As Q1 earnings season comes to a close, it’s time to take stock of this quarter's best and worst performers amongst the online marketplace stocks, including Teladoc (NYSE:TDOC) and its peers.

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission paying sellers, generating flywheel scale effects which feed back into further customer acquisition.

The 11 online marketplace stocks we track reported a mixed Q1; on average, revenues beat analyst consensus estimates by 3.34%, while on average next quarter revenue guidance was 1.52% under consensus. Increasing interest rates hurt growth companies as investors search for near-term cash flows , but online marketplace stocks held their ground better than others, with the share prices up 11.3% since the previous earnings results, on average.

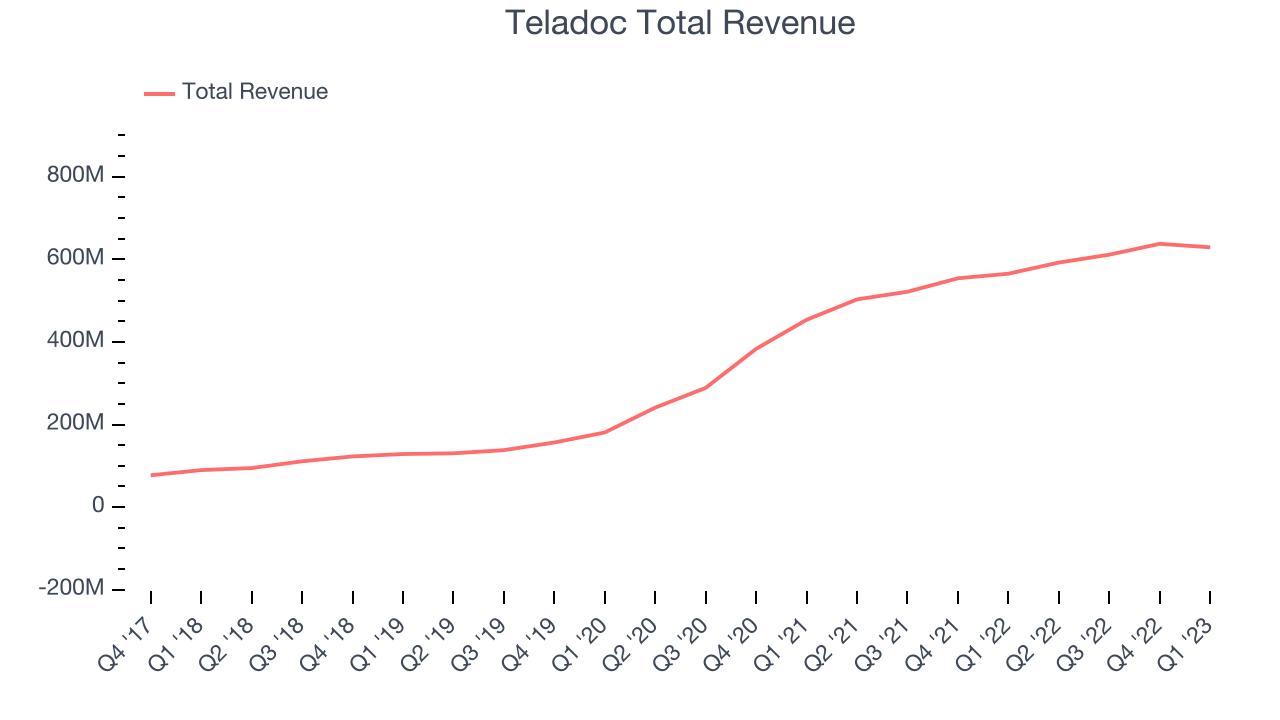

Teladoc (NYSE:TDOC)

Founded to help people in rural areas get online medical consultations, Teladoc Health (NYSE:TDOC) is a telemedicine platform that facilitates remote doctor’s visits.

Teladoc reported revenues of $629.2 million, up 11.3% year on year, beating analyst expectations by 1.78%. It was a mixed quarter for the company, with a decent beat of analyst estimates but slow revenue growth.

“Teladoc Health delivered strong first quarter results across all key financial and operating metrics to start the year,” said Jason Gorevic, chief executive officer of Teladoc Health.

The company reported 84.9 million users, up 6.79% year on year. The stock is down 1.24% since the results and currently trades at $25.44.

Is now the time to buy Teladoc? Access our full analysis of the earnings results here, it's free.

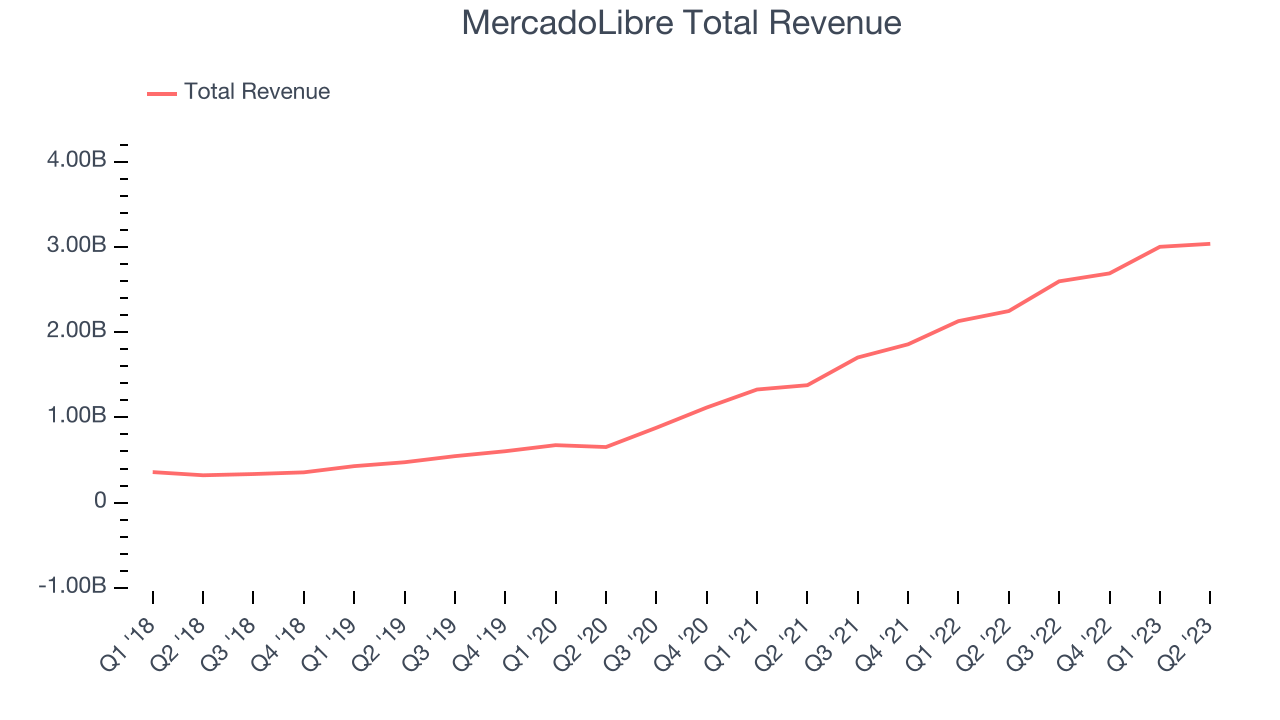

Best Q1: MercadoLibre (NASDAQ:MELI)

Originally started as an online auction platform, MercadoLibre (NASDAQ:MELI) today is a one-stop e-commerce marketplace in Latin America.

MercadoLibre reported revenues of $3.04 billion, up 35.1% year on year, beating analyst expectations by 5.22%. It was a very strong quarter for the company, with growing number of users and a solid beat of analyst estimates.

MercadoLibre delivered the fastest revenue growth among its peers. The company reported 101 million daily active users, up 24.7% year on year. The stock is down 7.53% since the results and currently trades at $1,187.

Is now the time to buy MercadoLibre? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Sea Limited (NYSE:SE)

Founded in 2009 and a publicly-traded company since 2017, Sea Limited (NYSE:SE) started as a gaming platform and has since expanded to offer a variety of services such as e-commerce, digital payments, and financial services across Southeast Asia.

Sea Limited reported revenues of $3.04 billion, up 4.88% year on year, in line with analyst expectations. It was a weak quarter for the company, with declining users and slow revenue growth. Looking ahead, management did not provide guidance but said that "as we continue to fine-tune our operations and navigate near-term macro uncertainties, we remain highly confident in the long-term opportunities in our markets and our ability to capture those profitably."

The company reported 37.6 million paying users, down 38.8% year on year. The stock is down 32.6% since the results and currently trades at $59.4.

Read our full analysis of Sea Limited's results here.

Farfetch (NYSE:FTCH)

Inspired by the idea of allowing anyone to buy clothes from landmark boutiques of cities like Paris or Milan without having to leave their couch, Farfetch (NYSE: FTCH) is a global marketplace for luxury fashion, connecting boutiques, brands and consumers.

Farfetch reported revenues of $556.4 million, up 8.08% year on year, beating analyst expectations by 7.96%. It was a decent quarter for the company, with an impressive beat of analyst estimates but slow revenue growth.

The company reported 3.99 million active buyers, up 4.45% year on year. The stock is up 41.1% since the results and currently trades at $6.14.

Read our full, actionable report on Farfetch here, it's free.

LegalZoom (NASDAQ:LZ)

LegalZoom (NASDAQ:LZ) is an online platform that provides online legal services to individuals and small businesses. The company’s co-founders found it difficult and expensive to find lawyers and file paperwork when trying to start a business so they started LegalZoom instead to address this pain point.

LegalZoom reported revenues of $165.9 million, up 7.6% year on year, beating analyst expectations by 6.94%. It was a strong quarter for the company, with a solid beat of analyst estimates. In addition, revenue and adjusted EBITDA guidance for the next quarter were above consensus, and the full-year revenue guidance was lifted.

LegalZoom pulled off the highest full year guidance raise among the peers. The company reported 1.5 million users, up 10.2% year on year. The stock is up 48.2% since the results and currently trades at $12.36.

Read our full, actionable report on LegalZoom here, it's free.

The author has no position in any of the stocks mentioned