Cloud communications infrastructure company Twilio (NYSE:TWLO) announced better-than-expected results in the Q4 FY2020 quarter, with revenue up 65.47% year on year to $548.1 million. Twilio made a GAAP loss of $179.4 million, down on its loss of $90.25 million, in the same quarter last year.

Twilio (TWLO) Q4 FY2020 Highlights:

• Revenue: $548.1 million vs analyst estimates of $454.9 million (20.50% beat)

• EPS (non-GAAP): $0.04 vs analyst estimates of -$0.07 ($0.11 beat)

• Revenue guidance for Q1 2021 is $531.0 million at the midpoint, above analyst estimates of $487.2 million

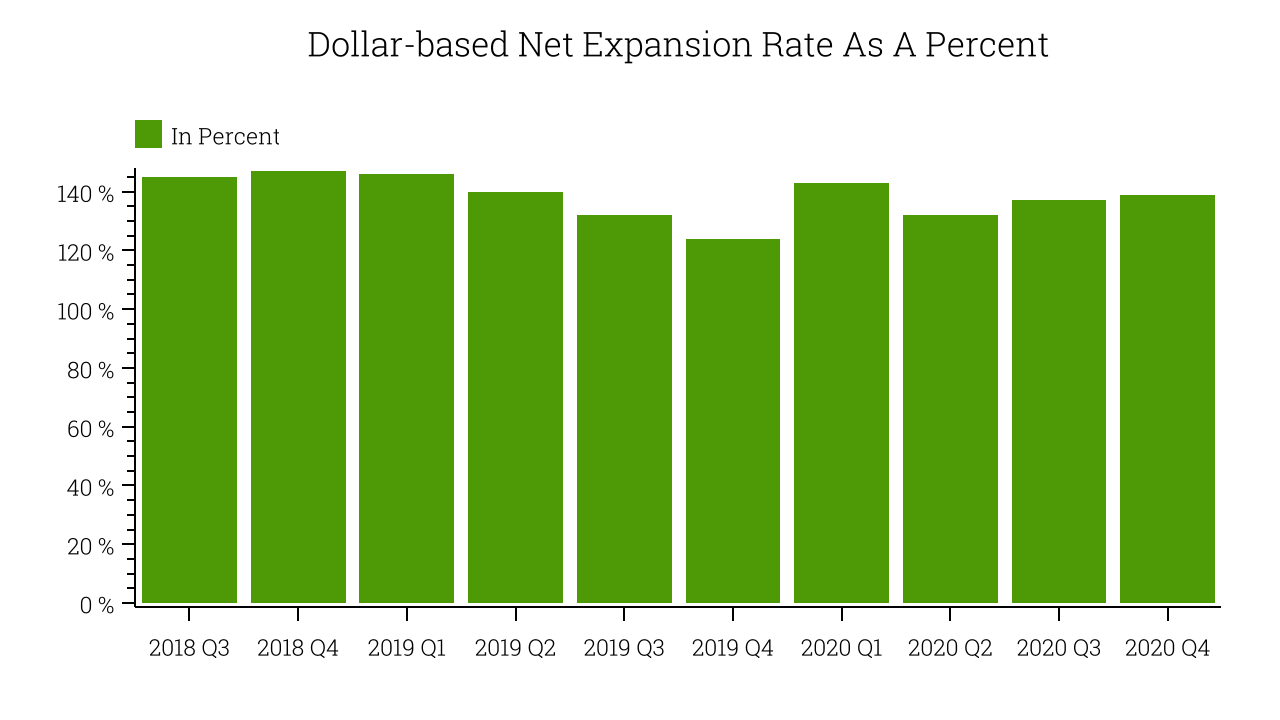

• Net Dollar Retention Rate: 139%, in line with previous quarter

• 221,000 customers, up from 208,000 in previous quarter

• Gross Margin (GAAP): 51.47%, in line with previous quarter

These results reinforced that we are addressing a generational opportunity, and with our acquisition of Segment and strong traction with Flex, we are building the leading customer engagement platform to improve every interaction that businesses have with their customers,” said Jeff Lawson, Twilio’s Co-Founder and CEO.

Bridge Between the Old and New World

Twilio is a software as a service platform that makes it really easy for software developers to use text messaging, voice calls and other forms of communication in their apps. The company functions as a bridge between the legacy systems of global telecommunications carriers and internet applications, and offers a set of building blocks developers can use to add external messaging to their services. For example it makes it possible for developers to provide SMS notifications in a food delivery app, the ability to call the driver in a ride-sharing app or two factor account verifications for internet banking without needing to invest in their own infrastructure and routing algorithms.

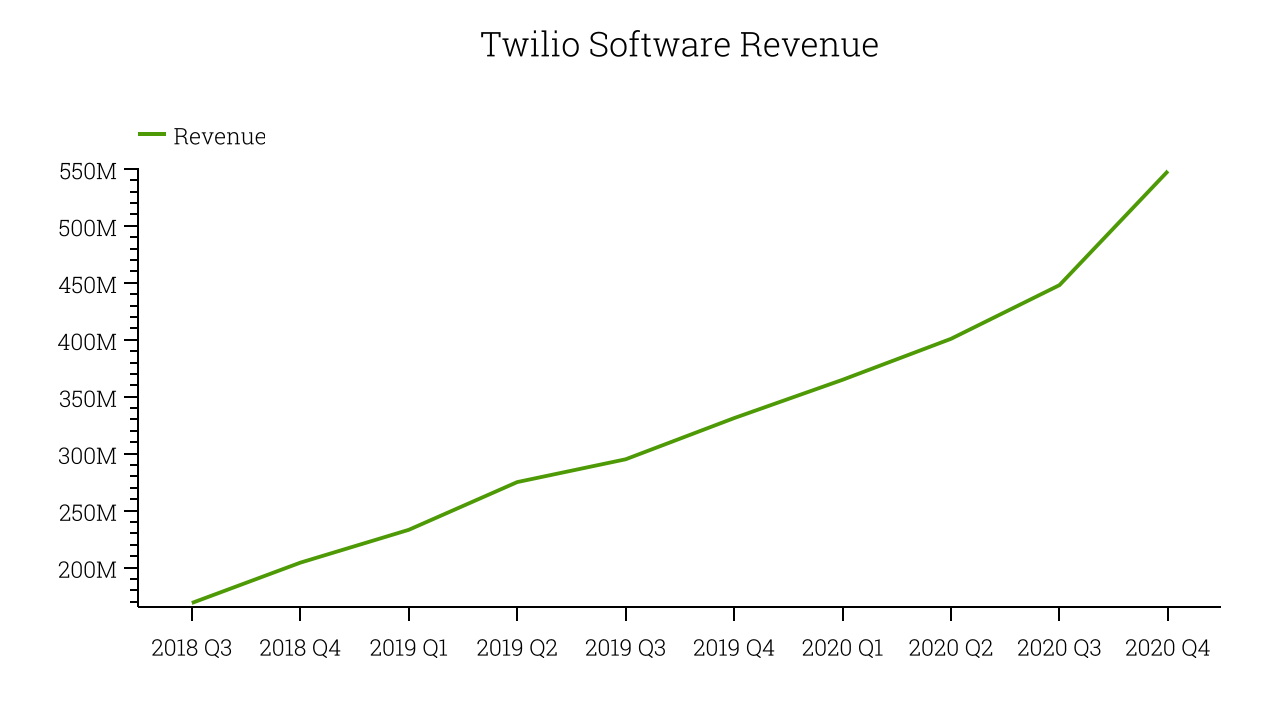

As you can see below, Twilio's revenue growth has been exceptional over the last couple of years.

This was another standout quarter with the revenue up a splendid 65.47% year on year. On top of that, revenue increased $100.1 million quarter on quarter, a very strong improvement on the $47.12 million increase in Q3 2020, and a sign of acceleration of growth, which is very nice to see indeed.

Shared Success

One of the best things about software as a service businesses (and a reason why they trade at such high multiples) is that customers tend to spend more with the company over time. Twilio’s pricing is usage-based which means that the more messages and phone calls their customers send through the platform the more money Twilio makes, although it does have to share some of it with the telecommunications carriers.

Twilio's net dollar retention rate, an important measure of how much customers from a year ago were spending at the end of the quarter, was at 139% in Q4. That means even if they didn't win any new customers, Twilio would have grown its revenue 39.00% year on year. In line with the last quarter, this is an absolutely exceptional retention rate, meaning Twilio's software is extremely successful with their customers who are rapidly expanding the use of it across their organizations.

Key Takeaways from the Q4 Results

With more than $3.040 billion of cash on the balance sheet, we're confident that Twilio has the resources it needs to pursue a high growth business strategy.

We were impressed by how strongly Twilio outperformed analysts’ revenue expectations this quarter. And we were also excited to see the really strong revenue growth that is forecasted to continue in Q1. Overall, we think this was a great quarter, that should leave shareholders feeling positive. While the market has high expectations of Twilio, its track record makes it look like a good growth stock, and these results do support that contention.