Looking back on large-format grocery & general merchandise retailer stocks' Q1 earnings, we examine this quarter's best and worst performers, including Target (NYSE:TGT) and its peers.

Big-box retailers operate large stores that sell groceries and general merchandise at highly competitive prices. Because of their scale and resulting purchasing power, these big-box retailers–with annual sales in the tens to hundreds of billions of dollars–are able to get attractive volume discounts and sell at often the lowest prices. While e-commerce is a threat, these retailers have been able to weather the storm by either providing a unique in-store shopping experience or by reinvesting their hefty profits into omnichannel investments.

The 4 large-format grocery & general merchandise retailer stocks we track reported a decent Q1; on average, revenues were in line with analyst consensus estimates. Stocks--especially those trading at higher multiples--had a strong end of 2023, but 2024 has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, and large-format grocery & general merchandise retailer stocks have held roughly steady amidst all this, with share prices up 3.7% on average since the previous earnings results.

Target (NYSE:TGT)

With a higher focus on style and aesthetics compared to other large general merchandise retailers, Target (NYSE:TGT) serves the suburban consumer who is looking for a wide range of products under one roof.

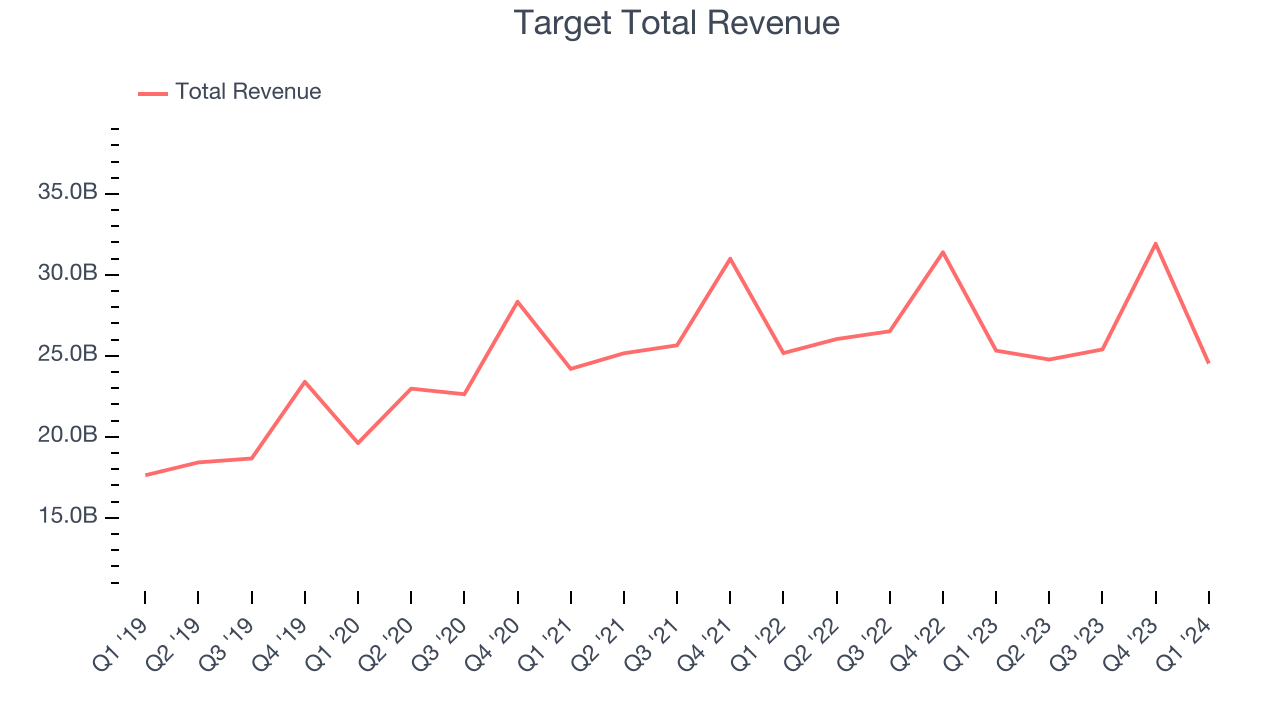

Target reported revenues of $24.53 billion, down 3.1% year on year, inline with analysts' expectations. It was a mixed quarter for the company, with an impressive beat of analysts' gross margin estimates. On the other hand, guidance was weak, with both next quarter and full-year earnings forecast missing analysts' expectations.

Target delivered the slowest revenue growth of the whole group. The stock is down 6.8% since the results and currently trades at $145.2.

Read our full report on Target here, it's free.

Best Q1: Walmart (NYSE:WMT)

Known for its large-format Supercenters, Walmart (NYSE:WMT) is a retail pioneer that serves a budget-conscious consumer who is looking for a wide range of products under one roof.

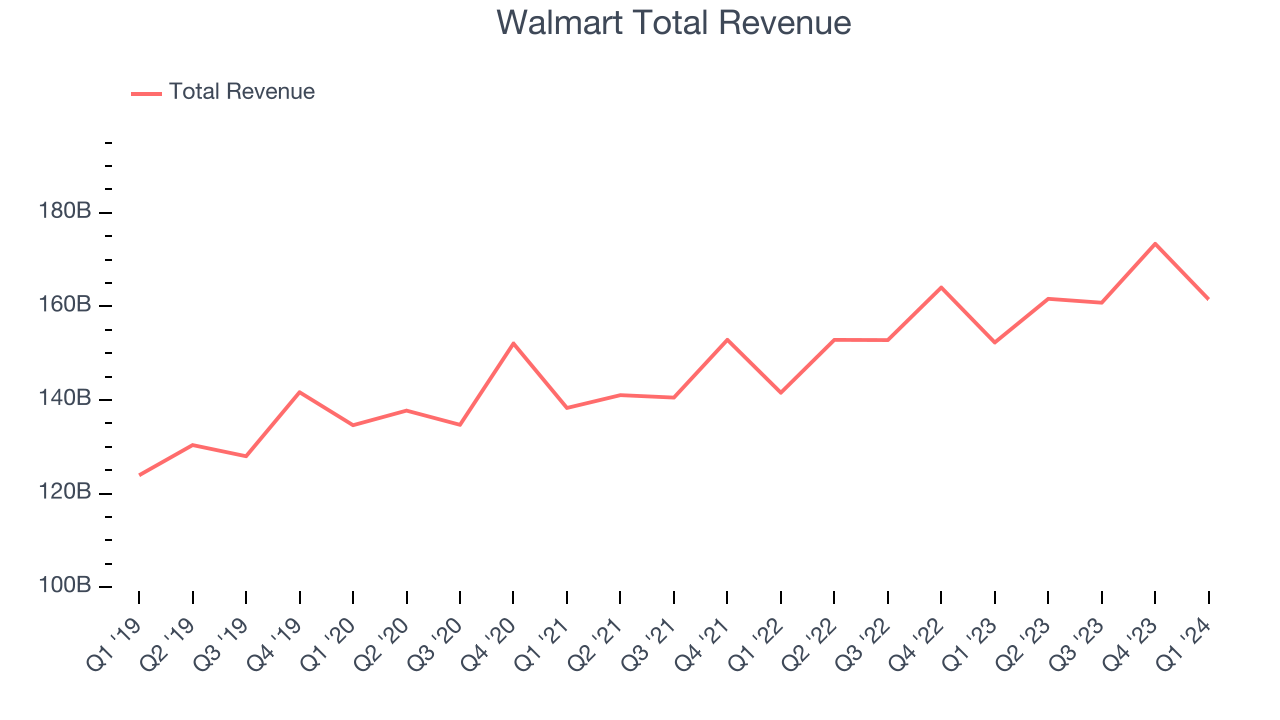

Walmart reported revenues of $161.5 billion, up 6% year on year, outperforming analysts' expectations by 2.1%. It was a very strong quarter for the company: Walmart's revenue outperformed Wall Street's estimates on slightly higher-than-expected same-store sales growth. Gross margin also came in better, leading to an EPS beat. The company effectively raised its full year guidance, saying that it now expects to come in at the high end of the previously-provided sales and EPS guidance ranges.

Walmart pulled off the biggest analyst estimates beat and fastest revenue growth among its peers. The stock is up 9.2% since the results and currently trades at $65.33.

Is now the time to buy Walmart? Access our full analysis of the earnings results here, it's free.

BJ's (NYSE:BJ)

Appealing to the budget-conscious individual shopping for a household, BJ’s Wholesale Club (NYSE:BJ) is a membership-only retail chain that sells groceries, appliances, electronics, and household items, often in bulk quantities.

BJ's reported revenues of $4.92 billion, up 4.1% year on year, in line with analysts' expectations. It was a slower quarter for the company, with a miss of analysts' gross margin estimates.

The stock is up 10.1% since the results and currently trades at $88.65.

Read our full analysis of BJ's results here.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.