Game engine maker Unity (NYSE:U) reported Q1 FY2023 results topping analyst expectations, with revenue up 56.3% year on year to $500.4 million. Guidance for next quarter's revenue was $515 million at the midpoint, 2.44% above the average of analyst estimates. Unity made a GAAP loss of $253.7 million, down on its loss of $177.6 million, in the same quarter last year.

Is now the time to buy Unity? Access our full analysis of the earnings results here, it's free.

Unity (U) Q1 FY2023 Highlights:

- Revenue: $500.4 million vs analyst estimates of $479.8 million (4.28% beat)

- EPS: -$0.67 vs analyst estimates of -$0.70 (4.83% beat)

- Revenue guidance for Q2 2023 is $515 million at the midpoint, above analyst estimates of $502.7 million

- The company lifted revenue guidance for the full year, from $2.13 billion to $2.14 billion at the midpoint

- Free cash flow was negative $19.4 million, compared to negative free cash flow of $63.9 million in previous quarter

- Gross Margin (GAAP): 67.6%, down from 71.1% same quarter last year

Started as a game studio by three friends in a Copenhagen apartment, Unity (NYSE:U) is a software as a service platform that makes it easier to develop and monetize new games and other visual digital experiences.

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

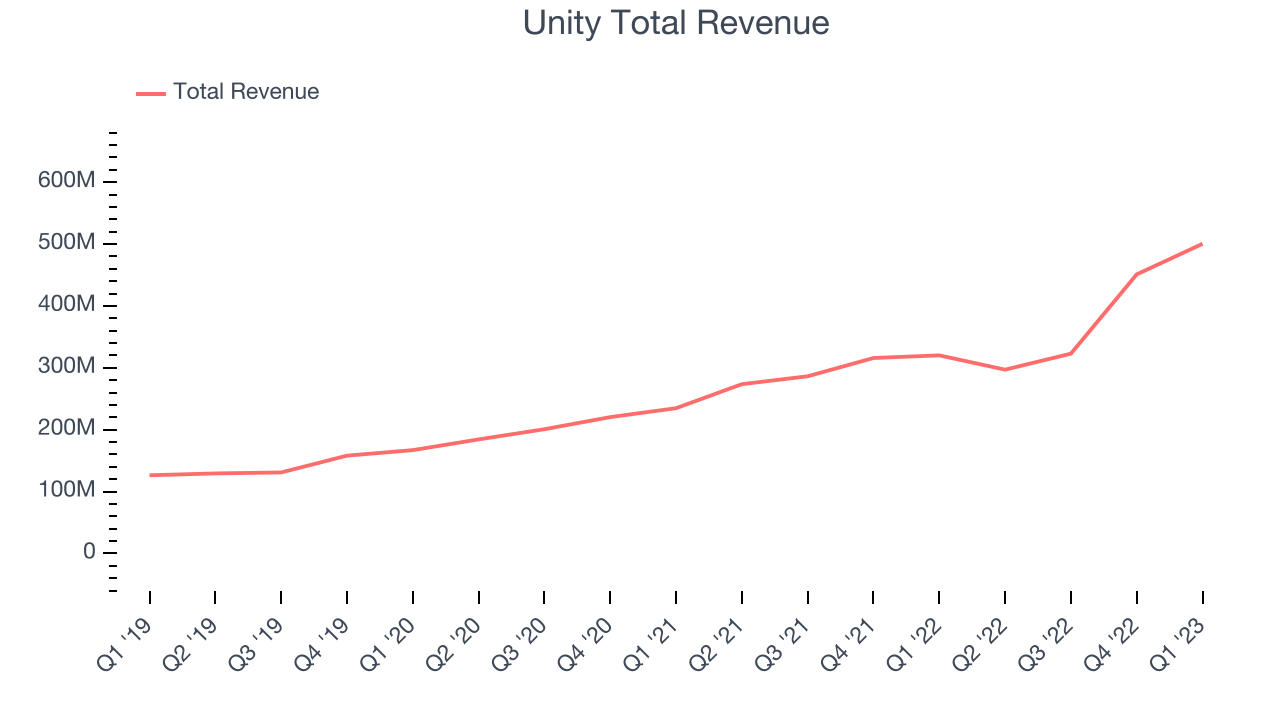

Sales Growth

As you can see below, Unity's revenue growth has been very strong over the last two years, growing from quarterly revenue of $234.8 million in Q1 FY2021, to $500.4 million.

This was a standout quarter for Unity with quarterly revenue up an absolutely stunning 56.3% year on year. which is above the two year trend for the company. But the growth did slow down compared to last quarter, as the revenue increased by just $49.4 million in Q1, compared to $128.1 million in Q4 2022. We'd like to see revenue increase by a greater amount each quarter, but a one-off fluctuation is usually not concerning.

Guidance for the next quarter indicates Unity is expecting revenue to grow 73.4% year on year to $515 million, improving on the 8.58% year-over-year increase in revenue the company had recorded in the same quarter last year. Ahead of the earnings results the analysts covering the company were estimating sales to grow 42.4% over the next twelve months.

Key Takeaways from Unity's Q1 Results

Since it has still been burning cash over the last twelve months it is worth keeping an eye on Unity’s balance sheet, but we note that with a market capitalization of $10.7 billion and more than $1.59 billion in cash, the company has the capacity to continue to prioritise growth over profitability.

It was good to see Unity outperform Wall St’s revenue expectations this quarter. And we were also glad that the revenue guidance for the next quarter exceeded analysts' expectations. On the other hand, it was less good to see the pretty significant deterioration in gross margin. Overall, this quarter's results seemed pretty positive and shareholders can feel optimistic. The company is up 16.4% on the results and currently trades at $33.45 per share.

Should you invest in Unity right now? It is important that you take into account its valuation and business qualities, as well as what happened in the latest quarter. We look at that in our actionable report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.