Under Armour has had an impressive run over the past six months as its shares have beaten the S&P 500 by 14.7%. The stock now trades at $8.21, marking a 20.7% gain. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is there a buying opportunity in Under Armour, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.We’re happy investors have made money, but we're sitting this one out for now. Here are three reasons why there are better opportunities than UAA and a stock we'd rather own.

Why Do We Think Under Armour Will Underperform?

Founded in 1996 by a former University of Maryland football player, Under Armour (NYSE:UAA) is an apparel brand specializing in sportswear designed to improve athletic performance.

1. Declining Constant Currency Revenue, Demand Takes a Hit

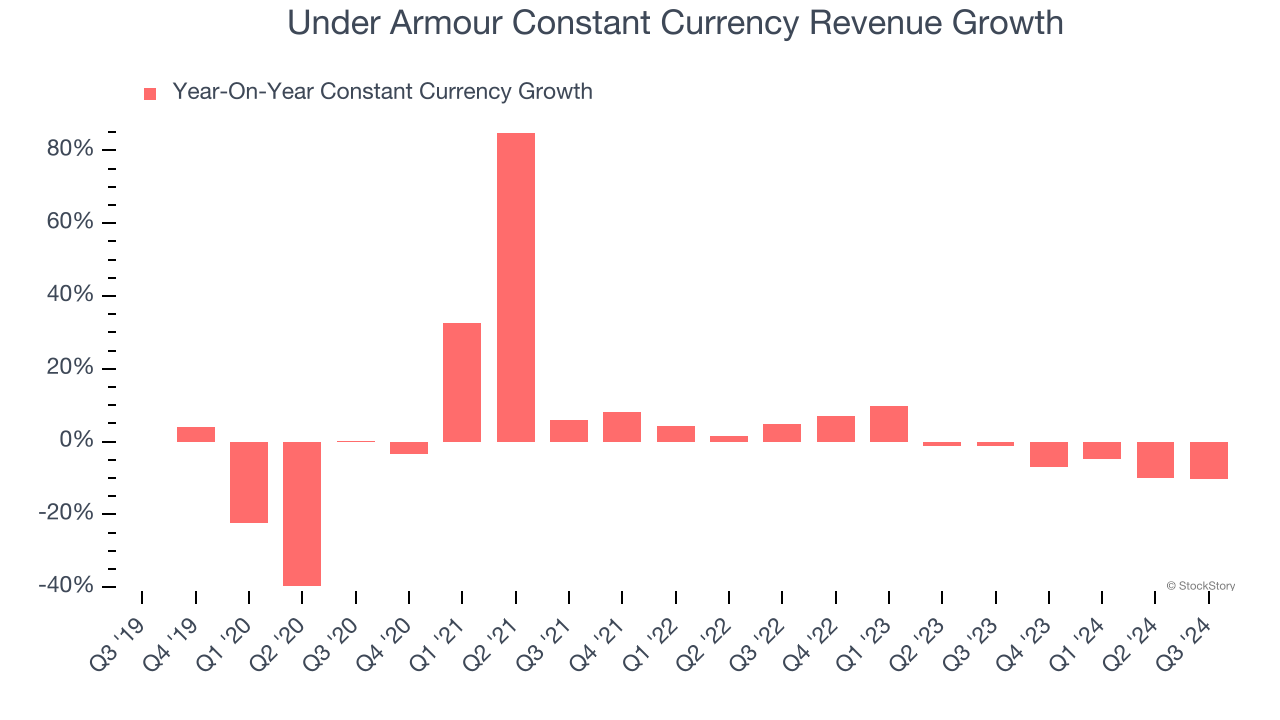

Investors interested in Apparel and Accessories companies should track constant currency revenue in addition to reported revenue. This metric excludes currency movements, which are outside of Under Armour’s control and are not indicative of underlying demand.

Over the last two years, Under Armour’s constant currency revenue averaged 2.2% year-on-year declines. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Under Armour might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

2. Cash Burn Ignites Concerns

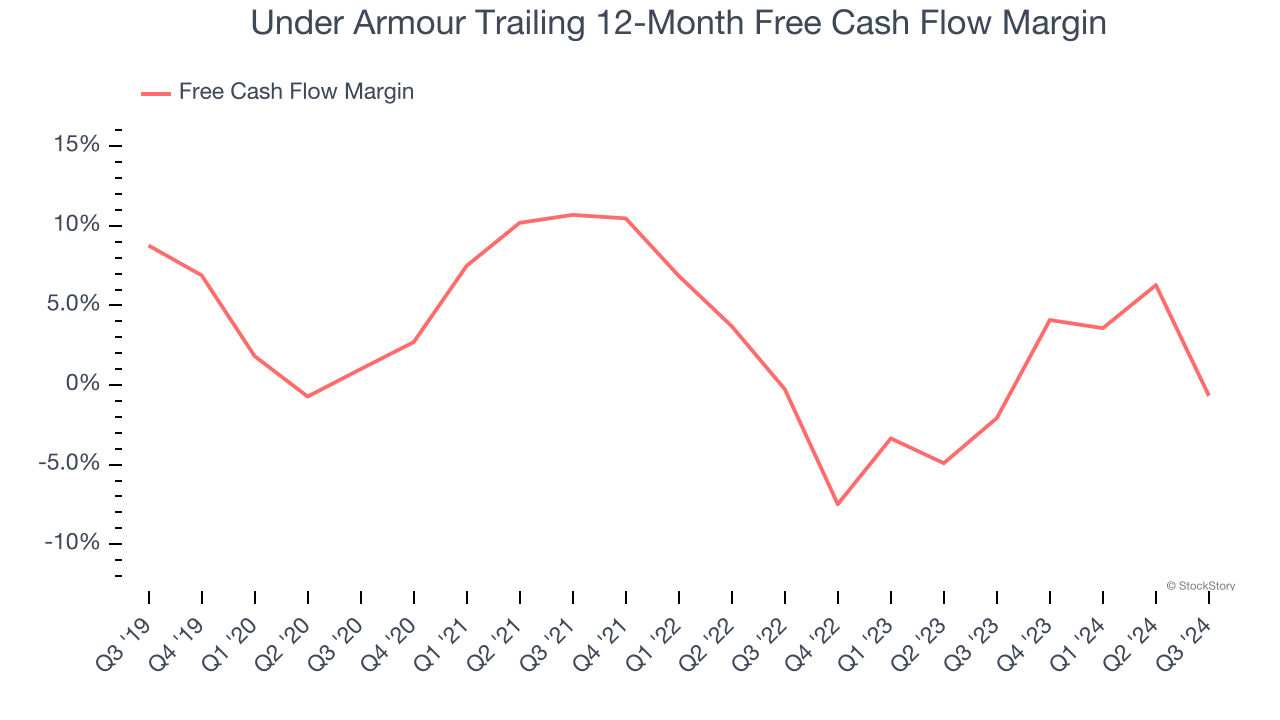

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Over the last two years, Under Armour’s demanding reinvestments to stay relevant have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 1.4%, meaning it lit $1.40 of cash on fire for every $100 in revenue.

3. Previous Growth Initiatives Haven’t Paid Off Yet

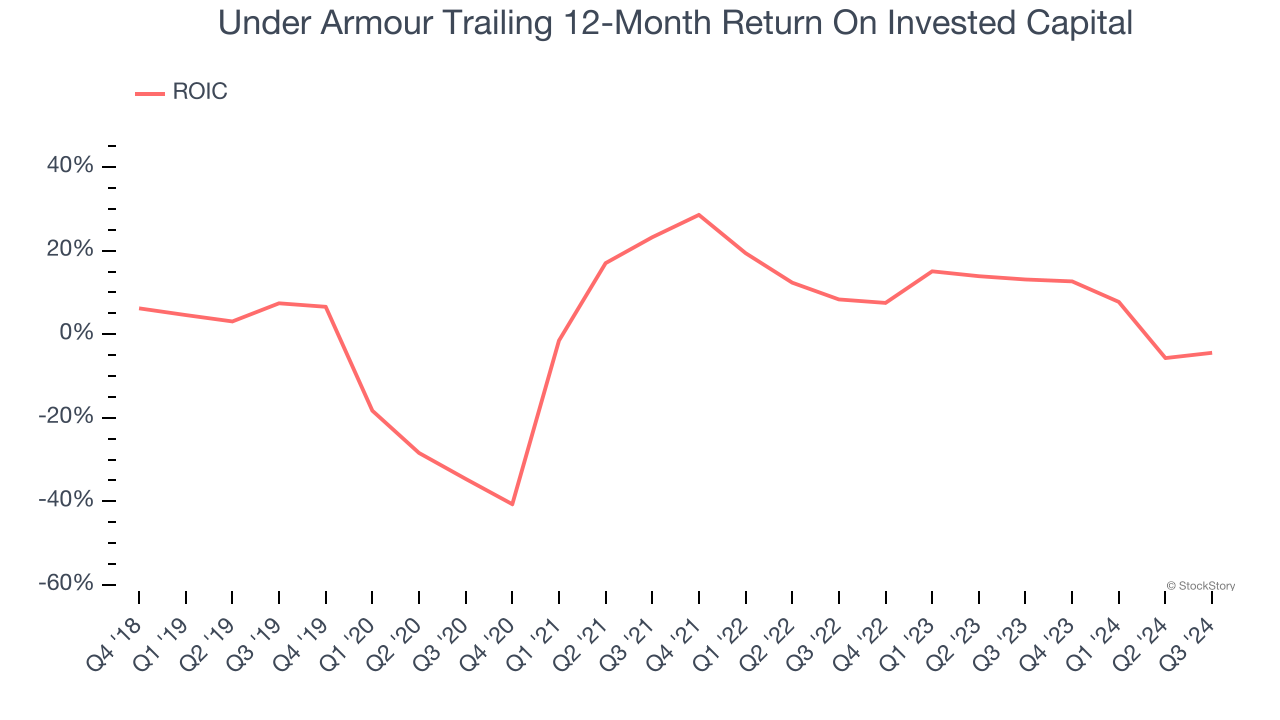

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Under Armour historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 1.1%, lower than the typical cost of capital (how much it costs to raise money) for consumer discretionary companies.

Final Judgment

We see the value of companies helping consumers, but in the case of Under Armour, we’re out. With its shares beating the market recently, the stock trades at 32.7× forward price-to-earnings (or $8.21 per share). This multiple tells us a lot of good news is priced in - we think there are better stocks to buy right now. Let us point you toward Google, whose cloud computing and YouTube divisions are firing on all cylinders.

Stocks We Would Buy Instead of Under Armour

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.