Digital medical services platform Teladoc Health (NYSE:TDOC) fell short of analysts' expectations in Q3 FY2023, with revenue up 7.99% year on year to $660.2 million. Next quarter's revenue guidance of $670.5 million was also less impressive, coming in 2.34% below analysts' estimates. Turning to EPS, Teladoc made a GAAP loss of $0.35 per share, improving from its loss of $0.45 per share in the same quarter last year.

Is now the time to buy Teladoc? Find out by accessing our full research report, it's free.

Teladoc (TDOC) Q3 FY2023 Highlights:

- Revenue: $660.2 million vs analyst estimates of $663.1 million (small miss)

- EPS: -$0.35 vs analyst estimates of -$0.37 (5.11% beat)

- Revenue Guidance for Q4 2023 is $670.5 million at the midpoint, below analyst estimates of $686.6 million

- Free Cash Flow of $68 million, similar to the previous quarter

- Gross Margin (GAAP): 71.8%, up from 69.6% in the same quarter last year

- US Integrated Care Members: 90.2 million, up 8.1 million year on year

"As we look into 2024, we will continue to advance virtual care in ways large and small. We've seen the positive impact of our unified app, which allows members for the first time to access complex states of care on a single device. We will accelerate our efforts to drive value through improved business performance across the enterprise, undertaking a comprehensive operational review of the business to further improve our efficiency. We are committed to building an even stronger company that continues to deliver on balanced growth, while keeping our promises to clients and caring for our members," said Jason Gorevic, CEO of Teladoc.

Founded to help people in rural areas get online medical consultations, Teladoc Health (NYSE:TDOC) is a telemedicine platform that facilitates remote doctor’s visits.

Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

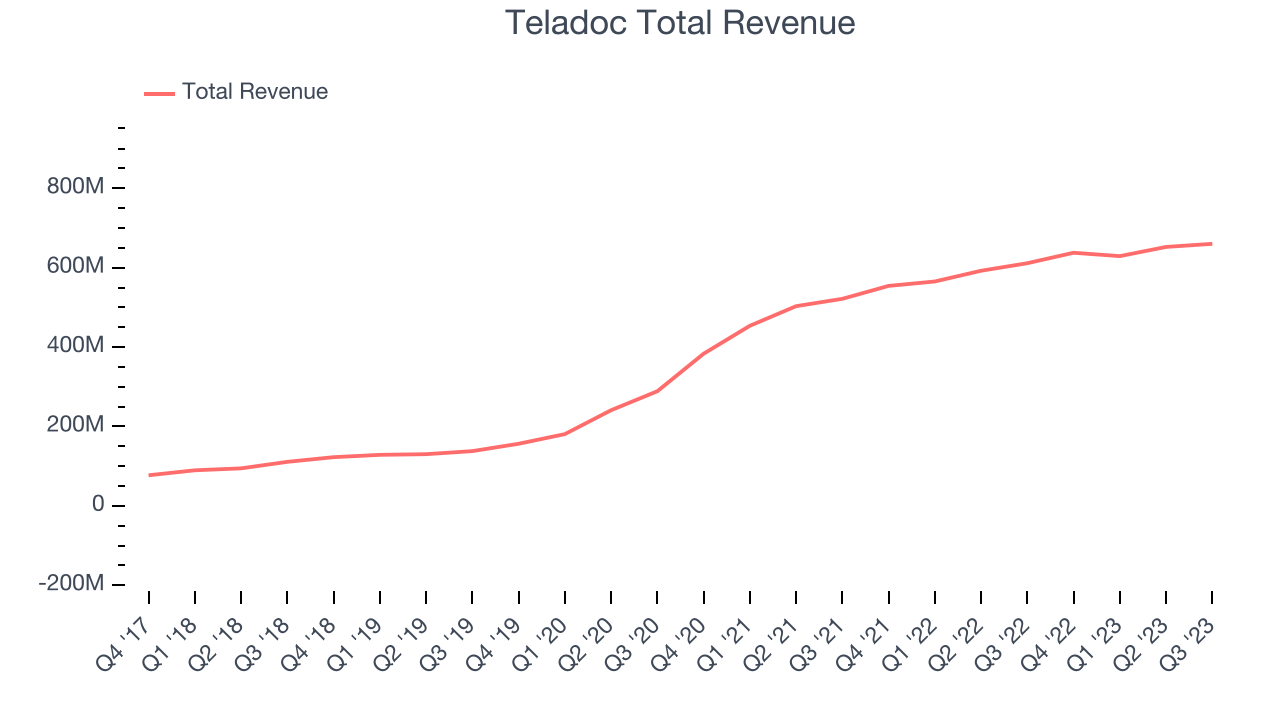

Sales Growth

Teladoc's revenue growth over the last three years has been exceptional, averaging 52.8% annually. This quarter, Teladoc reported mediocre 7.99% year-on-year revenue growth, missing Wall Street's expectations.

Guidance for the next quarter indicates Teladoc is expecting revenue to grow 5.14% year on year to $670.5 million, slowing down from the 15.1% year-on-year increase it recorded in the same quarter last year. Ahead of the earnings results, analysts covering the company were projecting sales to grow 8.21% over the next 12 months.

The pandemic fundamentally changed several consumer habits. There is a founder-led company that is massively benefiting from this shift. The business has grown astonishingly fast, with 40%+ free cash flow margins. Its fundamentals are undoubtedly best-in-class. Still, the total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

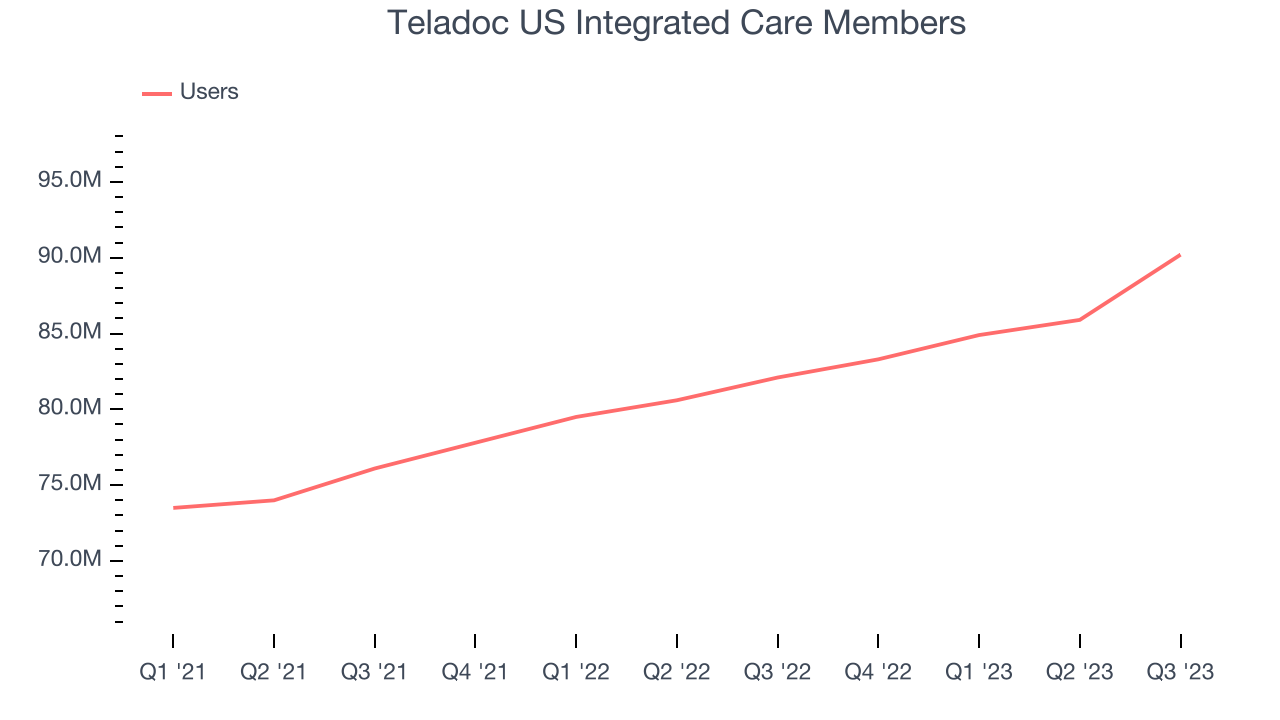

Usage Growth

As an online marketplace, Teladoc generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

Over the last two years, Teladoc's users, a key performance metric for the company, grew 7.9% annually to 90.2 million. This is decent growth for a consumer internet company.

In Q3, Teladoc added 8.1 million users, translating into 9.87% year-on-year growth.

Key Takeaways from Teladoc's Q3 Results

Sporting a market capitalization of $2.97 billion, Teladoc is among smaller companies, but its more than $1.03 billion in cash on hand and positive free cash flow over the last 12 months puts it in an attractive position to invest in growth.

We struggled to find many strong positives in these results. Its revenue missed and revenue guidance for next quarter underwhelmed; both were driven by lower-than-expected total visits within the Teladoc network. Additionally, while EPS beat by a bit this quarter, EPS guidance for next quarter missed Wall Street's estimates. Overall, the results could have been better. The company is down 4.3% on the results and currently trades at $140.6 per share.

Teladoc may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned in this report.