Digital medical services platform Teladoc Health (NYSE:TDOC) beat analysts' expectations in Q1 CY2024, with revenue up 2.7% year on year to $646.1 million. On the other hand, next quarter's revenue guidance of $647.5 million was less impressive, coming in 2.3% below analysts' estimates. It made a GAAP loss of $0.49 per share, down from its loss of $0.42 per share in the same quarter last year.

Teladoc (TDOC) Q1 CY2024 Highlights:

- Revenue: $646.1 million vs analyst estimates of $637.4 million (1.4% beat)

- EPS: -$0.49 vs analyst expectations of -$0.47 (3.9% miss)

- Revenue Guidance for Q2 CY2024 is $647.5 million at the midpoint, below analyst estimates of $662.6 million

- The company reconfirmed its revenue guidance for the full year of $2.69 billion at the midpoint

- Gross Margin (GAAP): 69.9%, in line with the same quarter last year

- Free Cash Flow was -$26.59 million, down from $128.7 million in the previous quarter

- US Integrated Care Members: 91.8 million, up 6.9 million year on year

- Market Capitalization: $2.32 billion

Founded to help people in rural areas get online medical consultations, Teladoc Health (NYSE:TDOC) is a telemedicine platform that facilitates remote doctor’s visits.

The company's key product is their virtual care platform, which allows patients to connect with licensed healthcare providers through a secure online portal or mobile app. Patients can get virtual consultations for a range of medical issues such as mental health, dermatology, and respiratory health.

The customer problem that Teladoc's product solves is access to proper healthcare. Many people, especially those in rural areas, have limited access to doctors or specialists. These individuals may be elderly or in poor health, making it difficult to travel long distances for medical care. Teladoc's platform enables medical consultations from home. Over time, though, a broader population has adopted the platform due to convenience and time saved.

Teladoc generates revenue by charging a fee for each virtual consultation, which varies depending on the type of service provided. A virtual consultation with a primary care physician may cost $75, while a therapy session may cost $150. The healthcare providers who partner with Teladoc are paid by the company for each virtual consultation, and fees also vary by service and specialty. Teladoc also generates revenue by partnering with insurance companies and employers to provide telemedicine services to their members or employees.

Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

Competitors offering online legal or document services include Doximity (NYSE:DOCS) and private companies Sesame Health and MDLive.Sales Growth

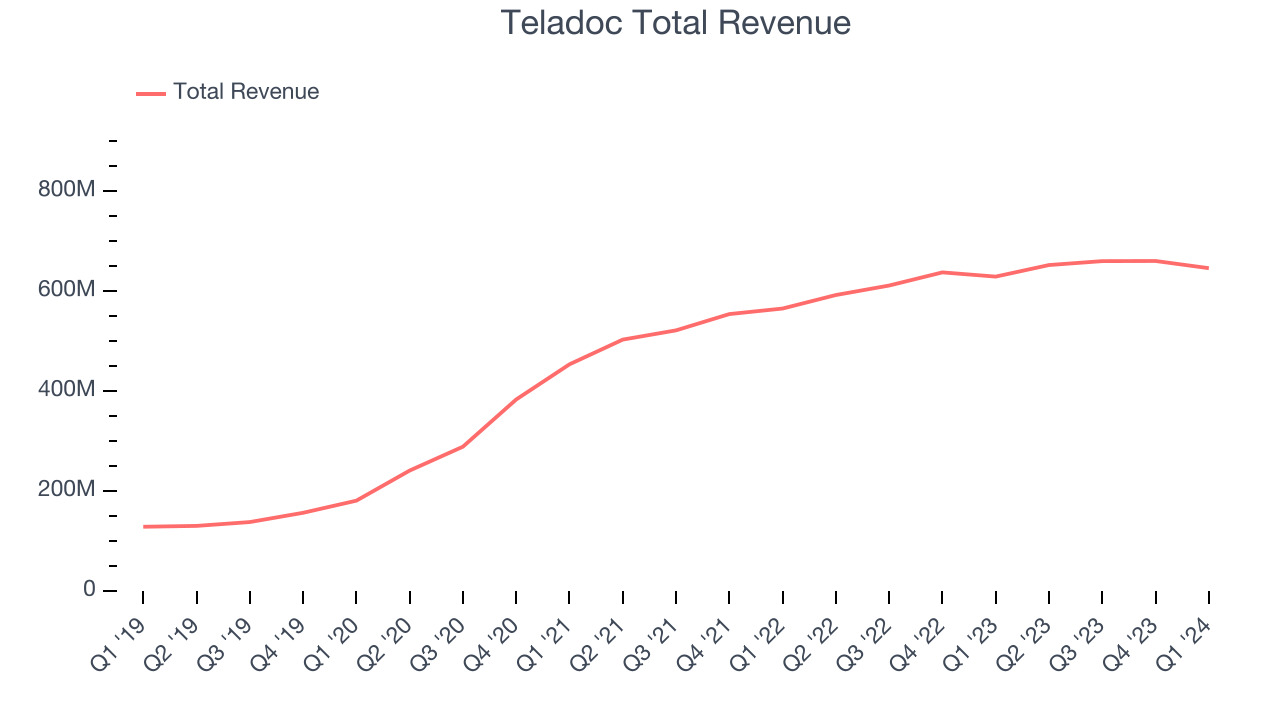

Teladoc's revenue growth over the last three years has been strong, averaging 28.7% annually. This quarter, Teladoc beat analysts' estimates but reported lacklustre 2.7% year-on-year revenue growth.

Teladoc is expecting next quarter's revenue to decline 0.8% year on year to $647.5 million, a reversal from the 10.1% year-on-year increase it recorded in the comparable quarter last year. Ahead of the earnings results, analysts were projecting sales to grow 3% over the next 12 months.

Usage Growth

As an online marketplace, Teladoc generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

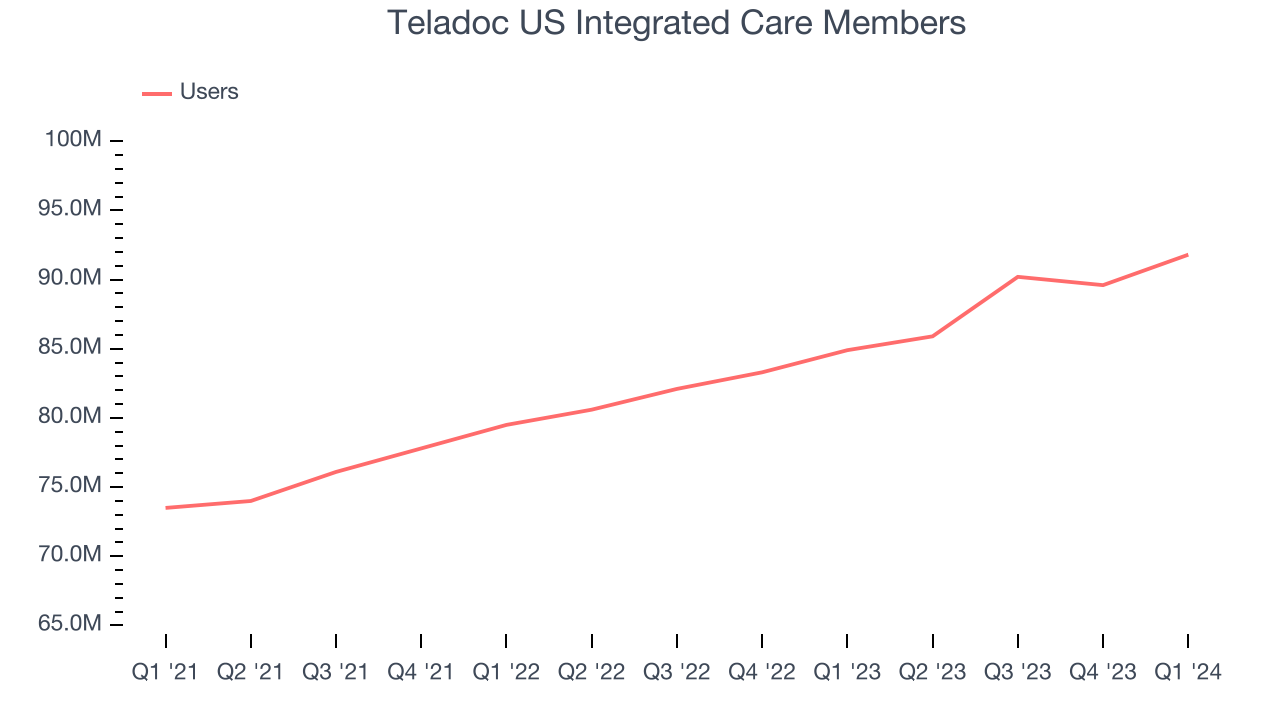

Over the last two years, Teladoc's users, a key performance metric for the company, grew 7.8% annually to 91.8 million. This is decent growth for a consumer internet company.

In Q1, Teladoc added 6.9 million users, translating into 8.1% year-on-year growth.

Revenue Per User

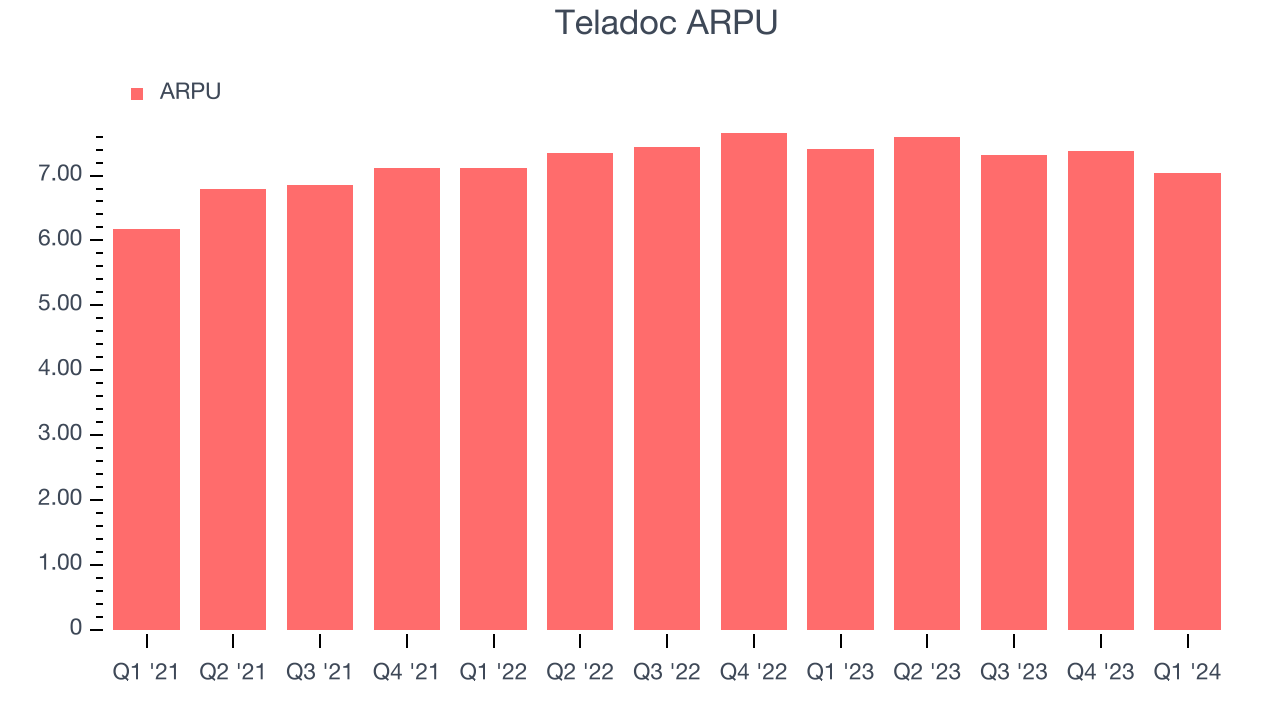

Average revenue per user (ARPU) is a critical metric to track for consumer internet businesses like Teladoc because it measures how much the company earns in transaction fees from each user. Furthermore, ARPU gives us unique insights as it's a function of a user's average order size and Teladoc's take rate, or "cut", on each order.

Teladoc's ARPU growth has been mediocre over the last two years, averaging 2.7%. However, the company's ability to continue increasing prices while growing its users shows they still find value in its platform. This quarter, ARPU declined 5% year on year to $7.04 per user.

Pricing Power

A company's gross profit margin has a major impact on its ability to exert pricing power, develop new products, and invest in marketing. These factors may ultimately determine the winner in a competitive market, making it a critical metric to track for the long-term investor.

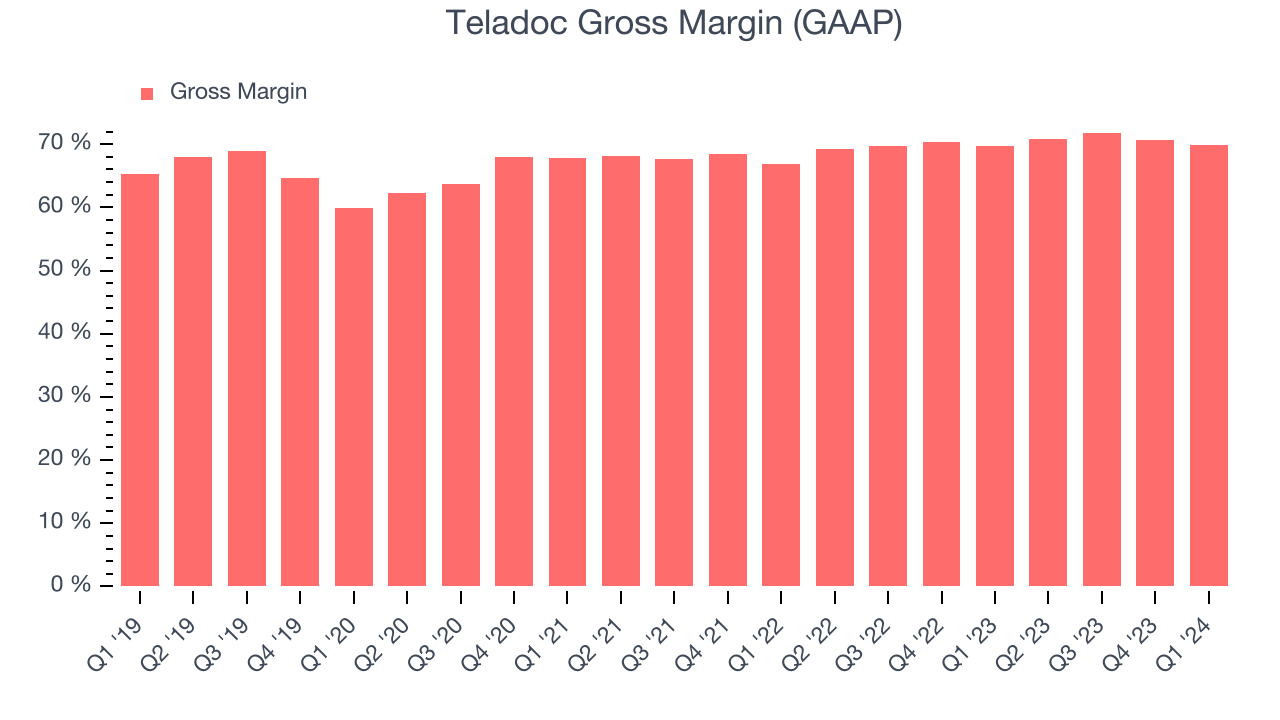

Teladoc's gross profit margin, which tells us how much money the company gets to keep after covering the base cost of its products and services, came in at 69.9% this quarter, up 0.1 percentage points year on year.

For online marketplaces like Teladoc, these aforementioned costs typically include payment processing, hosting, and bandwidth fees in addition to the costs necessary to onboard buyers and sellers, such as identity verification. After paying for these expenses, Teladoc had $0.70 for every $1 in revenue to invest in marketing, talent, and the development of new products and services.

Over the past year, Teladoc has seen its already strong gross margins rise, averaging 70.8%. These robust unit economics, driven by the company's lucrative business model and strong pricing power, are higher than its peers and allow Teladoc to make more investments in product and marketing.

User Acquisition Efficiency

Consumer internet businesses like Teladoc grow from a combination of product virality, paid advertisement, and incentives (unlike enterprise software products, which are often sold by dedicated sales teams).

It's relatively expensive for Teladoc to acquire new users as the company has spent 46% of its gross profit on sales and marketing expenses over the last year. This level of efficiency indicates that Teladoc has to compete for its users and continue investing to maintain its growth trajectory.

Profitability & Free Cash Flow

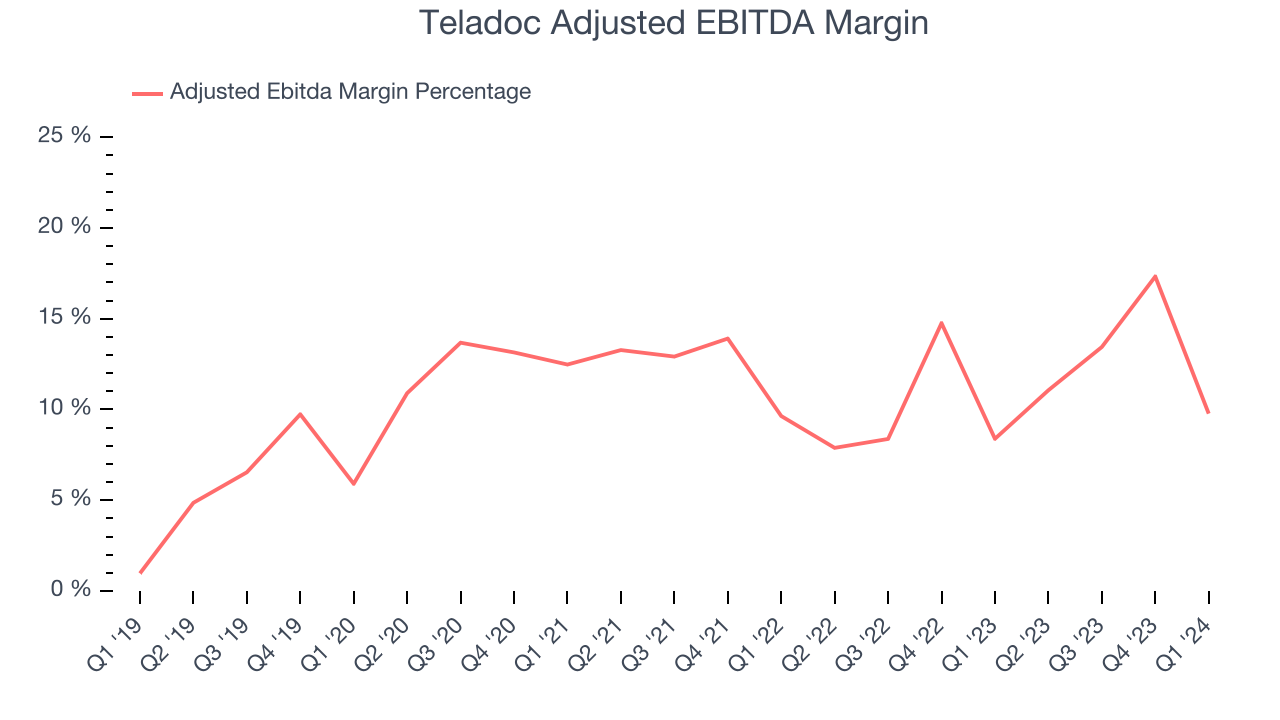

Investors frequently analyze operating income to understand a business's core profitability. Similar to operating income, adjusted EBITDA is the most common profitability metric for consumer internet companies because it removes various one-time or non-cash expenses, offering a more normalized view of a company's profit potential.

Teladoc reported EBITDA of $63.14 million this quarter, resulting in a 9.8% margin. The company has also shown above-average profitability for a consumer internet business over the last four quarters, with average EBITDA margins of 12.9%.

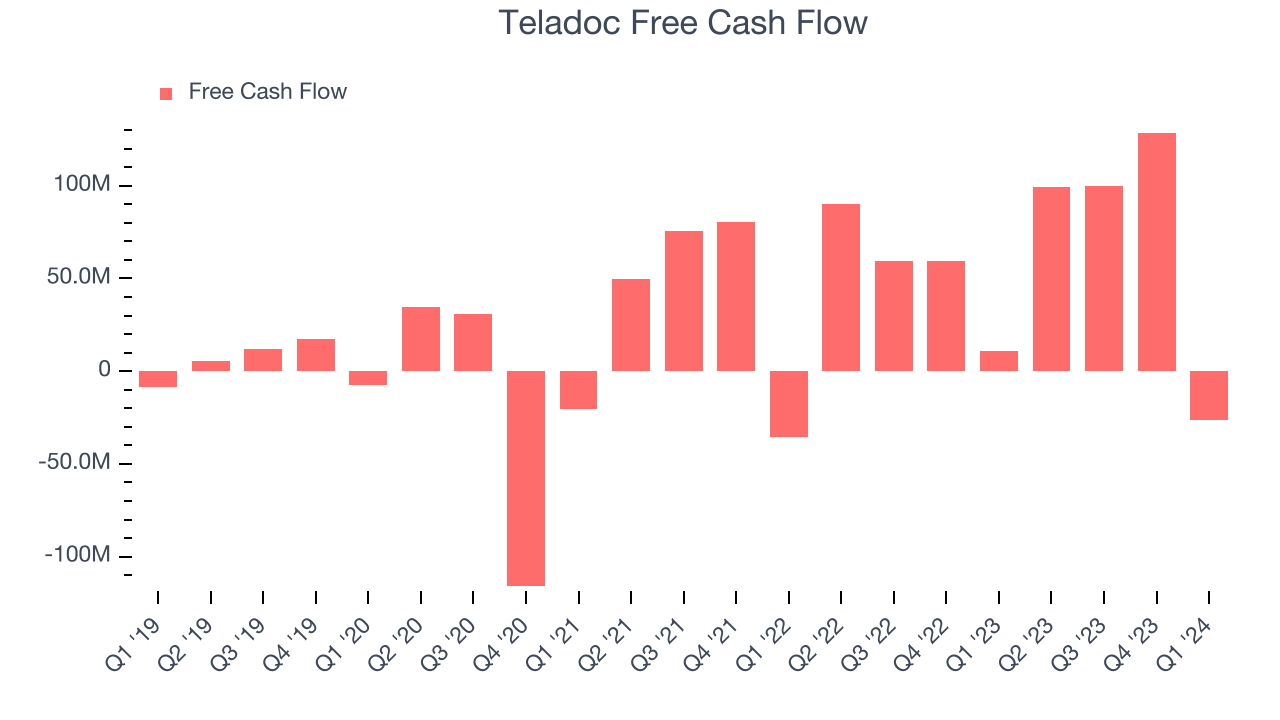

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Teladoc burned through $26.59 million in Q1, with cash flow turning negative year on year.

Teladoc has generated $301.2 million in free cash flow over the last 12 months, a solid 11.5% of revenue. This strong FCF margin stems from its asset-lite business model, giving it optionality and plenty of cash to reinvest in its business.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Teladoc reported $1.10 billion of cash and $1.58 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $338.5 million of EBITDA over the last 12 months, we view Teladoc's 1.4x net-debt-to-EBITDA ratio as safe. We also see its $29.15 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Teladoc's Q1 Results

It was good to see Teladoc narrowly top analysts' revenue and EBITDA expectations this quarter. Although next quarter's revenue guidance was softer than expected, its full-year sales outlook was in line. Furthermore, its full-year free cash flow and U.S. Integrated Care Member estimates beat Wall Street's estimates. Overall, this was a decent quarter for Teladoc. The stock is up 4.2% after reporting and currently trades at $13.89 per share.

Is Now The Time?

Teladoc may have had a fine quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

Although we have other favorites, we understand the arguments that Teladoc isn't a bad business. We'd expect growth rates to moderate from here, but its revenue growth has been good over the last three years. And while its ARPU has grown slowly over the last two years, the good news is its gross margins are a strong starting point for the overall profitability of the business.

At the moment, Teladoc trades at 5.8x next 12 months EV-to-EBITDA. In the end, beauty is in the eye of the beholder. While Teladoc wouldn't be our first pick, if you like the business, the shares are trading at a pretty interesting price right now.

Wall Street analysts covering the company had a one-year price target of $19.51 per share right before these results (compared to the current share price of $13.89).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.