage large amounts of data from multiple sources. Teradata Vantage is the cloud-based flagship product. For example, pharmaceutical giant Pfizer used Vantage to centralize and integrate data from clinical trials, manufacturing operations, and its supply chain. Vantage enabled Pfizer to perform predictive modeling to improve clinical trials yields and to eliminate redundancies in supply chain operations, leading to cost savings and better time to market for a number of popular and game-changing drugs.

From airlines looking to optimize routes and crews to e-commerce companies looking to understand consumer behavior, Teradata's customers come from a range of industries. The company generates revenue through the sale of software licenses, hardware, and services. The company offers a range of consulting and support services to help customers deploy and manage their data analytics platforms.

Data Infrastructure

Generating insights from system level data is an increasing priority for most businesses, but to do so requires connecting and analyzing piles of data stored and siloed in separate databases. This is the demand driver for cloud based data infrastructure software providers, who can more readily integrate, distribute and process information vs. legacy on-premise software providers.

Competitors in engineering and design software include Snowflake (NYSE:SNOW), IBM (NYSE:IBM), and SAP (XTRA:SAP).Sales Growth

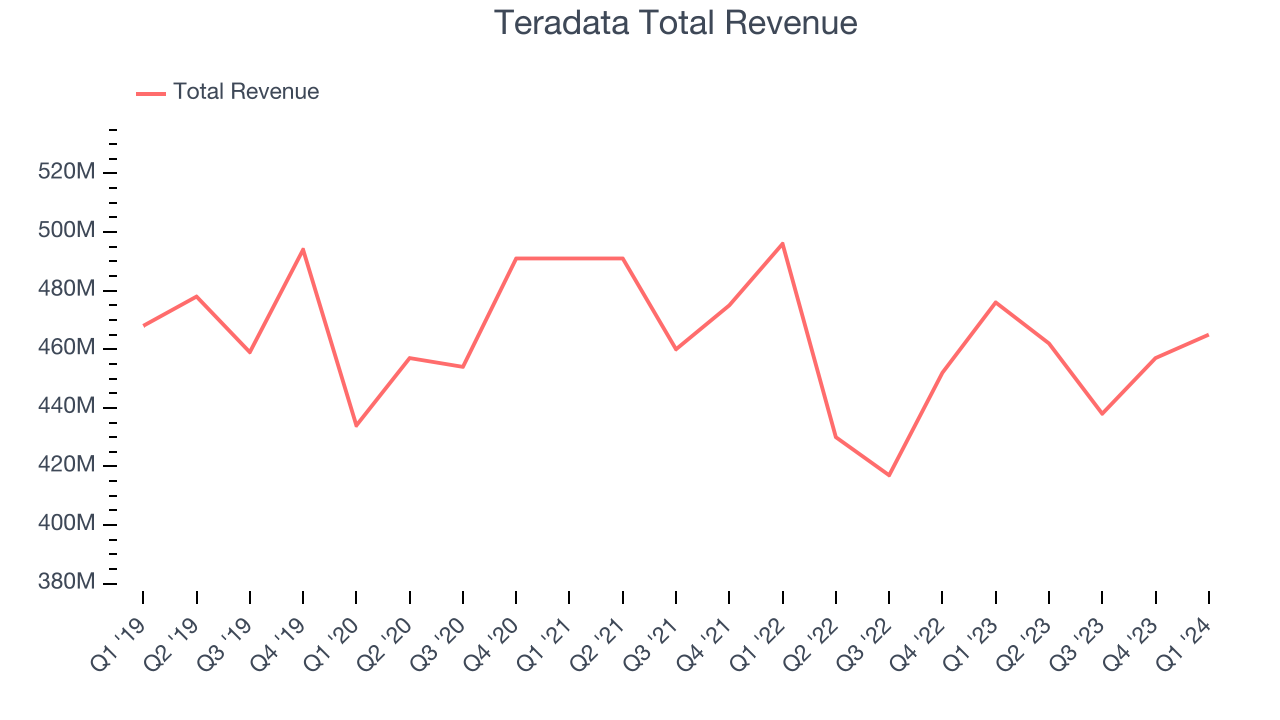

As you can see below, Teradata's revenue has declined over the last three years, shrinking from $491 million in Q1 2021 to $465 million this quarter.

Teradata's revenue was down again this quarter, falling 2.3% year on year.

Looking ahead, analysts covering the company were expecting sales to grow 1.5% over the next 12 months before the earnings results announcement.

Profitability

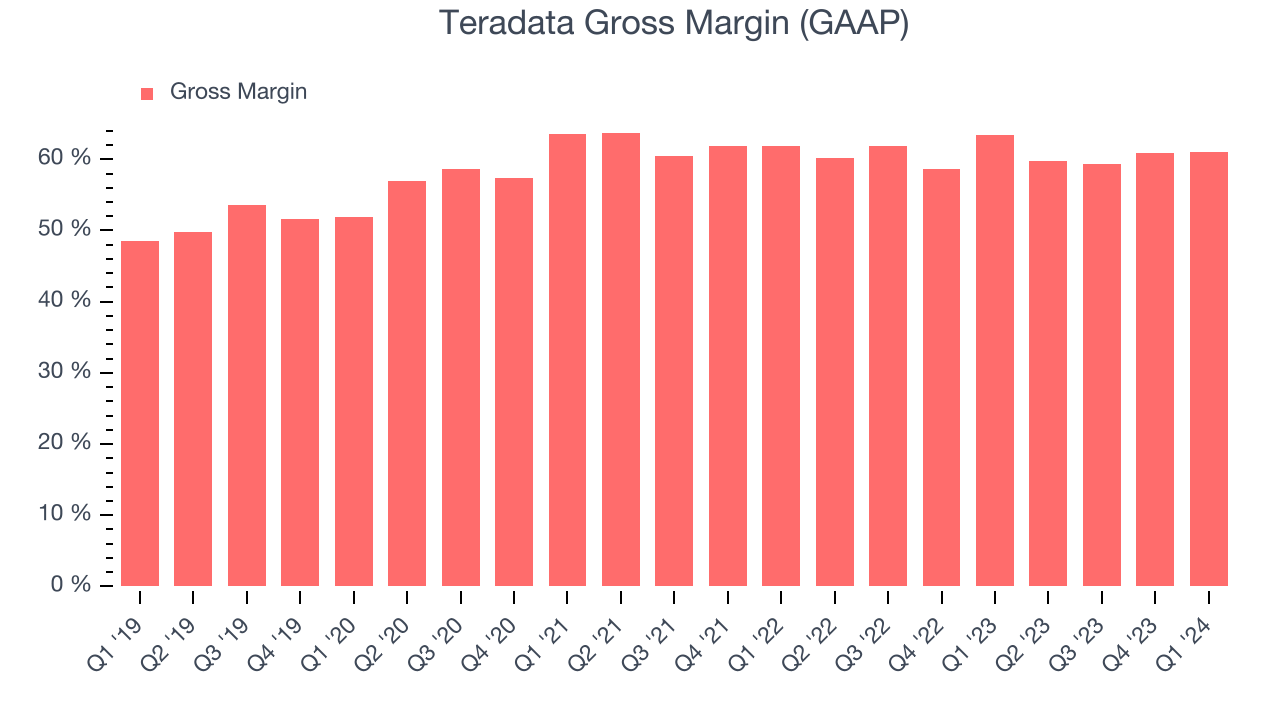

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Teradata's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 61.1% in Q1.

That means that for every $1 in revenue the company had $0.61 left to spend on developing new products, sales and marketing, and general administrative overhead. Teradata's gross margin is poor for a SaaS business and we'd like to see it start improving.

Cash Is King

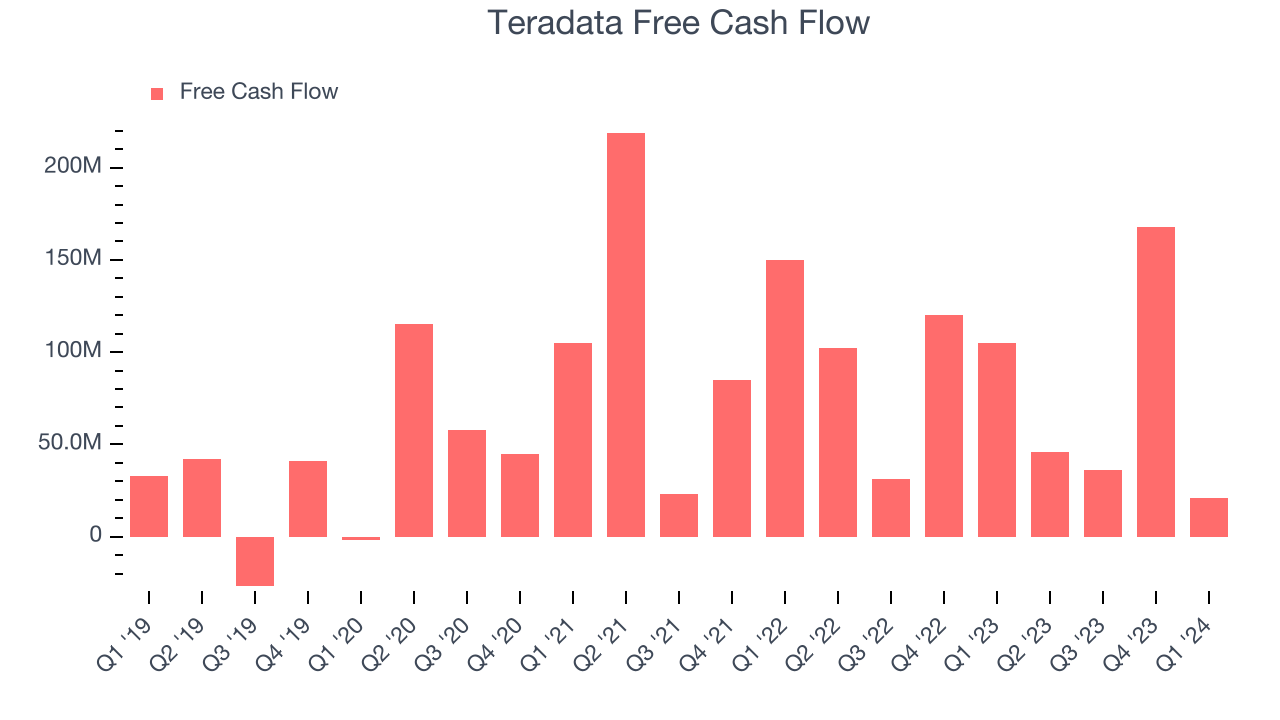

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Teradata's free cash flow came in at $21 million in Q1, down 80% year on year.

Teradata has generated $271 million in free cash flow over the last 12 months, a decent 14.9% of revenue. This FCF margin stems from its asset-lite business model and gives it a decent amount of cash to reinvest in its business.

Key Takeaways from Teradata's Q1 Results

Teradata's billings unfortunately missed analysts' expectations and its ARR (annual recurring revenue) also missed Wall Street's estimates. The company did try to assuage the market by maintaining full year guidance for ARR and revenue growth as well as EPS. Overall, this was a mediocre quarter for Teradata due to the underperformance of key topline metrics. The company is down 3.3% on the results and currently trades at $36.7 per share.

Is Now The Time?

When considering an investment in Teradata, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We cheer for everyone who's making the lives of others easier through technology, but in case of Teradata, we'll be cheering from the sidelines. Its revenue has declined over the last three years, and analysts expect growth to deteriorate from here. And while its efficient customer acquisition hints at the potential for strong profitability, unfortunately, its gross margins show its business model is much less lucrative than the best software businesses.

Teradata's price-to-sales ratio based on the next 12 months is 2.1x, suggesting the market has lower expectations for the business relative to the hottest tech stocks. While there are some things to like about Teradata and its valuation is reasonable, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $53 right before these results (compared to the current share price of $36.70).

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.