Bedding manufacturer Tempur Sealy (NYSE:TPX) missed analysts' expectations in Q1 CY2024, with revenue down 1.5% year on year to $1.19 billion. It made a non-GAAP profit of $0.50 per share, down from its profit of $0.53 per share in the same quarter last year.

Is now the time to buy Tempur Sealy? Find out by accessing our full research report, it's free.

Tempur Sealy (TPX) Q1 CY2024 Highlights:

- Revenue: $1.19 billion vs analyst estimates of $1.21 billion (1.3% miss)

- EPS (non-GAAP): $0.50 vs analyst estimates of $0.48 (3.6% beat)

- Full year EPS (non-GAAP) guidance: $2.75 at the midpoint, in line with expectations

- Gross Margin (GAAP): 43.1%, up from 41.4% in the same quarter last year

- Free Cash Flow of $98.7 million, up 67.3% from the previous quarter

- Market Capitalization: $8.70 billion

Company Chairman and CEO Scott Thompson commented, "We are pleased to report solid first quarter sales, earnings and record operating cash flow against a global backdrop which appears to be at a historical nadir. The strong reception to our newly launched innovative products and our ongoing investment in compelling marketing to support the industry, combined with our broad-based omni-channel reach and our commitment to driving operational efficiencies, drove our industry outperformance in the first quarter. Although we look forward to the market's recovery, this recessionary environment provides opportunity to highlight the strength of our global business model and our leading competitive position. We continue to invest in our key initiatives and expect to emerge from the current downturn positioned well for long term success.

Established through the merger of Tempur-Pedic and Sealy in 2012, Tempur Sealy (NYSE:TPX) is a bedding manufacturer known for its innovative memory foam mattresses and sleep products

Home Furnishings

A healthy housing market is good for furniture demand as more consumers are buying, renting, moving, and renovating. On the other hand, periods of economic weakness or high interest rates discourage home sales and can squelch demand. In addition, home furnishing companies must contend with shifting consumer preferences such as the growing propensity to buy goods online, including big things like mattresses and sofas that were once thought to be immune from e-commerce competition.

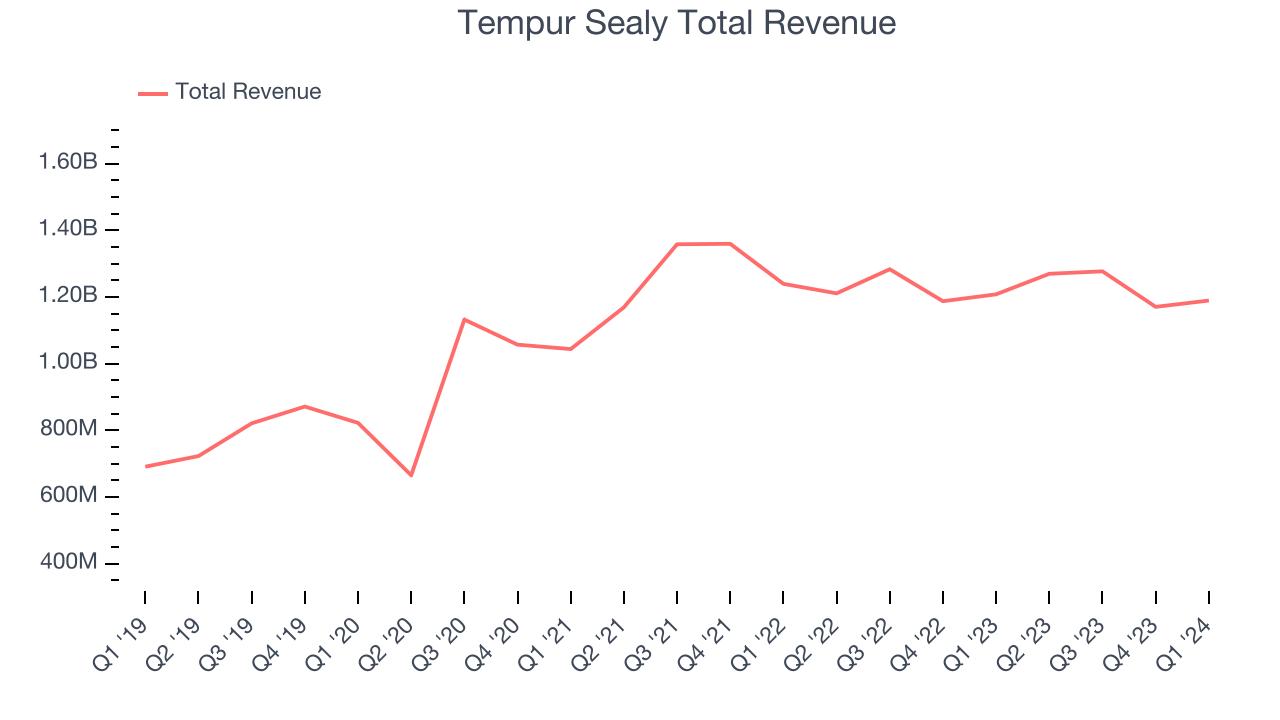

Sales Growth

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Tempur Sealy's annualized revenue growth rate of 12.2% over the last five years was mediocre for a consumer discretionary business.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Tempur Sealy's recent history shows a reversal from its already weak five-year trend as its revenue has shown annualized declines of 2.2% over the last two years.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Tempur Sealy's recent history shows a reversal from its already weak five-year trend as its revenue has shown annualized declines of 2.2% over the last two years.

We can better understand the company's revenue dynamics by analyzing its most important segments, Wholesale and Direct, which are 74.5% and 25.5% of revenue. Over the last two years, Tempur Sealy's Wholesale revenue (sales to retailers) averaged 4.3% year-on-year declines. On the other hand, its Direct revenue (sales made directly to consumers) averaged 9.9% growth.

This quarter, Tempur Sealy missed Wall Street's estimates and reported a rather uninspiring 1.5% year-on-year revenue decline, generating $1.19 billion of revenue. Looking ahead, Wall Street expects sales to grow 5.6% over the next 12 months, an acceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

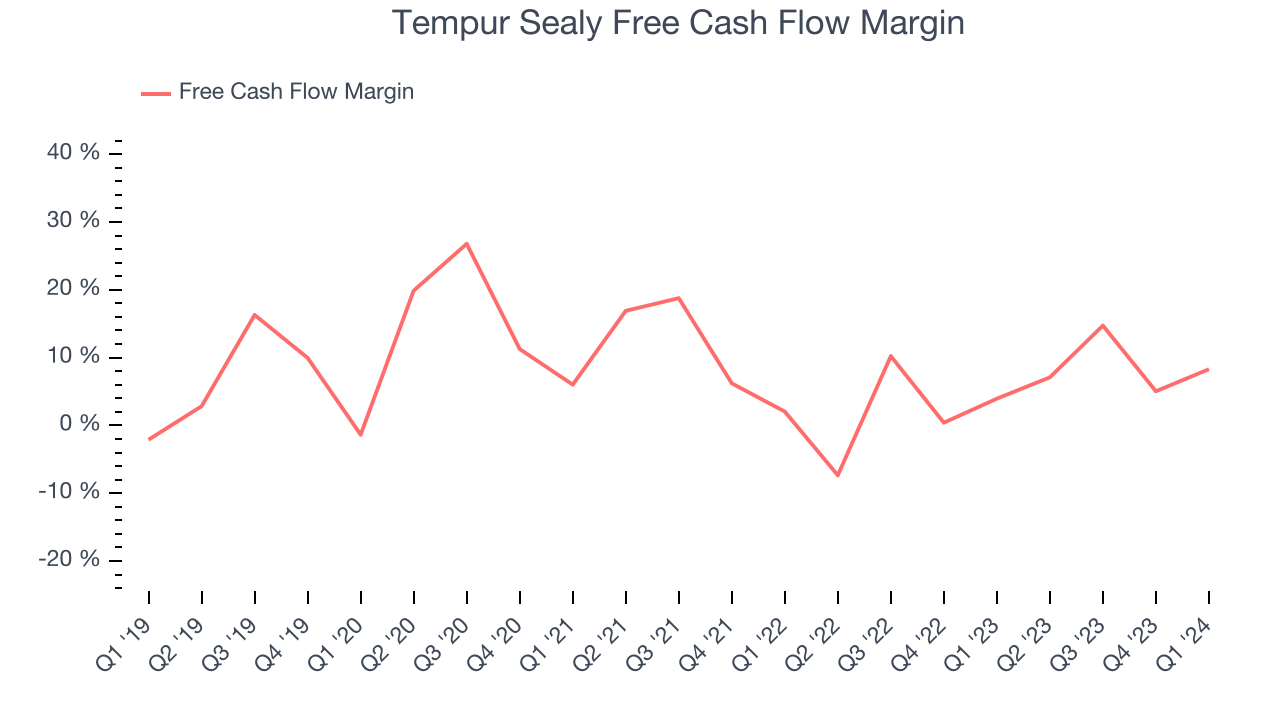

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, Tempur Sealy has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 5.4%, subpar for a consumer discretionary business.

Tempur Sealy's free cash flow came in at $98.7 million in Q1, equivalent to a 8.3% margin and up 107% year on year. Over the next year, analysts' consensus estimates show they're expecting Tempur Sealy's LTM free cash flow margin of 8.9% to remain the same.

Key Takeaways from Tempur Sealy's Q1 Results

It was encouraging to see Tempur Sealy slightly top analysts' EPS expectations this quarter. On the other hand, its operating margin missed and its Direct revenue fell short of Wall Street's estimates. That the company guided full year EPS in line with Consensus is comforting. Overall, this was a mixed quarter for Tempur Sealy. The stock is flat after reporting and currently trades at $50.13 per share.

So should you invest in Tempur Sealy right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.