Health and wellness products company USANA Health Sciences (NYSE:USNA) reported results in line with analysts' expectations in Q1 CY2024, with revenue down 8.3% year on year to $227.8 million. On the other hand, the company's full-year revenue guidance of $885 million at the midpoint came in slightly below analysts' estimates. It made a GAAP profit of $0.86 per share, down from its profit of $0.95 per share in the same quarter last year.

USANA (USNA) Q1 CY2024 Highlights:

- Revenue: $227.8 million vs analyst estimates of $226.8 million (small beat)

- EPS: $0.86 vs analyst estimates of $0.69 (24.6% beat)

- The company reconfirmed its revenue guidance for the full year of $885 million at the midpoint

- Gross Margin (GAAP): 81.1%, in line with the same quarter last year

- Market Capitalization: $827 million

Going to market with a direct selling model rather than through traditional retailers, USANA Health Sciences (NYSE:USNA) manufactures and sells nutritional, personal care, and skincare products.

Specifically, the company relies on the multi-level marketing approach to selling. This means that USANA customers act as its salespeople and these salespeople earn money through the recruitment of new salespeople, getting a percentage of sales made by their recruits.

With regard to its product portfolio, USANA offers vitamin and mineral supplements designed to meet cardiovascular, skeletal/structural, and digestive health needs. The company also sells meal replacement shakes, snack bars, and other related products. Lastly, it is also known for Celavive, a skin care regimen.

The USANA core customer is someone who cares about health and nutrition. These individuals are willing to spend a little extra to achieve their wellness goals, whether that is weight loss or improved overall health. Given its multi-level marketing approach, USANA customers are typically connected to someone who has had a good experience with the products.

However, many are skeptical about multi-level marketing approaches. Some say these companies are nothing more than pyramid schemes, which are illegal businesses where returns for older customers or investors are paid using the capital of newer customers and investors, rather than from profit earned. The structure relies on recruitment to sustain itself rather than actual demand for products.

Personal Care

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

Competitors offering health and wellness supplements and products include Herbalife (NYSE:HLF), Bellring Brands (NYSE:BRBR), and The Simply Good Foods Company (NASDAQ:SMPL).Sales Growth

USANA is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale.

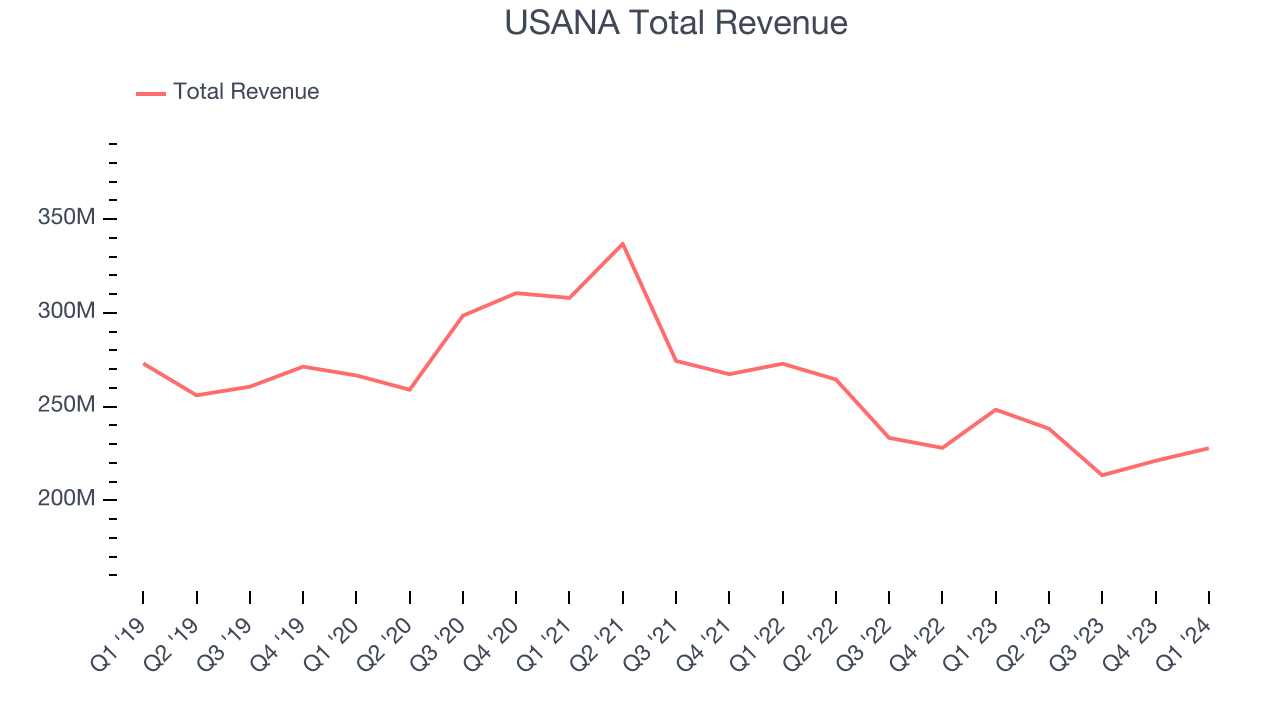

As you can see below, the company's revenue has declined over the last three years, dropping 8.5% annually. This is among the worst in the consumer staples industry, where demand is typically stable.

This quarter, USANA reported a rather uninspiring 8.3% year-on-year revenue decline to $227.8 million in revenue, in line with Wall Street's estimates. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months.

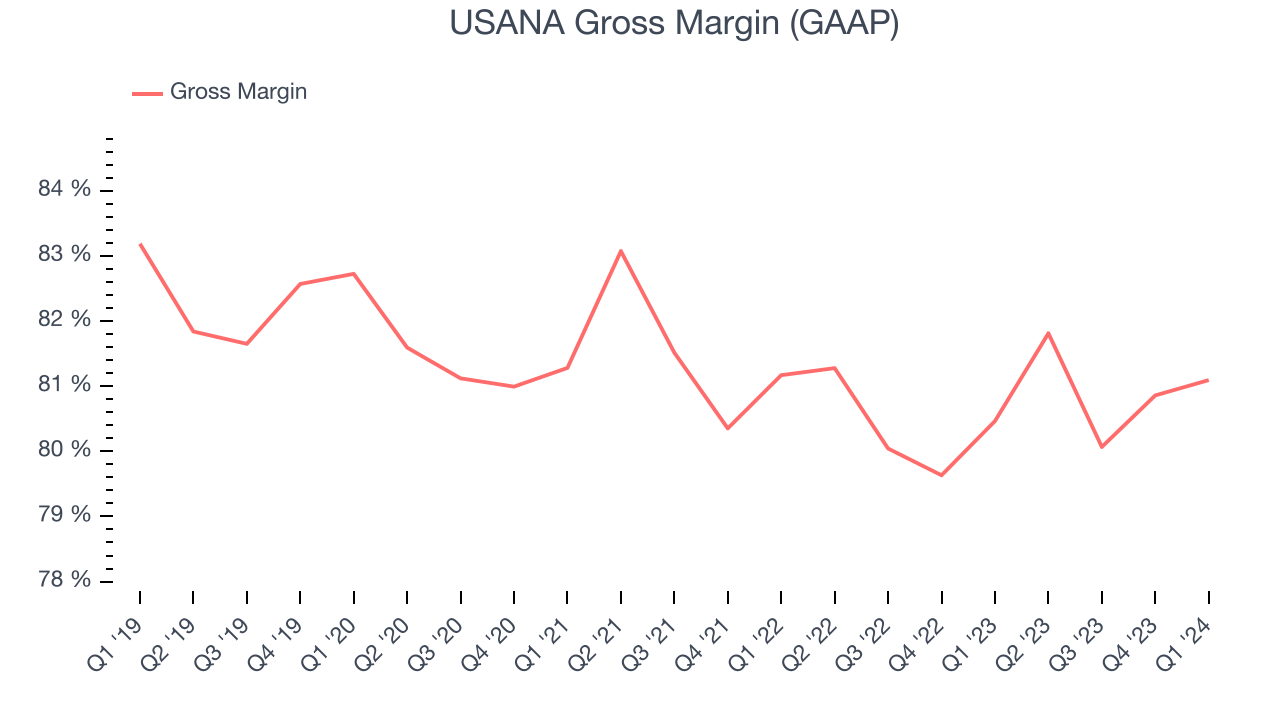

Gross Margin & Pricing Power

All else equal, we prefer higher gross margins. They usually indicate that a company sells more differentiated products and commands stronger pricing power.

This quarter, USANA's gross profit margin was 81.1%, in line with the same quarter last year. That means for every $1 in revenue, only $0.19 went towards paying for raw materials, production of goods, and distribution expenses.

USANA has best-in-class unit economics for a consumer staples company, enabling it to invest in areas such as marketing and talent to stay one step ahead of the competition. As you can see above, it's averaged an exceptional 80.7% gross margin over the last two years. Its margin has also been consistent over the last year, suggesting it has stable input costs (such as raw materials).

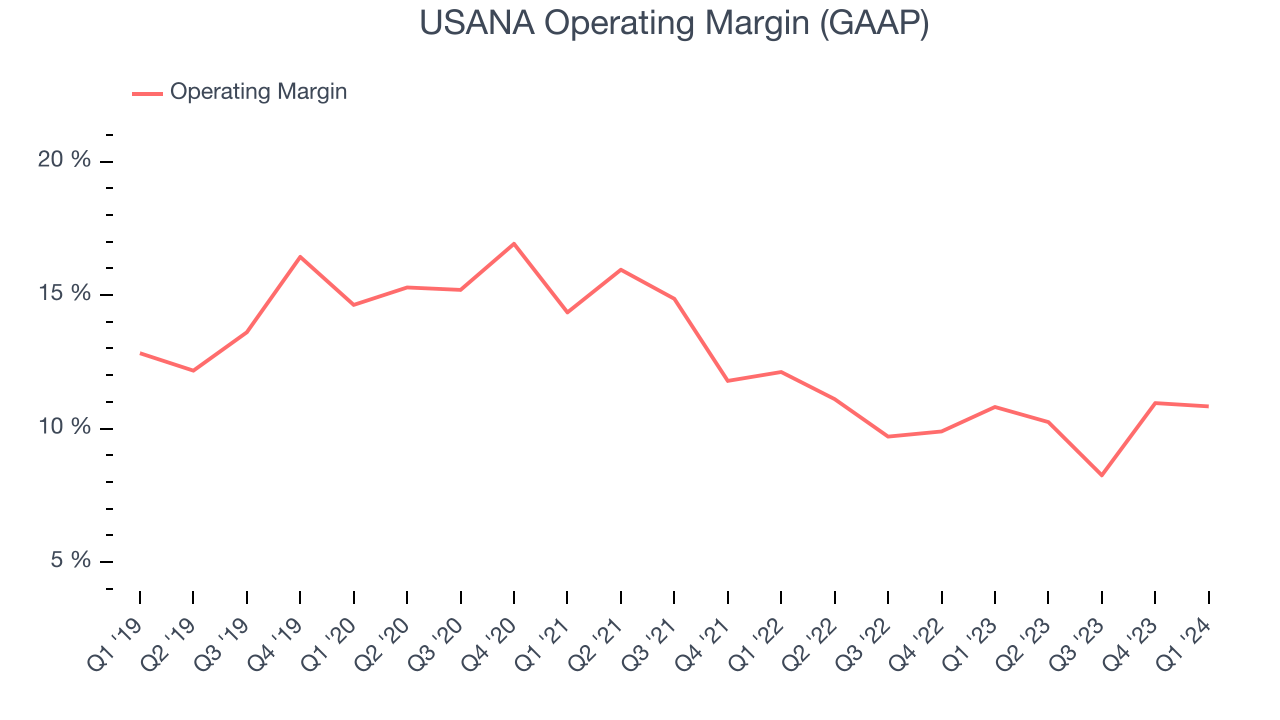

Operating Margin

Operating margin is an important measure of profitability accounting for key expenses such as marketing and advertising, IT systems, wages, and other administrative costs.

In Q1, USANA generated an operating profit margin of 10.8%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Zooming out, USANA has done a decent job managing its expenses over the last eight quarters. The company has produced an average operating margin of 10.3%, higher than the broader consumer staples sector. On top of that, its margin has remained more or less the same, highlighting the consistency of its business.

Zooming out, USANA has done a decent job managing its expenses over the last eight quarters. The company has produced an average operating margin of 10.3%, higher than the broader consumer staples sector. On top of that, its margin has remained more or less the same, highlighting the consistency of its business. EPS

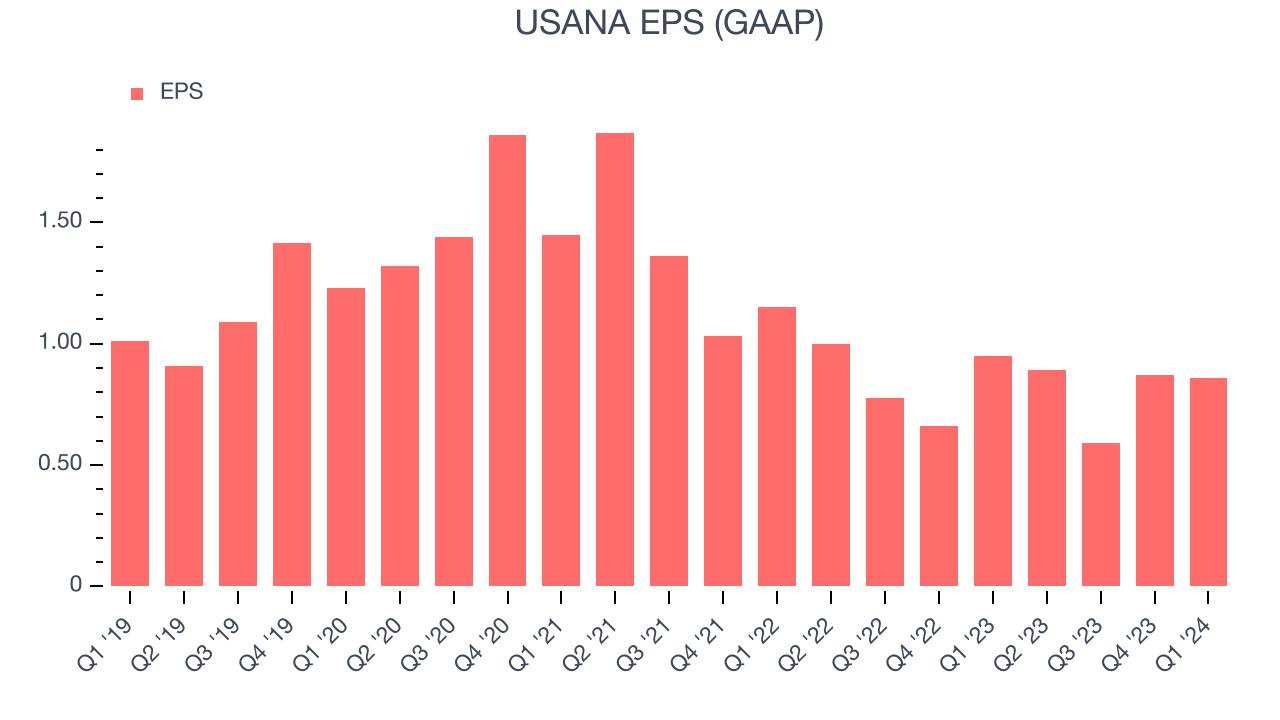

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

In Q1, USANA reported EPS at $0.86, down from $0.95 in the same quarter a year ago. This print beat Wall Street's estimates by 24.6%.

Between FY2021 and FY2024, USANA's EPS dropped 47.1%, translating into 19.1% annualized declines. We tend to steer our readers away from companies with falling EPS, especially in the consumer staples sector, where shrinking earnings could imply changing secular trends or consumer preferences. If there's no earnings growth, it's difficult to build confidence in a business's underlying fundamentals, leaving a low margin of safety around the company's valuation (making the stock susceptible to large downward swings).

Wall Street expects USANA to continue performing poorly over the next 12 months, with analysts projecting an average 11.7% year-on-year decline in EPS.

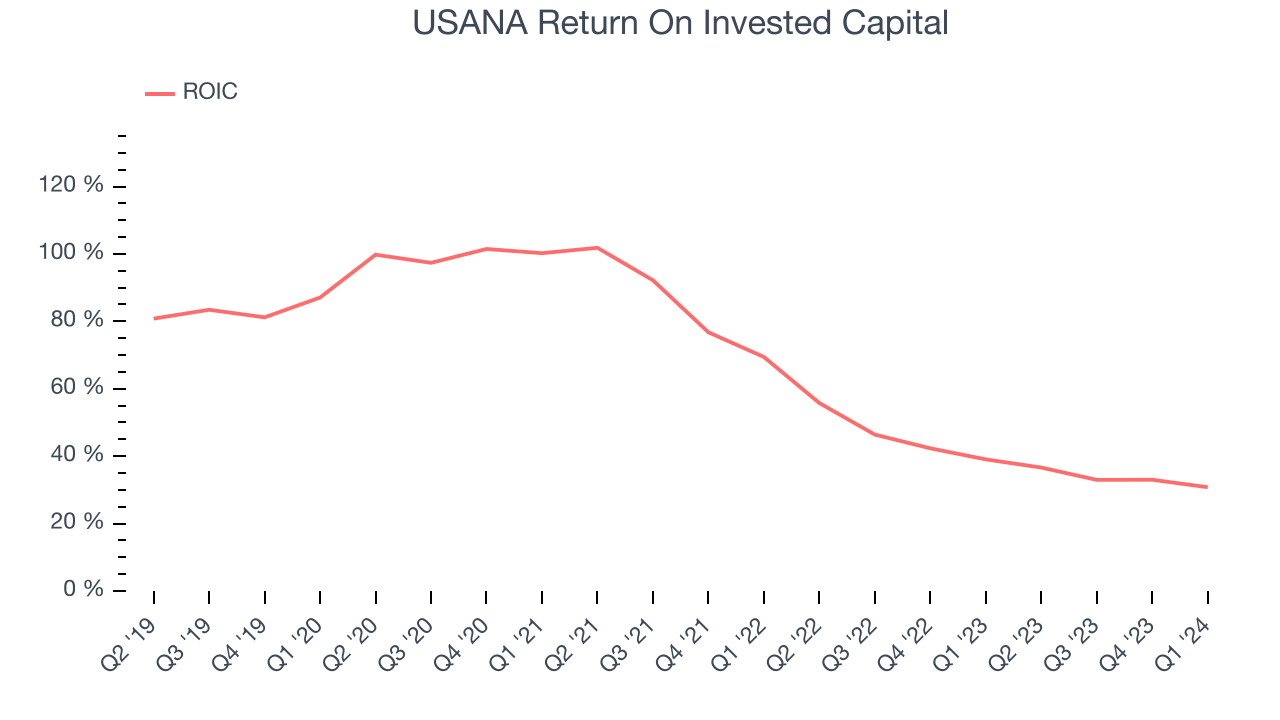

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Although USANA hasn't been the highest-quality company lately because of its poor top-line performance, it historically did a wonderful job investing in profitable business initiatives. Its five-year average ROIC was 56.6%, splendid for a consumer staples business.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, USANA's ROIC significantly decreased over the last few years. We like what management has done historically but are concerned its ROIC is declining, perhaps a symptom of waning business opportunities to invest profitably.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

USANA is a well-capitalized company with $328.3 million of cash and $1.32 million of debt, meaning it could pay back all its debt tomorrow and still have $327 million of cash on its balance sheet. This net cash position gives USANA the freedom to raise more debt, return capital to shareholders, or invest in growth initiatives.

Key Takeaways from USANA's Q1 Results

We enjoyed seeing USANA exceed analysts' operating margin and EPS expectations this quarter. On the other hand, its gross margin and full-year revenue guidance were underwhelming. Overall this quarter's results were mixed. The stock is flat after reporting and currently trades at $41.52 per share.

Is Now The Time?

USANA may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of USANA, we'll be cheering from the sidelines. Its revenue has declined over the last three years, but at least growth is expected to increase in the short term. And while its impressive gross margins are a wonderful starting point for the overall profitability of the business, the downside is its declining EPS over the last three years makes it hard to trust. On top of that, its projected EPS for the next year is lacking.

USANA's price-to-earnings ratio based on the next 12 months is 14.6x. While there are some things to like about USANA and its valuation is reasonable, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $56.50 per share right before these results (compared to the current share price of $41.52).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.