General merchandise retailer Target (NYSE:TGT) reported results in line with analysts' expectations in Q4 FY2023, with revenue up 1.7% year on year to $31.92 billion. It made a non-GAAP profit of $2.98 per share, improving from its profit of $1.89 per share in the same quarter last year.

Target (TGT) Q4 FY2023 Highlights:

- Revenue: $31.92 billion vs analyst estimates of $31.85 billion (small beat)

- EPS (non-GAAP): $2.98 vs analyst estimates of $2.41 (23.5% beat)

- EPS (non-GAAP) Guidance for full year 2024 is $9.10 at the midpoint, below analyst estimates of $9.15

- Free Cash Flow of $2.44 billion, similar to the same quarter last year

- Gross Margin (GAAP): 26.7%, up from 23.7% in the same quarter last year

- Same-Store Sales were down 4.4% year on year (slight beat)

- Store Locations: 1,956 at quarter end, increasing by 8 over the last 12 months

- Market Capitalization: $69.48 billion

With a higher focus on style and aesthetics compared to other large general merchandise retailers, Target (NYSE:TGT) serves the suburban consumer who is looking for a wide range of products under one roof.

Founded in 1902 as the Dayton Dry Goods Company, Target now positions itself as both a one-stop shop but also a trendier alternative to competitors. The company serves the customer who is both value and trend-focused, and this customer is usually a middle-aged female shopping for herself and her family. While that shopper can find everything from clothing to home decor to toys to groceries at Target, the company differentiates itself through collaborations with designers to create exclusive clothing lines or partnerships with popular brands. The aim is to bring affordable luxury within reach of its customers.

A traditional Target store is large and averages over 100,000 square feet. These stores are located mostly in suburban areas, often as an anchor tenant in a shopping center and in close proximity to residential neighborhoods. The store layout is straightforward and organized, with sections for grocery, apparel, electronics, and home goods. Target has also introduced smaller, more localized store formats to serve urban and densely populated areas such as college campuses. In addition to physical stores, Target has an e-commerce presence that was launched in 2000. Customers can shop online and choose home delivery or store pickup, even with grocery offerings.

Large-format Grocery & General Merchandise Retailer

Big-box retailers operate large stores that sell groceries and general merchandise at highly competitive prices. Because of their scale and resulting purchasing power, these big-box retailers–with annual sales in the tens to hundreds of billions of dollars–are able to get attractive volume discounts and sell at often the lowest prices. While e-commerce is a threat, these retailers have been able to weather the storm by either providing a unique in-store shopping experience or by reinvesting their hefty profits into omnichannel investments.

Scaled competitors that sell general merchandise and/or groceries to US consumers include Walmart (NYSE:WMT), Amazon.com (NASDAQ:AMZN)–which as a reminder owns Whole Foods market, and Costco (NYSE:COST).Sales Growth

Target is a behemoth in the consumer retail sector and benefits from economies of scale, an important advantage giving the business an edge in distribution and more negotiating power with suppliers.

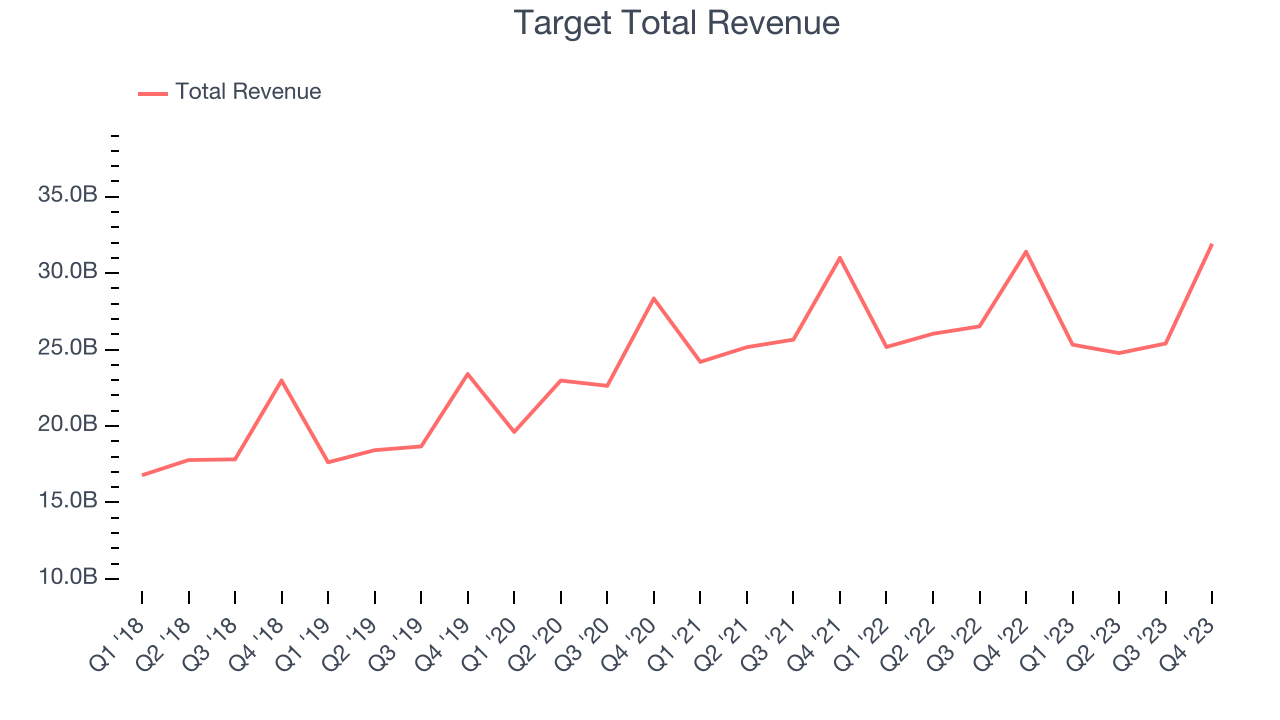

As you can see below, the company's annualized revenue growth rate of 8.3% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was mediocre despite not opening many new stores.

This quarter, Target grew its revenue by 1.7% year on year, and its $31.92 billion in revenue was in line with Wall Street's estimates. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months, a deceleration from this quarter.

Number of Stores

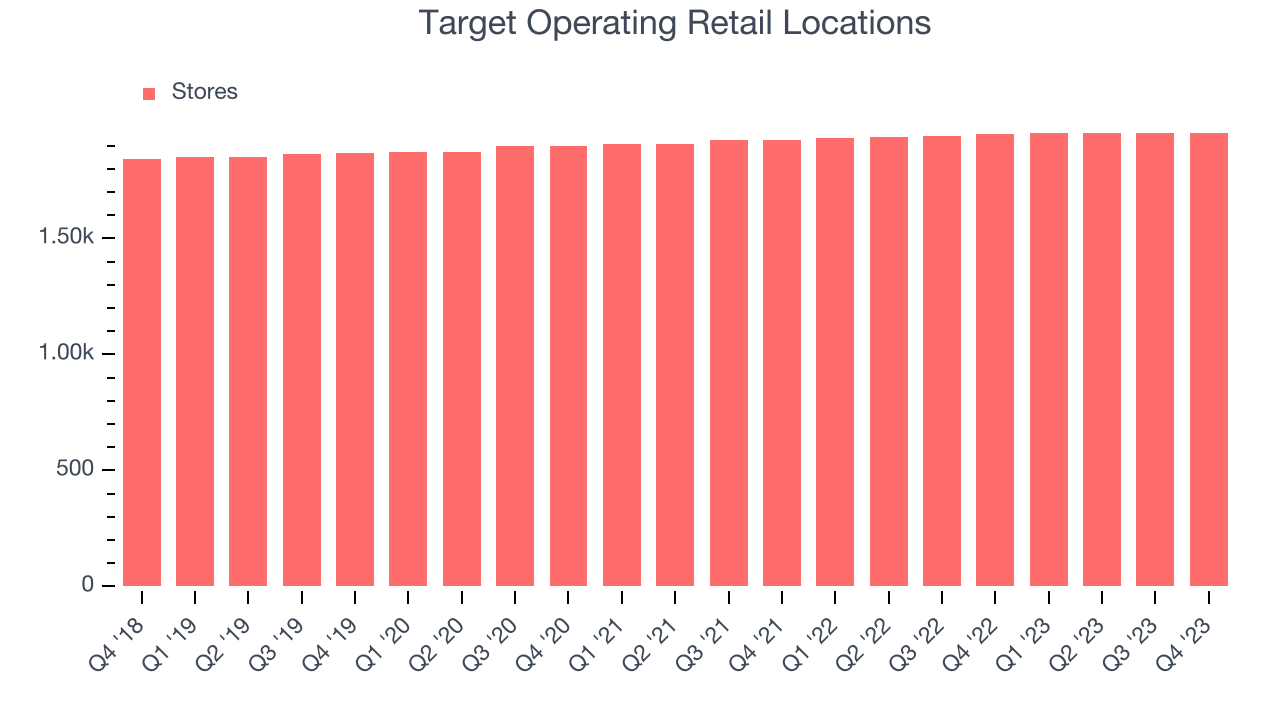

When a retailer like Target keeps its store footprint steady, it usually means that demand is stable and it's focused on improving operational efficiency to increase profitability. At the end of this quarter, Target operated 1,956 total retail locations, in line with its store count 12 months ago.

Taking a step back, the company has kept its physical footprint more or less flat over the last two years while other consumer retail businesses have opted for growth. A flat store base means that revenue growth must come from increased e-commerce sales or higher foot traffic and sales per customer at existing stores.

Same-Store Sales

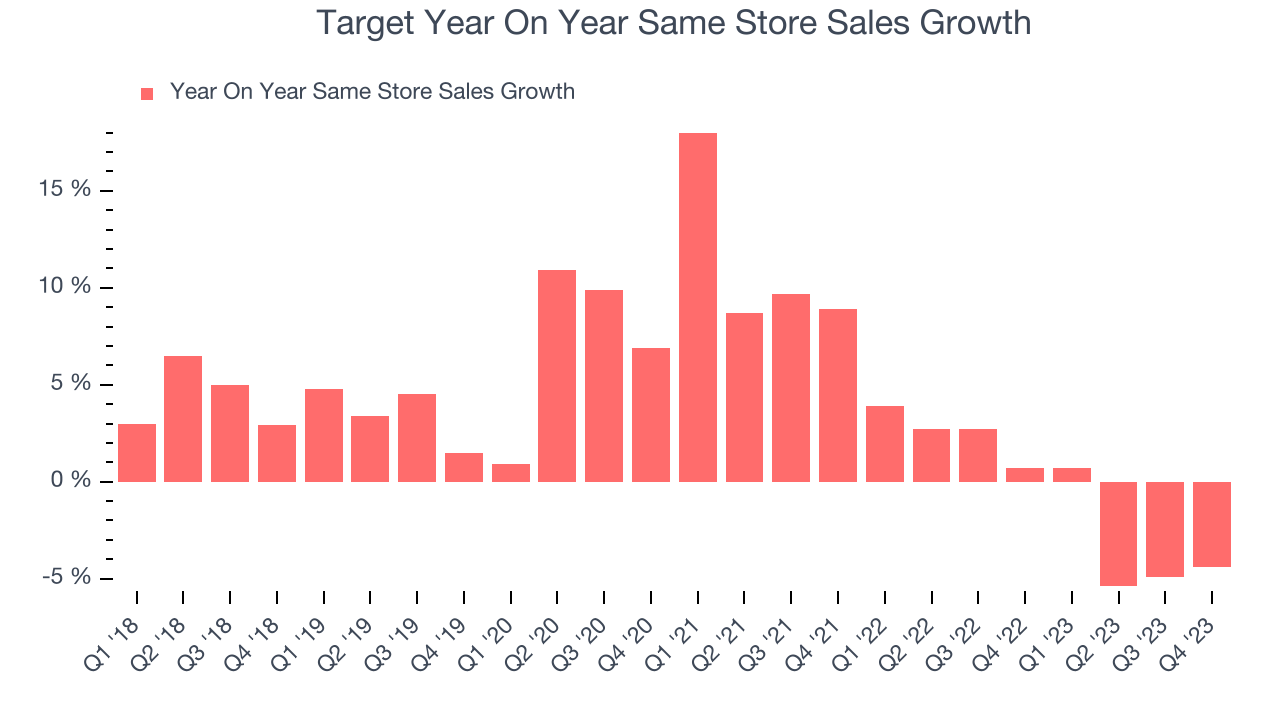

Target's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 0.7% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

In the latest quarter, Target's same-store sales fell 4.4% year on year. This decline was a reversal from the 0.7% year-on-year increase it posted 12 months ago. We'll be keeping a close eye on the company to see if this turns into a longer-term trend.

Gross Margin & Pricing Power

We prefer higher gross margins because they make it easier to generate more operating profits.

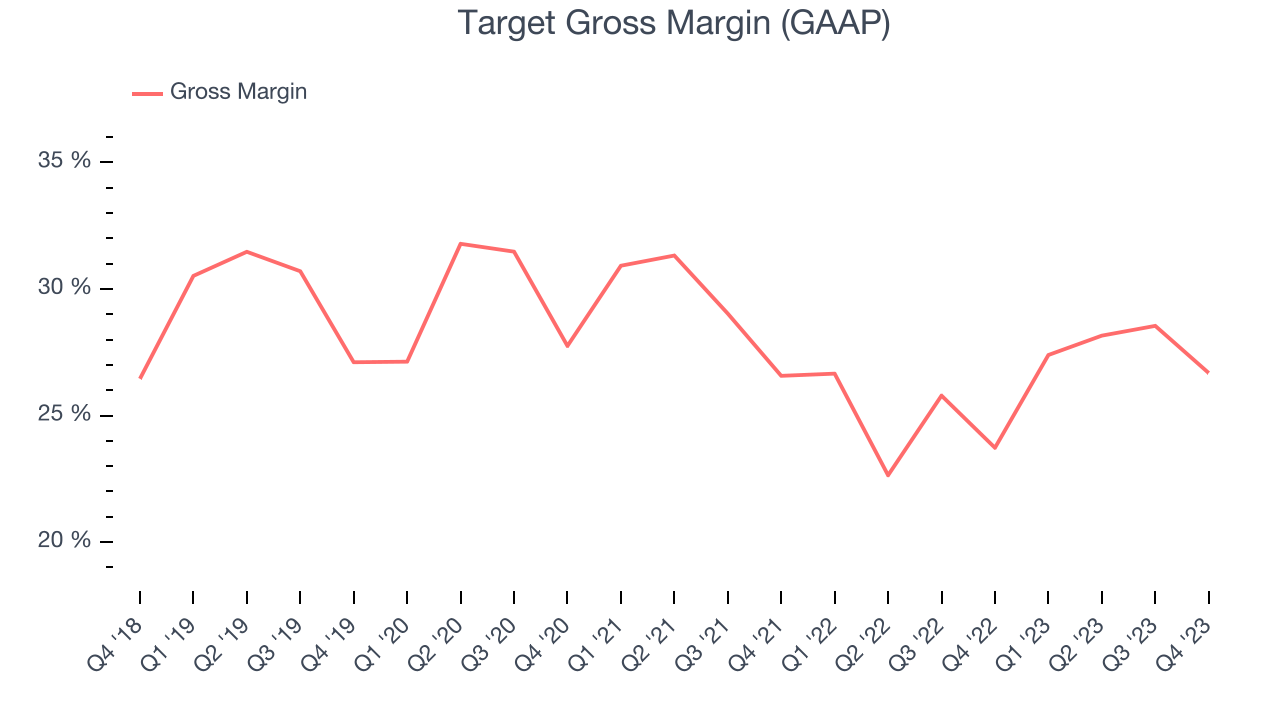

Target has poor unit economics for a retailer, leaving it with little room for error if things go awry. As you can see below, it's averaged a 26.1% gross margin over the last two years. However, when comparing its margin specifically to other non-discretionary retailers, it's actually pretty decent. That's because non-discretionary retailers have structurally lower gross margins as they compete to provide the lowest possible price, sell products easily found elsewhere, and have high transportation costs to move their goods. We believe the best metrics to assess these types of companies are free cash flow margin, operating leverage, and profit volatility, which take their scale advantages and non-cyclical demand characteristics into account.

Target produced a 26.7% gross profit margin in Q4, marking a 3 percentage point increase from 23.7% in the same quarter last year. This margin expansion was particularly strong for a retailer like Target, which is structurally less profitable than the typical retail business for the reasons mentioned above, as it signals a less competitive environment with more stable input costs (such as freight expenses to transport goods) and less pressure to discount products.

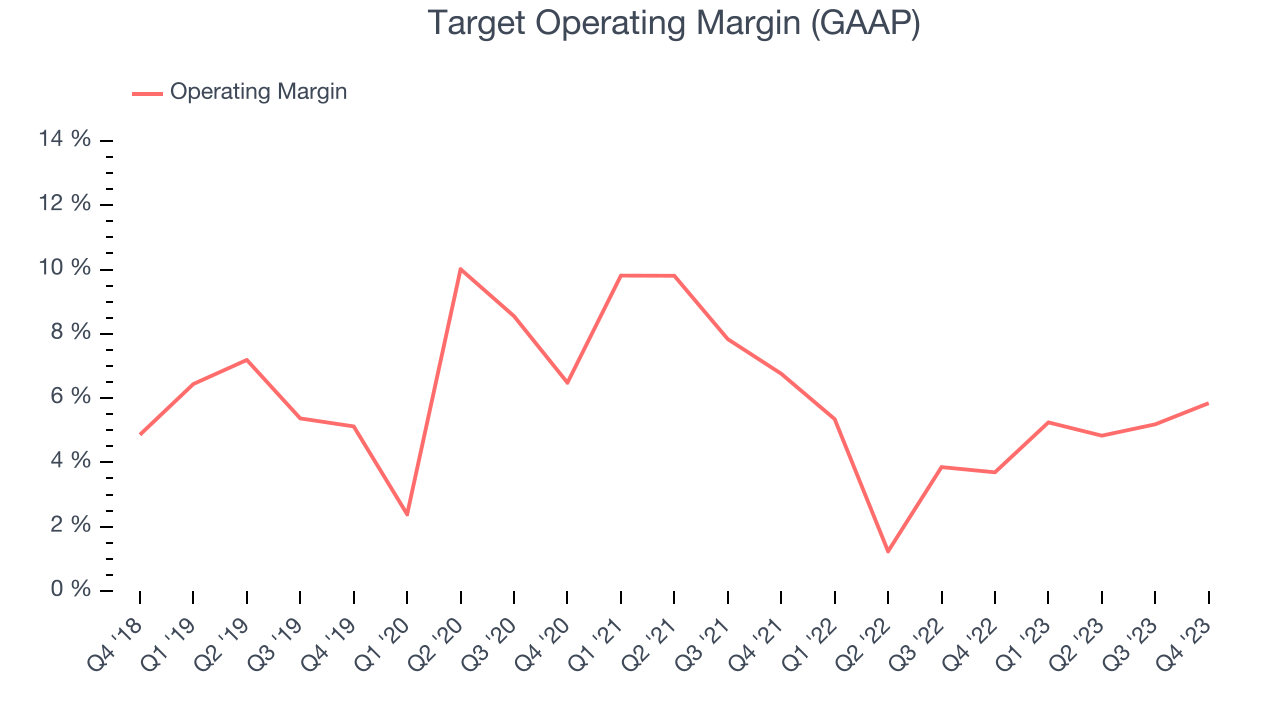

Operating Margin

Operating margin is a key profitability metric for retailers because it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

This quarter, Target generated an operating profit margin of 5.8%, up 2.2 percentage points year on year. This increase was encouraging and driven by stronger pricing power, as indicated by the company's larger rise in gross margin.

Zooming out, Target was profitable over the last eight quarters but held back by its large expense base. It's demonstrated subpar profitability for a consumer retail business, producing an average operating margin of 4.4%. However, Target's margin has improved, on average, by 1.8 percentage points year on year, an encouraging sign for shareholders. The tide could be turning.

Zooming out, Target was profitable over the last eight quarters but held back by its large expense base. It's demonstrated subpar profitability for a consumer retail business, producing an average operating margin of 4.4%. However, Target's margin has improved, on average, by 1.8 percentage points year on year, an encouraging sign for shareholders. The tide could be turning.EPS

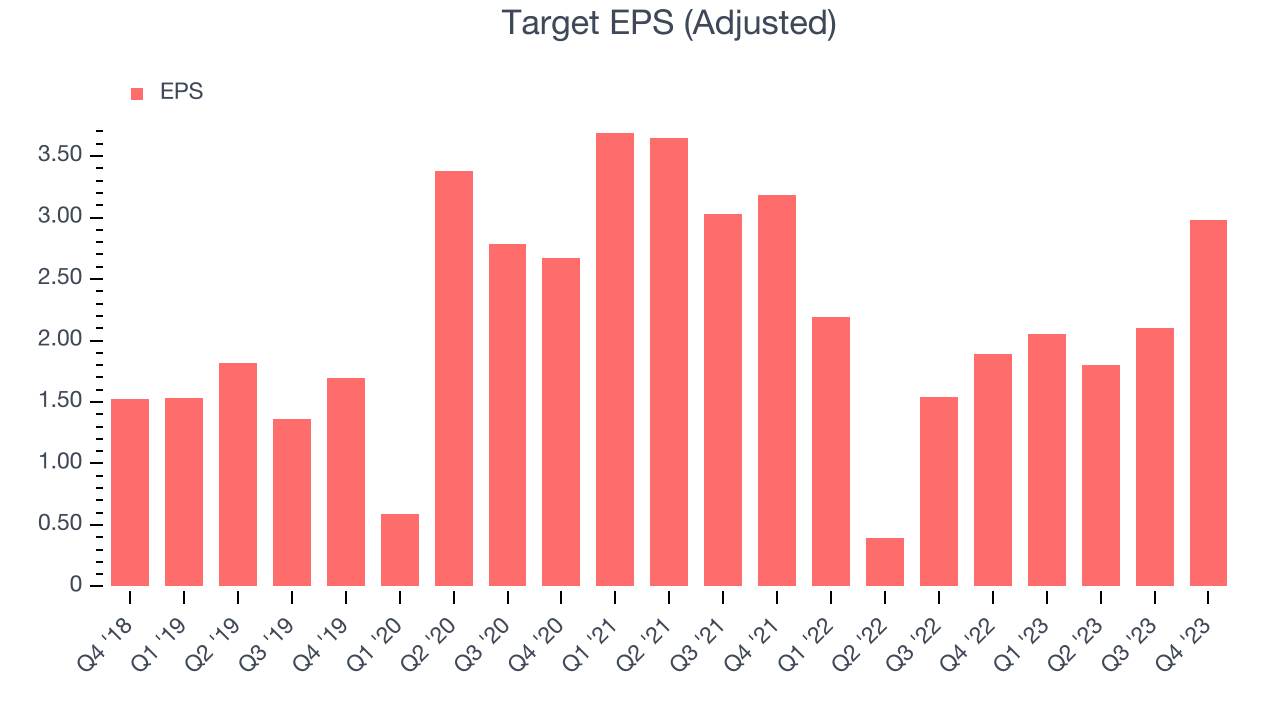

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

In Q4, Target reported EPS at $2.98, up from $1.89 in the same quarter a year ago. This print beat Wall Street's estimates by 23.5%.

Between FY2019 and FY2023, Target's adjusted diluted EPS grew 39.6%, translating into an unimpressive 8.7% compounded annual growth rate.

On the bright side, Wall Street expects the company to continue growing earnings over the next 12 months, with analysts projecting an average 3.5% year-on-year increase in EPS.

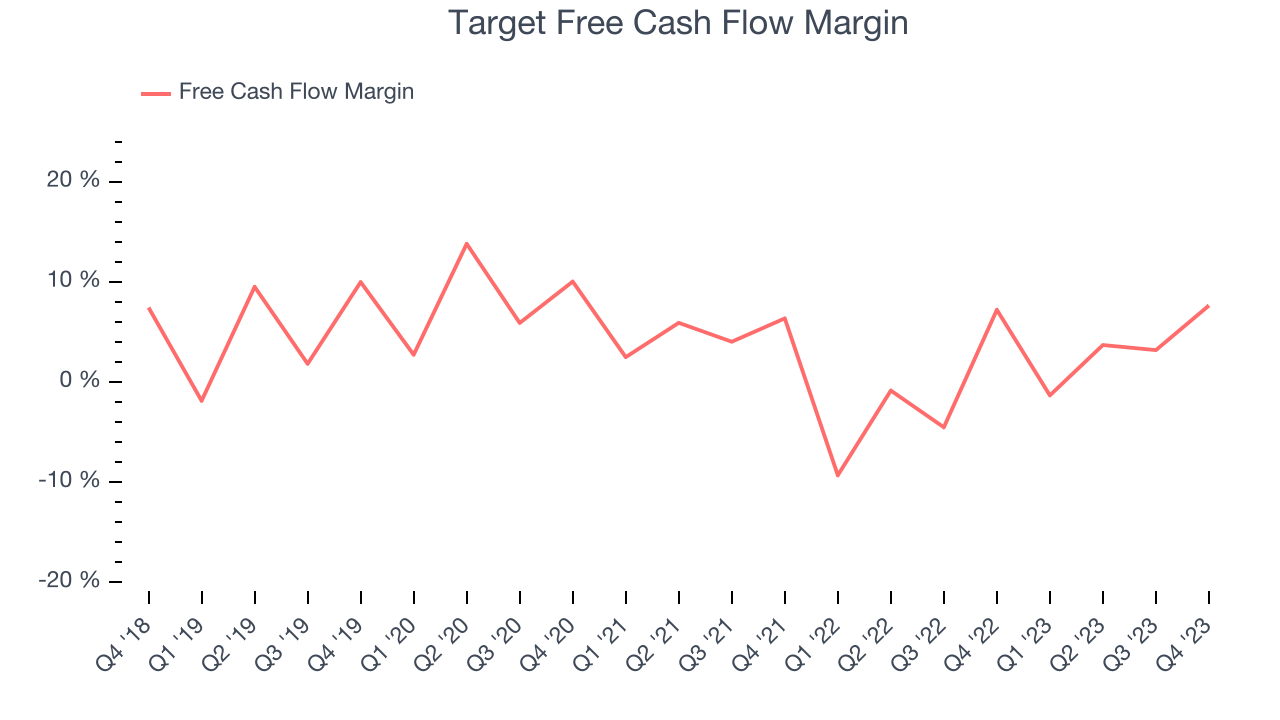

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe in the end, cash is king, and you can't use accounting profits to pay the bills.

Target's free cash flow came in at $2.44 billion in Q4, up 7.7% year on year. This result represents a 7.6% margin.

Over the last eight quarters, Target has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 1.1%, subpar for a consumer retail business. However, its margin has averaged year-on-year increases of 4.9 percentage points, a great result that should improve its prospects.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Although Target hasn't been the highest-quality company lately, it historically did a solid job investing in profitable business initiatives. Its five-year average ROIC was 19.7%, higher than most retailers.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Target's ROIC over the last two years averaged 6.9 percentage point decreases each year. We like what management has done historically but are concerned its ROIC is declining, perhaps a symptom of waning business opportunities to invest profitably.

Key Takeaways from Target's Q4 Results

We were impressed by how significantly Target blew past analysts' gross margin and operating profit expectations this quarter, which led to EPS outperformance versus Wall Street estimates. On the other hand, its earnings forecast for next quarter and the full year ending January 2025 missed analysts' expectations. Zooming out, we think this was still a decent, albeit mixed, quarter. The stock is up 5.4% after reporting and currently trades at $158.5 per share, potentially showing the market had priced in a worse quarter. Larger market cap companies and high-profile stocks can see a slew of data intra-quarter from third-party providers (everything from credit card spend data to store traffic data), causing expectations to change more frequently.

Is Now The Time?

Target may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Target, we'll be cheering from the sidelines. Its revenue growth has been mediocre over the last four years, and analysts expect growth to deteriorate from here. And while its coveted brand awareness makes it a household name consumers consistently turn to, the downside is its shrinking same-store sales suggests it'll need to change its strategy to succeed. On top of that, its gross margins make it more challenging to reach positive operating profits compared to other consumer retail businesses.

Target's price-to-earnings ratio based on the next 12 months is 16.3x. While the price is reasonable and there are some things to like about Target, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $157.92 per share right before these results (compared to the current share price of $158.50).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.