Game engine maker Unity (NYSE:U) reported Q3 CY2024 results beating Wall Street’s revenue expectations, but sales fell 18% year on year to $446.5 million. The company expects next quarter’s revenue to be around $424.5 million, close to analysts’ estimates. Its GAAP loss of $0.31 per share was also 19.7% above analysts’ consensus estimates.

Is now the time to buy Unity? Find out by accessing our full research report, it’s free.

Unity (U) Q3 CY2024 Highlights:

- Revenue: $446.5 million vs analyst estimates of $428.2 million (4.3% beat)

- EPS: -$0.31 vs analyst estimates of -$0.39 (19.7% beat)

- EBITDA: $91.72 million vs analyst estimates of $82.03 million (11.8% beat)

- Revenue Guidance for Q4 CY2024 is $424.5 million at the midpoint, roughly in line with what analysts were expecting

- EBITDA guidance for the full year is $365.5 million at the midpoint, above analyst estimates of $358 million

- Gross Margin (GAAP): 74.9%, up from 72.2% in the same quarter last year

- Operating Margin: -28.5%, down from -23.4% in the same quarter last year

- EBITDA Margin: 20.5%, down from 24.1% in the same quarter last year

- Free Cash Flow Margin: 40.4%, up from 17.7% in the previous quarter

- Market Capitalization: $8.6 billion

Company Overview

Started as a game studio by three friends in a Copenhagen apartment, Unity (NYSE:U) is a software as a service platform that makes it easier to develop and monetize new games and other visual digital experiences.

Design Software

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

Sales Growth

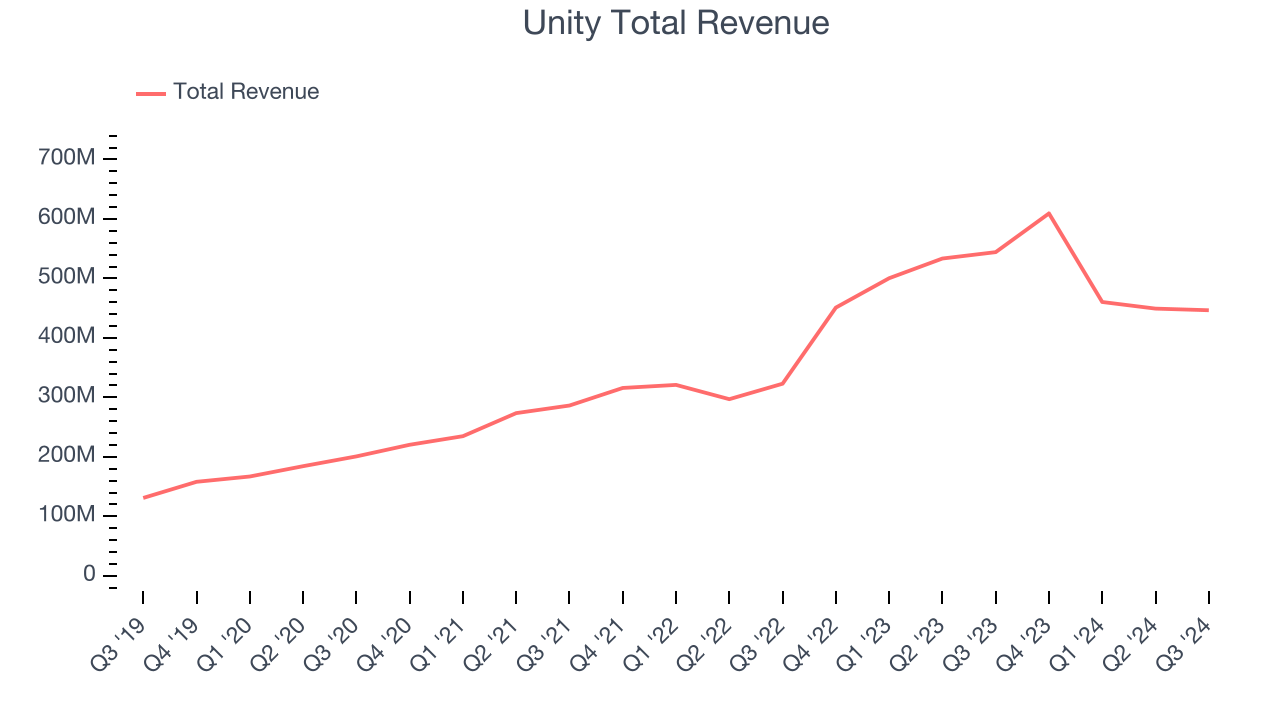

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Unity’s sales grew at a solid 24.6% compounded annual growth rate over the last three years. This is a useful starting point for our analysis.

This quarter, Unity’s revenue fell 18% year on year to $446.5 million but beat Wall Street’s estimates by 4.3%. Management is currently guiding for a 30.3% year-on-year decline next quarter.

Looking further ahead, sell-side analysts expect revenue to decline 12.1% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and shows the market thinks its products and services will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Customer Acquisition Efficiency

Customer acquisition cost (CAC) payback represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for marketing and sales investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

It’s very expensive for Unity to acquire new customers as its CAC payback period checked in at -76.1 months this quarter. The company’s inefficiency indicates a highly competitive environment with little differentiation between Unity’s products and its peers.

Key Takeaways from Unity’s Q3 Results

We were impressed by how significantly Unity blew past analysts’ EBITDA expectations this quarter. We were also glad its full-year EBITDA guidance exceeded Wall Street’s estimates. On the other hand, its full-year revenue guidance was below expectations and its EBITDA guidance for next quarter fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $22.09 immediately following the results.

Is Unity an attractive investment opportunity at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.