Private label food company TreeHouse Foods (NYSE:THS) reported Q1 CY2024 results topping analysts' expectations, with revenue down 3.9% year on year to $820.7 million. On the other hand, next quarter's revenue guidance of $785 million was less impressive, coming in 1.6% below analysts' estimates. It made a non-GAAP loss of $0.03 per share, down from its profit of $0.27 per share in the same quarter last year.

TreeHouse Foods (THS) Q1 CY2024 Highlights:

- Revenue: $820.7 million vs analyst estimates of $798.4 million (2.8% beat)

- EPS (non-GAAP): -$0.03 vs analyst estimates of -$0.01 (-$0.02 miss)

- Revenue Guidance for Q2 CY2024 is $785 million at the midpoint, below analyst estimates of $797.7 million

- The company reconfirmed its revenue guidance for the full year of $3.47 billion at the midpoint

- Gross Margin (GAAP): 13.6%, up from 13.1% in the same quarter last year

- Free Cash Flow was -$80.7 million, down from $84.3 million in the previous quarter

- Organic Revenue was down 7.7% year on year

- Sales Volumes were up 3.8% year on year

- Market Capitalization: $2.01 billion

Whether it be packaged crackers, broths, or beverages, Treehouse Foods (NYSE:THS) produces a wide range of private-label foods for grocery and food service customers.

Private-label products refer to goods that are produced by one company (Treehouse) and then branded and sold under another company's brand (a grocer’s store brand, for example). The grocer’s rationale for offering private label products is usually control over product design and production as well as the higher margins associated with private label goods.

TreeHouse Foods was founded in 2005 as a spin-off of dairy company Dean Foods. Today, the company’s private label production capabilities encompass crackers, creamers, single-serve beverages, broths/stocks, and in-store bakery items like cookies, among other products. Overall, though, cereals, pasta, and dressings are its top-selling categories.

TreeHouse Foods’ customers are mainly grocery stores and food service businesses such as corporate cafeterias. These customers typically choose TreeHouse because of its expertise in the private label arena and its broad portfolio of offerings. End consumers may not be familiar with the TreeHouse brand but if you’ve ever purchased a store brand or picked up an unbranded item at a cafeteria, chances are you’ve consumed one of the company’s products.

Shelf-Stable Food

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

Competitors in the private label manufacturing business include B&G Foods (NYSE:BGS), J&J Snack Foods (NASDAQ:JJSF), and private company Cott Corporation.Sales Growth

TreeHouse Foods is larger than most consumer staples companies and benefits from economies of scale, giving it an edge over its smaller competitors.

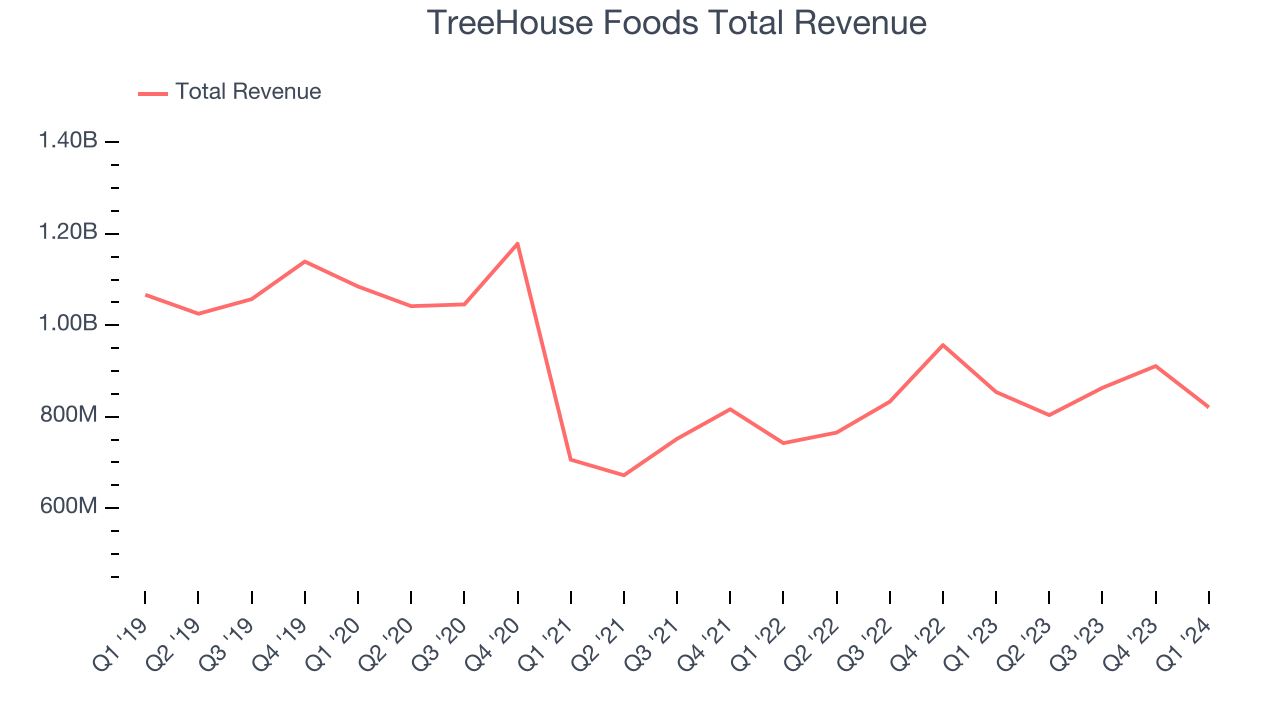

As you can see below, the company's revenue has declined over the last three years, dropping 5.1% annually as consumers bought less of its products.

This quarter, TreeHouse Foods's revenue fell 3.9% year on year to $820.7 million but beat Wall Street's estimates by 2.8%. The company is guiding for a 2.3% year-on-year revenue decline next quarter to $785 million, a reversal from the 5% year-on-year increase it recorded in the same quarter last year. Looking ahead, Wall Street expects sales to grow 2.4% over the next 12 months, an acceleration from this quarter.

Volume Growth

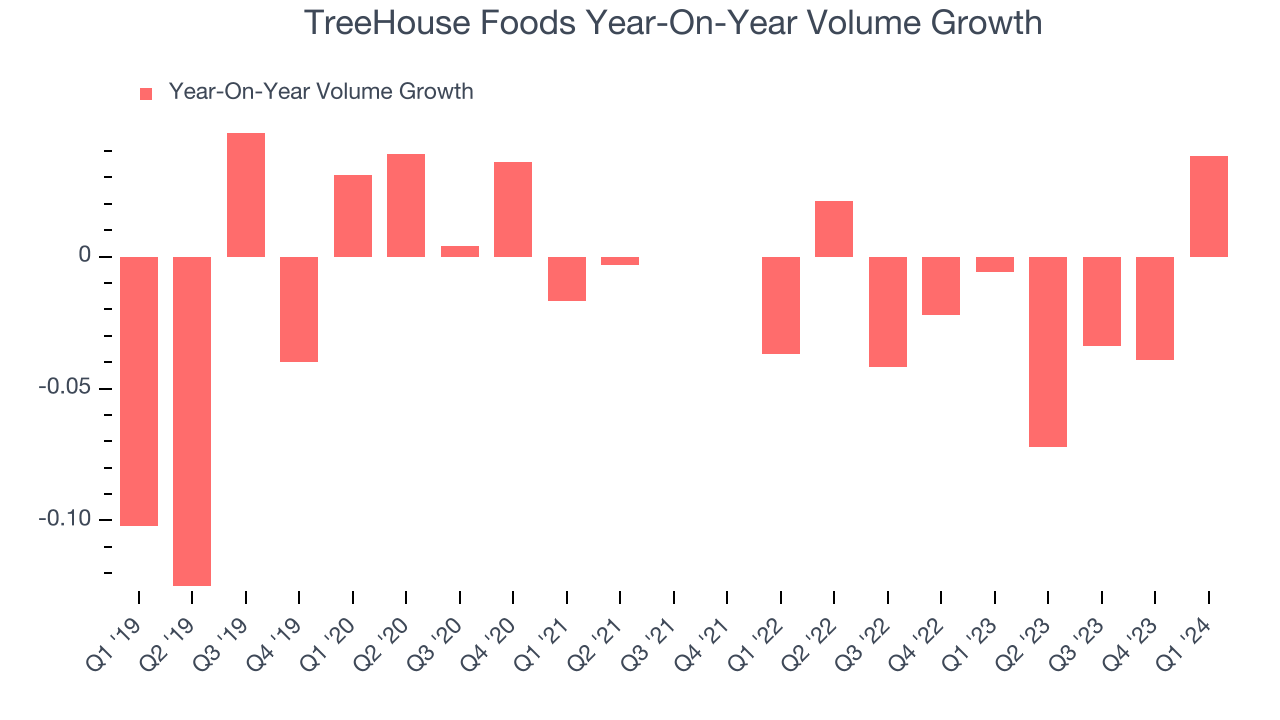

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

To analyze whether TreeHouse Foods generated its growth from changes in price or volume, we can compare its volume growth to its organic revenue growth, which excludes non-fundamental impacts on company financials like mergers and currency fluctuations.

Over the last two years, TreeHouse Foods's average quarterly sales volumes have shrunk by 2%. This decrease isn't ideal as the quantity demanded for consumer staples products is typically stable. Luckily, TreeHouse Foods was able to offset fewer customers purchasing its products by charging higher prices, enabling it to generate 7.8% average organic revenue growth. We hope the company can grow its volumes soon, however, as consistent price increases (on top of inflation) aren't sustainable over the long term unless the business is really really special.

In TreeHouse Foods's Q1 2024, sales volumes jumped 3.8% year on year. This result was a well-appreciated turnaround from the 0.6% year-on-year decline it posted 12 months ago, showing the company is heading in the right direction.

Gross Margin & Pricing Power

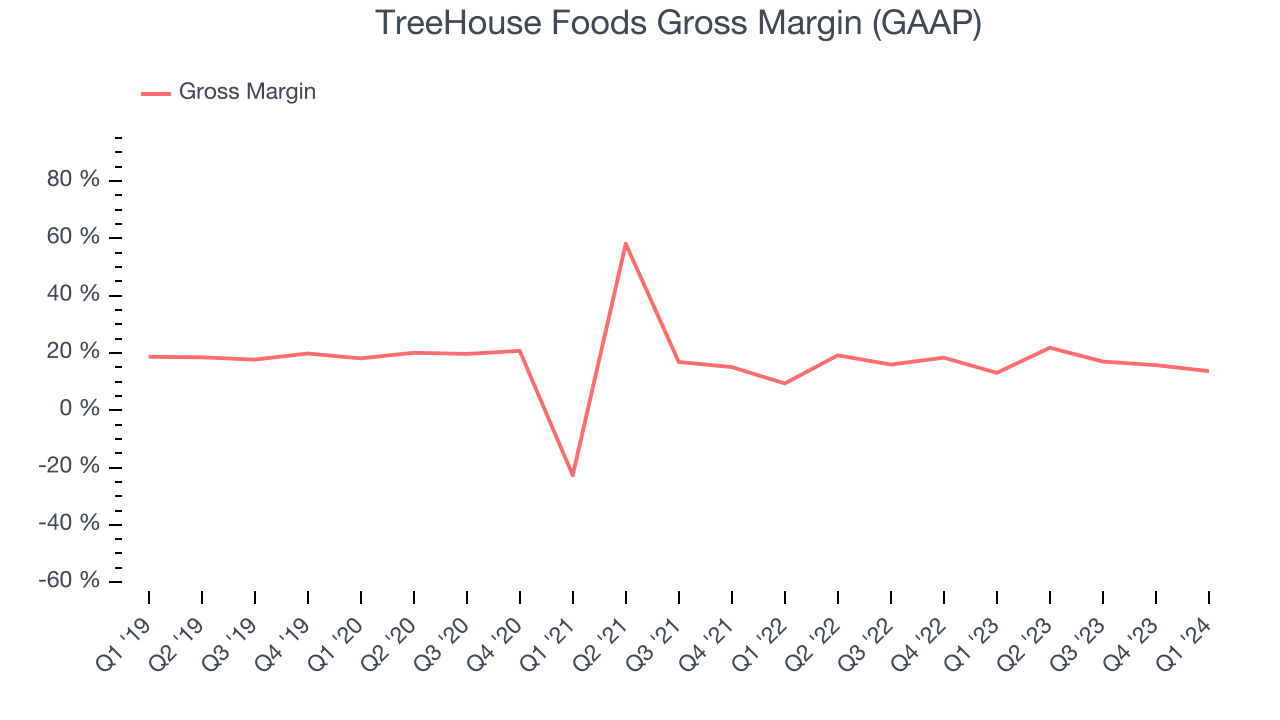

We prefer higher gross margins because they make it easier to generate more operating profits.

TreeHouse Foods's gross profit margin came in at 13.6% this quarter, in line with the same quarter last year. That means for every $1 in revenue, a chunky $0.86 went towards paying for raw materials, production of goods, and distribution expenses.

TreeHouse Foods has poor unit economics for a consumer staples company, leaving it with little room for error if things go awry. As you can see above, it's averaged a paltry 16.8% gross margin over the last two years. Its margin, however, has been trending up over the last 12 months, averaging 2.7% year-on-year increases each quarter. If this trend continues, it could suggest a less competitive environment.

Operating Margin

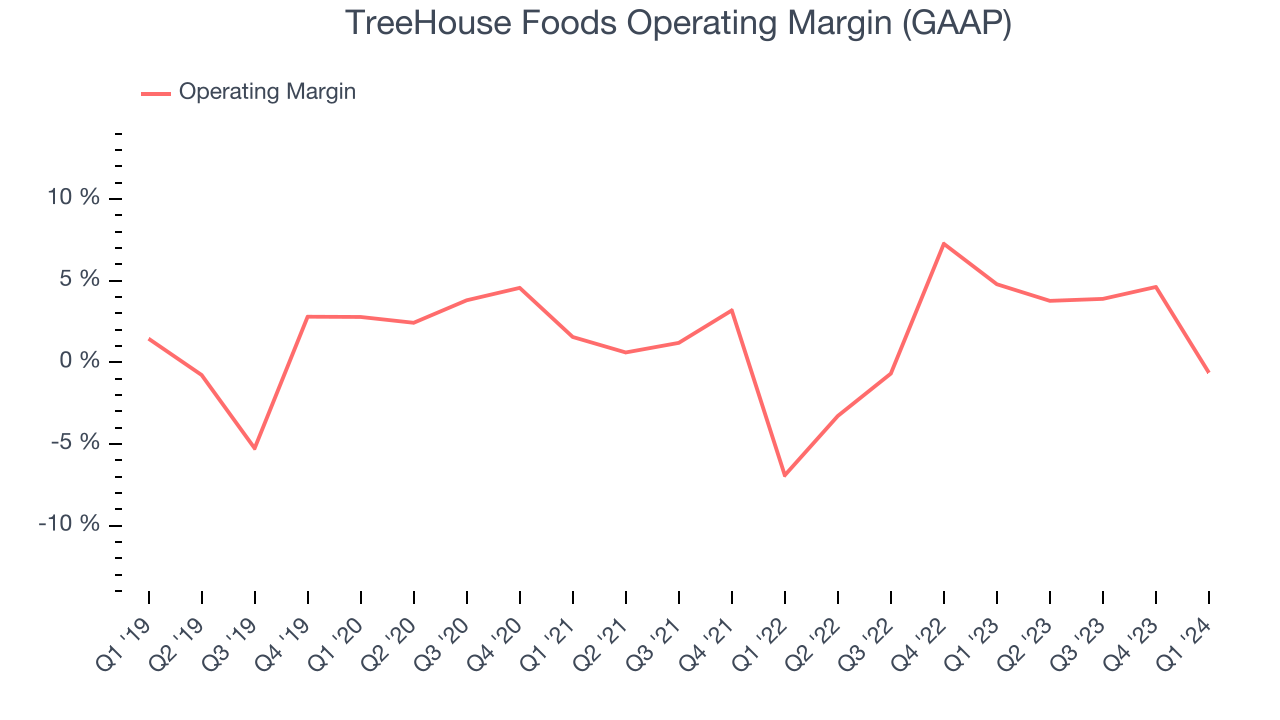

Operating margin is an important measure of profitability accounting for key expenses such as marketing and advertising, IT systems, wages, and other administrative costs.

This quarter, TreeHouse Foods generated an operating profit margin of negative 0.6%, down 5.4 percentage points year on year. Conversely, the company's gross margin actually increased, so we can assume the reduction was driven by operational inefficiencies and a step up in discretionary spending in areas like corporate overhead and advertising.

Zooming out, TreeHouse Foods was profitable over the last eight quarters but held back by its large expense base. It's demonstrated subpar profitability for a consumer staples business, producing an average operating margin of 2.7%. Its margin has also seen few fluctuations, meaning it will likely take a big change to improve profitability.

Zooming out, TreeHouse Foods was profitable over the last eight quarters but held back by its large expense base. It's demonstrated subpar profitability for a consumer staples business, producing an average operating margin of 2.7%. Its margin has also seen few fluctuations, meaning it will likely take a big change to improve profitability.EPS

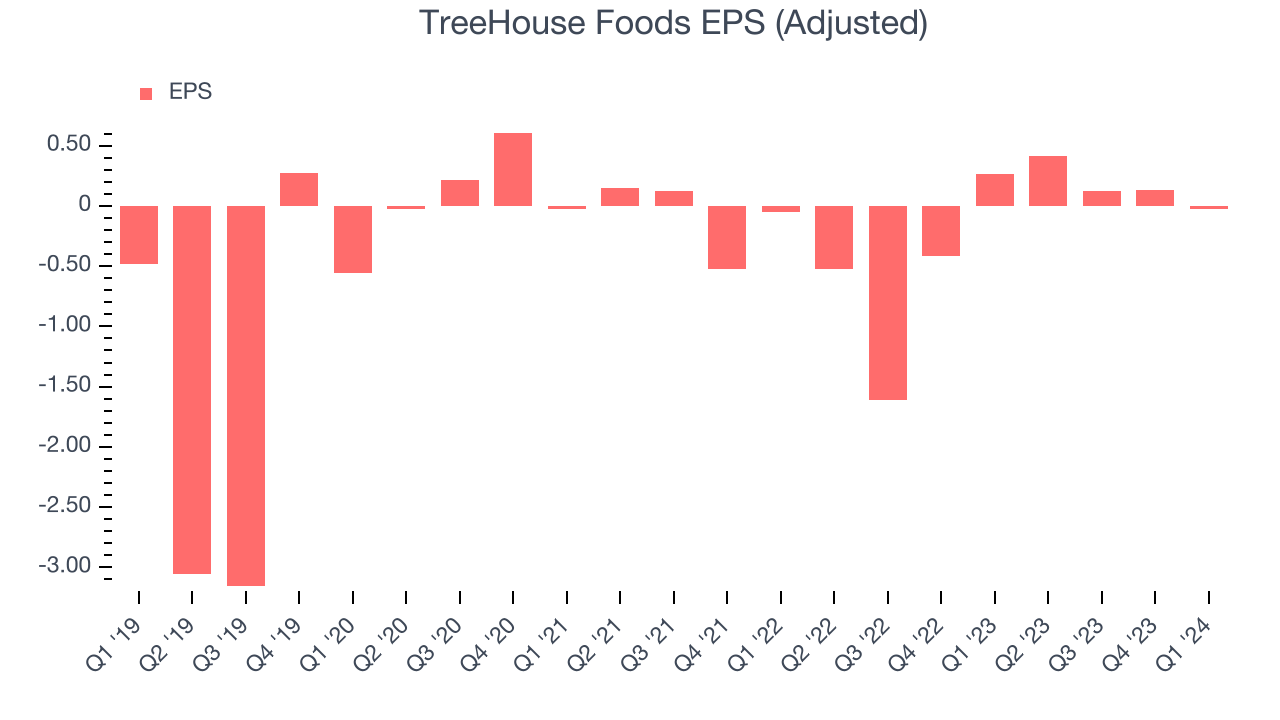

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

In Q1, TreeHouse Foods reported EPS at negative $0.03, down from $0.27 in the same quarter a year ago. This print unfortunately missed Wall Street's estimates, but we care more about long-term EPS growth rather than short-term movements.

Between FY2021 and FY2024, TreeHouse Foods's EPS dropped 16.4%, translating into 5.8% annualized declines. We tend to steer our readers away from companies with falling EPS, especially in the consumer staples sector, where shrinking earnings could imply changing secular trends or consumer preferences. If there's no earnings growth, it's difficult to build confidence in a business's underlying fundamentals, leaving a low margin of safety around the company's valuation (making the stock susceptible to large downward swings).

On the bright side, Wall Street expects the company's earnings to grow over the next 12 months, with analysts projecting an average 296% year-on-year increase in EPS.

Cash Is King

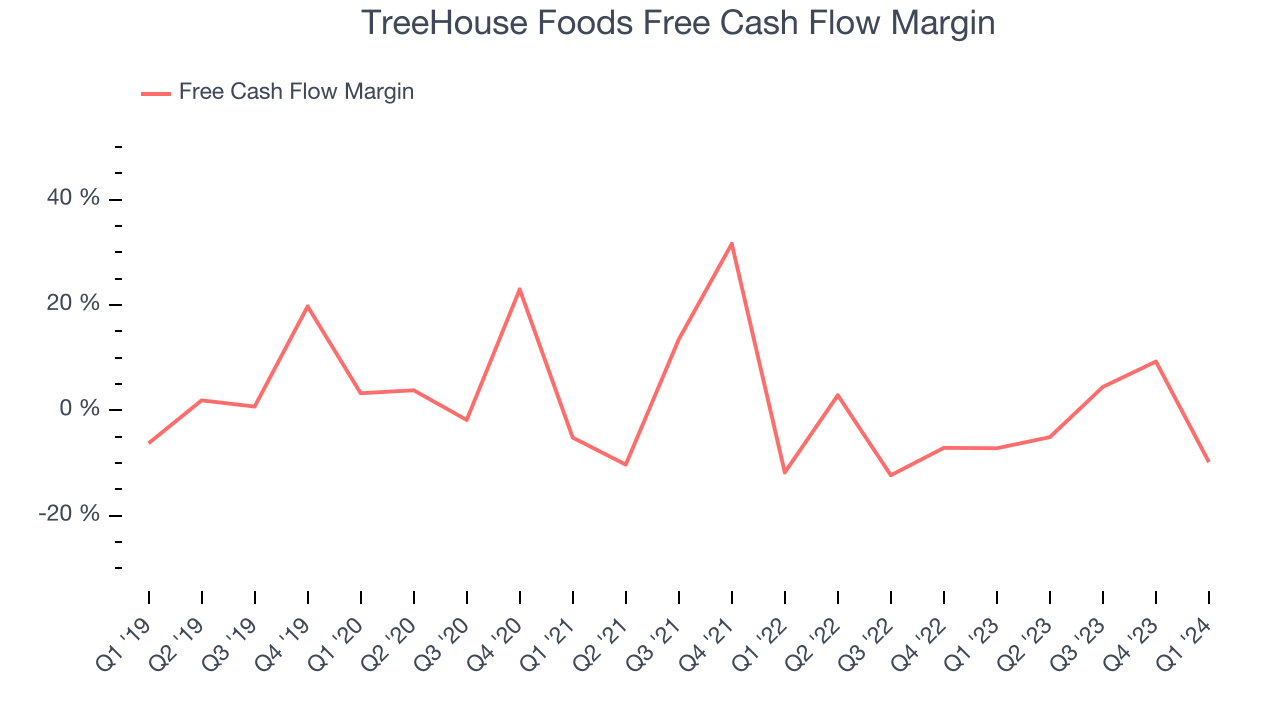

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

TreeHouse Foods burned through $80.7 million of cash in Q1, representing a negative 9.8% free cash flow margin. The company reduced its cash burn by 31.2% year on year.

Over the last eight quarters, TreeHouse Foods's demanding reinvestment strategy has consumed many company resources. Its free cash flow margin has averaged negative 3.1%, poor for a consumer staples business. However, its margin has averaged year-on-year increases of 6.2 percentage points over the last 12 months, showing the company is at least improving.

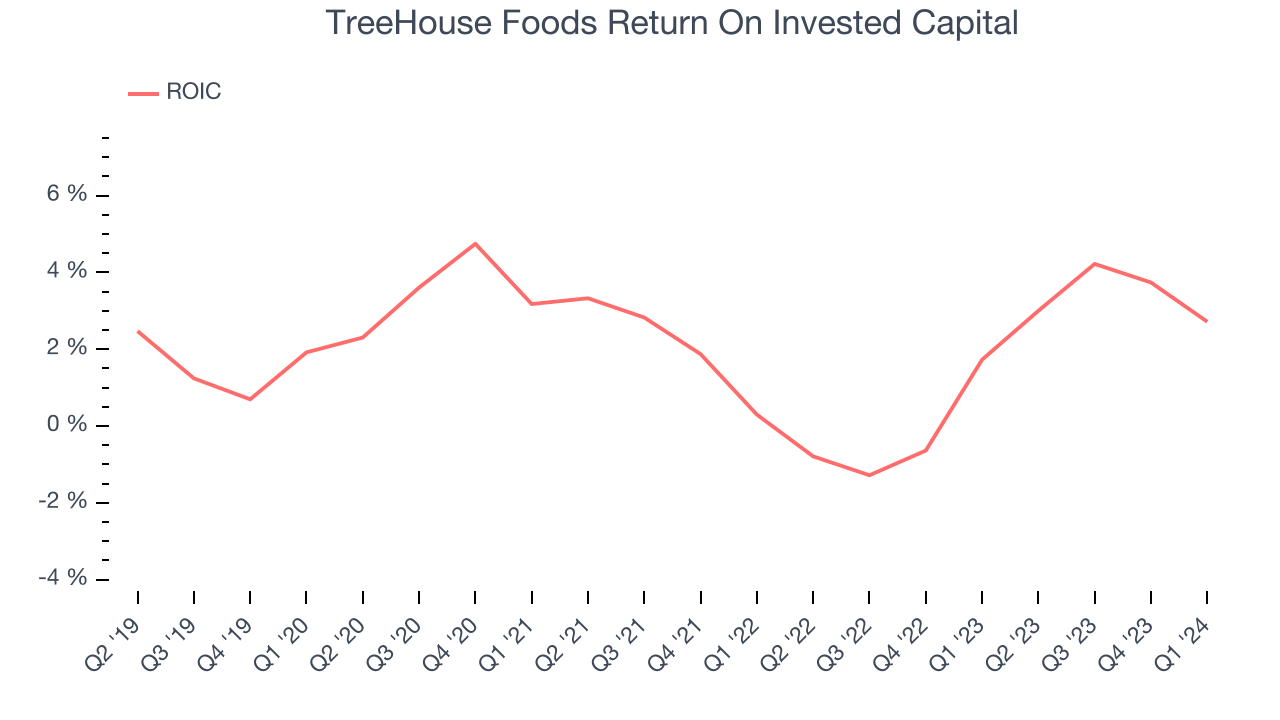

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

TreeHouse Foods's five-year average ROIC was 2%, somewhat low compared to the best consumer staples companies that consistently pump out 20%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, TreeHouse Foods's ROIC has stayed the same over the last few years. If the company wants to become an investable business, it will need to increase its returns.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

TreeHouse Foods reported $191.8 million of cash and $1.55 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $306 million of EBITDA over the last 12 months, we view TreeHouse Foods's 4.4x net-debt-to-EBITDA ratio as safe. We also see its $30.2 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from TreeHouse Foods's Q1 Results

We were impressed by how significantly TreeHouse Foods blew past analysts' organic revenue growth expectations this quarter. We were also excited its revenue outperformed Wall Street's estimates. On the other hand, its operating margin missed analysts' expectations and its gross margin missed Wall Street's estimates. Overall, this was a mediocre quarter for TreeHouse Foods. The company is down 4.3% on the results and currently trades at $35.65 per share.

Is Now The Time?

TreeHouse Foods may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of TreeHouse Foods, we'll be cheering from the sidelines. Its revenue has declined over the last three years, but at least growth is expected to increase in the short term. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its gross margins make it more challenging to reach positive operating profits compared to other consumer staples businesses. On top of that, its relatively low ROIC suggests it has struggled to grow profits historically.

TreeHouse Foods's price-to-earnings ratio based on the next 12 months is 14.6x. While there are some things to like about TreeHouse Foods and its valuation is reasonable, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $39 per share right before these results (compared to the current share price of $35.65).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.