Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at Taylor Morrison Home (NYSE:TMHC) and its peers.

Traditionally, homebuilders have built competitive advantages with economies of scale that lead to advantaged purchasing and brand recognition among consumers. Aesthetic trends have always been important in the space, but more recently, energy efficiency and conservation are driving innovation. However, these companies are still at the whim of the macro, specifically interest rates that heavily impact new and existing home sales. In fact, homebuilders are one of the most cyclical subsectors within industrials.

The 12 home builders stocks we track reported a decent Q2. As a group, revenues beat analysts’ consensus estimates by 2.8%.

Stocks, especially growth stocks with cash flows further into the future, had a good end of 2023. On the other hand, this year has seen more volatile stock market swings due to mixed inflation data. However, home builders stocks have held steady amidst all this with share prices up 2.2% on average since the latest earnings results.

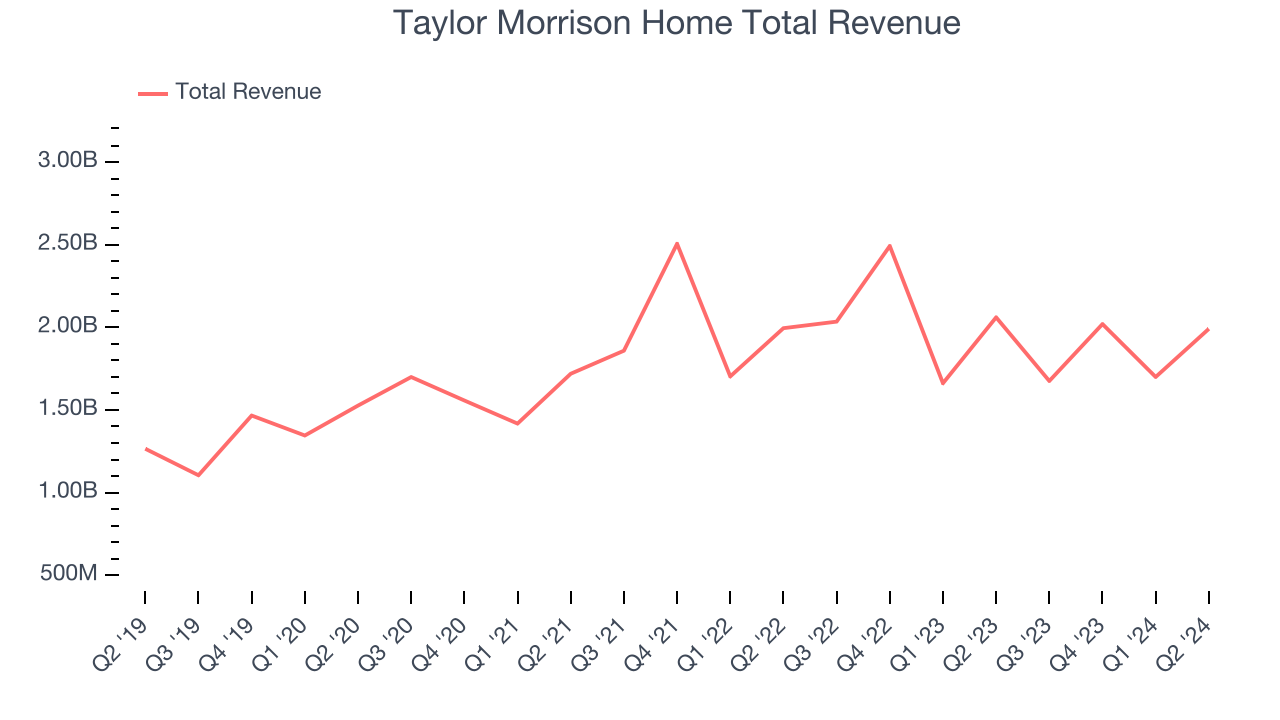

Taylor Morrison Home (NYSE:TMHC)

Named “America’s Most Trusted Home Builder” in 2019, Taylor Morrison Home (NYSE:TMHC) builds single family homes and communities across the United States.

Taylor Morrison Home reported revenues of $1.99 billion, down 3.4% year on year. This print exceeded analysts’ expectations by 4.8%. Overall, it was a mixed quarter for the company with an impressive beat of analysts’ revenue estimates but a miss of analysts’ backlog sales estimates.

"In the second quarter, our team delivered solid results, highlighted by both our closings volume and home closings gross margin exceeding our expectations. Following this strength, we now expect to deliver between 12,600 to 12,800 homes this year at a home closings gross margin around 24%. Most importantly, our performance and updated outlook once again reflect the overall strength and stability of our diversified consumer and geographic strategy. By meeting the needs of well-qualified homebuyers with appropriate product offerings in prime community locations, we continue to benefit from healthy demand and pricing resiliency across our portfolio," said Sheryl Palmer, Taylor Morrison Chairman and CEO.

Unsurprisingly, the stock is down 2.7% since reporting and currently trades at $64.15.

Is now the time to buy Taylor Morrison Home? Access our full analysis of the earnings results here, it’s free.

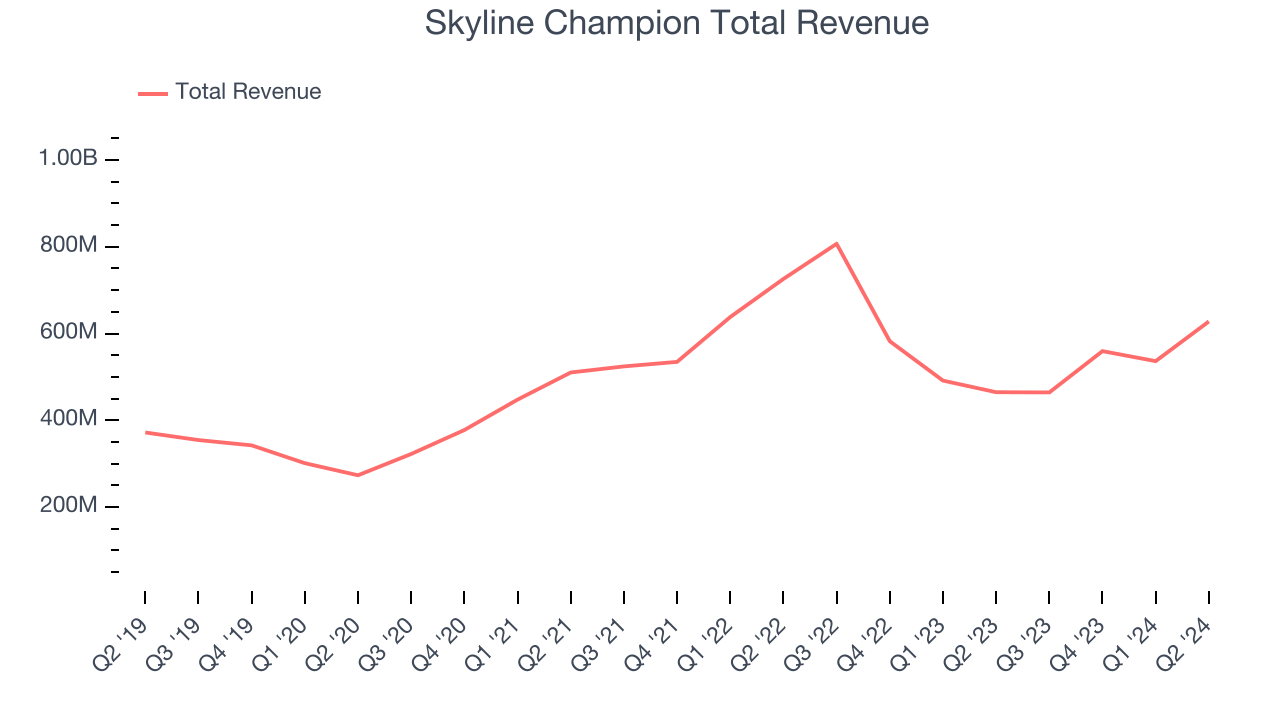

Best Q2: Skyline Champion (NYSE:SKY)

Founded in 1951, Skyline Champion (NYSE:SKY) is a manufacturer of modular homes and buildings in North America.

Skyline Champion reported revenues of $627.8 million, up 35.1% year on year, outperforming analysts’ expectations by 4.6%. It was an incredible quarter for the company with an impressive beat of analysts’ earnings estimates.

The market seems happy with the results as the stock is up 18.9% since reporting. It currently trades at $88.53.

Is now the time to buy Skyline Champion? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: TopBuild (NYSE:BLD)

Established in 2015 following a spinoff from Masco Corporation, TopBuild (NYSE:BLD) is a distributor and installer of insulation and other building products.

TopBuild reported revenues of $1.37 billion, up 3.7% year on year, falling short of analysts’ expectations by 2.3%. It was a weak quarter for the company with a miss of analysts’ earnings estimates.

As expected, the stock is down 15.3% since the results and currently trades at $360.40.

Read our full analysis of TopBuild’s results here.

KB Home (NYSE:KBH)

The first homebuilder to be listed on the NYSE, KB Home (NYSE:KB) is a homebuilding company targeting the first-time home buyer and move-up buyer markets.

KB Home reported revenues of $1.71 billion, down 3.1% year on year, surpassing analysts’ expectations by 3.4%. More broadly, it was a stunning quarter for the company with an impressive beat of analysts’ backlog sales estimates.

The stock is up 16.6% since reporting and currently trades at $79.35.

Read our full, actionable report on KB Home here, it’s free.

Lennar (NYSE:LEN)

One of the largest homebuilders in America, Lennar (NYSE:LEN) is known for constructing affordable, move-up, and retirement homes across a range of markets and communities.

Lennar reported revenues of $8.77 billion, up 9% year on year, surpassing analysts’ expectations by 2.5%. More broadly, it was a slower quarter for the company with a miss of analysts’ backlog sales estimates.

The stock is up 14.6% since reporting and currently trades at $179.42.

Read our full, actionable report on Lennar here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.