Restaurant software platform Toast (NYSE:TOST) beat analysts' expectations in Q1 CY2024, with revenue up 31.3% year on year to $1.08 billion. It made a GAAP loss of $0.15 per share, improving from its loss of $0.15 per share in the same quarter last year.

Toast (TOST) Q1 CY2024 Highlights:

- Revenue: $1.08 billion vs analyst estimates of $1.04 billion (3.3% beat)

- EPS: -$0.15 vs analyst expectations of -$0.14 (6% miss)

- Gross Margin (GAAP): 23.2%, up from 21.4% in the same quarter last year

- Free Cash Flow was -$33 million, down from $81 million in the previous quarter

- Market Capitalization: $13.04 billion

Founded by three MIT engineers at a local Cambridge bar, Toast (NYSE:TOST) provides integrated point-of-sale (POS) hardware, software, and payments solutions for restaurants.

Many restaurants still rely on manual processes or antiquated one off technology solutions to manage operations, which results in a myriad of operational inefficiencies. Today’s restaurants must juggle online ordering, delivery, takeout, and curbside pickup orders, and are expected to communicate timing for order completion to both customers and employees. Layer on demand managing menu changes, incorporating marketing and loyalty programs, and keeping track of employee payroll and tracking supplies, and the need for a modern vertical specific software operating system targeted at restaurants becomes clear.

Toast is a cloud-based, end-to-end software and payments platform that is built specifically for restaurants. The company offers a range of functionality that includes the ability to accept and process payments, manage kitchen display systems, along with payroll and labor. It also has a marketing component that allows restaurants to build loyalty programs and email marketing, and even has Toast Capital, which provides working capital through small business loans. In 2021 prior to its IPO, Toast acquired xtraCHEF, which added functionality for supply chain management, such as accounts payable automation and inventory management. The Toast platform also has a range of integrations with third parties like DoorDash for delivery or Staples for supplies.

The value proposition for restaurants is to generate a virtuous cycle between restaurants, their employees, customers, and suppliers. Happy customers increase sales and tips, improving employee morale, and so forth. Additionally, the end-to-end nature of the operating system allows restaurants analytics and insights that leads to better decisions and improved restaurant performance.

Hospitality & Restaurant Software

Enterprise resource planning (ERP) and customer relationship management (CRM) are two of the largest software categories dominated by the likes of Microsoft, Oracle, and Salesforce.com. Today, the secular trend of mass customization is driving vertical software that customizes ERP and CRM functions for specific industry requirements. Restaurants are a prime example where a set of customized software providers have sprung up in recent years to create unique operating systems that blend tax and accounting software, order management and delivery, along with supply chain management. Hotels and other hospitality providers are another example.

Toast’s main competitors are a mix of legacy restaurant systems like Oracle’s Micros (NYSE:ORCL), Par Technology Corp (NYSE:PAR), and NCR (NYSE:NCR) along with newer general purpose POS technologies readily configurable to restaurants such as Square (NASDAQ: SQ), Shopify (NYSE:SHOP), along with Olo (NYSE:OLO) and a host of mostly private pure play rivals.

Sales Growth

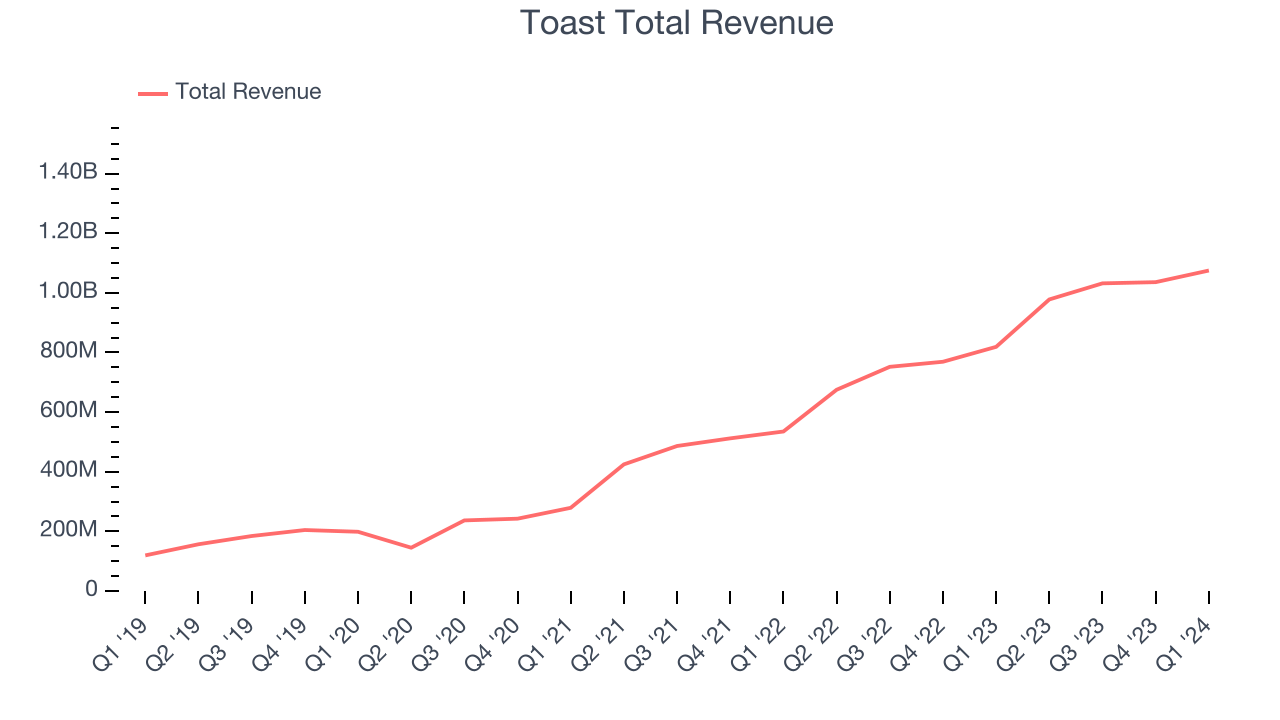

As you can see below, Toast's revenue growth has been incredible over the last three years, growing from $279 million in Q1 2021 to $1.08 billion this quarter.

Unsurprisingly, this was another great quarter for Toast with revenue up 31.3% year on year. On top of that, its revenue increased $39 million quarter on quarter, a very strong improvement from the $4 million increase in Q4 CY2023. This is a sign of acceleration of growth and great to see.

Looking ahead, analysts covering the company were expecting sales to grow 24% over the next 12 months before the earnings results announcement.

Profitability

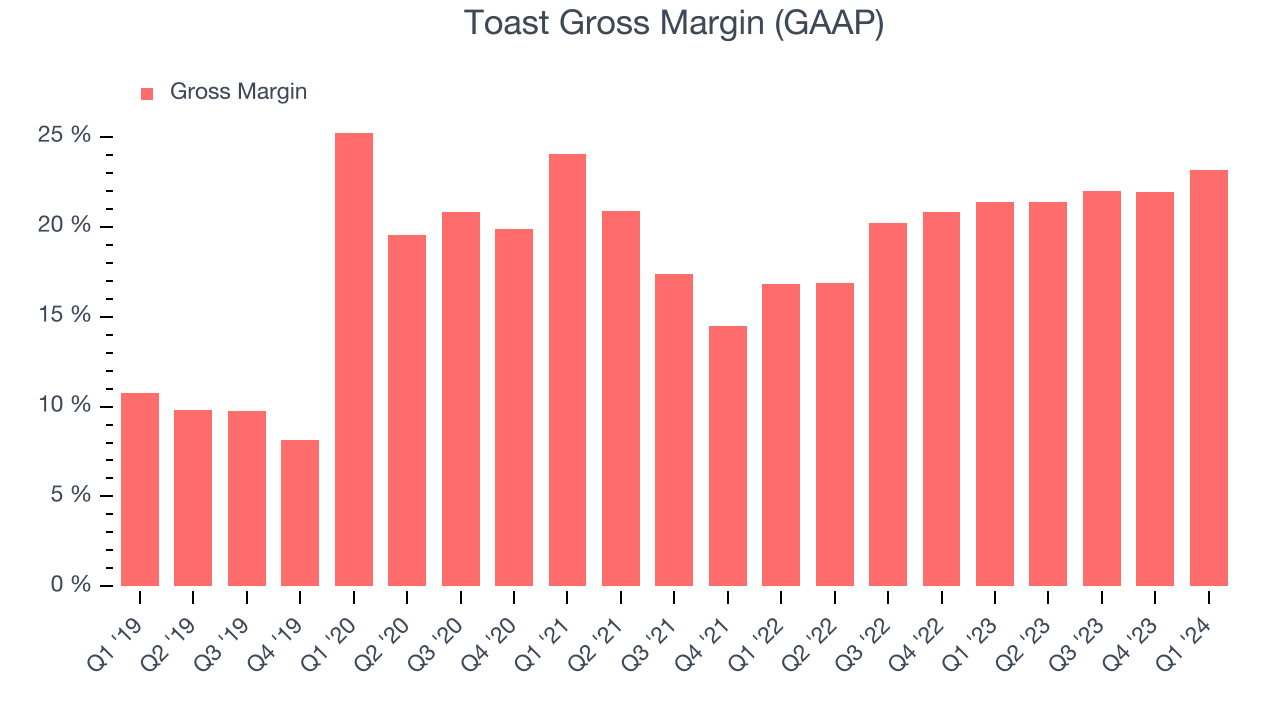

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Toast's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 23.2% in Q1.

That means that for every $1 in revenue the company had $0.23 left to spend on developing new products, sales and marketing, and general administrative overhead. While its gross margin has improved significantly since the previous quarter, Toast's gross margin is still poor for a SaaS business.

Cash Is King

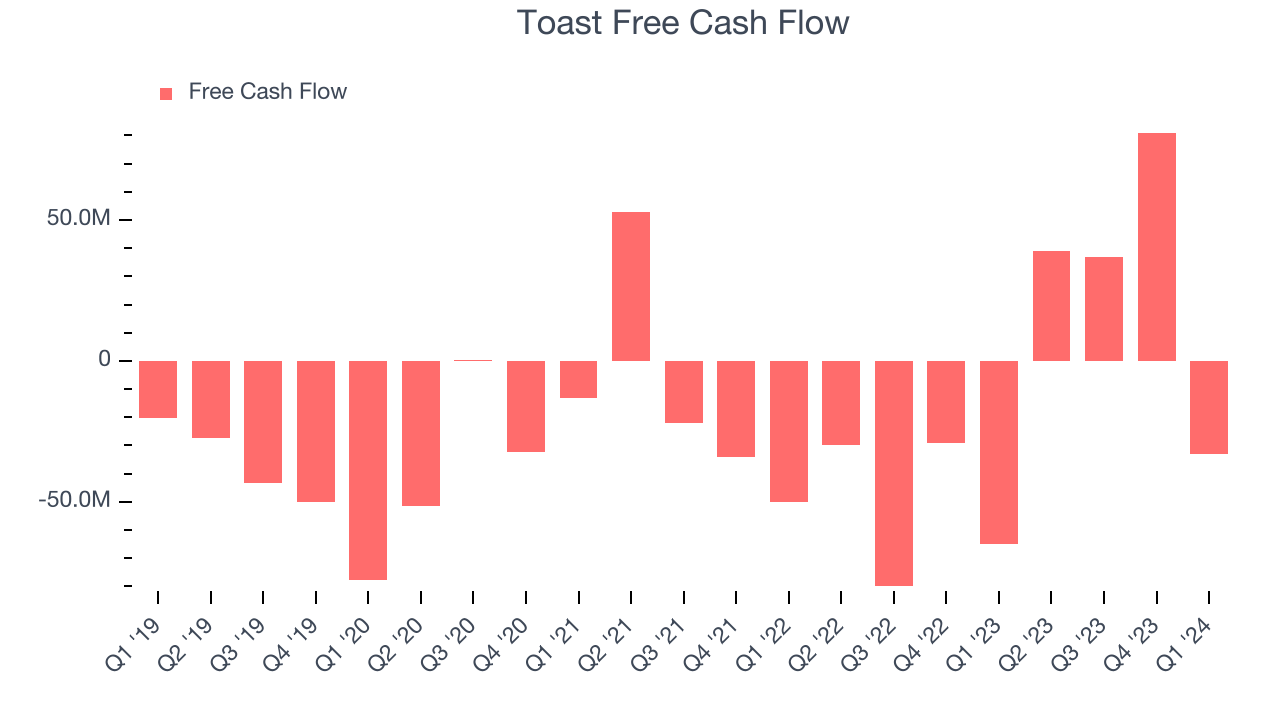

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Toast burned through $33 million of cash in Q1, increasing its cash burn by 49.2% year on year.

Toast has generated $124 million in free cash flow over the last 12 months, or 3% of revenue. This FCF margin enables it to reinvest in its business without depending on the capital markets.

Key Takeaways from Toast's Q1 Results

We were impressed by Toast's strong gross margin improvement this quarter. We were also glad its revenue outperformed Wall Street's estimates. Overall, we think this was a really good quarter that should please shareholders. The stock is up 3.4% after reporting and currently trades at $24.55 per share.

Is Now The Time?

When considering an investment in Toast, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We think Toast is a solid business. We'd expect growth rates to moderate from here, but its revenue growth has been exceptional over the last three years.

Toast's price-to-sales ratio based on the next 12 months is 2.5x, suggesting the market is expecting slower growth relative to the hottest software stocks. There are definitely a lot of things to like about Toast, and looking at the tech landscape right now, it seems to be trading at a pretty compelling price.

Wall Street analysts covering the company had a one-year price target of $24.52 right before these results (compared to the current share price of $24.55).

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.