Quarterly earnings results are a good time to check in on a company’s progress, especially compared to other peers in the same sector. Today we are looking at Unity (NYSE:U), and the best and worst performers in the vertical software group.

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, there are industries that have very specific needs. Whether it is life-sciences, education or banking, the demand for so called vertical software, addressing industry specific workflows, is growing, fueled by the pressures on improving productivity and quality of offerings.

The 13 vertical software stocks we track reported a solid Q3; on average, revenues beat analyst consensus estimates by 4.23%, while on average next quarter revenue guidance was 3.87% above consensus. The whole tech sector has been facing a sell-off since late last year and vertical software stocks have not been spared, with share price down 34.7% since earnings, on average.

Unity (NYSE:U)

Started as a game studio by three friends in a Copenhagen apartment, Unity (NYSE:U) is a software as a service platform that makes it easier to develop and monetize new games and other visual digital experiences.

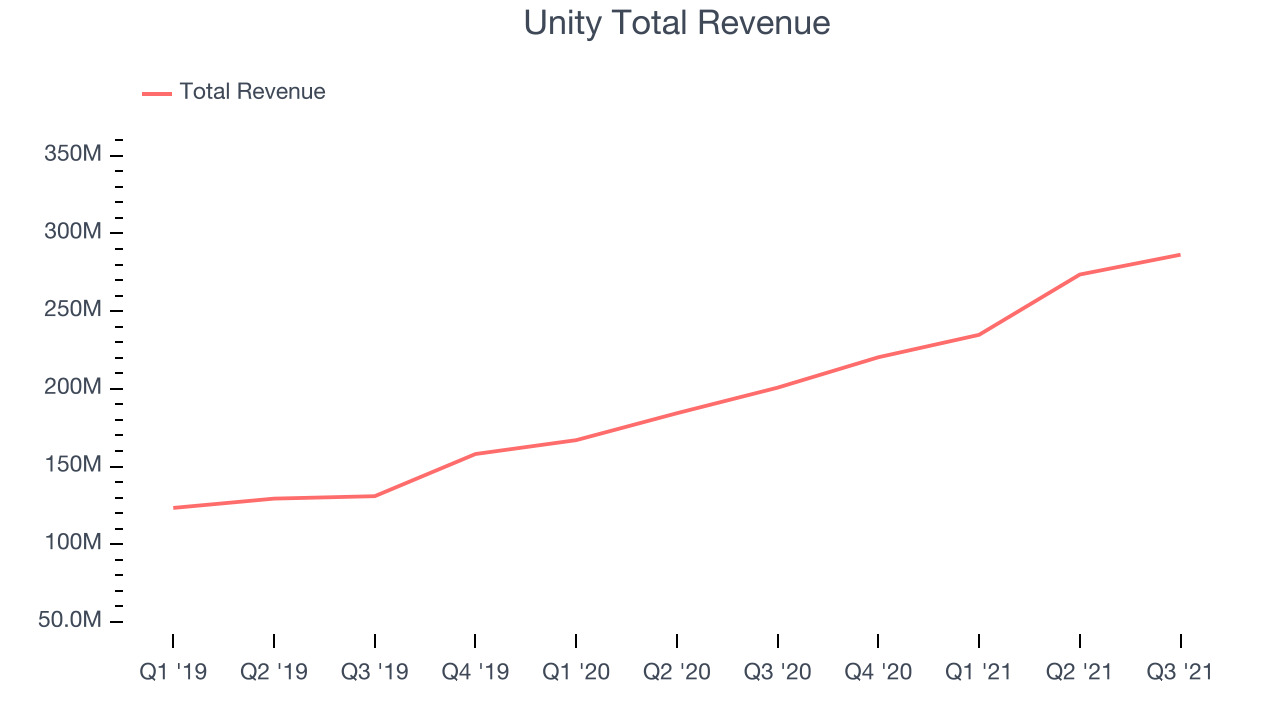

Unity reported revenues of $286.3 million, up 42.6% year on year, beating analyst expectations by 7.49%. It was a strong quarter for the company, with accelerating growth in large customers and an exceptional revenue growth.

“Unity’s strong performance this quarter was driven by innovation in data science, vertical growth and making significant strides in bringing RT3D technologies and tools to as many creators and artists as possible,” said John Riccitiello, President and Chief Executive Officer, Unity.

The stock is down 31.1% since the results and currently trades at $118.

We think Unity is a good business, but is it a buy today? Read our full report here, it's free.

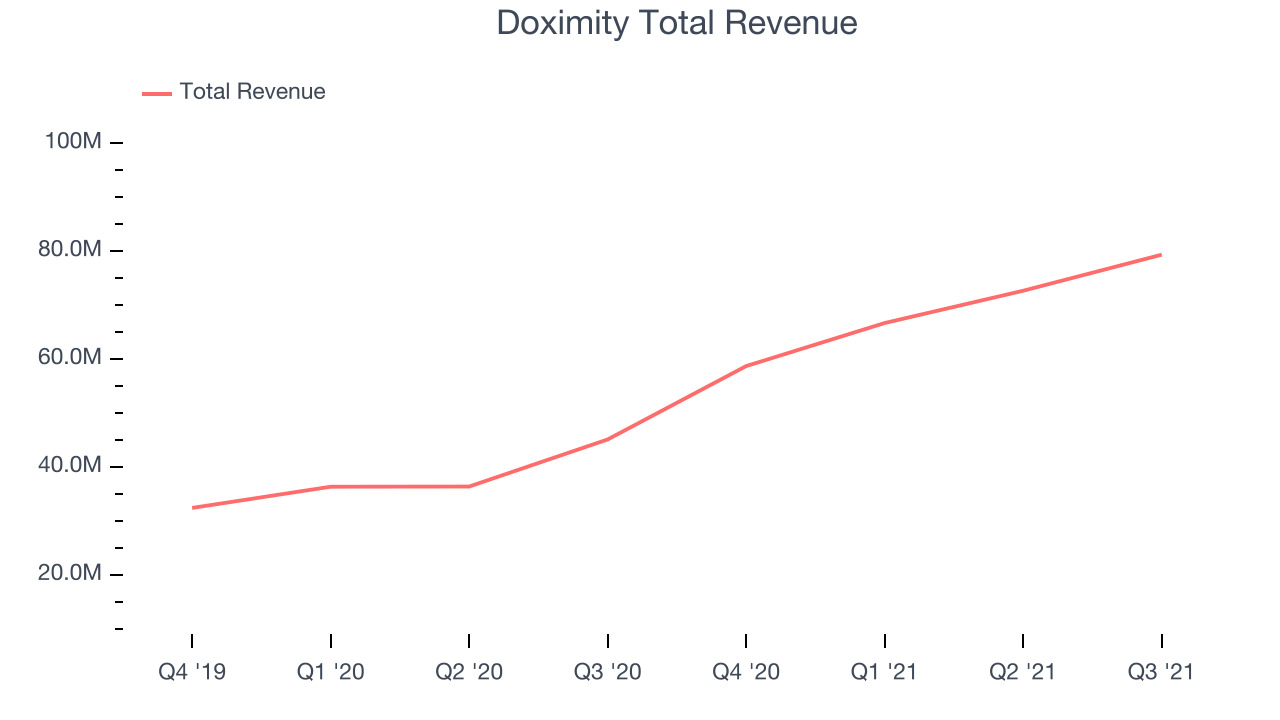

Best Q3: Doximity (NYSE:DOCS)

Founded in 2010 and named for a combination of “docs” and “proximity”, Doximity (NYSE:DOCS) is the leading professional network for U.S. medical professionals.

Doximity reported revenues of $79.3 million, up 75.8% year on year, beating analyst expectations by 7.9%. It was a great quarter for the company, with a very optimistic guidance for the next quarter and a revenue growth.

Doximity achieved the highest full year guidance raise among its peers. The stock is down 39.7% since the results and currently trades at $46.10.

Is now the time to buy Doximity? Access our full analysis of the earnings results here, it's free.

Weakest Q3: Adobe (NASDAQ:ADBE)

One of the most well-known Silicon Valley software companies around, Adobe (NASDAQ:ADBE) is a leading provider of software as service in the digital design and document management space.

Adobe reported revenues of $4.11 billion, up 20% year on year, in line with analyst expectations. It was a weaker quarter for the software behemoth, with both full year and next quarter guidance missing analysts' expectations.

Adobe had the weakest full year guidance update in the group. The stock is down 17.3% since the results and currently trades at $521.12.

Read our full analysis of Adobe's results here.

Toast (NYSE:TOST)

Founded by three MIT engineers at a local Cambridge bar, Toast (NYSE:TOST) provides integrated point of sale (POS) hardware, software, and payments solutions for restaurants.

Toast reported revenues of $486.3 million, up 105% year on year, beating analyst expectations by 12.1%. It was a very strong quarter for the company, with an impressive beat of analyst estimates.

Toast pulled off the strongest analyst estimates beat among the peers. The stock is down 58.2% since the results and currently trades at $25.41.

Read our full, actionable report on Toast here, it's free.

Upstart (NASDAQ:UPST)

Founded by the former head of Google's enterprise business Dave Girouard, Upstart (NASDAQ:UPST) is an AI-powered lending platform that helps banks better evaluate the risk of lending money to a person and provide loans to more customers.

Upstart reported revenues of $228.4 million, up 249% year on year, beating analyst expectations by 6.31%. It was a very strong quarter for the company, with a very optimistic guidance for the next quarter.

Upstart achieved the fastest revenue growth among the peers. The high-flying stock is down eye-watering 64.4% since the results and currently trades at $111.39.

Read our full, actionable report on Upstart here, it's free.

The author has no position in any of the stocks mentioned