Cloud communications infrastructure company Twilio (NYSE:TWLO) reported Q1 FY2021 results that beat analyst expectations, with revenue up 61.6% year on year to $589 million. Twilio made a GAAP loss of $206 million, down on its loss of $94.7 million, in the same quarter last year.

Twilio (NYSE:TWLO) Q1 FY2021 Highlights:

- Revenue: $589 million vs analyst estimates of $533 million (10.5% beat)

- EPS (non-GAAP): $0.05 vs analyst estimates of -$0.10 ($0.15 beat)

- Revenue guidance for Q2 2021 is $596 million at the midpoint, above analyst estimates of $571 million

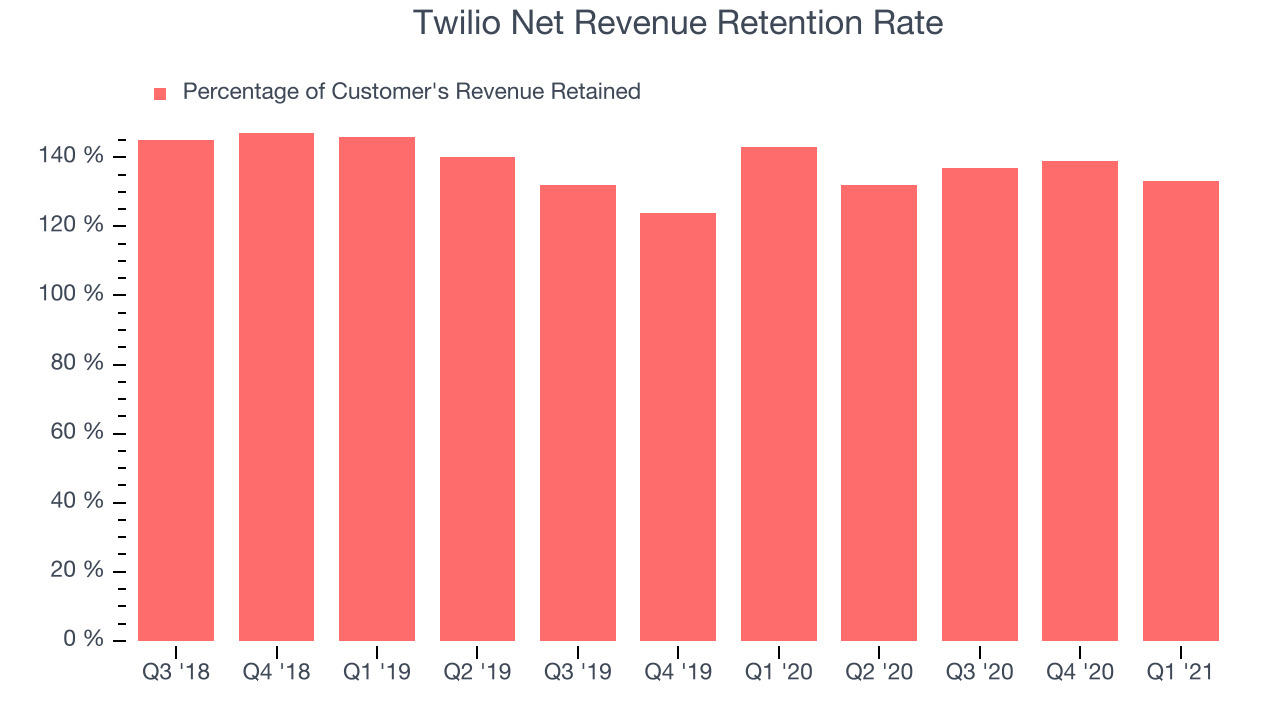

- Net Revenue Retention Rate: 133%, down from 139% previous quarter

- Customers: 235,000, up from 221,000 in previous quarter

- Gross Margin (GAAP): 50.5%, in line with previous quarter

“We delivered another quarter of outstanding growth in Q1, as companies across industries and around the world continue to turn to Twilio’s customer engagement platform to drive their digital transformation,” said Jeff Lawson, Twilio’s Co-Founder and CEO. “Over the last year, one thing has become extremely clear: we are in the midst of a massive shift in the way companies engage with their customers that is driving a generational opportunity for Twilio."

A Bridge Between the Old and New World

Twilio (NYSE:TWLO) is a software as a service platform that makes it really easy for software developers to use text messaging, voice calls and other forms of communication in their apps. The company functions as a bridge between the legacy systems of global telecommunications carriers and internet applications, and offers a set of building blocks developers can use to add external messaging to their services. For example it makes it possible for developers to provide SMS notifications in a food delivery app, the ability to call the driver in a ride-sharing app or two factor account verifications for internet banking without needing to invest in their own infrastructure and routing algorithms.

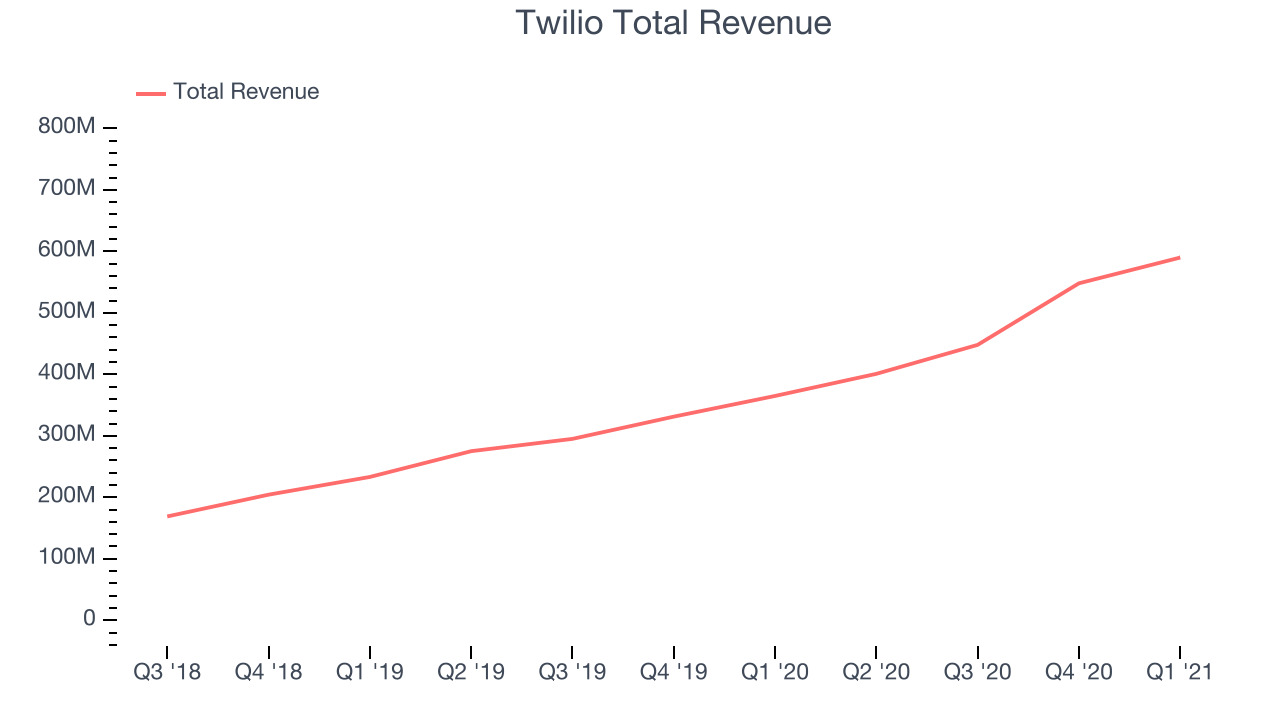

As you can see below, Twilio's revenue growth has been exceptional over the last twelve months, growing from $364 million to $589 million.

This was another standout quarter with the revenue up a splendid 61.6% year on year. But the growth did slow down compared to last quarter, as the revenue increased by just $41.8 million in Q1, compared to $100 million in Q4 2020. A one-off fluctuation is usually not concerning, but it is worth keeping in mind.

Shared Success

One of the best things about software as a service businesses (and a reason why they trade at such high multiples) is that customers tend to spend more with the company over time. Twilio’s pricing is usage-based which means that the more messages and phone calls their customers send through the platform the more money Twilio makes, although it does have to share some of it with the telecommunications carriers.

Twilio's net revenue retention rate, an important measure of how much customers from a year ago were spending at the end of the quarter, was at 133% in Q1. That means even if they didn't win any new customers, Twilio would have grown its revenue 33% year on year. Despite it going down over the last year this is still a great retention rate and a clear proof of a great product. We can see that Twilio's customers are very satisfied with their software and are using it more and more over time.

Key Takeaways from Twilio's Q1 Results

With market capitalisation of $58.5 billion and more than $5.7 billion in cash, the company has the capacity to continue to prioritise growth.

We were impressed by how strongly Twilio outperformed analysts’ revenue expectations this quarter. And we were also excited to see the really strong revenue growth. On the other hand, it was disappointing to see the deterioration in revenue retention rate. Zooming out, we think this was a great quarter and we have no doubt shareholders will feel excited about the results. Therefore, we think Twilio will continue to stand out as a compelling growth stock, arguably even more so than before.

PS. Have you noticed we published this analysis in less than 300 seconds since Twilio made their numbers public? We use technology until now only reserved for the top hedge funds to provide you with the fastest earnings analysis on the market. Get investing superpowers with StockStory. Signup here for early access.

The author has no position in any of the stocks mentioned.