As the Q2 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the air freight and logistics industry, including United Parcel Service (NYSE:UPS) and its peers.

The growth of e-commerce and global trade continues to drive demand for expedited shipping services, presenting opportunities for air freight companies. The industry continues to invest in advanced technologies such as automated sorting systems and real-time tracking solutions to enhance operational efficiency. Despite the advantages of speed and global reach, air freight and logistics companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

The 7 air freight and logistics stocks we track reported a slower Q2. As a group, revenues missed analysts’ consensus estimates by 1%.

Big picture, the Federal Reserve has a dual mandate of inflation and employment. The former had been running hot throughout 2021 and 2022 but cooled towards the central bank's 2% target as of late. This prompted the Fed to cut its policy rate by 50bps (half a percent) in September 2024. Given recent employment data that suggests the US economy could be wobbling, the markets will be assessing whether this rate and future cuts (the Fed signaled more to come in 2024 and 2025) are the right moves at the right time or whether they're too little, too late for a macro that has already cooled.

In light of this news, air freight and logistics stocks have held steady with share prices up 2.9% on average since the latest earnings results.

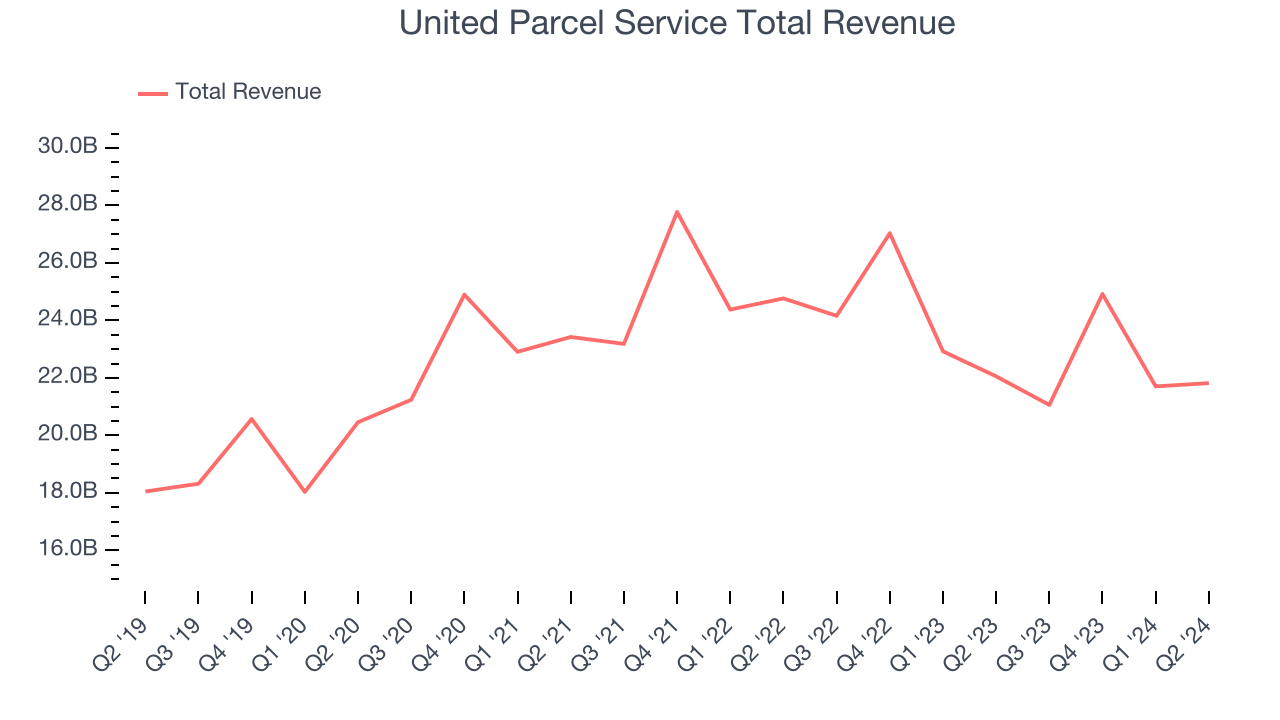

United Parcel Service (NYSE:UPS)

Trademarking its recognizable UPS Brown color, UPS (NYSE:UPS) offers package delivery, supply chain management, and freight forwarding services.

United Parcel Service reported revenues of $21.82 billion, down 1.1% year on year. This print fell short of analysts’ expectations by 1.9%. Overall, it was a softer quarter for the company with a miss of analysts’ earnings estimates.

“I want to thank all UPSers for their hard work and efforts in the second quarter,” said Carol Tomé, UPS chief executive officer.

United Parcel Service achieved the highest full-year guidance raise of the whole group. Even though it had a great quarter relative to its peers, the market seems discontent with the results. The stock is down 22.1% since reporting and currently trades at $108.75.

Read our full report on United Parcel Service here, it’s free.

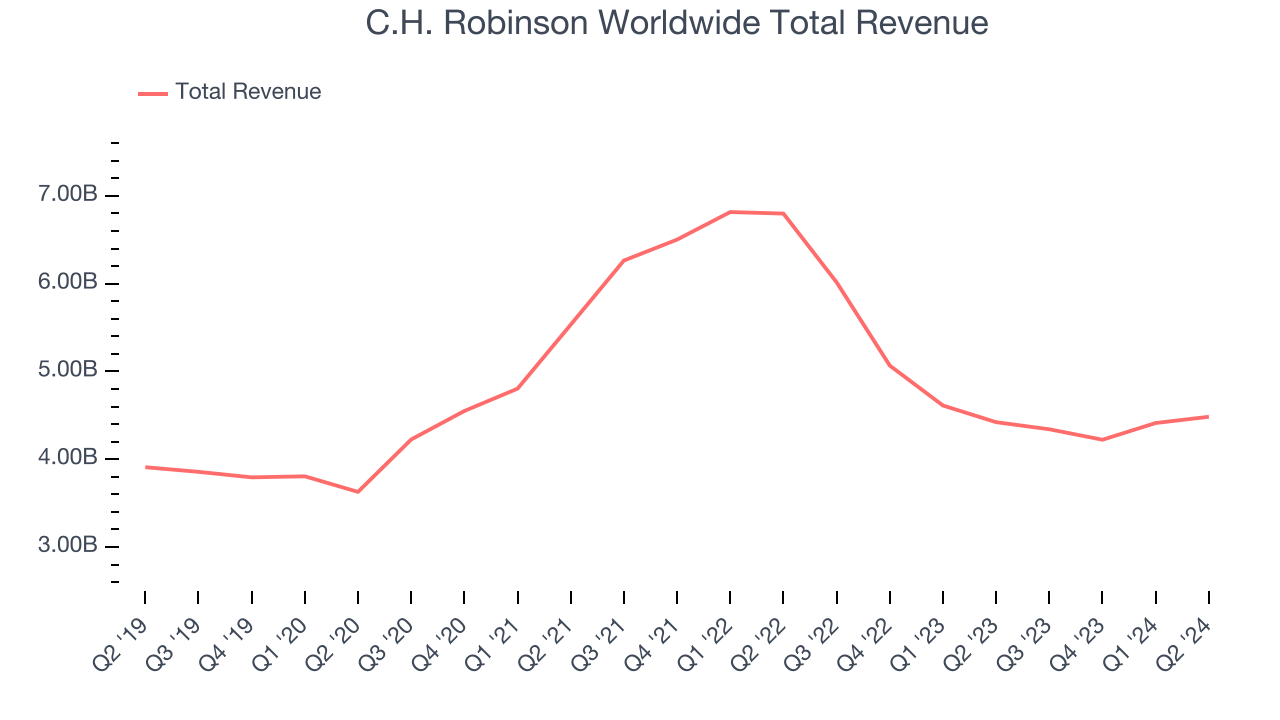

Best Q2: C.H. Robinson Worldwide (NASDAQ:CHRW)

Engaging in contracts with tens of thousands of transportation companies, C.H. Robinson (NASDAQ:CHRW) offers freight transportation and logistics services.

C.H. Robinson Worldwide reported revenues of $4.48 billion, up 1.4% year on year, in line with analysts’ expectations. The business had a strong quarter with an impressive beat of analysts’ operating margin and earnings estimates.

The market seems happy with the results as the stock is up 22.1% since reporting. It currently trades at $108.75.

Is now the time to buy C.H. Robinson Worldwide? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: FedEx (NYSE:FDX)

Infamously taking its last $5,000 to a Las Vegas blackjack table to keep the company afloat, FedEx (NYSE:FDX) is a provider of parcel and cargo delivery services

FedEx reported revenues of $21.58 billion, flat year on year, falling short of analysts’ expectations by 1.5%. It was a disappointing quarter as it posted a miss of analysts’ earnings estimates.

As expected, the stock is down 11.3% since the results and currently trades at $266.66.

Read our full analysis of FedEx’s results here.

Air Transport Services (NASDAQ:ATSG)

Founded in 1980, Air Transport Services Group (NASDAQ:ATSG) provides air cargo transportation and logistics solutions.

Air Transport Services reported revenues of $491.5 million, down 7.1% year on year. This result came in 4.3% below analysts' expectations. It was a slower quarter as it also produced a miss of analysts’ Cargo Aircraft Management revenue estimates.

Air Transport Services had the slowest revenue growth among its peers. The stock is up 17.8% since reporting and currently trades at $15.62.

Read our full, actionable report on Air Transport Services here, it’s free.

Hub Group (NASDAQ:HUBG)

Started with $10,000, Hub Group (NASDAQ:HUBG) is a provider of intermodal, truck brokerage, and logistics services, facilitating transportation solutions for businesses worldwide.

Hub Group reported revenues of $986.5 million, down 5.2% year on year. This print lagged analysts' expectations by 9.7%. It was a softer quarter as it also recorded full-year revenue guidance missing analysts’ expectations and a miss of analysts’ volume estimates.

Hub Group had the weakest performance against analyst estimates and weakest full-year guidance update among its peers. The stock is down 5.2% since reporting and currently trades at $43.86.

Read our full, actionable report on Hub Group here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.