General contracting company Tutor Perini (NYSE:TPC) fell short of the market’s revenue expectations in Q3 CY2024 as sales rose 2.1% year on year to $1.08 billion. Its GAAP loss of $1.92 per share was also 678% below analysts’ consensus estimates.

Is now the time to buy Tutor Perini? Find out by accessing our full research report, it’s free.

Tutor Perini (TPC) Q3 CY2024 Highlights:

- Revenue: $1.08 billion vs analyst estimates of $1.17 billion (7.2% miss)

- EPS: -$1.92 vs analyst estimates of $0.33 (-$2.25 miss)

- Gross Margin (GAAP): -2.4%, down from 4.8% in the same quarter last year

- Operating Margin: -9.9%, down from -1.1% in the same quarter last year

- Backlog: $14 billion at quarter end

- Market Capitalization: $1.44 billion

Ronald Tutor, Chairman and Chief Executive Officer, commented, “We have tremendous momentum with several large new project wins in the third quarter that resulted in a new record backlog of $14 billion. This backlog provides us a solid foundation upon which we expect to build a profitable, multi-year revenue stream, with the potential for significant continued growth over the next few months as we look to finalize the contract for the multi-billion-dollar Manhattan Jail, as we announced this morning, and pursue other large projects. We are pleased to put many of our largest disputes behind us, and expect to return to profitability in 2025, with even stronger earnings anticipated in 2026 and beyond, as various newer projects progress to advanced design and enter the construction phase.”

Company Overview

Known for constructing the Philadelphia Eagles’ Stadium, Tutor Perini (NYSE:TPC) is a civil and building construction company offering diversified general contracting and design-build services.

Construction and Maintenance Services

Construction and maintenance services companies not only boast technical know-how in specialized areas but also may hold special licenses and permits. Those who work in more regulated areas can enjoy more predictable revenue streams - for example, fire escapes need to be inspected every five years–. More recently, services to address energy efficiency and labor availability are also creating incremental demand. But like the broader industrials sector, construction and maintenance services companies are at the whim of economic cycles as external factors like interest rates can greatly impact the new construction that drives incremental demand for these companies’ offerings.

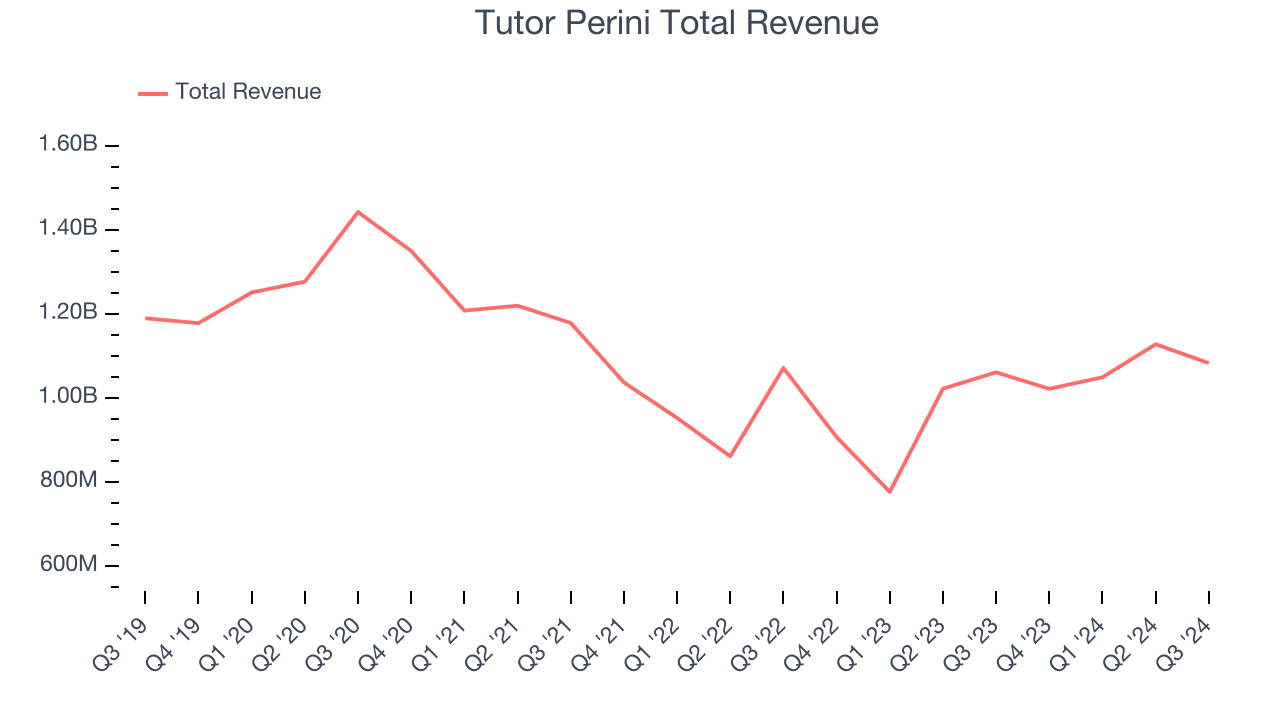

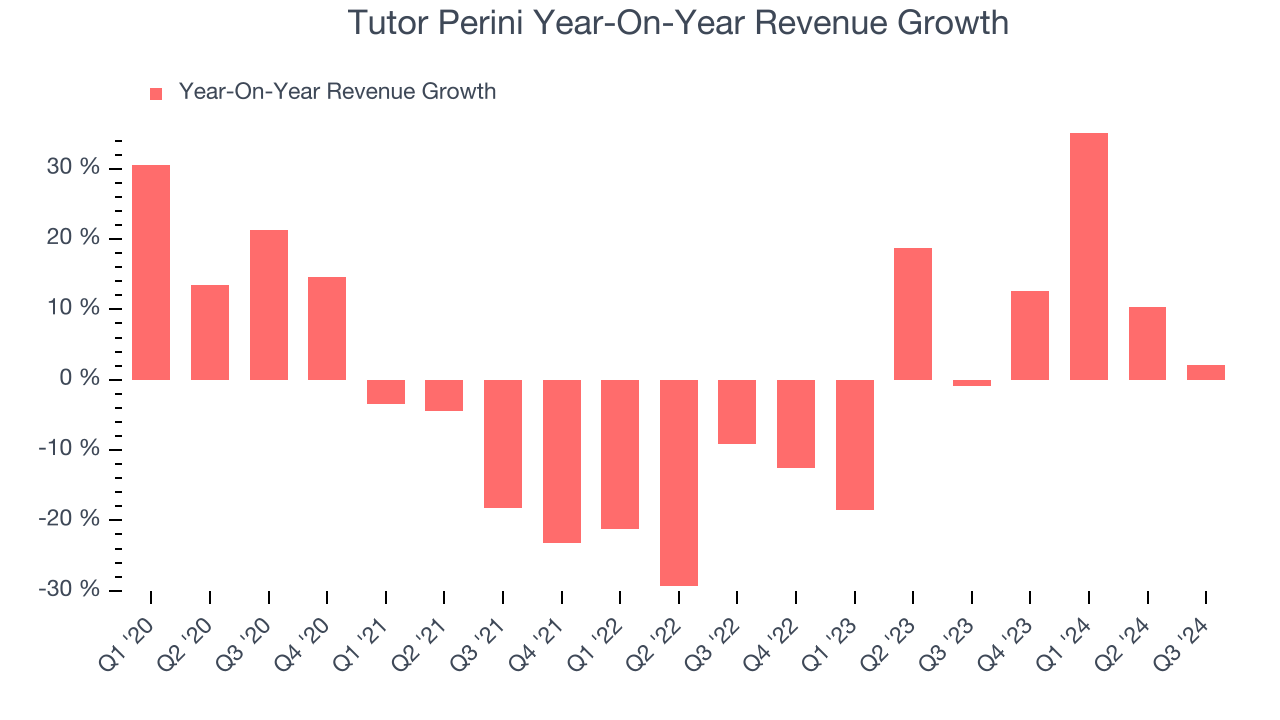

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Tutor Perini’s sales were flat. This shows demand was soft and is a tough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Tutor Perini’s annualized revenue growth of 4.5% over the last two years is above its five-year trend, but we were still disappointed by the results.

This quarter, Tutor Perini’s revenue grew 2.1% year on year to $1.08 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 15% over the next 12 months, an improvement versus the last two years. This projection is commendable and shows the market thinks its newer products and services will catalyze higher growth rates.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

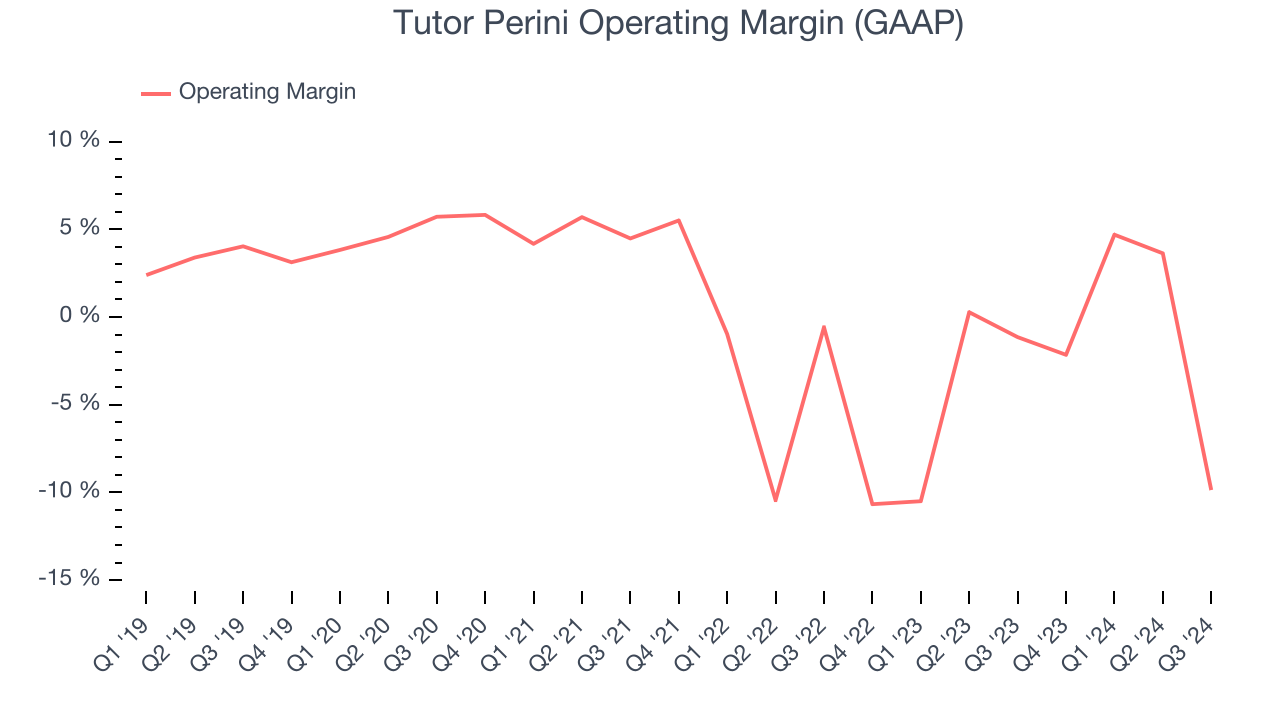

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Tutor Perini was roughly breakeven when averaging the last five years of quarterly operating profits, inadequate for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, Tutor Perini’s annual operating margin decreased by 5.3 percentage points over the last five years. The company’s performance was poor no matter how you look at it. It shows operating expenses were rising and it couldn’t pass those costs onto its customers.

In Q3, Tutor Perini generated an operating profit margin of negative 9.9%, down 8.7 percentage points year on year. Since Tutor Perini’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

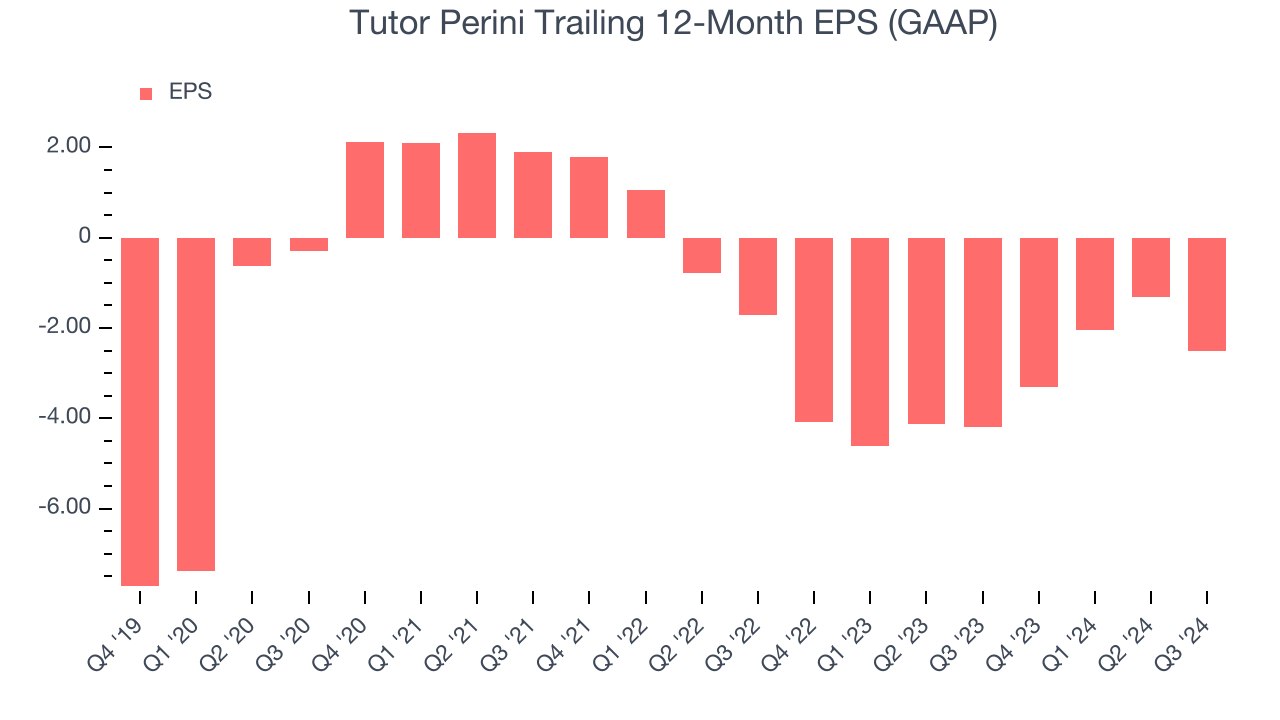

Earnings Per Share

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although Tutor Perini’s full-year earnings are still negative, it reduced its losses and improved its EPS by 23.2% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Tutor Perini, its two-year annual EPS declines of 21.2% mark a reversal from its (seemingly) healthy five-year trend. We hope Tutor Perini can return to earnings growth in the future.In Q3, Tutor Perini reported EPS at negative $1.92, down from negative $0.71 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Tutor Perini’s full-year EPS of negative $2.52 will flip to positive $1.49.

Key Takeaways from Tutor Perini’s Q3 Results

We struggled to find many strong positives in these results. Its revenue missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $30.28 immediately following the results.

Is Tutor Perini an attractive investment opportunity right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.