Glass and windows manufacturer Tecnoglass (NYSE:TGLS) reported results in line with analysts' expectations in Q2 CY2024, with revenue down 2.5% year on year to $219.7 million. The company's full-year revenue guidance of $885 million at the midpoint came in 1.1% above analysts' estimates. It made a non-GAAP profit of $0.86 per share, down from its profit of $1.12 per share in the same quarter last year.

Is now the time to buy Tecnoglass? Find out by accessing our full research report, it's free.

Tecnoglass (TGLS) Q2 CY2024 Highlights:

- Revenue: $219.7 million vs analyst estimates of $219.3 million (small beat)

- EPS (non-GAAP): $0.86 vs analyst estimates of $0.83 (4% beat)

- EBITDA guidance for the full year is $272.5 million at the midpoint, above analyst estimates of $267.4 million

- Gross Margin (GAAP): 40.8%, down from 48.7% in the same quarter last year

- EBITDA Margin: 29.2%, down from 37.7% in the same quarter last year

- Free Cash Flow of $14.2 million, down 39.7% from the previous quarter

- Market Capitalization: $2.24 billion

The first-ever Colombian company to trade on the NASDAQ, Tecnoglass (NYSE:TGLS) is a manufacturer of architectural glass, windows, and aluminum products.

Building Materials

Traditionally, building materials companies have built competitive advantages with economies of scale, brand recognition, and strong relationships with builders and contractors. More recently, advances to address labor availability and job site productivity have spurred innovation. Additionally, companies in the space that can produce more energy-efficient materials have opportunities to take share. However, these companies are at the whim of construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of building materials companies.

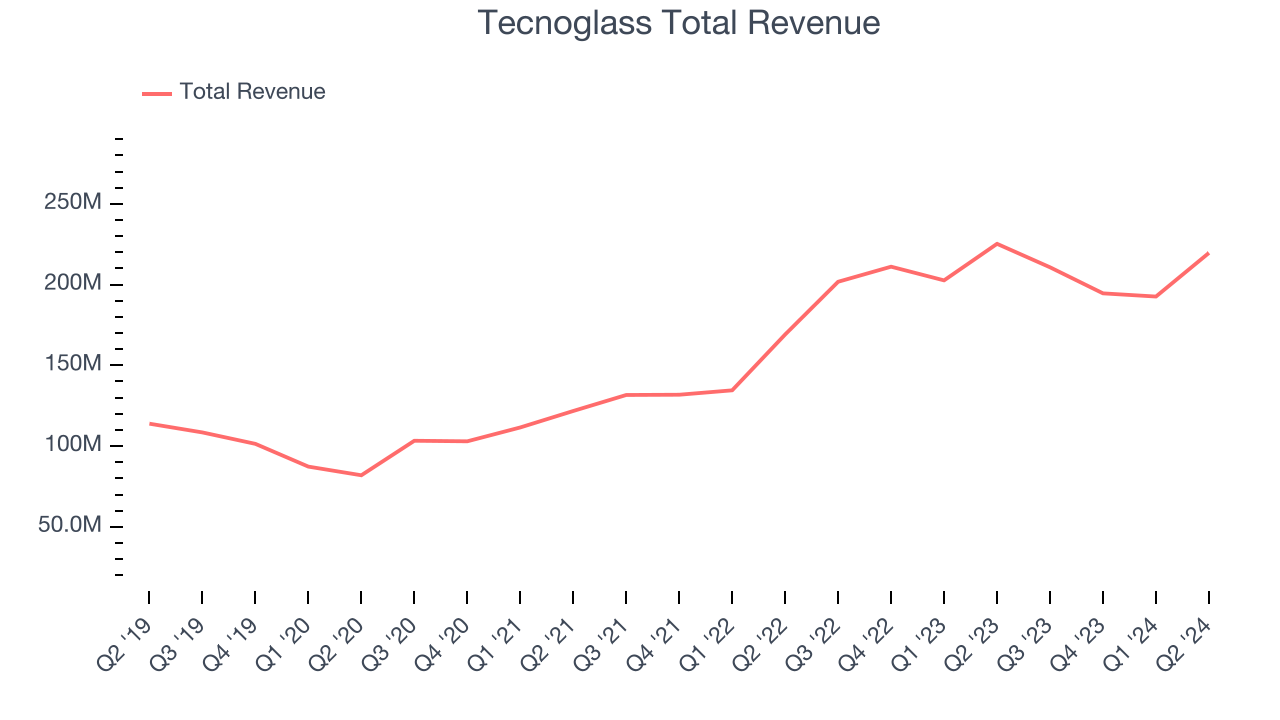

Sales Growth

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, Tecnoglass's 14.5% annualized revenue growth over the last five years was exceptional. This is a great starting point for our analysis because it shows Tecnoglass's offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Tecnoglass's annualized revenue growth of 20.1% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Tecnoglass reported a rather uninspiring 2.5% year-on-year revenue decline to $219.7 million of revenue, in line with Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 12.2% over the next 12 months, an acceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

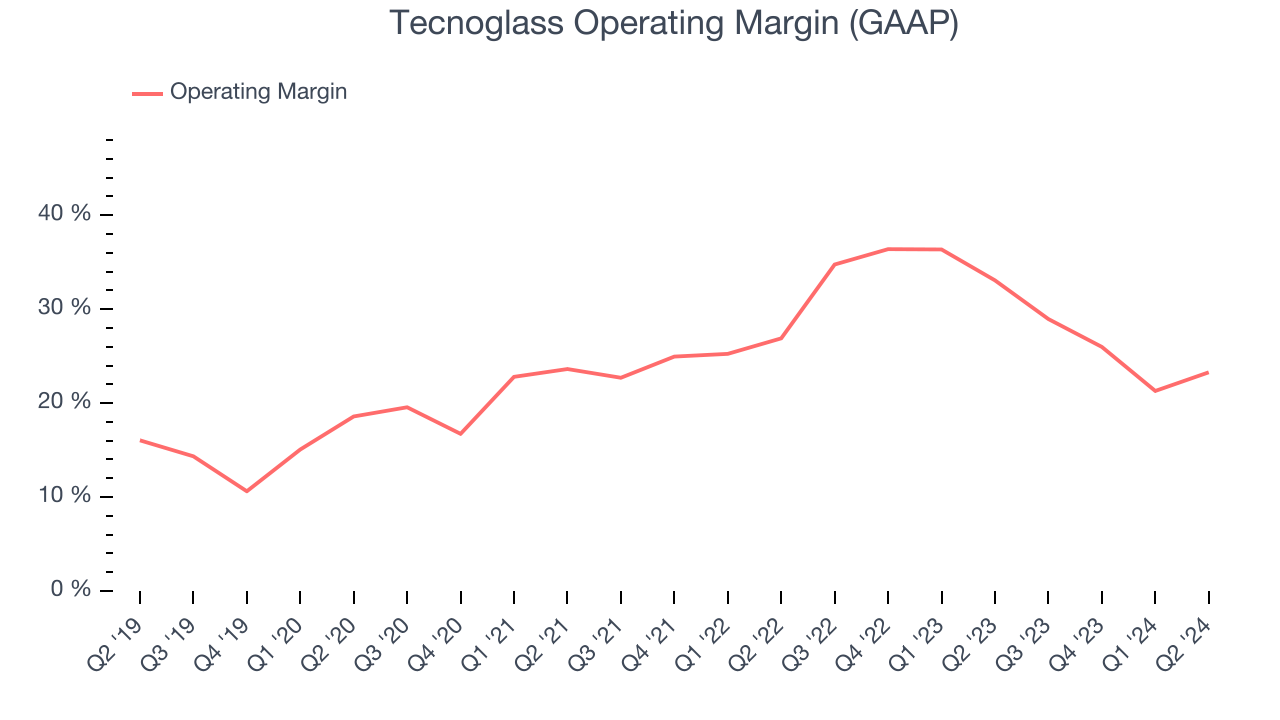

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Tecnoglass has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 25.9%. This result isn't surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Tecnoglass's annual operating margin rose by 10.5 percentage points over the last five years, as its sales growth gave it immense operating leverage.

In Q2, Tecnoglass generated an operating profit margin of 23.3%, down 9.8 percentage points year on year. Since Tecnoglass's operating margin decreased more than its gross margin, we can assume the company was recently less efficient because expenses such as sales, marketing, R&D, and administrative overhead increased.

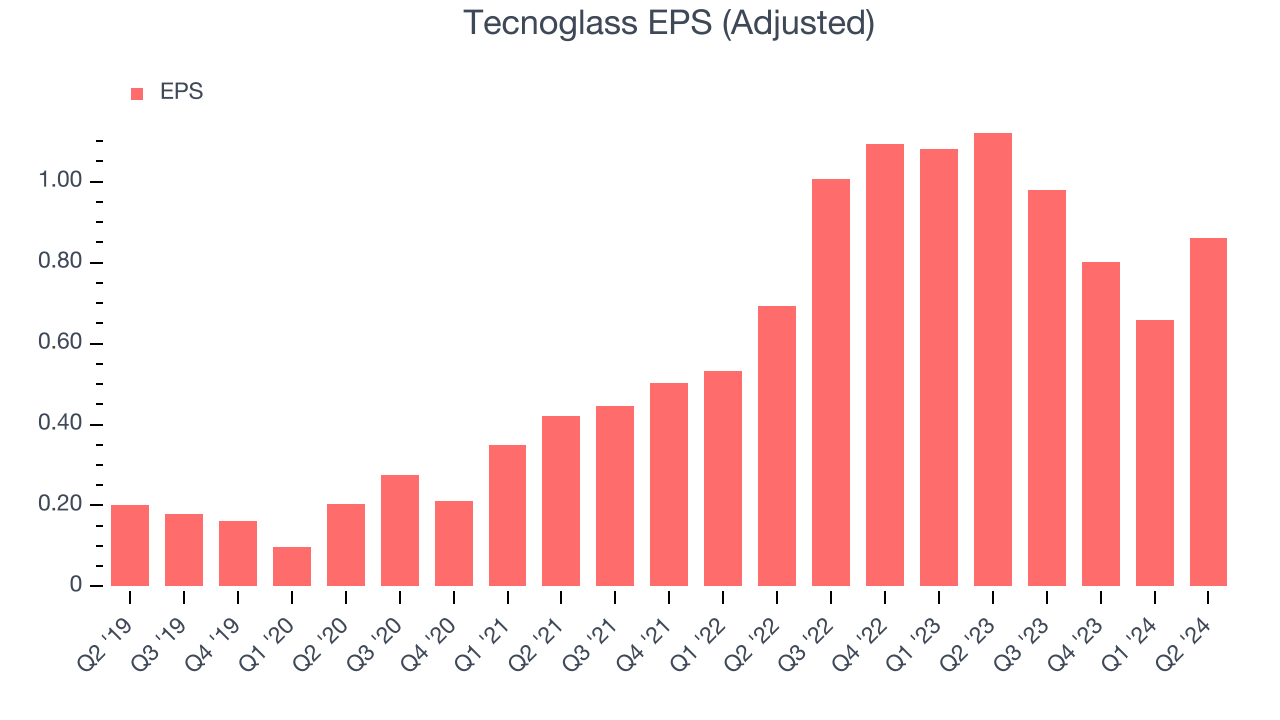

EPS

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Tecnoglass's EPS grew at an astounding 31.4% compounded annual growth rate over the last five years, higher than its 14.5% annualized revenue growth. This tells us the company became more profitable as it expanded.

Diving into the nuances of Tecnoglass's earnings can give us a better understanding of its performance. As we mentioned earlier, Tecnoglass's operating margin declined this quarter but expanded by 10.5 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don't tell us as much about a company's fundamentals.

Like with revenue, we also analyze EPS over a shorter period to see if we are missing a change in the business. For Tecnoglass, its two-year annual EPS growth of 23.2% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q2, Tecnoglass reported EPS at $0.86, down from $1.12 in the same quarter last year. Despite falling year on year, this print beat analysts' estimates by 4%. Over the next 12 months, Wall Street expects Tecnoglass to grow its earnings. Analysts are projecting its EPS of $3.30 in the last year to climb by 12.1% to $3.70.

Key Takeaways from Tecnoglass's Q2 Results

It was good to see Tecnoglass's full-year revenue and EBITDA forecast beat analysts' expectations. We were also glad this quarter's revenue and EPS exceeded Wall Street's estimates. Overall, this quarter showed some key positives. The stock remained flat at $47.58 immediately following the results.

Tecnoglass may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.