Young adult apparel retailer Tilly’s (NYSE:TLYS) reported Q2 FY2023 results beating Wall Street analysts' expectations, with revenue down 4.97% year on year to $160 million. On top of that, next quarter's revenue guidance ($168.5 million at the midpoint) was surprisingly good and 4.07% above what analysts were expecting. Turning to EPS, Tilly's made a GAAP loss of $0.04 per share, down from its profit of $0.13 per share in the same quarter last year.

Is now the time to buy Tilly's? Find out by accessing our full research report, it's free.

Tilly's (TLYS) Q2 FY2023 Highlights:

- Revenue: $160 million vs analyst estimates of $150.9 million (5.99% beat)

- EPS: -$0.04 vs analyst estimates of -$0.23 ($0.19 beat)

- Revenue Guidance for Q3 2023 is $168.5 million at the midpoint, above analyst estimates of $161.9 million

- Free Cash Flow of $10.2 million, up 66.7% from the same quarter last year

- Gross Margin (GAAP): 27.7%, down from 43.3% in the same quarter last year

- Same-Store Sales were down 8.5% year on year (beat vs. expectations of down 11.5% year on year)

- Store Locations: 246 at quarter end, increasing by 3 over the last 12 months

With an emphasis on skate and surf culture, Tilly’s (NYSE:TLYS) is a specialty retailer that sells clothing, footwear and accessories geared towards fashion-forward teens and young adults.

Apparel sales are not driven so much by personal need but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

Sales Growth

Tilly's is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale.

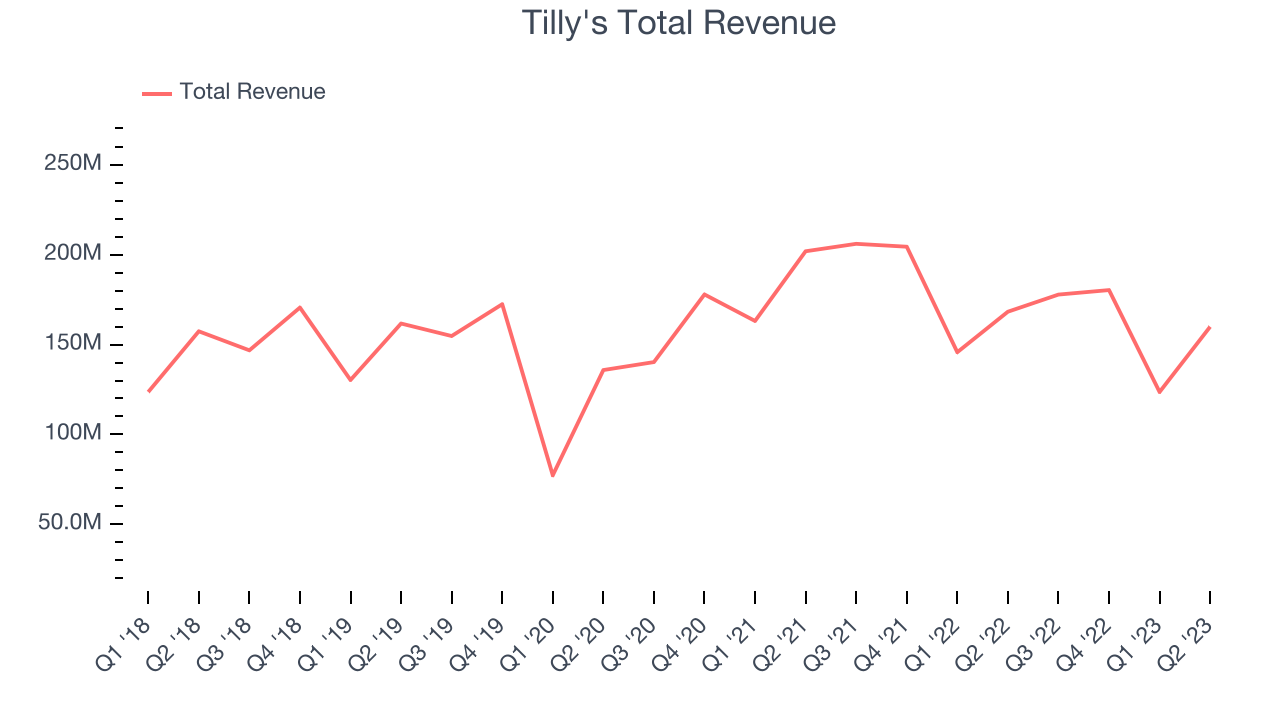

As you can see below, the company's annualized revenue growth rate of 1.3% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was weak as its store footprint remained relatively unchanged.

This quarter, Tilly's revenue fell 4.97% year on year to $160 million but beat Wall Street's estimates by 5.99%. The company is guiding for a 5.26% year-on-year revenue decline next quarter to $168.5 million, an improvement from the 13.7% year-on-year decrease it recorded in the same quarter last year. Looking ahead, Wall Street expects revenue to decline 3.8% over the next 12 months.

The pandemic fundamentally changed several consumer habits. There is a founder-led company that is massively benefiting from this shift. The business has grown astonishingly fast, with 40%+ free cash flow margins. Its fundamentals are undoubtedly best-in-class. Still, the total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

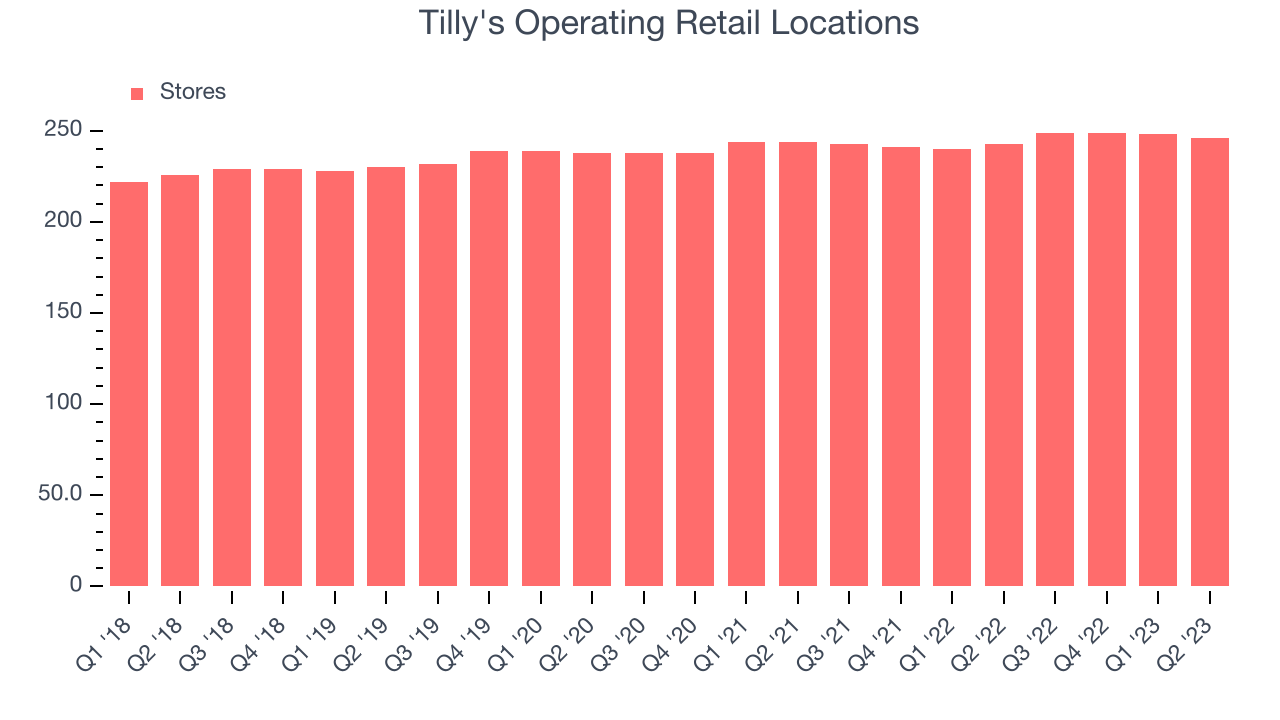

Number of Stores

When a retailer like Tilly's keeps its store footprint steady, it usually means that demand is stable and it's focused on improving its operational efficiency to increase profitability. Tilly's store count increased by 3 locations, or 1.23%, over the last 12 months to 246 total retail locations in the most recently reported quarter.

Over the last two years, the company has only opened a few new stores, averaging 1.46% annual growth in new locations. This sluggish pace lags the broader sector. A flat store base means that revenue growth must come from increased e-commerce sales or higher foot traffic and sales per customer at existing stores.

Same-Store Sales

Same-store sales growth is an important metric that tracks demand for a retailer's established brick-and-mortar stores and e-commerce platform.

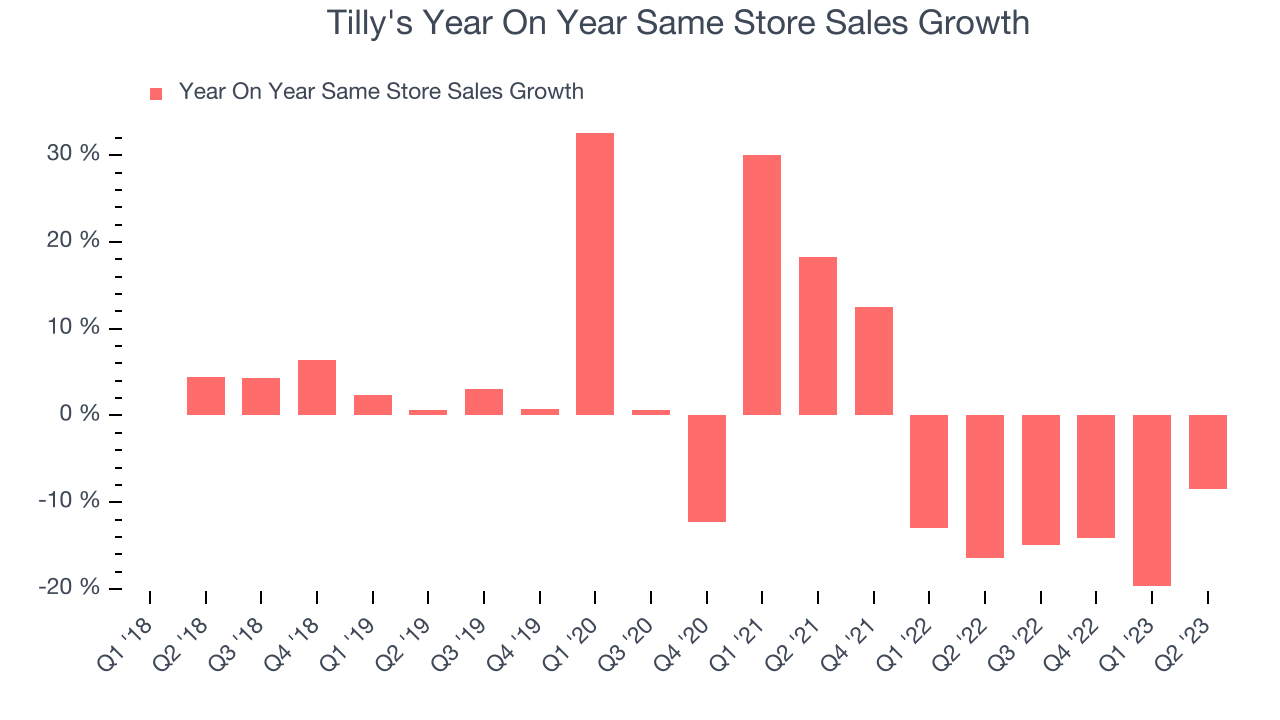

Tilly's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 10.6% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

In the latest quarter, Tilly's same-store sales fell 8.5% year on year. This decrease was an improvement from the 16.4% year-on-year decline it posted 12 months ago. It's always great to see a business improve its prospects.

Key Takeaways from Tilly's Q2 Results

With a market capitalization of $261.1 million, Tilly's is among smaller companies, but its more than $54.6 million in cash on hand and near break-even free cash flow margins puts it in a stable financial position.

We liked that Tilly's beat on same-store sales, revenue, and EPS this quarter. We were also glad that next quarter's earnings guidance exceeded Wall Street's estimates, although next quarter's EPS guidance is relatively in line. Overall, the results could have been better. The stock is up 11% after reporting and currently trades at $9.98 per share.

So should you invest in Tilly's right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned in this report.