Game engine maker Unity (NYSE:U) reported Q1 CY2024 results topping analysts' expectations, with revenue down 8% year on year to $460.4 million. It made a GAAP loss of $0.75 per share, down from its loss of $0.53 per share in the same quarter last year.

Unity (U) Q1 CY2024 Highlights:

- Revenue: $460.4 million vs analyst estimates of $433.5 million (6.2% beat)

- EPS: -$0.75 vs analyst expectations of -$0.67 (11.5% miss)

- Q2 2024 revenue guidance of $423 million at the midpoint vs. vs analyst estimates of $443.2 million (4.6% miss) (full year revenue guidance also below)

- Gross Margin (GAAP): 68.6%, up from 67.6% in the same quarter last year

- Free Cash Flow was -$14.56 million, down from $60.74 million in the previous quarter

- Market Capitalization: $9.42 billion

Started as a game studio by three friends in a Copenhagen apartment, Unity (NYSE:U) is a software as a service platform that makes it easier to develop and monetize new games and other visual digital experiences.

Instead of having to build everything from scratch, game developers can use Unity’s game engine that handles things like the physics of how players and objects move or how networking and in-app purchases work.

Similarly to when opening a new restaurant a chef just buys an oven and other tools needed, and focuses their effort on the recipes and the food, a game developer can now focus on the story, characters and rules of their game rather than having to build their own tools. While it has been lately venturing into VR and movie production, Unity is still most popular with mobile game makers, powering a large share of the top 1,000 games.

Design Software

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

Competitors include Autodesk (NASDAQ: ADSK), Blender, Unreal Engine, and Roblox (NYSE:RBLX).

Sales Growth

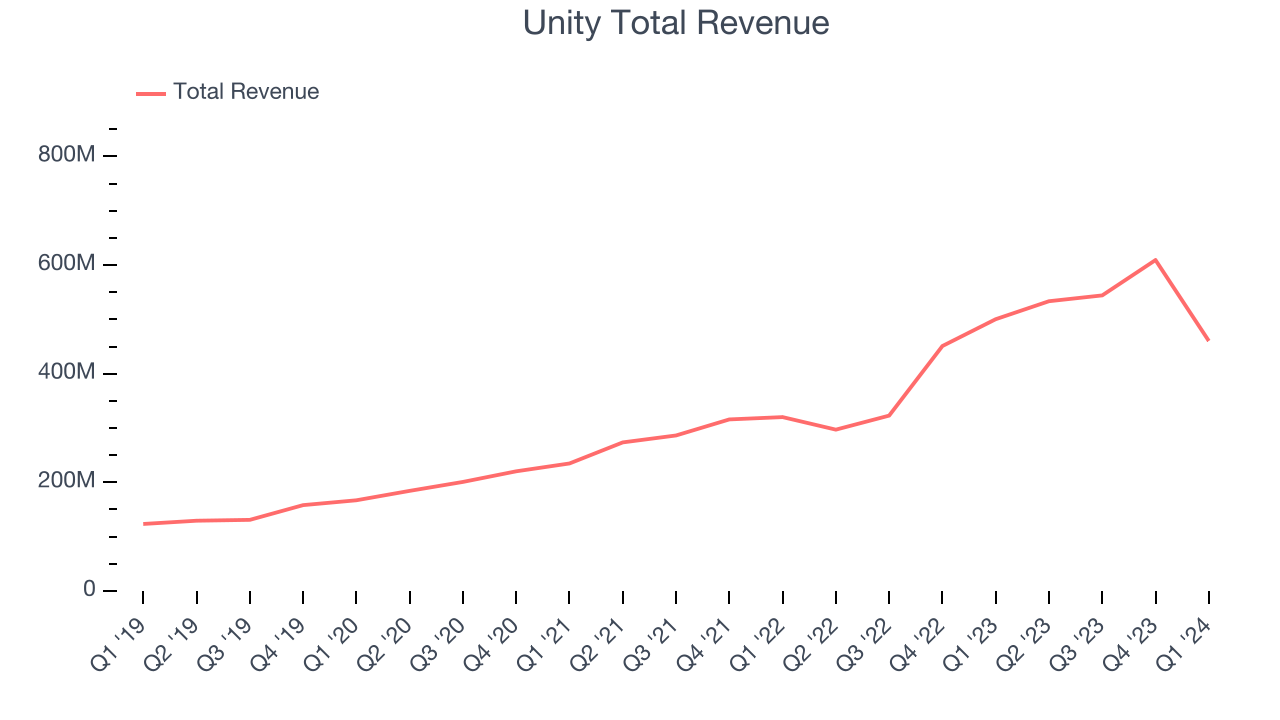

As you can see below, Unity's revenue growth has been very strong over the last three years, growing from $234.8 million in Q1 2021 to $460.4 million this quarter.

This quarter, Unity's revenue was down 8% year on year, which might disappointment some shareholders.

Looking ahead, Wall Street was expecting revenue to decline 13.6% over the next 12 months before the earnings results announcement.

Profitability

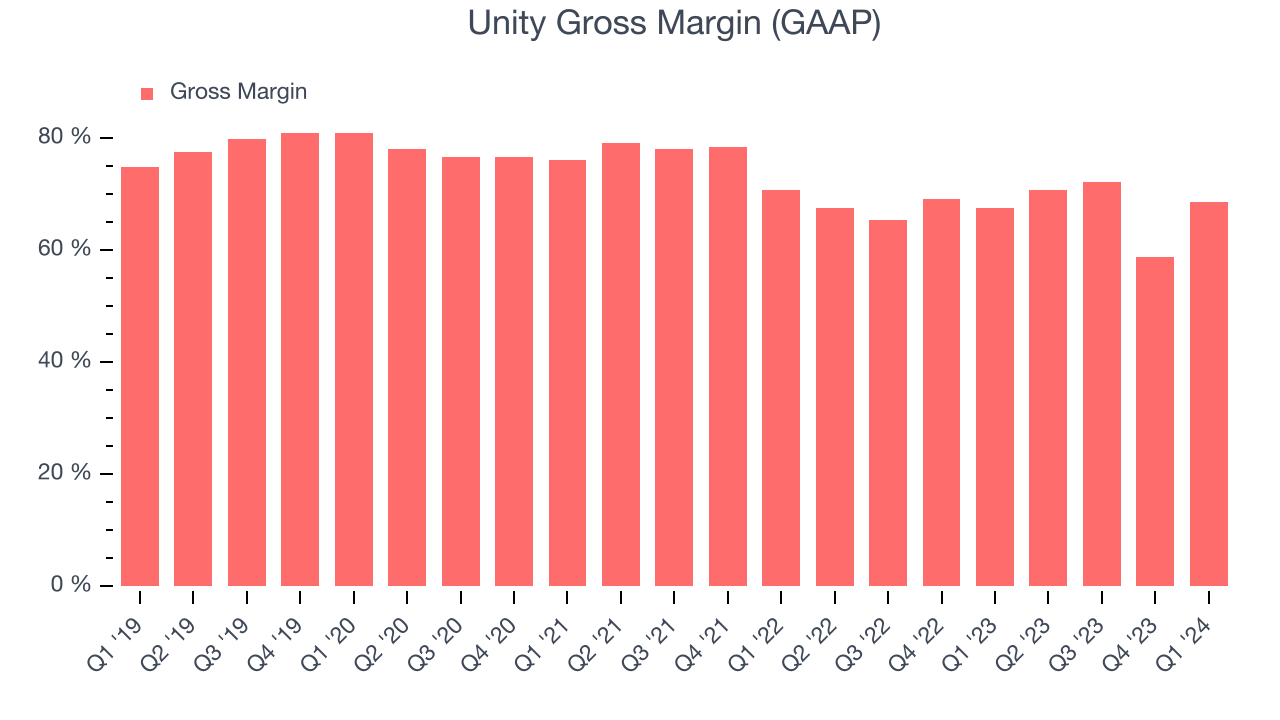

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Unity's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 68.6% in Q1.

That means that for every $1 in revenue the company had $0.69 left to spend on developing new products, sales and marketing, and general administrative overhead. While its gross margin has improved significantly since the previous quarter, Unity's gross margin is still poor for a SaaS business. It's vital that the company continues to improve this key metric.

Cash Is King

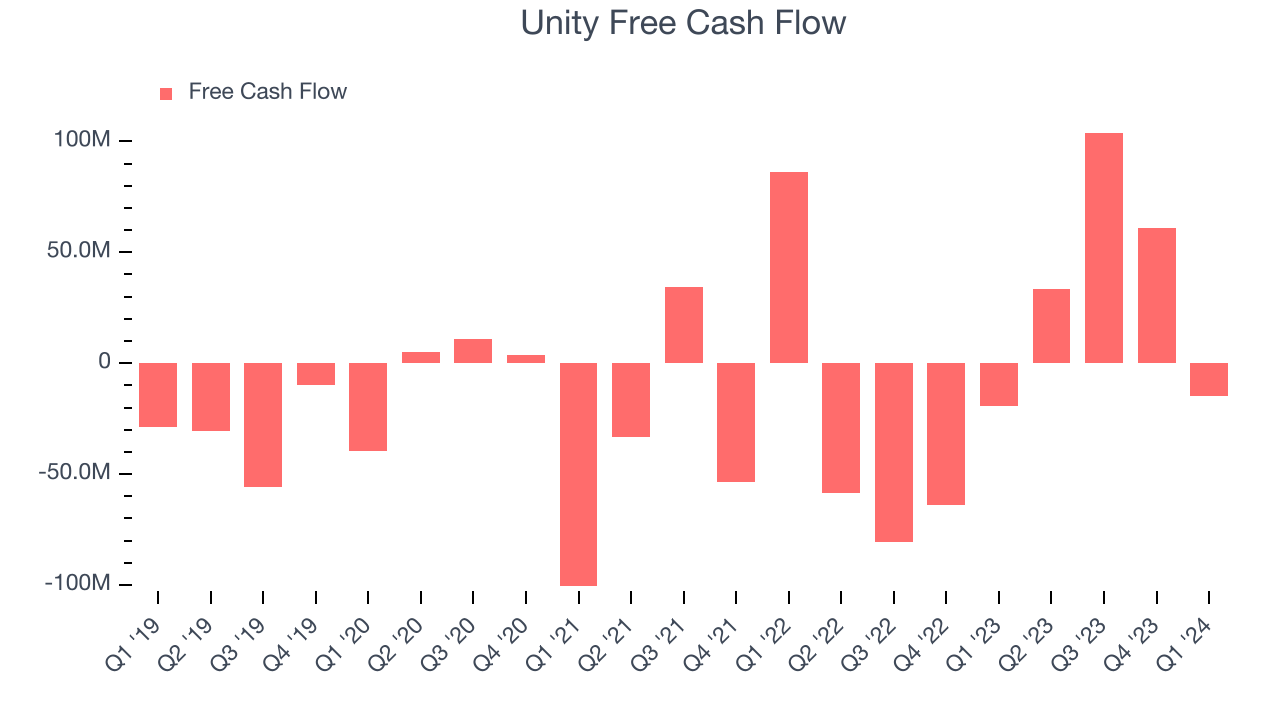

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Unity burned through $14.56 million of cash in Q1 , increasing its cash burn by 25.1% year on year.

Unity has generated $183.7 million in free cash flow over the last 12 months, or 8.6% of revenue. This FCF margin enables it to reinvest in its business without depending on the capital markets.

Key Takeaways from Unity's Q1 Results

We were impressed by Unity's strong gross margin improvement this quarter. We were also excited its revenue outperformed Wall Street's estimates. On the other hand, revenue guidance for next quarter and the full year are below expectations. Zooming out, we think this was an impressive quarter that should delight shareholders. The stock is down 3.2% after reporting, trading at $23.4 per share.

Is Now The Time?

Unity may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

Although Unity isn't a bad business, it probably wouldn't be one of our picks. Although its revenue growth has been exceptional over the last three years, Wall Street expects growth to deteriorate from here. On top of that, its gross margins aren't as good as other tech businesses we look at.

Given its price-to-sales ratio of 5.0x based on the next 12 months, the market is certainly expecting long-term growth from Unity. We can find things to like about Unity, and there's no doubt it's a bit of a market darling, at least for some. However, we think there are better opportunities elsewhere right now.

Wall Street analysts covering the company had a one-year price target of $30.10 right before these results (compared to the current share price of $23.40).

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.