Quarterly earnings results are a good time to check in on a company’s progress, especially compared to other peers in the same sector. Today we are looking at Twilio (NYSE:TWLO), and the best and worst performers in the software development group.

Software is eating the world, as Marc Andreessen says, and there is virtually no industry left that has been untouched by it. That in turn drives increasing demand for tools that help software developers do their jobs, whether it is monitoring critical cloud infrastructure, integrating audio and video functionality or ensuring smooth streaming of content.

The 12 software development stocks we track reported a solid Q3; on average, revenues beat analyst consensus estimates by 4.79%, while on average next quarter revenue guidance was 2.65% above consensus. Tech stocks have had a rocky start in 2022 and while some of the software development stocks have fared somewhat better, they have not been spared, with share price declining 17.9% since earnings, on average.

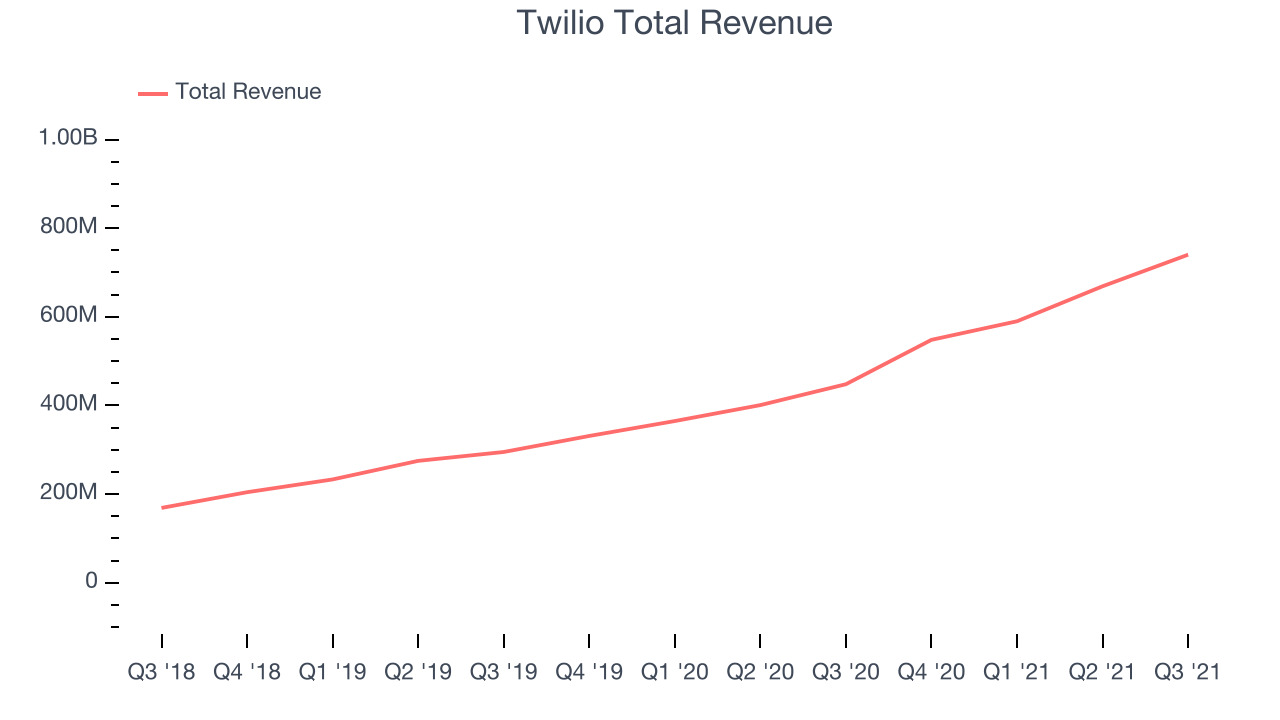

Twilio (NYSE:TWLO)

Founded in 2008 by Jeff Lawson, a former engineer at Amazon, Twilio (NYSE:TWLO) is a software as a service platform that makes it really easy for software developers to use text messaging, voice calls and other forms of communication in their apps.

Twilio reported revenues of $740.1 million, up 65.2% year on year, beating analyst expectations by 8.19%. It was a very strong quarter for the company, with accelerating customer growth and an exceptional revenue growth.

“We delivered another quarter of strong growth at scale in the third quarter as companies continue to turn to Twilio in this digital-first world,” said Jeff Lawson, Twilio’s co-founder and CEO.

The stock is down 37.1% since the results and currently trades at $217.25.

Is now the time to buy Twilio? Access our full analysis of the earnings results here, it's free.

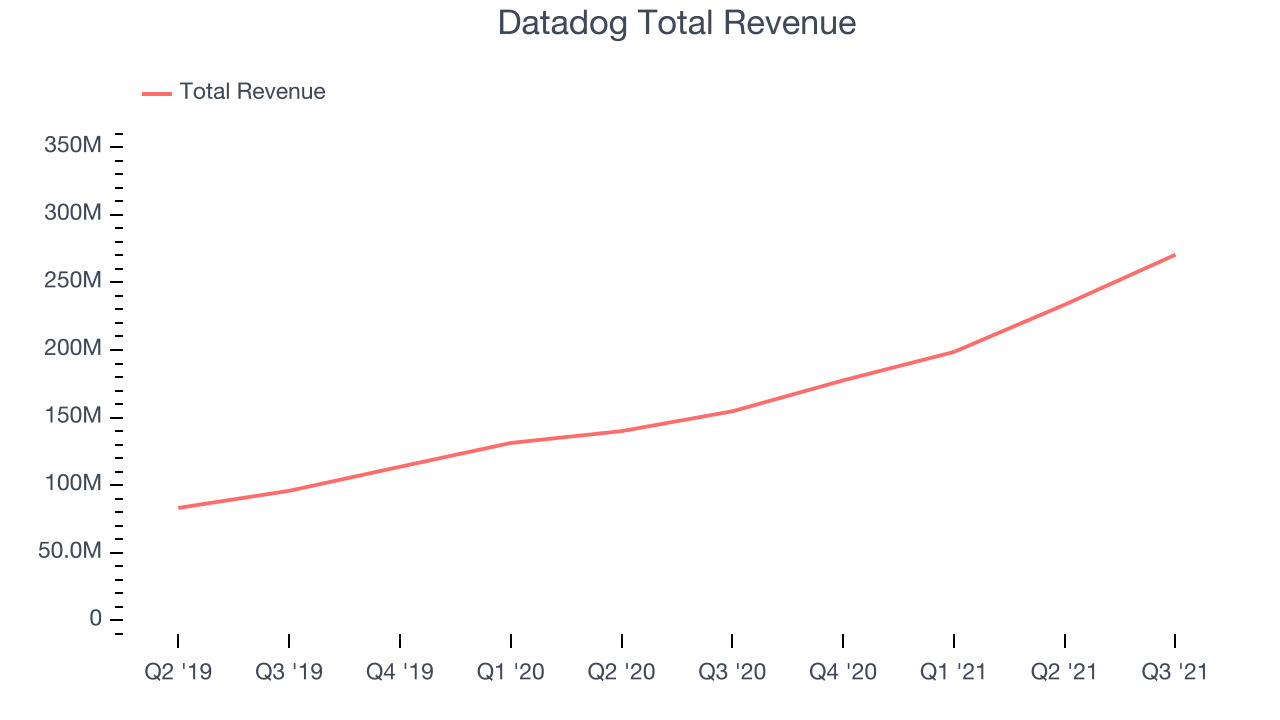

Best Q3: Datadog (NASDAQ:DDOG)

Named after a database the founders had to painstakingly look after at their previous company, Datadog (NASDAQ:DDOG) is a software as a service platform that makes it easier to monitor cloud infrastructure and applications.

Datadog reported revenues of $270.4 million, up 74.8% year on year, beating analyst expectations by 9.14%. It was an impressive quarter for the company, with a very optimistic guidance for the next quarter and an exceptional revenue growth.

Datadog pulled off the fastest revenue growth among its peers. The company added 190 enterprise customers paying more than $100,000 annually to a total of 1,800. The stock is down 18.5% since the results and currently trades at $136.

Is now the time to buy Datadog? Access our full analysis of the earnings results here, it's free.

Slowest Q3: Akamai (NASDAQ:AKAM)

Founded in 1999 by two engineers from MIT, Akamai (NASDAQ:AKAM) provides software for organizations to efficiently deliver web content to their customers.

Akamai reported revenues of $860.3 million, up 8.51% year on year, in line with analyst expectations. It was an OK quarter for the company, with a slower revenue growth compared to some of its high-flying peers.

Akamai had the weakest performance against analyst estimates and slowest revenue growth in the group. The stock is up 7.4% since the results and currently trades at $112.91.

Read our full analysis of Akamai's results here.

Bandwidth (NASDAQ:BAND)

Started in 1999 by David Morken who was later joined by Henry Kaestner as co-founder in 2001, Bandwidth (NASDAQ:BAND) provides thousands of customers with a software platform that uses its own global network to provide phone numbers, voice, and text connectivity.

Bandwidth reported revenues of $130.6 million, up 54.1% year on year, beating analyst expectations by 3.61%. It was a weaker quarter for the company, with an underwhelming revenue guidance for the next quarter and a decline in net revenue retention rate.

Bandwidth had the weakest full year guidance update among the peers. The company added 122 customers to a total of 3,173. The stock is down 19.3% since the results and currently trades at $66.98.

Read our full, actionable report on Bandwidth here, it's free.

New Relic (NYSE:NEWR)

With the name being an anagram of its founder, Lew Cirne, New Relic (NYSE:NEWR) makes a monitoring software that collects, scores, and analyses performance data about a client's IT stack.

New Relic reported revenues of $195.6 million, up 17.8% year on year, beating analyst expectations by 7.4%. It was a very strong quarter for the company, with accelerating growth in large customers.

New Relic achieved the highest full year guidance raise among the peers. The company added 47 enterprise customers paying more than $100,000 annually to a total of 1,011. The stock is up 14.2% since the results and currently trades at $103.91.

Read our full, actionable report on New Relic here, it's free.

The author has no position in any of the stocks mentioned