Ride sharing and on demand delivery service Uber (NYSE: UBER) announced better-than-expected results in the Q3 FY2022 quarter, with revenue up 72.1% year on year to $8.34 billion. Uber made a GAAP loss of $1.2 billion, improving on its loss of $2.43 billion, in the same quarter last year.

Is now the time to buy Uber? Access our full analysis of the earnings results here, it's free.

Uber (UBER) Q3 FY2022 Highlights:

- Revenue: $8.34 billion vs analyst estimates of $8.12 billion (2.69% beat)

- EPS: -$0.61 vs analyst estimates of -$0.18 (-$0.43 miss)

- Free cash flow of $358 million, roughly flat from previous quarter

- Gross Margin (GAAP): 37.9%, down from 39.8% same quarter last year

- Monthly Active Platform Consumers: 124 million, up 15 million year on year

“Our global scale and unique platform advantages are working together to drive more profitable growth, with Gross Bookings growth of 32% and record Adjusted EBITDA of $516 million,” said Dara Khosrowshahi, CEO.

Born out of a winter night thought: "What if you could request a ride from your phone?" Uber (NYSE: UBER) operates a global network of on demand services, most prominently ride hailing and food delivery, and freight.

The iPhone changed the world, ushering in the era of the “always-on” internet and “on-demand” services - anything someone could want is just a few taps away. Likewise, the gig economy sprang up in a similar fashion, with a proliferation of tech-enabled freelance labor marketplaces, which work hand and hand with many on demand services. Individuals can now work on demand too. What began with tech enabled platforms that aggregated riders and drivers has expanded over the past decade to include food delivery, groceries, and now even a plumber or graphic designer are all just a few taps away.

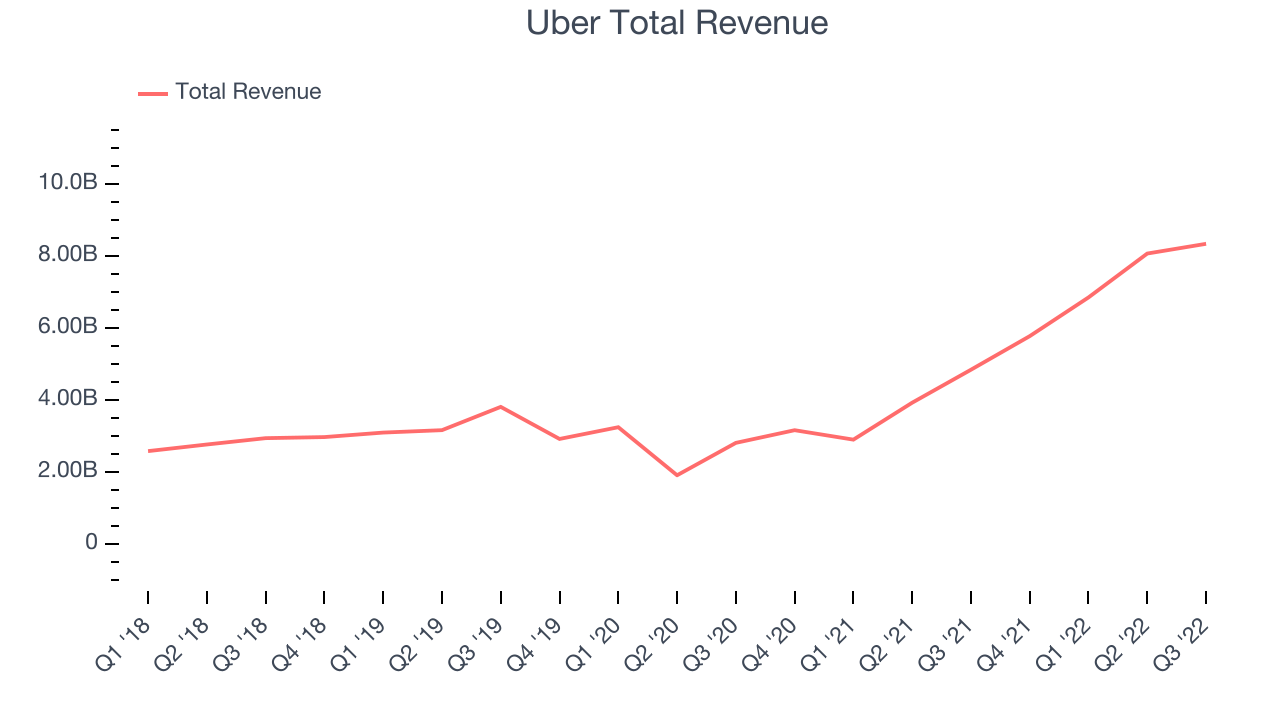

Sales Growth

Uber's revenue growth over the last three years has been impressive, averaging 42.4% annually.

This quarter, Uber beat analyst estimates and reported a very impressive 72.1% year on year revenue growth.

Ahead of the earnings results the analysts covering the company were estimating sales to grow 27.3% over the next twelve months.

In volatile times like these we look for robust businesses with strong pricing power. Unknown to most investors, this company is one of the highest-quality software companies in the world, and their software products have been the default standard in critical industries for decades. The result is an impressive business that is up an incredible 18,152% since the IPO. You can find it on our platform for free.

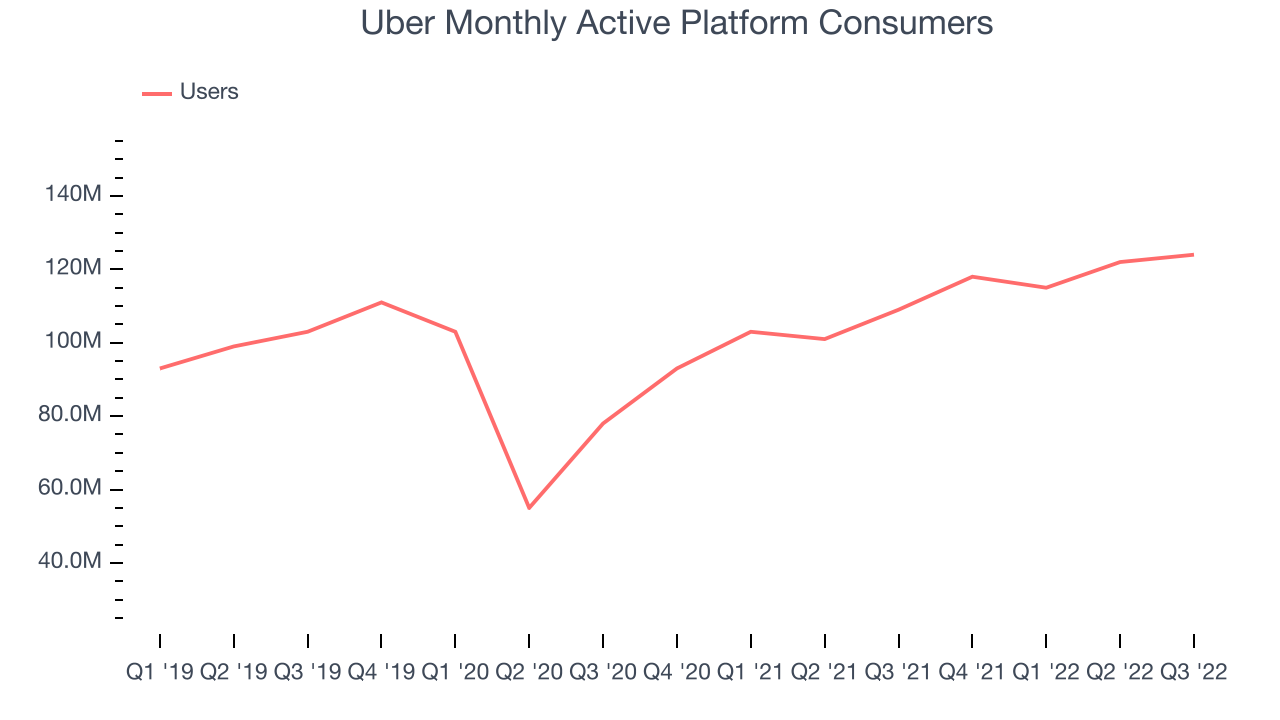

Usage Growth

As a gig economy marketplace, Uber generates revenue growth by a combination of the volume of services users order and how much commission it earns.

Over the last two years the number of Uber's paying users, a key usage metric for the company, grew 22.5% annually to 124 million users. This is a strong growth for a consumer internet company.

In Q3 the company added 15 million paying users, translating to a 13.7% growth year on year.

Key Takeaways from Uber's Q3 Results

Sporting a market capitalization of $52.6 billion, more than $8.5 billion in cash and with positive free cash flow over the last twelve months, we're confident that Uber has the resources it needs to pursue a high growth business strategy.

We were impressed by the exceptional revenue growth Uber delivered this quarter. And we were also excited to see that it outperformed analysts' expectations. Overall, we think this was a really good quarter, that should leave shareholders feeling very positive. The company is up 8.31% on the results and currently trades at $28.79 per share.

Uber may have had a good quarter, so should you invest right now? It is important that you take into account its valuation and business qualities, as well as what happened in the latest quarter. We look at that in our actionable report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.