Cloud communications infrastructure company Twilio (NYSE:TWLO) reported Q1 CY2024 results beating Wall Street analysts' expectations, with revenue up 4% year on year to $1.05 billion. On the other hand, next quarter's revenue guidance of $1.06 billion was less impressive, coming in 2% below analysts' estimates. It made a non-GAAP profit of $0.80 per share, improving from its profit of $0.47 per share in the same quarter last year.

Twilio (TWLO) Q1 CY2024 Highlights:

- Revenue: $1.05 billion vs analyst estimates of $1.03 billion (1.4% beat)

- EPS (non-GAAP): $0.80 vs analyst estimates of $0.59 (34.6% beat)

- Revenue Guidance for Q2 CY2024 is $1.06 billion at the midpoint, below analyst estimates of $1.08 billion

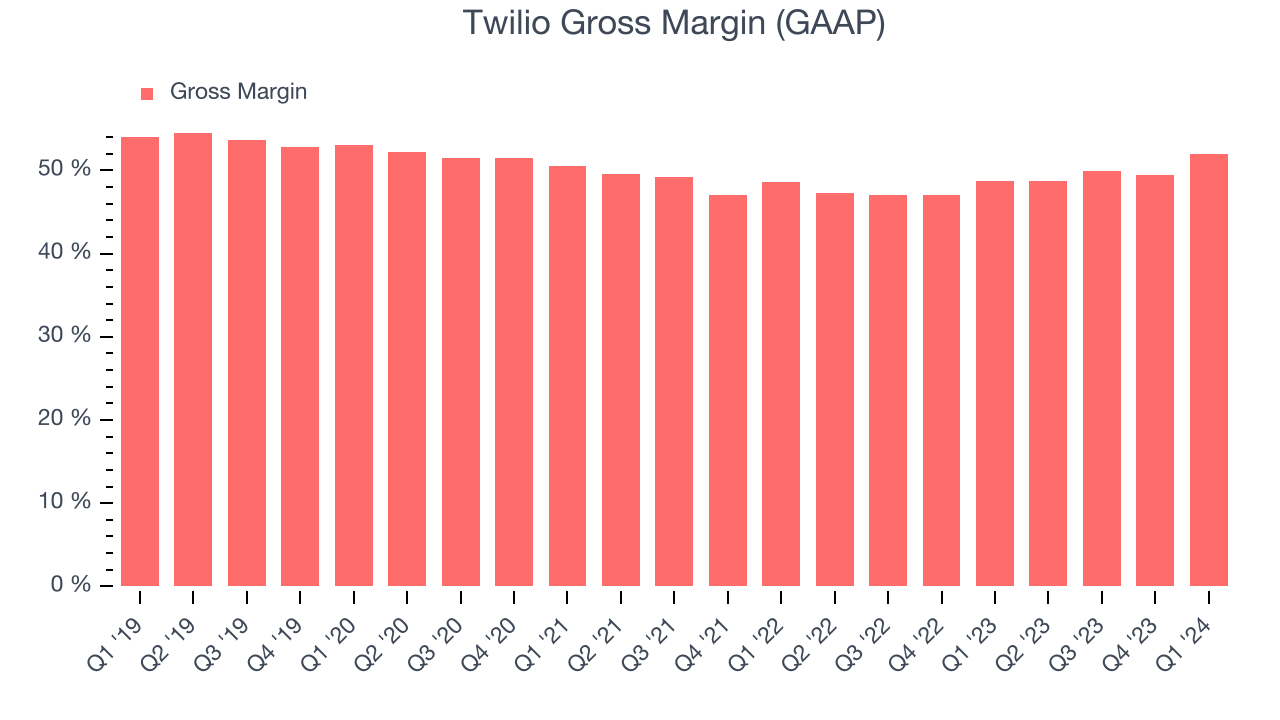

- Gross Margin (GAAP): 52%, up from 48.8% in the same quarter last year

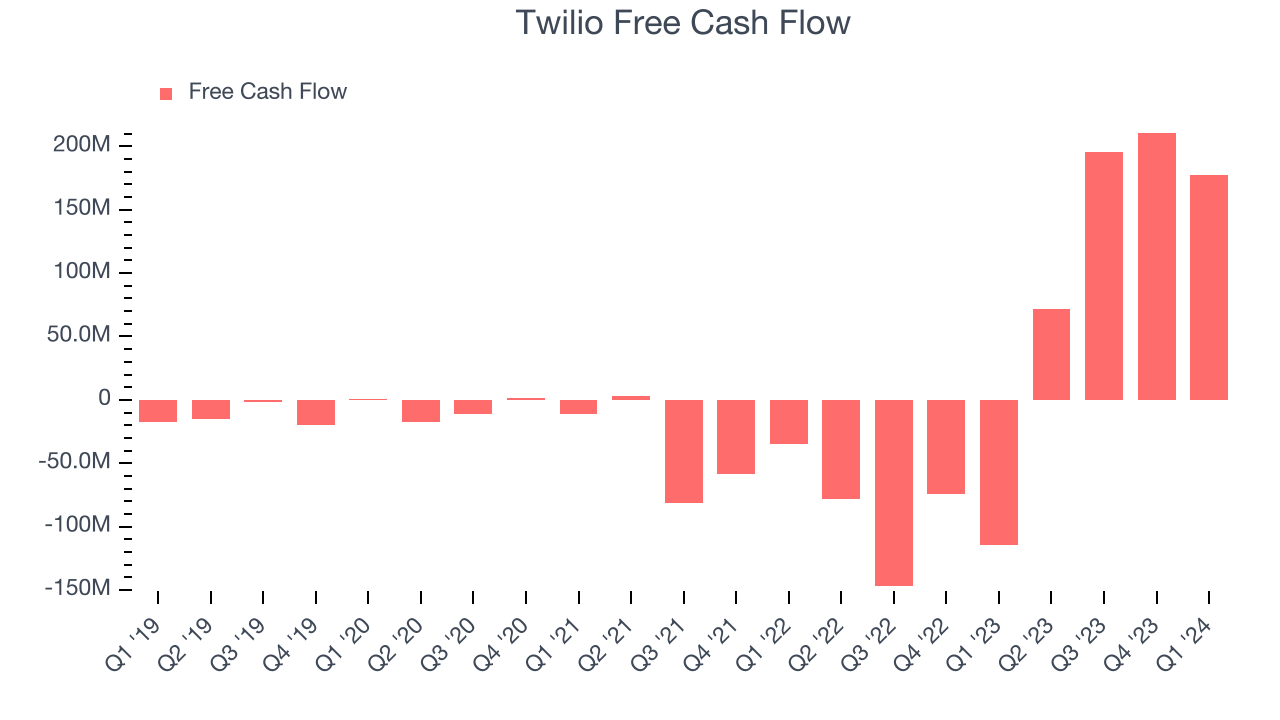

- Free Cash Flow of $177.3 million, down 15.9% from the previous quarter

- Net Revenue Retention Rate: 102%, in line with the previous quarter

- Customers: 313,000, up from 305,000 in the previous quarter

- Market Capitalization: $11.06 billion

Founded in 2008 by Jeff Lawson, a former engineer at Amazon, Twilio (NYSE:TWLO) is a software as a service platform that makes it really easy for software developers to use text messaging, voice calls and other forms of communication in their apps.

The company functions as a bridge between the legacy systems of global telecommunications carriers and internet applications, and offers a set of building blocks developers can use to add external messaging to their services.

For example it makes it possible for developers to provide SMS notifications in a food delivery app, the ability to call the driver in a ride-sharing app or two factor account verifications for internet banking without needing to invest in their own infrastructure and routing algorithms.

Communications Platform

The first shift towards voice communication over the internet (VOIP), rather than traditional phone networks, happened when the enterprises started replacing business phones with the cheaper VOIP technology. Today, the rise of the consumer internet has increased the need for two way audio and video functionality in applications, driving demand for software tools and platforms that enable this utility.

Competitors include Agora (NASDAQ:API), Vonage, Plivo, and Bandwidth (NASDAQ:BAND).

Sales Growth

As you can see below, Twilio's revenue growth has been strong over the last three years, growing from $590 million in Q1 2021 to $1.05 billion this quarter.

Twilio's quarterly revenue was only up 4% year on year, which might disappoint some shareholders. On top of that, the company's revenue actually decreased by $28.9 million in Q1 compared to the $42.28 million increase in Q4 CY2023. Sales also dropped by a similar amount a year ago and management is guiding for revenue to rebound in the coming quarter, which might hint at an emerging seasonal pattern.

Next quarter's guidance suggests that Twilio is expecting revenue to grow 1.7% year on year to $1.06 billion, slowing down from the 10% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 6.5% over the next 12 months before the earnings results announcement.

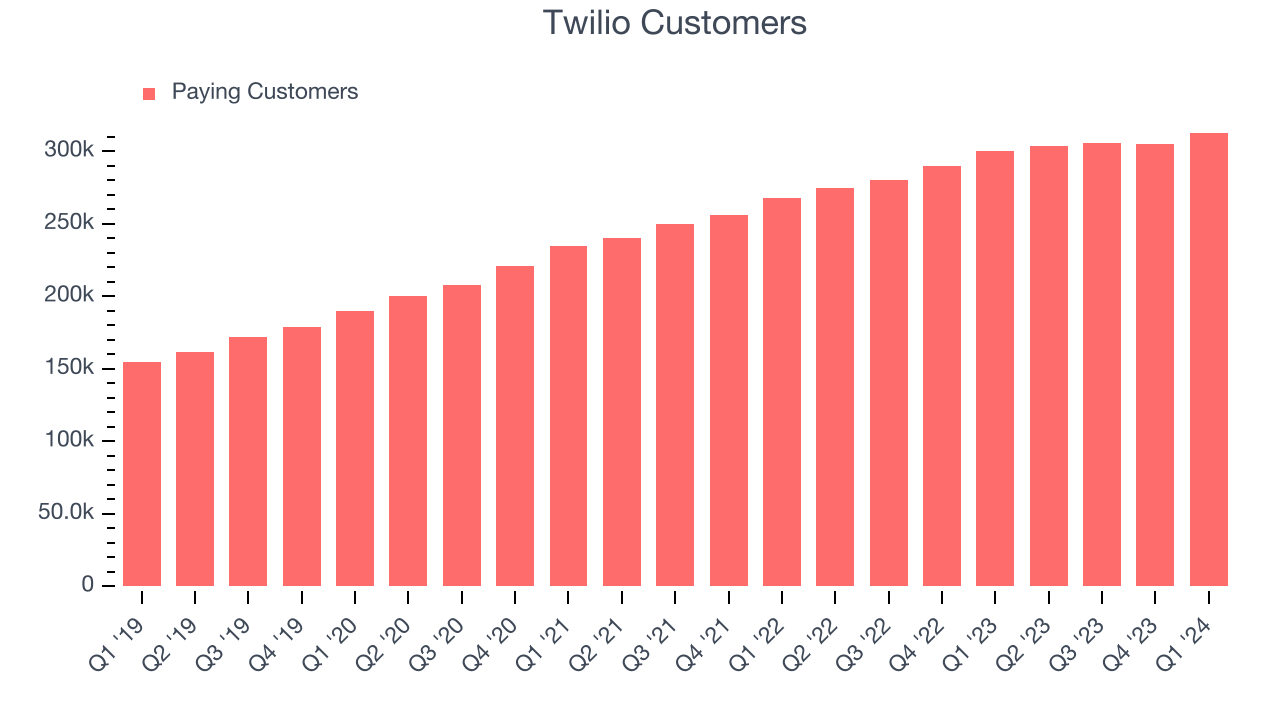

Customer Growth

Twilio reported 313,000 customers at the end of the quarter, an increase of 8,000 from the previous quarter. That's a little better customer growth than last quarter and quite a bit above the typical growth we've seen in past quarters, demonstrating that the business has strong sales momentum. We've no doubt shareholders will take this as an indication that Twilio's go-to-market strategy is working very well.

Product Success

One of the best parts about the software-as-a-service business model (and a reason why SaaS companies trade at such high valuation multiples) is that customers typically spend more on a company's products and services over time.

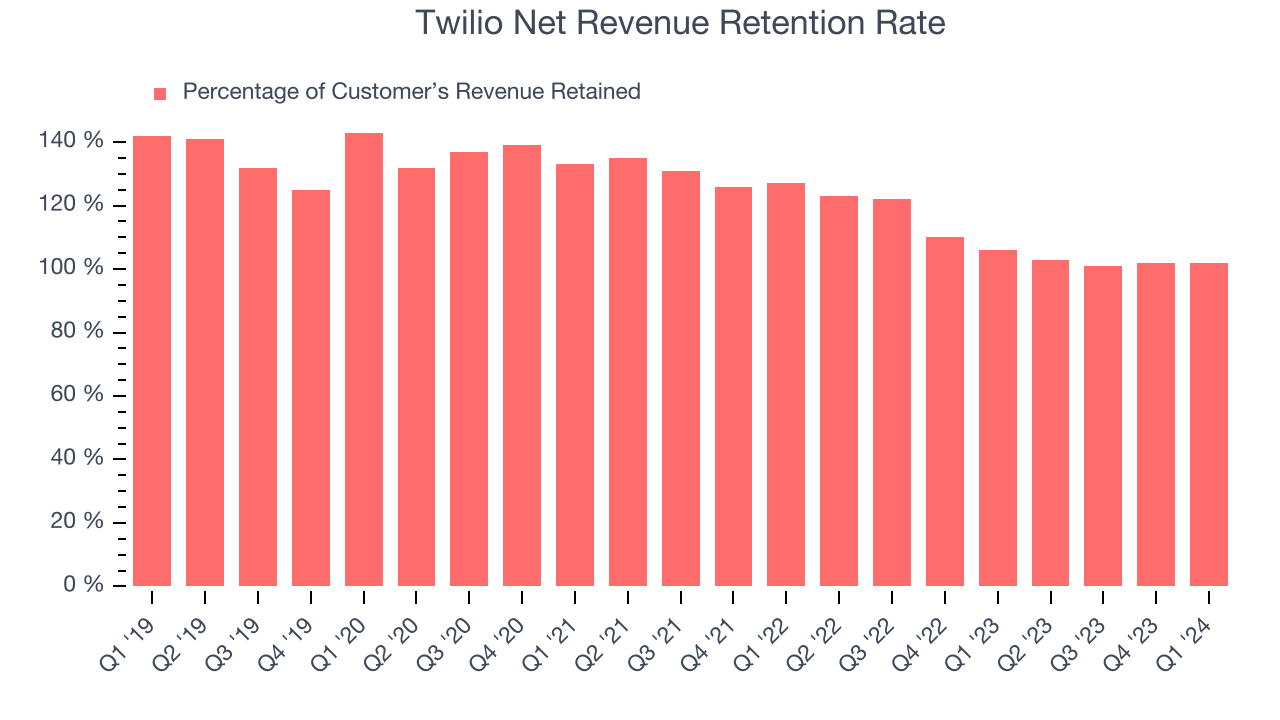

Twilio's net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 102% in Q1. This means that even if Twilio didn't win any new customers over the last 12 months, it would've grown its revenue by 2%.

Despite falling over the last year, Twilio still has an adequate net retention rate, showing us that it generally keeps customers but lags behind the best SaaS businesses, which routinely post net retention rates of 120%+.

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Twilio's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 52% in Q1.

That means that for every $1 in revenue the company had $0.52 left to spend on developing new products, sales and marketing, and general administrative overhead. While its gross margin has improved significantly since the previous quarter, Twilio's gross margin is still poor for a SaaS business. It's vital that the company continues to improve this key metric.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Twilio's free cash flow came in at $177.3 million in Q1, turning positive over the last year.

Twilio has generated $655.3 million in free cash flow over the last 12 months, a solid 15.6% of revenue. This strong FCF margin stems from its asset-lite business model, giving it optionality and plenty of cash to reinvest in its business.

Key Takeaways from Twilio's Q1 Results

We were impressed by Twilio's strong growth in customers this quarter. We were also glad its gross margin improved and free cash flow turned positive year on year (fourth quarter in a row). On the other hand, its revenue guidance for next quarter missed analysts' expectations. Zooming out, we think this was still a decent, albeit mixed, quarter, showing that the company is staying on track. The market was likely expecting more, and the stock is down 6.1% after reporting, trading at $59.5 per share.

Is Now The Time?

When considering an investment in Twilio, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We cheer for everyone who's making the lives of others easier through technology, but in case of Twilio, we'll be cheering from the sidelines. Although its revenue growth has been strong over the last three years, Wall Street expects growth to deteriorate from here. And while its strong free cash flow generation gives it re-investment options, the downside is its customer acquisition is less efficient than many comparable companies. On top of that, its gross margins show its business model is much less lucrative than the best software businesses.

Twilio's price-to-sales ratio based on the next 12 months is 2.6x, suggesting the market has lower expectations for the business relative to the hottest tech stocks. While there are some things to like about Twilio and its valuation is reasonable, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $70.73 right before these results (compared to the current share price of $59.50).

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.