Ride sharing and on demand delivery service Uber (NYSE: UBER) announced better-than-expected results in Q2 CY2024, with revenue up 15.9% year on year to $10.7 billion. It made a GAAP profit of $0.47 per share, improving from its profit of $0.19 per share in the same quarter last year.

Is now the time to buy Uber? Find out by accessing our full research report, it's free.

Uber (UBER) Q2 CY2024 Highlights:

- Revenue: $10.7 billion vs analyst estimates of $10.58 billion (1.1% beat)

- Adjusted EBITDA: $1.57 billion vs analyst estimates of $1.51 billion (4.0% beat)

- EPS: $0.47 vs analyst estimates of $0.31 ($0.16 beat)

- Q3 Guidance: $41.0 billion of gross bookings (miss), $1.63 billion of adjusted EBITDA (in line)

- Gross Margin (GAAP): 39.4%, up from 33.1% in the same quarter last year

- Adjusted EBITDA Margin: 14.7%, up from 9.9% in the same quarter last year

- Free Cash Flow of $1.72 billion, up 26.6% from the previous quarter

- Monthly Active Platform Consumers: 156 million, up 19 million year on year

- Market Capitalization: $122.2 billion

“Uber’s growth engine continues to hum, delivering our sixth consecutive quarter of trip growth above 20 percent, alongside record profitability,” said Dara Khosrowshahi, CEO.

Born out of a winter night thought: "What if you could request a ride from your phone?" Uber (NYSE: UBER) operates a global network of on demand services, most prominently ride hailing and food delivery, and freight.

Gig Economy

The iPhone changed the world, ushering in the era of the “always-on” internet and “on-demand” services - anything someone could want is just a few taps away. Likewise, the gig economy sprang up in a similar fashion, with a proliferation of tech-enabled freelance labor marketplaces, which work hand and hand with many on demand services. Individuals can now work on demand too. What began with tech enabled platforms that aggregated riders and drivers has expanded over the past decade to include food delivery, groceries, and now even a plumber or graphic designer are all just a few taps away.

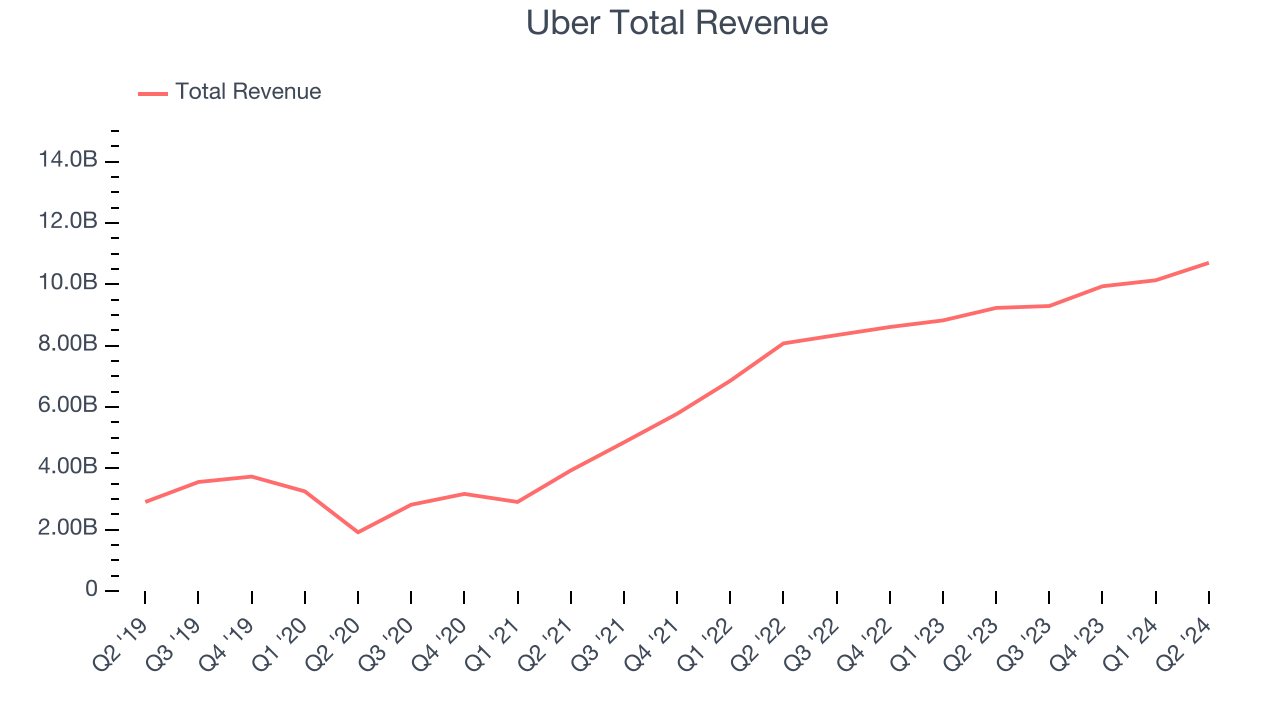

Sales Growth

Uber's revenue growth over the last three years has been exceptional, averaging 51.5% annually. This quarter, Uber beat analysts' estimates and reported 15.9% year-on-year revenue growth.

Ahead of the earnings results, analysts were projecting sales to grow 16.6% over the next 12 months.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

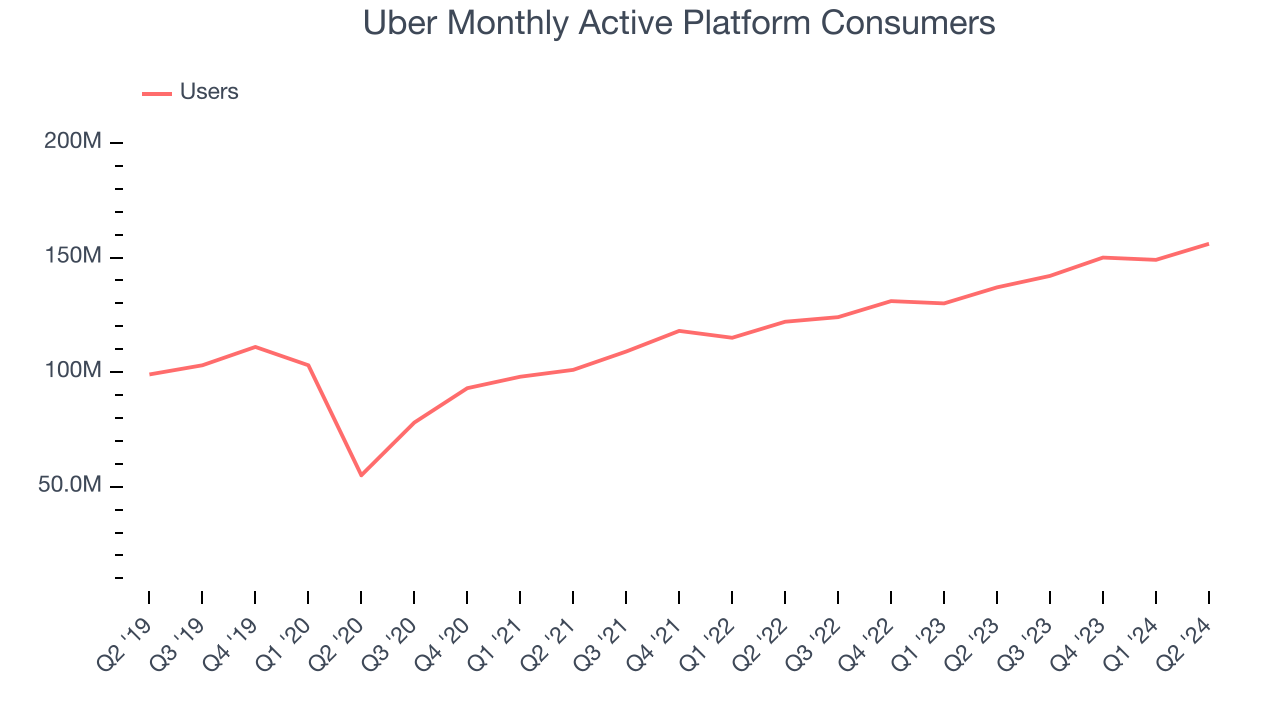

Usage Growth

As a gig economy marketplace, Uber generates revenue growth by expanding the number of services on its platform (e.g. rides, deliveries, freelance jobs) and raising the commission fee from each service provided.

Over the last two years, Uber's users, a key performance metric for the company, grew 13.5% annually to 156 million. This is solid growth for a consumer internet company.

In Q2, Uber added 19 million users, translating into 13.9% year-on-year growth.

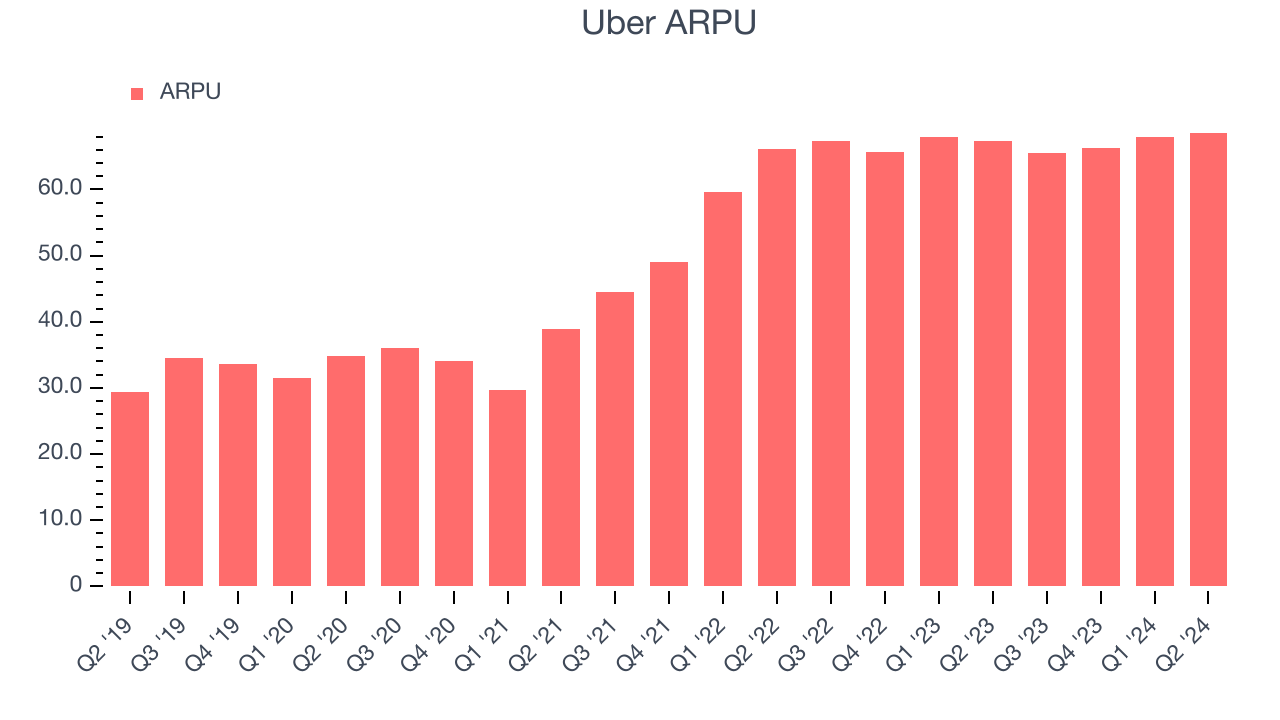

Revenue Per User

Average revenue per user (ARPU) is a critical metric to track for consumer internet businesses like Uber because it measures how much the company earns in transaction fees from each user. This number also informs us about Uber's take rate, which represents its pricing leverage over the ecosystem, or "cut" from each transaction.

Uber's ARPU growth has been impressive over the last two years, averaging 12.7%. The company's ability to increase prices while growing its users demonstrates its platform's value, as its users continue to spend more each year. This quarter, ARPU grew 1.8% year on year to $68.59 per user.

Key Takeaways from Uber's Q2 Results

It was great to see Uber increase its number of users this quarter. We were also glad its users outperformed Wall Street's estimates. On the other hand, its revenue growth regrettably stalled, although adjusted EBITDA beat expectations by a healthy amount. Guidance was also mixed, with Q3 revenue guidance slightly below but adjusted EBITDA was in line). Zooming out, we think this was still a decent, albeit mixed, quarter, showing the company is staying on track. The stock traded up 3.9% to $60.78 immediately after reporting.

So should you invest in Uber right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.