Game engine maker Unity (NYSE:U) announced better-than-expected results in the Q1 FY2021 quarter, with revenue up 40.5% year on year to $234.7 million. Unity made a GAAP loss of $107.4 million, down on its loss of $26.7 million, in the same quarter last year.

Get investing superpowers with StockStory. View our latest analysis for Unity

Unity (NYSE:U) Q1 FY2021 Highlights:

- Revenue: $234.7 million vs analyst estimates of $217 million (8.15% beat)

- EPS (non-GAAP): -$0.10 vs analyst estimates of -$0.12

- Revenue guidance for Q2 2021 is $242.5 million at the midpoint, above analyst estimates of $231.9 million

- The company lifted revenue guidance for the full year, from $960 million to $1 billion at the midpoint, a 4.94% increase

- Free cash flow was negative -$100.63 million, down from positive free cash flow of $3.56 million in previous quarter

- Net Revenue Retention Rate: 140%, in line with previous quarter

- Customers: 837 customers paying more than $100,000 annually

- Gross Margin (GAAP): 74.9%, in line with previous quarter

“Our first quarter results are reflective of the powerful transition from linear 2D to real-time 3D, which is one of the most important changes in how people interact with technology,” said John Riccitiello, President and Chief Executive Officer, Unity. “We believe that real-time 3D will continue to grow at an accelerated pace and achieve massive scale.”

A bet on the future of gaming

Founded in 2004 as a game studio by three friends in a Copenhagen apartment, Unity is a software as a service platform that makes it easier to develop and monetize new games.

Instead of having to build everything from scratch, game developers can use Unity’s game engine that handles things like physics of how players and objects move or how networking and in-app purchases work. Similarly as when opening a new restaurant a chef just buys an oven and other tools needed and focuses their effort on the recipes and the food, a game developer can now focus on the story, characters and rules of their game rather than having to build their own tools. While it has been lately venturing into VR and movie production, Unity is still most popular with mobile game makers, powering a large share of the top 1,000 games.

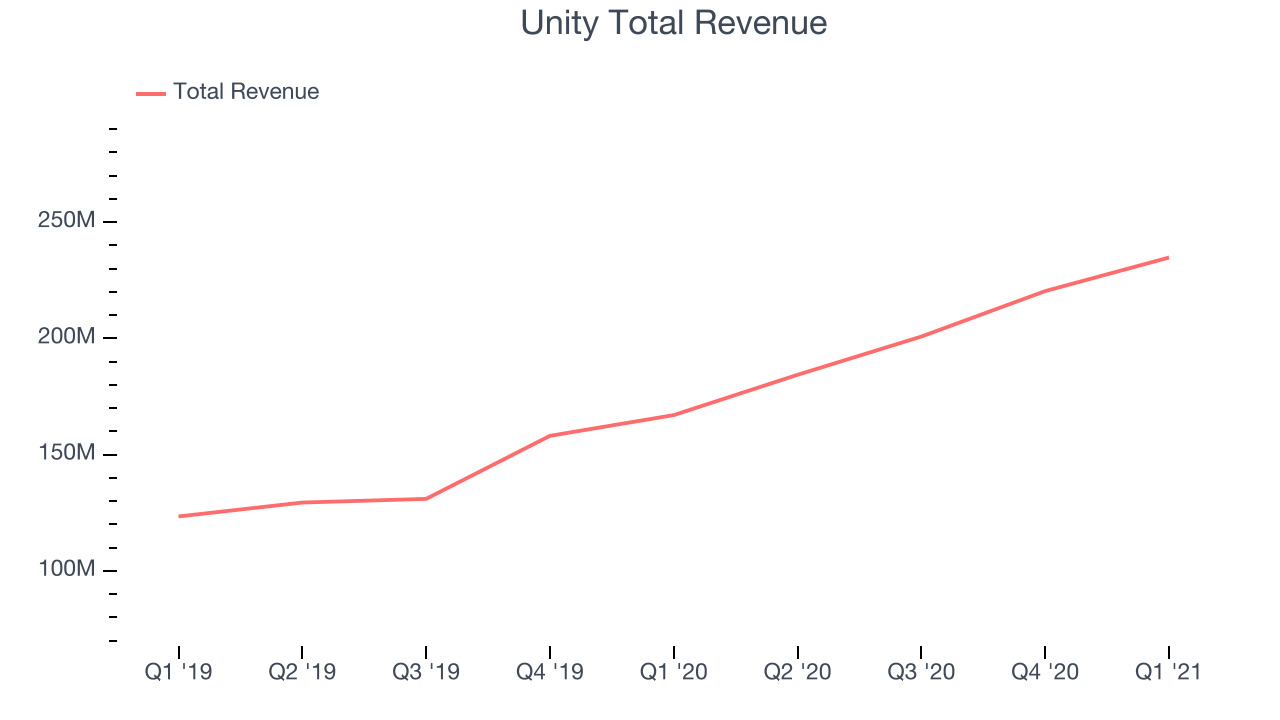

As you can see below, Unity's revenue growth has been impressive over the last twelve months, growing from $166.9 million to $234.7 million.

And unsurprisingly, this was another great quarter for Unity with revenue up an absolutely stunning 40.5% year on year. But the growth did slow down compared to last quarter, as the revenue increased by just $14.4 million in Q1, compared to $19.5 million in Q4 2020. A one-off fluctuation is usually not concerning, but it is worth keeping in mind.

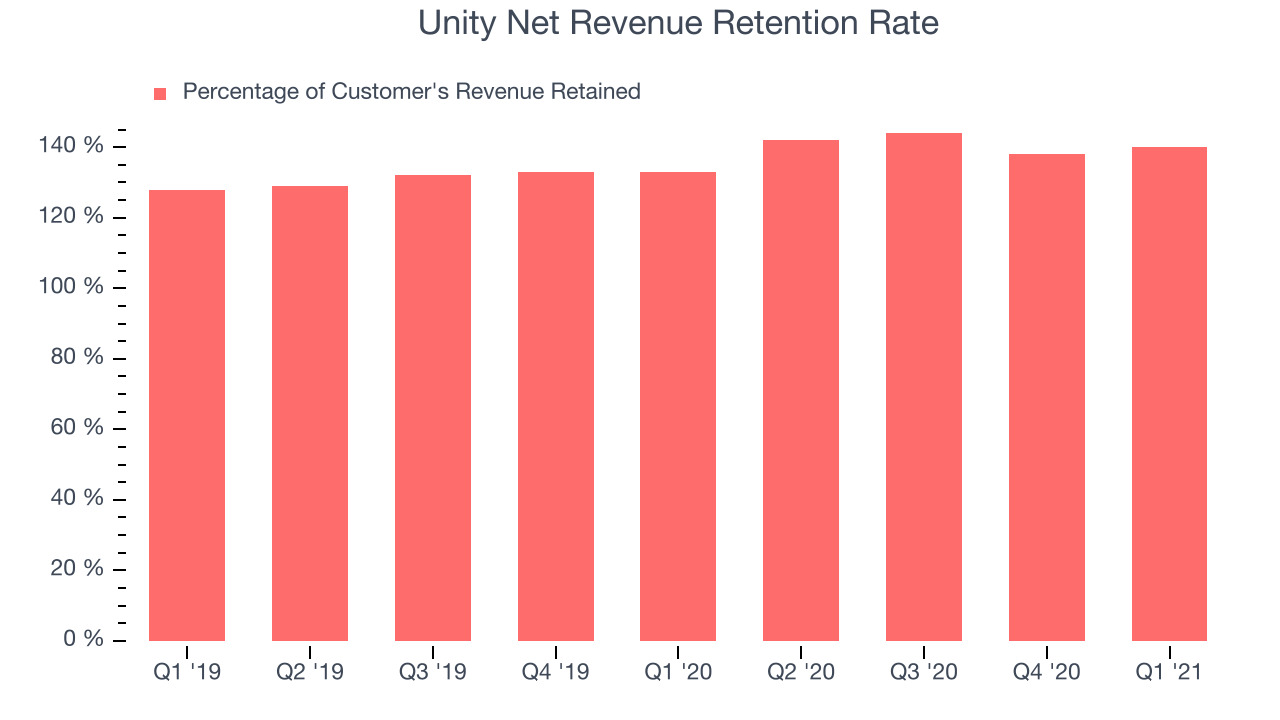

Shared success

One of the best things about software as a service businesses (and a reason why they trade at such high multiples) is that customers tend to spend more with the company over time. Unity charges a monthly subscription for the tools to create games, but offers the services that help developers monetize and operate games through revenue-share and usage-based models.

Unity's net revenue retention rate, an important measure of how much customers from a year ago were spending at the end of the quarter, was at 140% in Q1. That means even if they didn't win any new customers, Unity would have grown its revenue 40% year on year. Significantly up from the last quarter, this is an absolutely exceptional retention rate, meaning Unity's software is extremely successful with their customers who are rapidly expanding the use of it across their organizations.

Key Takeaways from Unity's Q1 Results

With market capitalisation of $22.7 billion, more than $1.64 billion in cash and the fact it is operating close to free cash flow break-even the company is in a strong financial position to invest in growth.

We were impressed by how strongly Unity outperformed analysts’ revenue expectations this quarter. And we were also glad that the revenue guidance for the next quarter exceeded analysts' expectations. Zooming out, we think this was a great quarter and we have no doubt shareholders will feel excited about the results. Therefore, we think Unity will continue to stand out as an attractive growth stock, even more so than before.

Get access to insights until now only reserved for the top hedge funds. Discover great tech investments the market is overlooking. Get investing superpowers with StockStory. Signup here for early access.

The author has no position in any of the stocks mentioned.