As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q2. Today we are looking at the software development stocks, starting with Twilio (NYSE:TWLO).

The rise of the consumer internet is what drives the demand for platforms like Twilio. The rise of the consumer internet has increased the need for two way audio and video functionality in applications, driving demand for software tools and platforms that enable this utility, and the COVID pandemic has only further accelerated this shift.

The 11 software development stocks we track reported a a decent Q2; on average, revenues beat analyst consensus estimates by 4.42%, while on average next quarter revenue guidance was 3.96% above consensus. On average the share price was down 0.12% the day after the earnings.

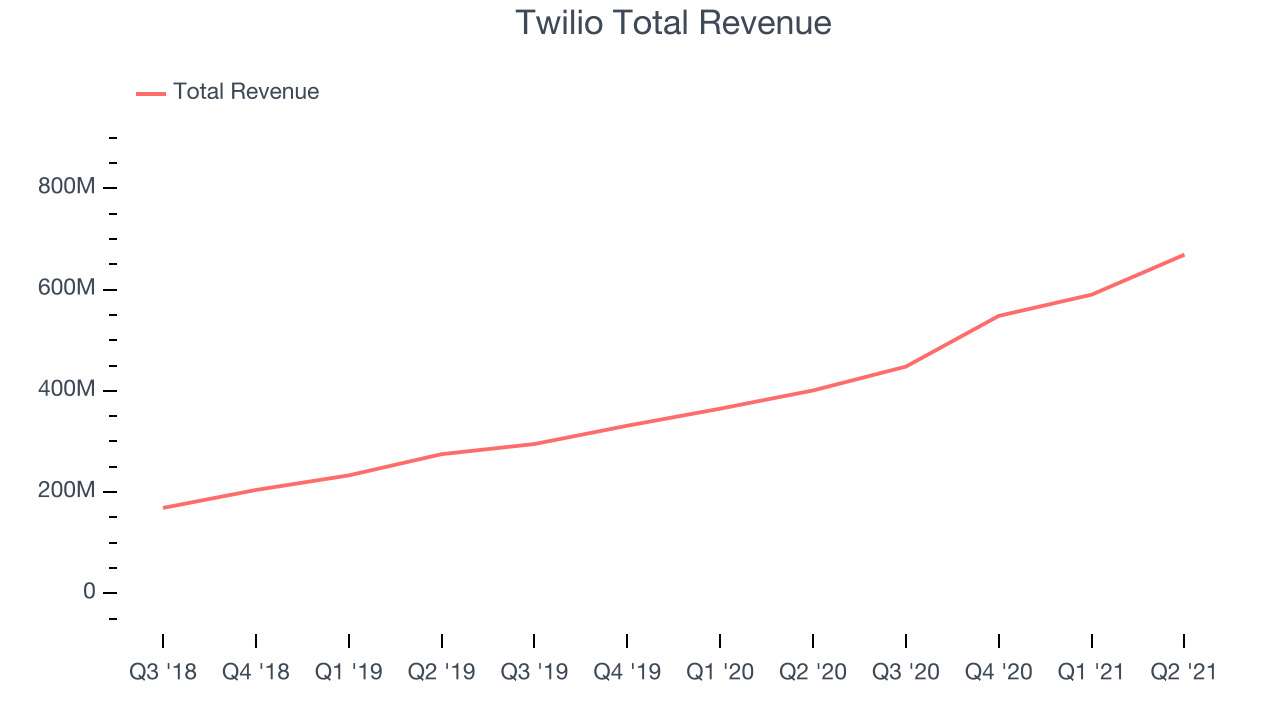

Twilio (NYSE:TWLO)

Founded in 2008 by Jeff Lawson, a former engineer at Amazon, Twilio is a software as a service platform that makes it really easy for software developers to use text messaging, voice calls and other forms of communication in their apps.

Twilio reported revenues of $668.9 million, up 66.8% year on year, beating analyst expectations by 11.6%. It was a strong quarter for the company, with an impressive beat of analyst estimates and an exceptional revenue growth.

“Our strong momentum continued in the second quarter as our revenue growth accelerated at a run rate of more than $2.6 billion,” said Jeff Lawson, Twilio’s co-founder and CEO.

Twilio scored the strongest analyst estimates beat and fastest revenue growth of the whole group. The stock is down 17.4% since the results and currently trades at $324.11.

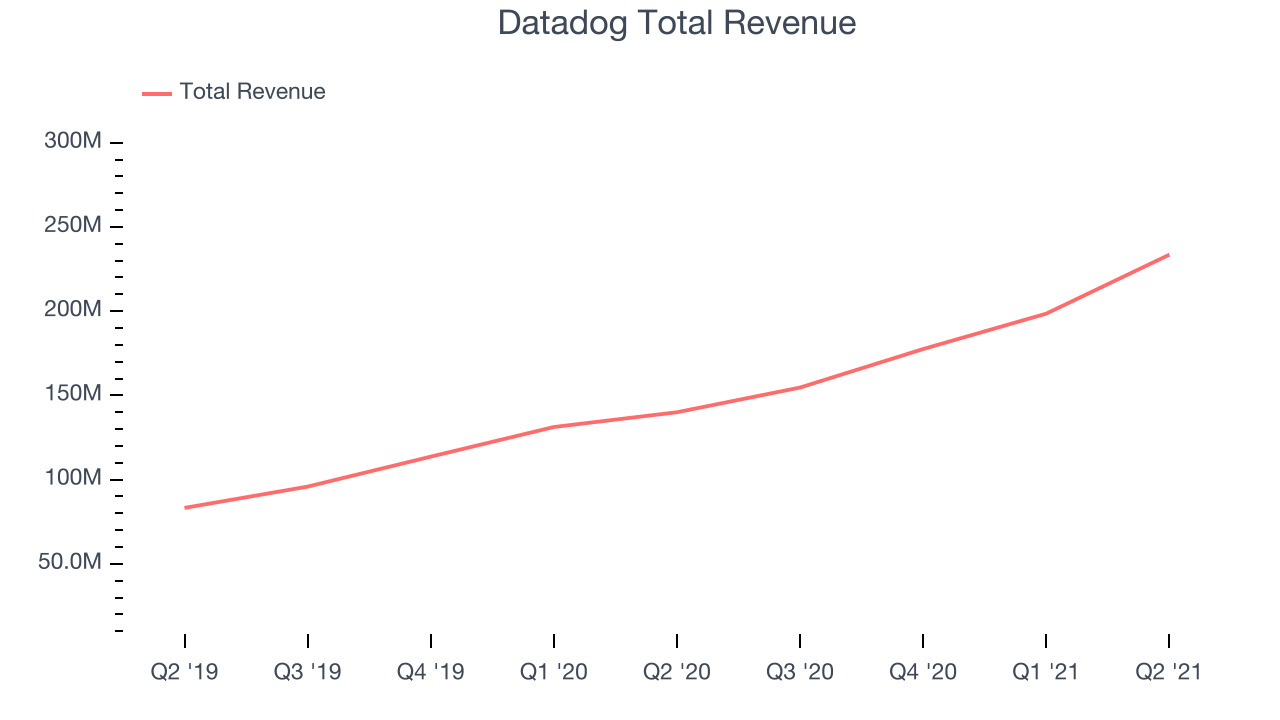

Best Q2: Datadog (NASDAQ:DDOG)

Named after a database the founders had to painstakingly look after at their previous company, Datadog (NASDAQ:DDOG) is a software as a service platform that makes it easier to monitor cloud infrastructure and applications.

Datadog reported revenues of $233.5 million, up 66.8% (same as Twilio, what are the odds) year on year, beating analyst expectations by 9.93%. It was a very strong quarter for the company, with an exceptional revenue growth and a very optimistic guidance for the next quarter.

The stock is up 23.5% since the results and currently trades at $141.97.

Is now the time to buy Datadog? Access our full analysis of the earnings results here, it's free.

Weakest Q2: Agora (NASDAQ:API)

Founded in 2014 by former engineers at WebEx and based in China, Agora provides a cloud platform that makes it easy for developers to integrate real-time audio and video functionalities in their apps.

Agora reported revenues of $42.3 million, up 24.8% year on year, beating analyst expectations by 2.56%. It was a weak quarter for the company, with a decline in net revenue retention rate and a full year guidance missing analysts' expectations.

The stock is down 8.28% since the results and currently trades at $27.12.

Read our full analysis of Agora's results here.

Cloudflare (NYSE:NET)

Founded in San Francisco in 2009, Cloudflare is a software as a service platform that helps improve security, reliability and loading times of internet applications and websites.

Cloudflare reported revenues of $152.4 million, up 52.8% year on year, beating analyst expectations by 4.33%. It was a very strong quarter for the company, with an exceptional revenue growth.

The stock is up 13% since the results and currently trades at $137.

Read our full, actionable report on Cloudflare here, it's free.

Dynatrace (NYSE:DT)

Founded in Austria in 2005, Dynatrace provides companies with software that allows them to monitor the performance of their full technology stack, from software applications to the infrastructure they run on.

Dynatrace reported revenues of $209.7 million, up 34.8% year on year, beating analyst expectations by 3.08%. It was a strong quarter for the company, with a full year guidance beating analysts' expectations.

Dynatrace achieved the highest full year guidance raise among the peers.

The stock is up 15% since the results and currently trades at $71.86.

Read our full, actionable report on Dynatrace here, it's free.

The author has no position in any of the stocks mentioned