As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q2. Today we are looking at the social networking stocks, starting with Twitter (NYSE:TWTR).

Businesses must meet their customers where they are, which over the past decade has come to mean on social networks. In 2020, users spent over 2.5 hours a day on social networks, a figure that has increased every year since measurement began. As a result, businesses continue to shift their advertising and marketing dollars online.

The 4 social networking stocks we track reported a weak Q2; on average, revenues missed analyst consensus estimates by 3.64%, while on average next quarter revenue guidance was 10.3% under consensus. Technology stocks have been hit hard on fears of higher interest rates as investors search for near-term cash flows and while some of the social networking stocks have fared somewhat better than others, they have not been spared, with share prices declining 7.81% since the previous earnings results, on average.

Twitter (NYSE:TWTR)

Born out of a failed podcasting startup, Twitter (NYSE: TWTR) is the town square of the internet, one part social network, one part media distribution platform.

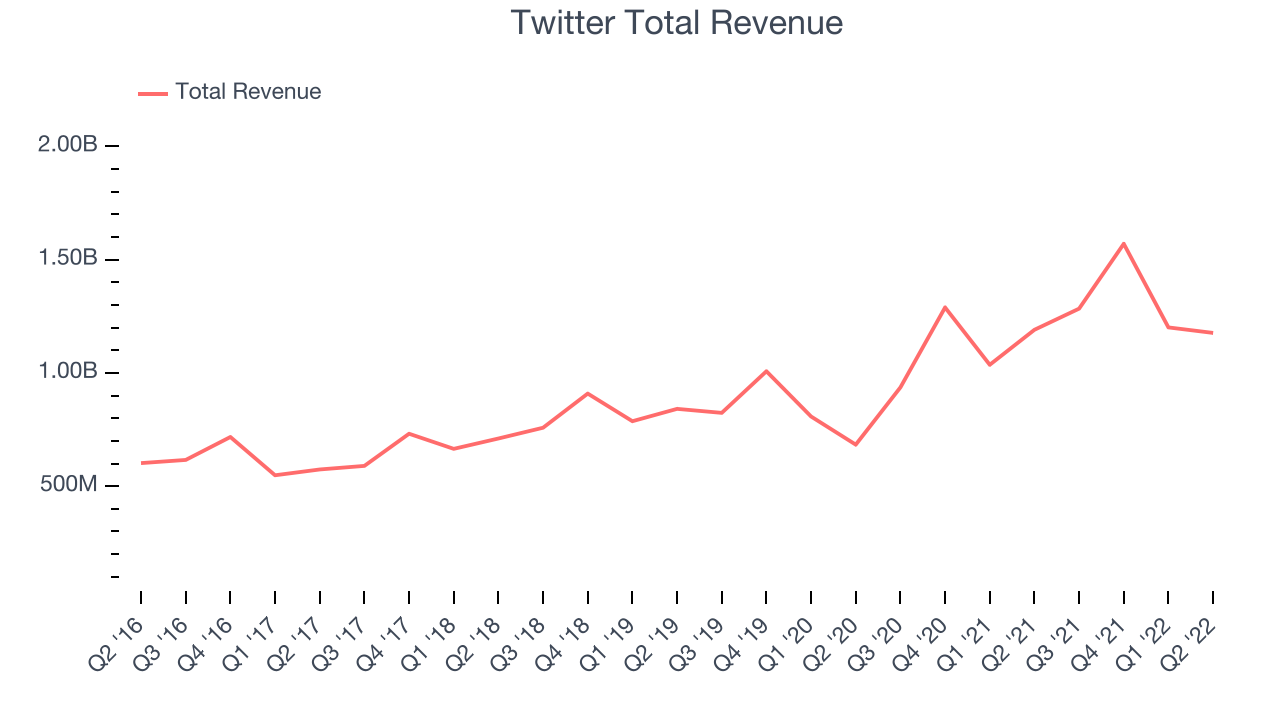

Twitter reported revenues of $1.17 billion, down 1.16% year on year, missing analyst expectations by 11.9%. It was a weak quarter for the company, with a slow revenue growth and a miss of the top line analyst estimates.

Twitter delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. The company reported 237.8 million daily active users, up 15.4% year on year. The stock is up 8.73% since the results and currently trades at $43.01.

Twitter has previously entered into a definitive agreement to be acquired by Elon Musk, for $54.20 per share in cash in a transaction valued at approximately $44 billion.

Read our full report on Twitter here, it's free.

Best Q2: Snap (NYSE:SNAP)

Founded by Stanford University students Evan Spiegel, Reggie Brown, and Bobby Murphy, and originally called Picaboo, Snapchat (NYSE: SNAP) is an image centric social media network.

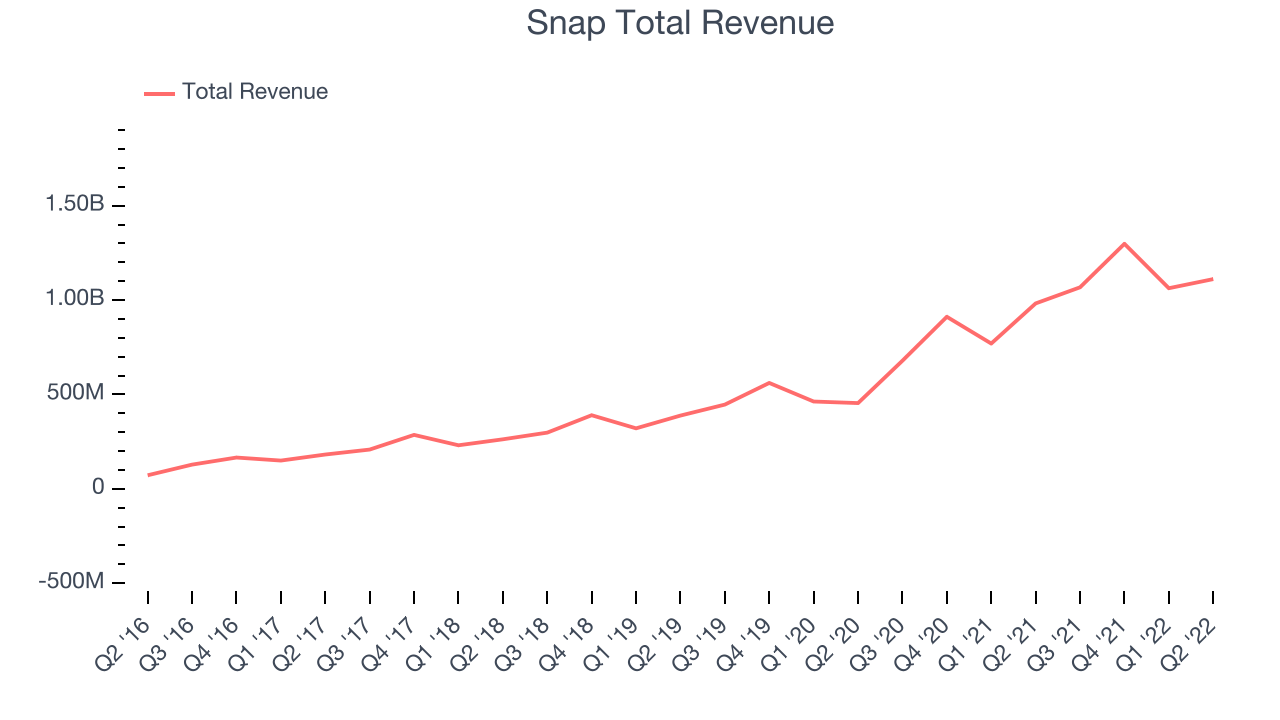

Snap reported revenues of $1.11 billion, up 13.1% year on year, missing analyst expectations by 2.07%. Despite the stock dropping on the results, it was an ok quarter for the company, with a growing number of users.

Snap pulled off the fastest revenue growth among its peers. The company reported 347 million daily active users, up 18.4% year on year. The stock is down 37.7% since the results and currently trades at $10.20.

Is now the time to buy Snap? Access our full analysis of the earnings results here, it's free.

Weakest Q2: Meta (NASDAQ:META)

Famously founded by Mark Zuckerberg in his Harvard dorm, Meta Platforms (NASDAQ: META ) operates a collection of the largest social networks in the world - Facebook, Instagram, WhatsApp, and Messenger, along with its metaverse focused Facebook Reality Labs.

Meta reported revenues of $28.8 billion, down 0.88% year on year, missing analyst expectations by 0.44%. It was a weak quarter for the company, with a slow revenue growth and an underwhelming revenue guidance for the next quarter.

The stock is down 19.1% since the results and currently trades at $136.93.

Read our full analysis of Meta's results here.

Pinterest (NYSE:PINS)

Created with the idea of virtually replacing paper catalogues, Pinterest (NYSE: PINS) is an online image and social discovery platform.

Pinterest reported revenues of $665.9 million, up 8.59% year on year, missing analyst expectations by 0.09%. It was a weak quarter for the company, with a declining number of users and a slow revenue growth.

Pinterest pulled off the strongest analyst estimates beat among the peers. The company reported 433 million monthly active users, down 4.63% year on year. The stock is up 16.8% since the results and currently trades at $23.23.

Read our full, actionable report on Pinterest here, it's free.

The author has no position in any of the stocks mentioned