Meat company Tyson Foods (NYSE:TSN) fell short of analysts' expectations in Q1 CY2024, with revenue flat year on year at $13.07 billion. It made a non-GAAP profit of $0.62 per share, improving from its loss of $0.04 per share in the same quarter last year.

Tyson Foods (TSN) Q1 CY2024 Highlights:

- Revenue: $13.07 billion vs analyst estimates of $13.16 billion (small miss)

- EPS (non-GAAP): $0.62 vs analyst estimates of $0.40 (56.8% beat)

- Gross Margin (GAAP): 6.6%, up from 4.7% in the same quarter last year

- Free Cash Flow was -$390 million, down from $946 million in the previous quarter

- Sales Volumes were down 1.5% year on year

- Market Capitalization: $22.1 billion

Started as a simple trucking business, Tyson Foods (NYSE:TSN) today is one of the world’s largest producers of chicken, beef, and pork.

These humble beginnings can be traced to 1935 when John W. Tyson started his company in Springdale, Arkansas. Over time, this trucking business focused on delivering chickens. During the surge in food demand in the 1940s due to World War II, Tyson began investing in his own chicken hatcheries and feed mills. From there, vertical integration was adopted, where the company controlled every stage of poultry production from hatching to feed to processing.

Today, Tyson Foods is not just a chicken producer–it’s a diversified protein powerhouse that extends beyond meat into prepared foods and alternative protein sources. Among their most recognizable brands are Tyson, Jimmy Dean, Hillshire Farm, and Ball Park (hot dogs).

The Tyson Foods core customer is broad but can generally be understood as someone who shops for the household. This person is seeking convenient meal solutions–whether that’s chicken or beef from a trusted source that can be quickly tossed into a pan or a pre-made meal that just needs to be heated up. However, customers also include large-scale buyers such as restaurants and food service companies in need of bulk protein.

Tyson products are widely distributed in supermarkets, club stores, and special grocery stores. Restaurant and food service customers can procure their meats and prepared foods directly from Tyson, with discounts available for larger orders.

Perishable Food

The perishable food industry is diverse, encompassing large-scale producers and distributors to specialty and artisanal brands. These companies sell produce, dairy products, meats, and baked goods and have become integral to serving modern American consumers who prioritize freshness, quality, and nutritional value. Investing in perishable food stocks presents both opportunities and challenges. While the perishable nature of products can introduce risks related to supply chain management and shelf life, it also creates a constant demand driven by the necessity for fresh food. Companies that can efficiently manage inventory, distribution, and quality control are well-positioned to thrive in this competitive market. Navigating the perishable food industry requires adherence to strict food safety standards, regulations, and labeling requirements.

Competitors in protein and packaged foods include Pilgrim’s Pride (NASDAQ:PPC) and private companies Perdue Farms, Sanderson Farms, and Koch Foods.Sales Growth

Tyson Foods is one of the most widely recognized consumer staples companies in the world. Its influence over consumers gives it extremely high negotiating leverage with distributors, enabling it to pick and choose where it sells its products (a luxury many don't have).

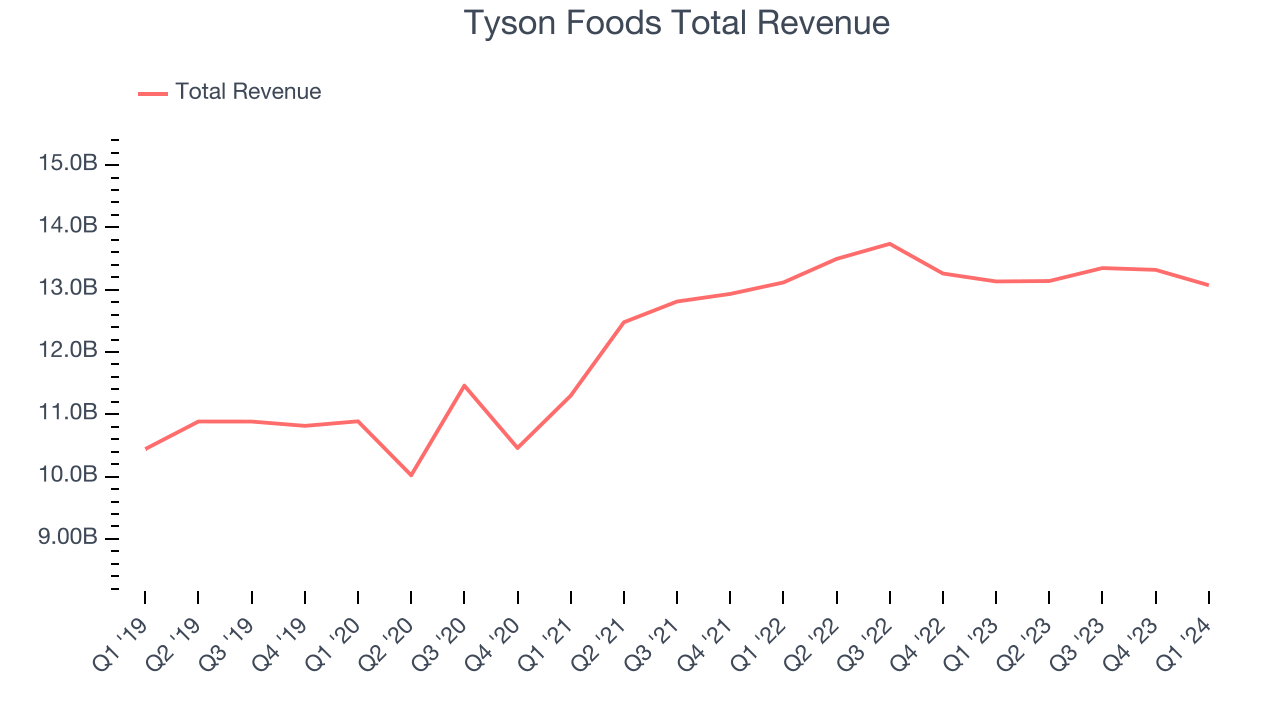

As you can see below, the company's annualized revenue growth rate of 6.9% over the last three years was mediocre for a consumer staples business.

This quarter, Tyson Foods missed Wall Street's estimates and reported a rather uninspiring 0.5% year-on-year revenue decline, generating $13.07 billion in revenue. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months.

Volume Growth

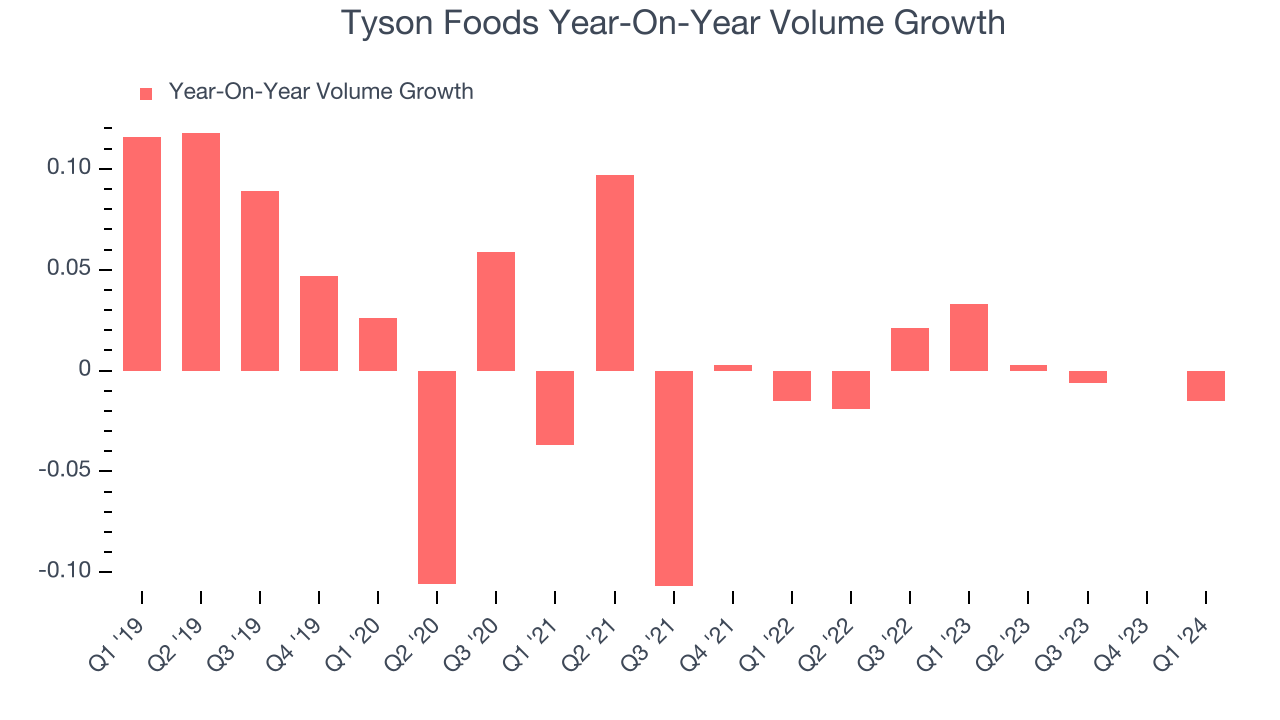

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Tyson Foods's quarterly sales volumes have, on average, stayed about the same over the last two years. This stability is normal because the quantity demanded for consumer staples products typically doesn't see much volatility.

In Tyson Foods's Q1 2024, sales volumes dropped 1.5% year on year. This result was a reversal from the 3.3% year-on-year increase it posted 12 months ago. A one quarter hiccup shouldn't deter you from investing in a business. We'll be monitoring the company to see how things progress.

Gross Margin & Pricing Power

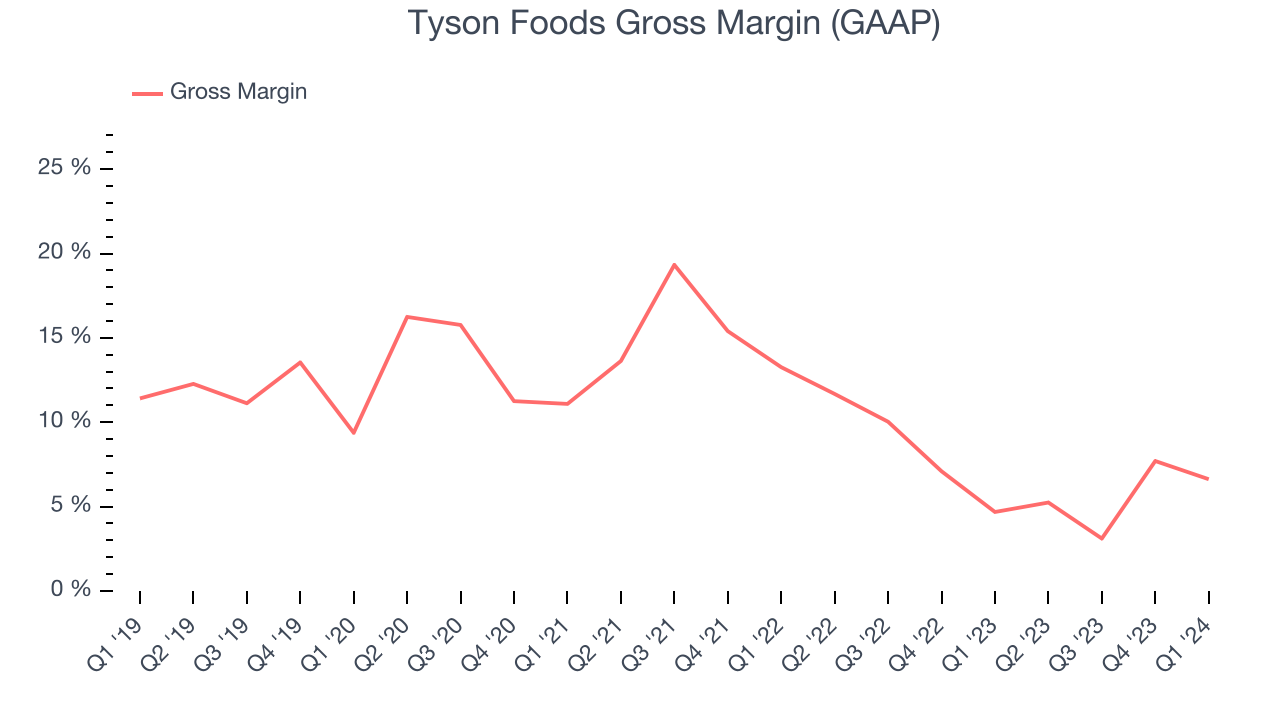

All else equal, we prefer higher gross margins. They make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

Tyson Foods's gross profit margin came in at 6.6% this quarter, up 1.9 percentage points year on year. That means for every $1 in revenue, a chunky $0.93 went towards paying for raw materials, production of goods, and distribution expenses.

Tyson Foods has poor unit economics for a consumer staples company, leaving it with little room for error if things go awry. As you can see above, it's averaged a paltry 7% gross margin over the last two years. Its margin has also been trending down over the last year, averaging 18.5% year-on-year decreases each quarter. If this trend continues, it could suggest a more competitive environment where Tyson Foods has diminishing pricing power and less favorable input costs (such as raw materials).

Operating Margin

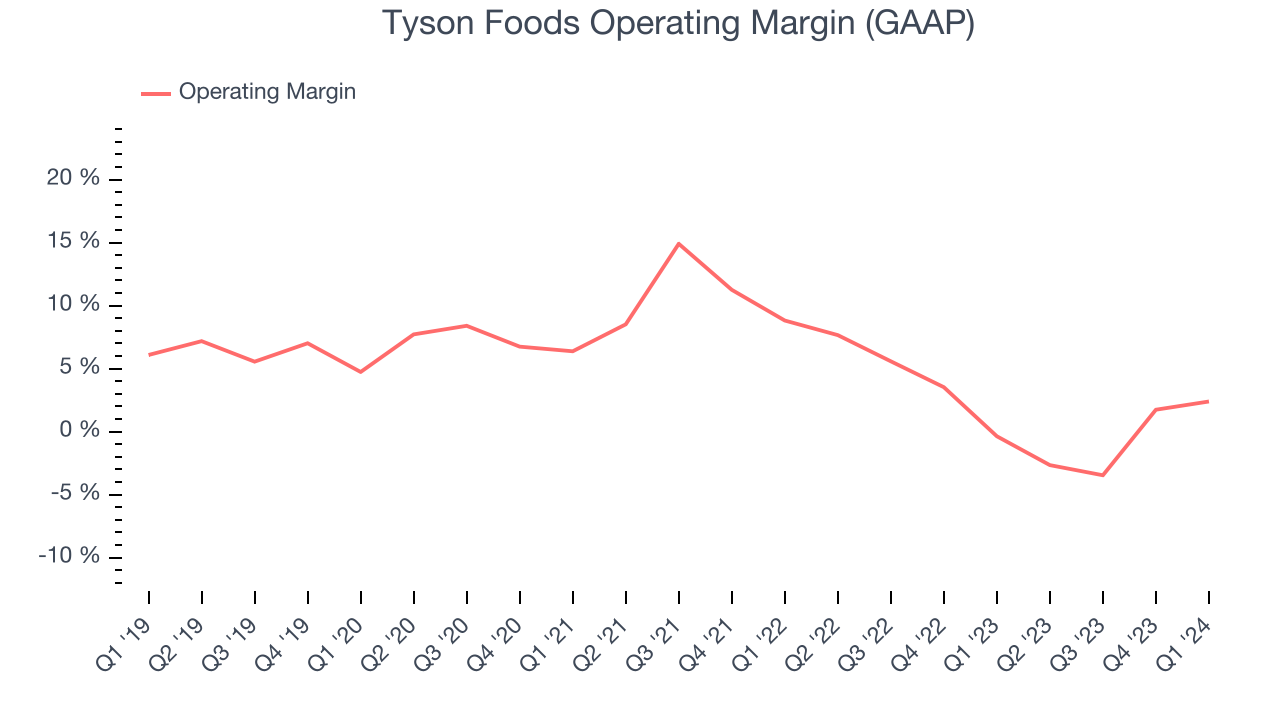

Operating margin is a key profitability metric for companies because it accounts for all expenses enabling a business to operate smoothly, including marketing and advertising, IT systems, wages, and other administrative costs.

In Q1, Tyson Foods generated an operating profit margin of 2.4%, up 2.8 percentage points year on year. This increase was encouraging, and we can infer Tyson Foods was more efficient with its expenses because its operating margin expanded more than its gross margin.

Zooming out, Tyson Foods was profitable over the last eight quarters but held back by its large expense base. It's demonstrated subpar profitability for a consumer staples business, producing an average operating margin of 1.8%. On top of that, Tyson Foods's margin has declined by 4.6 percentage points on average over the last year. This shows the company is heading in the wrong direction, and investors are likely hoping for better results in the future.

Zooming out, Tyson Foods was profitable over the last eight quarters but held back by its large expense base. It's demonstrated subpar profitability for a consumer staples business, producing an average operating margin of 1.8%. On top of that, Tyson Foods's margin has declined by 4.6 percentage points on average over the last year. This shows the company is heading in the wrong direction, and investors are likely hoping for better results in the future.EPS

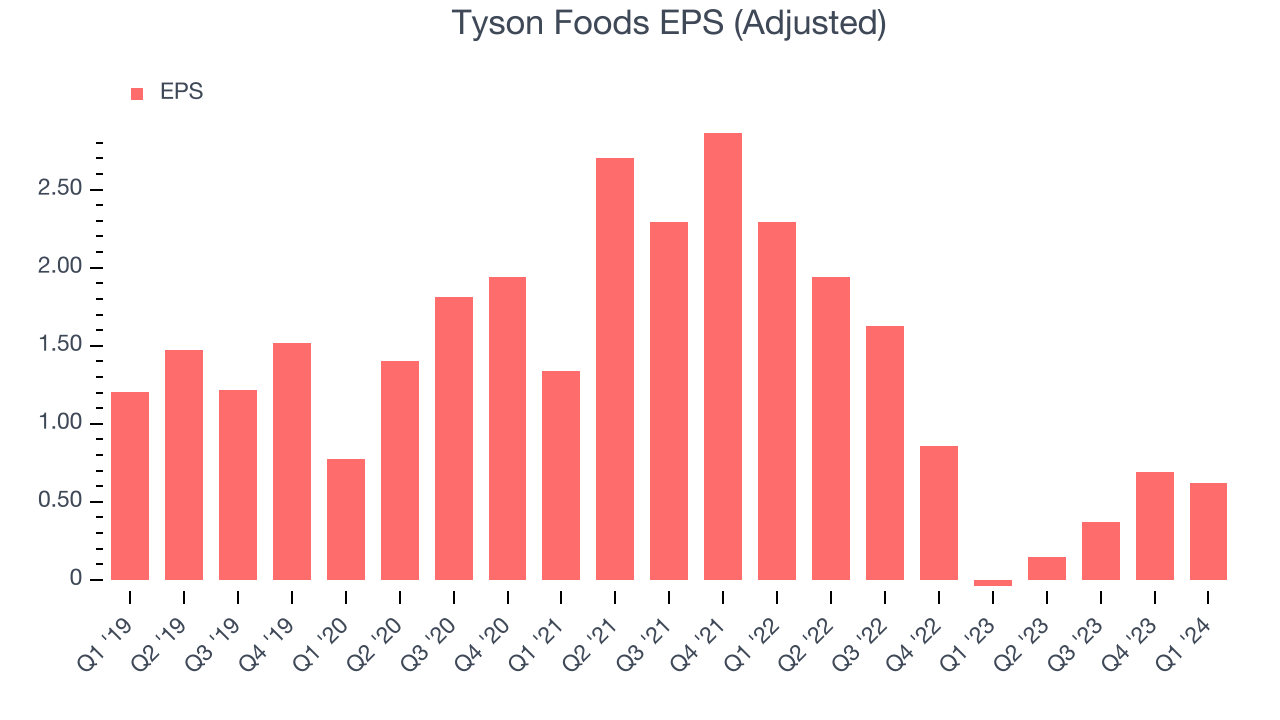

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

In Q1, Tyson Foods reported EPS at $0.62, up from negative $0.04 in the same quarter a year ago. This print beat Wall Street's estimates by 56.8%.

Between FY2021 and FY2024, Tyson Foods's EPS dropped 71.9%, translating into 34.5% annualized declines. We tend to steer our readers away from companies with falling EPS, especially in the consumer staples sector, where shrinking earnings could imply changing secular trends or consumer preferences. If there's no earnings growth, it's difficult to build confidence in a business's underlying fundamentals, leaving a low margin of safety around the company's valuation (making the stock susceptible to large downward swings).

On the bright side, Wall Street expects the company's earnings to grow over the next 12 months, with analysts projecting an average 69% year-on-year increase in EPS.

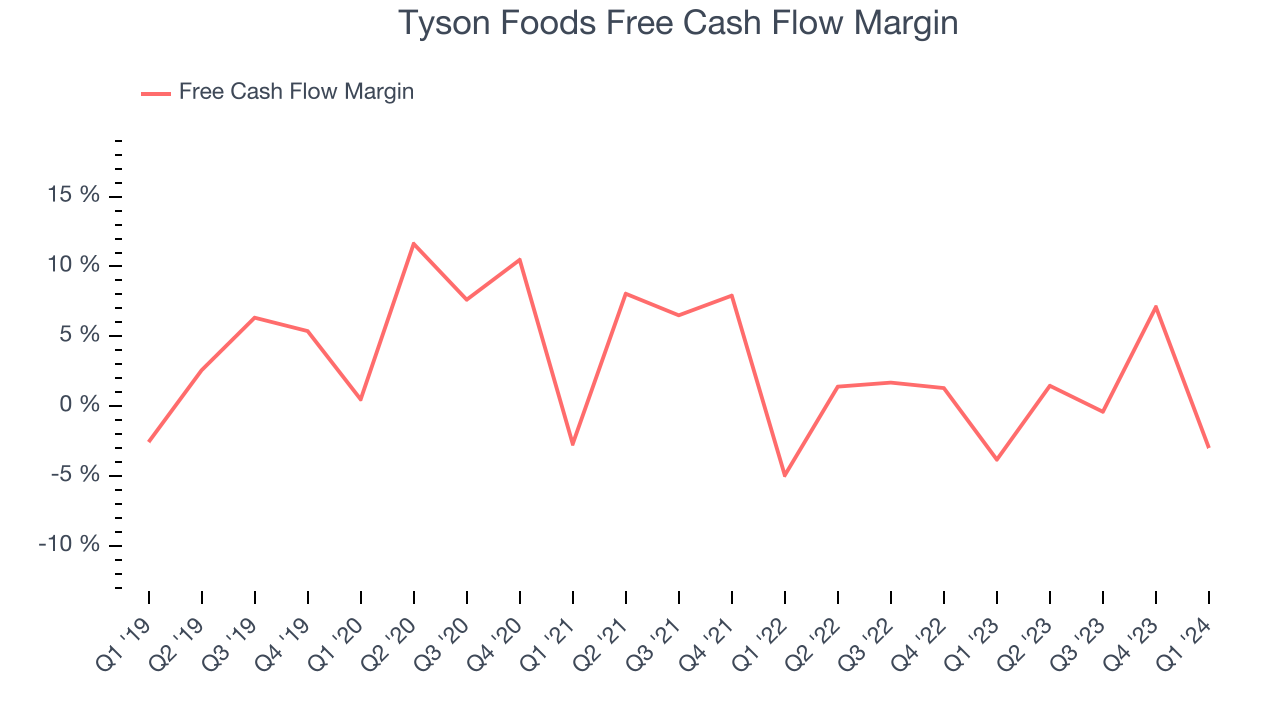

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Tyson Foods burned through $390 million of cash in Q1, representing a negative 3% free cash flow margin. The company increased its cash burn by 22.2% year on year.

Over the last eight quarters, Tyson Foods has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 0.7%, subpar for a consumer staples business. However, its margin has averaged year-on-year increases of 1.1 percentage points over the last 12 months. Continued momentum should improve its cash flow prospects.

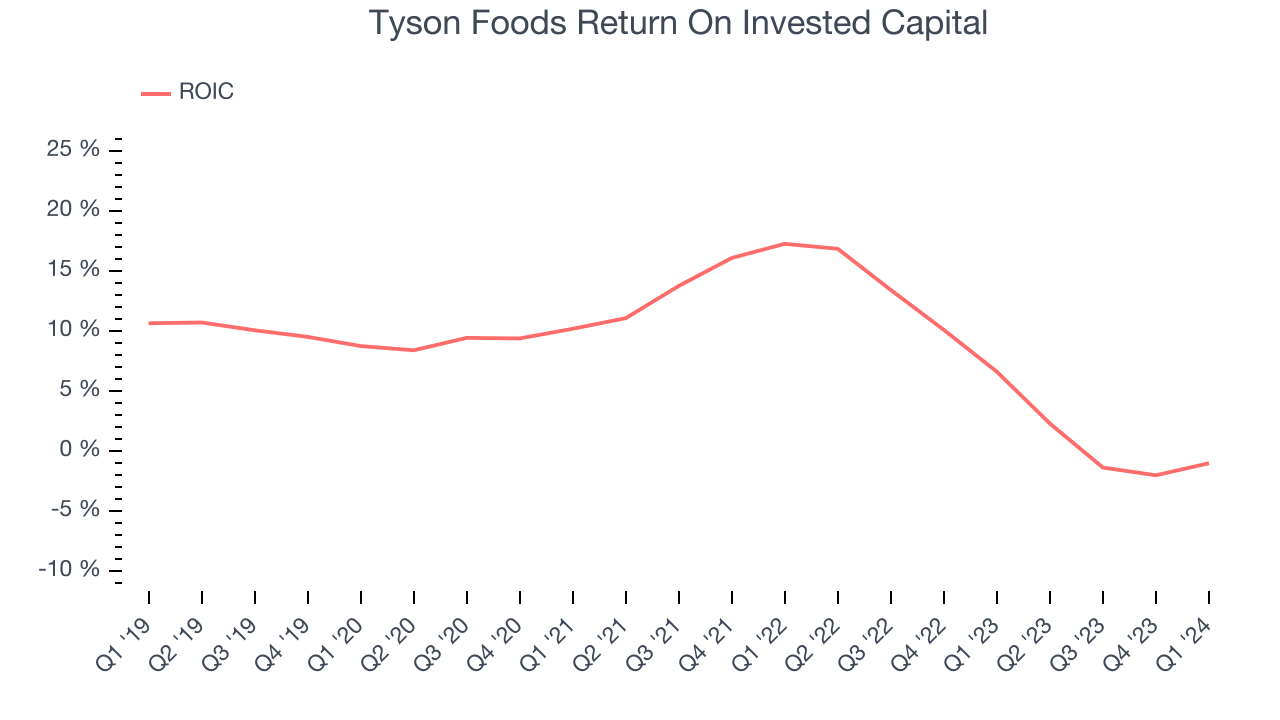

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Tyson Foods's five-year average ROIC was 8.4%, somewhat low compared to the best consumer staples companies that consistently pump out 20%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Tyson Foods's ROIC averaged 6.7 percentage point decreases over the last few years. Paired with its already low returns, these declines suggest the company's profitable business opportunities are few and far between.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Tyson Foods reported $2.18 billion of cash and $10.96 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $2.58 billion of EBITDA over the last 12 months, we view Tyson Foods's 3.4x net-debt-to-EBITDA ratio as safe. We also see its $166 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Tyson Foods's Q1 Results

We were impressed by how significantly Tyson Foods blew past analysts' gross margin, operating income, and EPS expectations this quarter. We were also glad its full-year operating income guidance beat Wall Street's estimates, though its revenue outlook fell short. Zooming out, we think this was a great quarter that shareholders will appreciate. The stock is up 2.1% after reporting and currently trades at $63.23 per share.

Is Now The Time?

Tyson Foods may have had a good quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Tyson Foods, we'll be cheering from the sidelines. Its revenue growth has been mediocre over the last three years, and analysts expect growth to deteriorate from here. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its declining EPS over the last three years makes it hard to trust. On top of that, its gross margins make it more challenging to reach positive operating profits compared to other consumer staples businesses.

Tyson Foods's price-to-earnings ratio based on the next 12 months is 20.1x. While there are some things to like about Tyson Foods and its valuation is reasonable, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $62.58 per share right before these results (compared to the current share price of $63.23).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.