Vocational education Universal Technical Institute (NYSE:UTI) reported Q1 CY2024 results topping analysts' expectations, with revenue up 12.4% year on year to $184.2 million. The company's full-year revenue guidance of $725 million at the midpoint also came in 1.3% above analysts' estimates. It made a GAAP profit of $0.14 per share, improving from its profit of $0.04 per share in the same quarter last year.

Universal Technical Institute (UTI) Q1 CY2024 Highlights:

- Revenue: $184.2 million vs analyst estimates of $177.2 million (4% beat)

- EPS: $0.14 vs analyst expectations of $0.15 (4.1% miss)

- The company lifted its revenue guidance for the full year from $715 million to $725 million at the midpoint, a 1.4% increase

- Gross Margin (GAAP): 47.1%, down from 55.2% in the same quarter last year

- Free Cash Flow was -$8.40 million, down from $6.99 million in the previous quarter

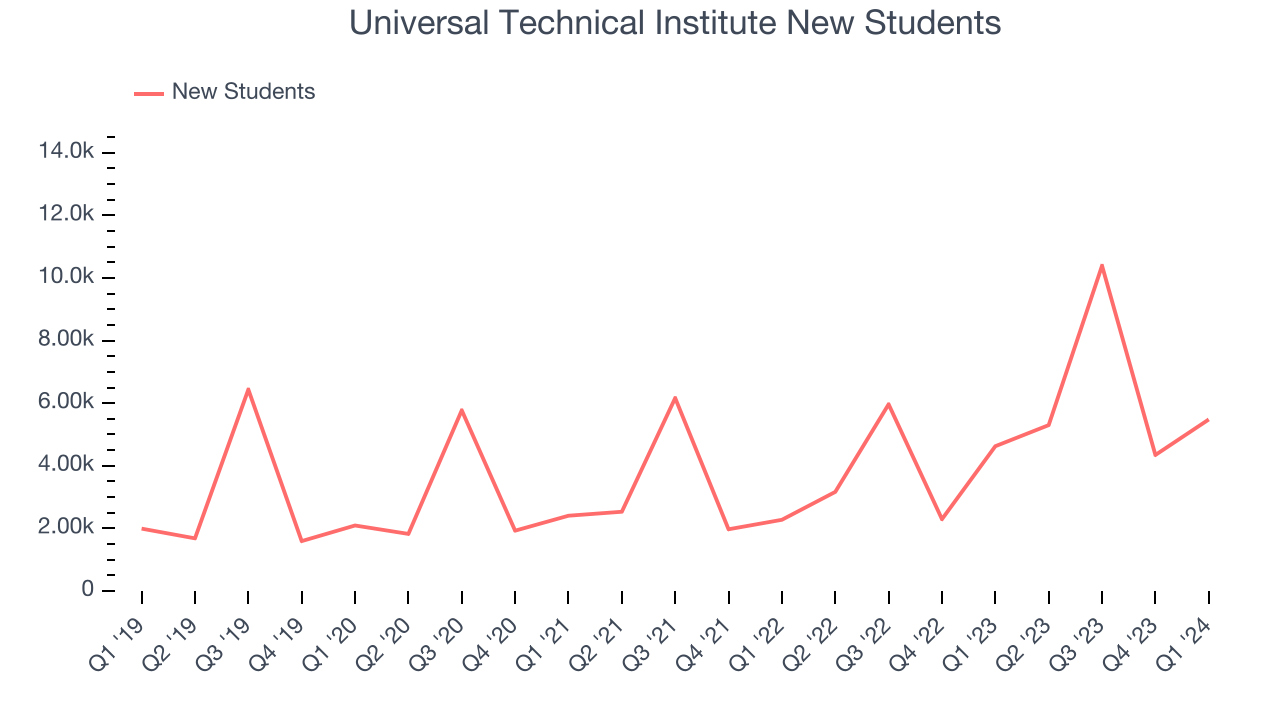

- New Students: 5,480

- Market Capitalization: $893.6 million

Founded in 1965, Universal Technical Institute (NYSE: UTI) is a leading provider of technical training programs, specializing in automotive, diesel, collision repair, motorcycle, and marine technicians.

UTI offers industry-aligned curricula and a hands-on training approach. The institute collaborates with some of the biggest names in the automotive and manufacturing sectors, such as Ford, BMW, and Harley-Davidson, to ensure that the training and education provided are aligned with industry needs and technological advancements.

The programs offered at UTI cover a range of transportation-related fields, and students pay tuition to enroll in its courses. In automotive, students are trained in vehicle repair and maintenance, including engine diagnostics, drivability, and electronic systems. The diesel technician training involves learning about large vehicles and engines, focusing on fuel systems, hydraulics, and power generators. Additionally, UTI offers specialized programs in collision repair, welding, CNC machining, and marine technology.

In addition to its core programs, UTI has expanded its offerings to include Manufacturer-Specific Advanced Training (MSAT) programs. These specialized courses are designed to provide advanced training in specific brands and technologies to give students an edge in the highly competitive job market.

One of UTI’s focuses is on career readiness. Its Career Services department actively assists students and graduates in finding employment opportunities, utilizing UTI's extensive network of industry contacts. This includes job placement assistance, resume building, and interview preparation.

Education Services

A whole industry has emerged to address the problem of rising education costs, offering consumers alternatives to traditional education paths such as four-year colleges. These alternative paths, which may include online courses or flexible schedules, make education more accessible to those with work or child-rearing obligations. However, some have run into issues around the value of the degrees and certifications they provide and whether customers are getting a good deal. Those who don’t prove their value could struggle to retain students, or even worse, invite the heavy hand of regulation.

Universal Technical Institute’s primary competitors include Lincoln Educational Services (NASDAQ:LINC), Adtalem Global Education (NYSE:ATGE), Strategic Education (NASDAQ:STRA), Chegg (NYSE:CHGG), and private companies WyoTech and Ohio Technical College.Sales Growth

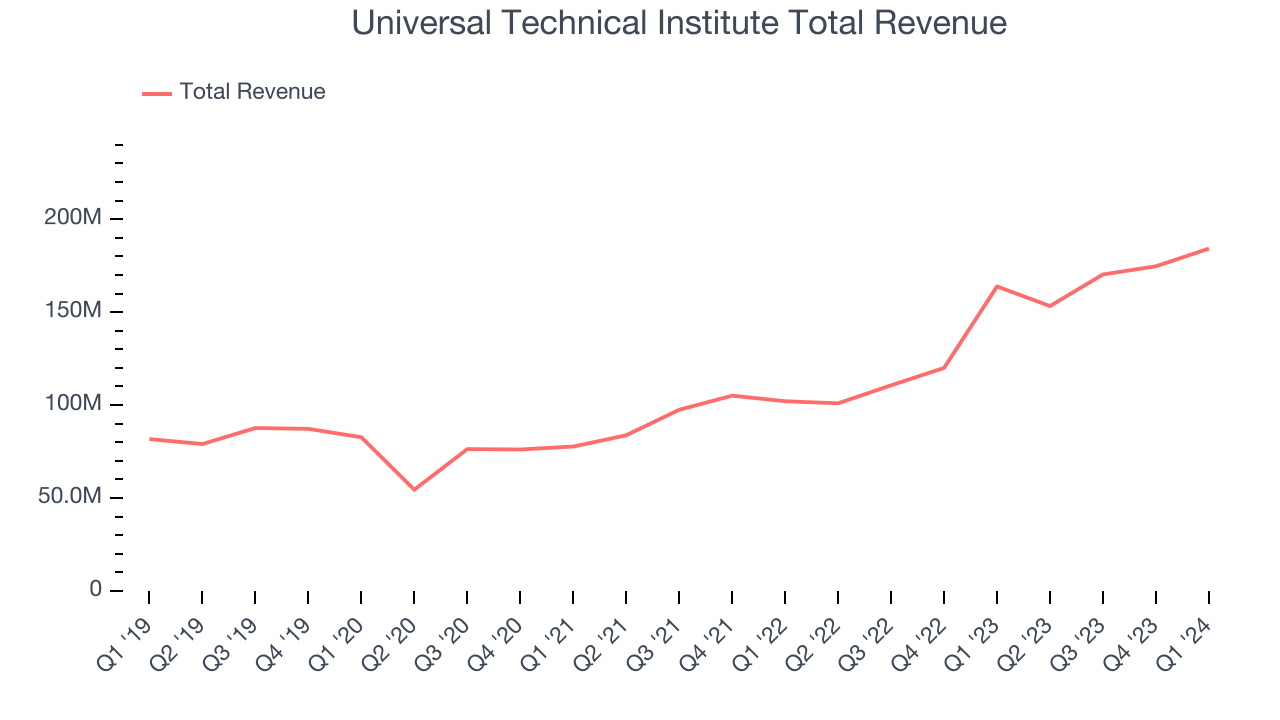

A company's long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones demonstrate sustained growth over multiple years. Universal Technical Institute's annualized revenue growth rate of 16.6% over the last five years was decent for a consumer discretionary business.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow more recent performance. Universal Technical Institute's annualized revenue growth of 32.6% over the last two years is above its five-year trend, suggesting its demand has recently accelerated.

We can better understand the company's revenue dynamics by analyzing its number of new students, which reached 5,480 in the latest quarter. Over the last two years, Universal Technical Institute's new students averaged 48.9% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company's monetization has fallen.

This quarter, Universal Technical Institute reported robust year-on-year revenue growth of 12.4%, and its $184.2 million of revenue exceeded Wall Street's estimates by 4%. Looking ahead, Wall Street expects sales to grow 7.7% over the next 12 months, a deceleration from this quarter.

Operating Margin

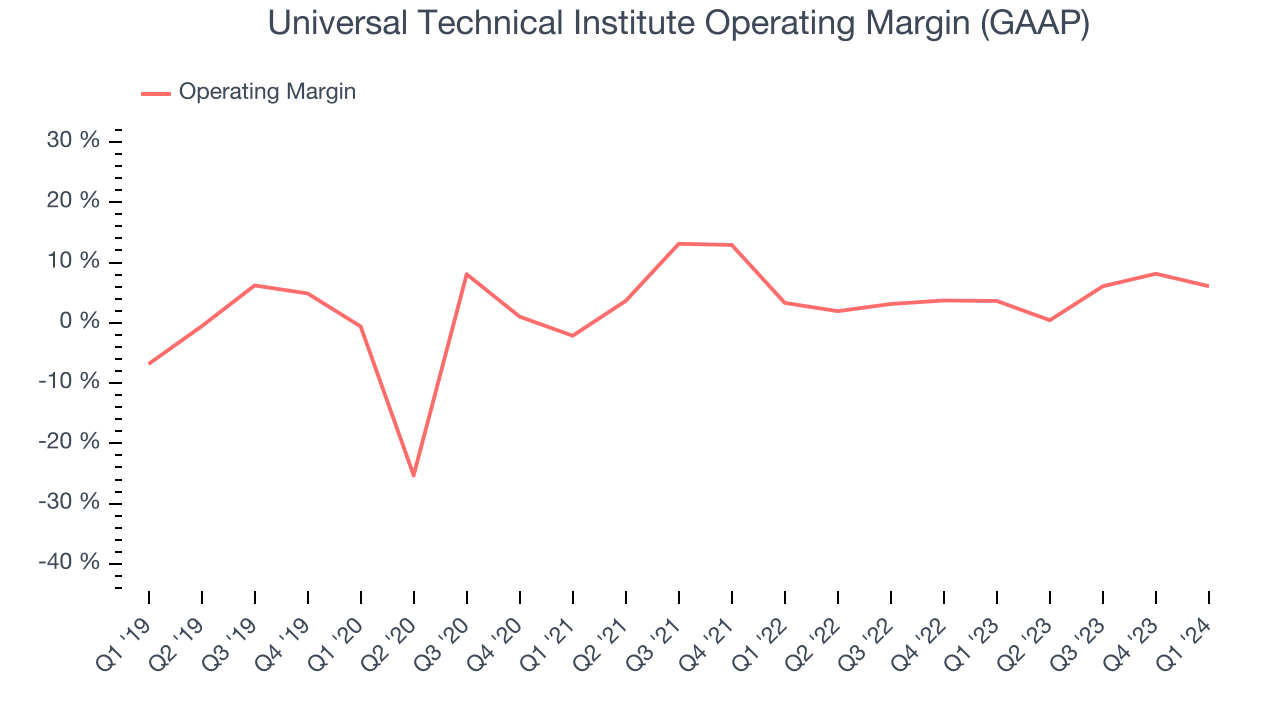

Universal Technical Institute was profitable over the last eight quarters but held back by its large expense base. It's demonstrated weak profitability for a consumer discretionary business, producing an average operating margin of 4.4%.

This quarter, Universal Technical Institute generated an operating profit margin of 6.1%, up 2.4 percentage points year on year. Looking ahead, Wall Street expects Universal Technical Institute to become more profitable. Analysts are expecting the company’s trailing 12 month operating margin of 5.3% to rise to 8.7% in the coming year.

EPS

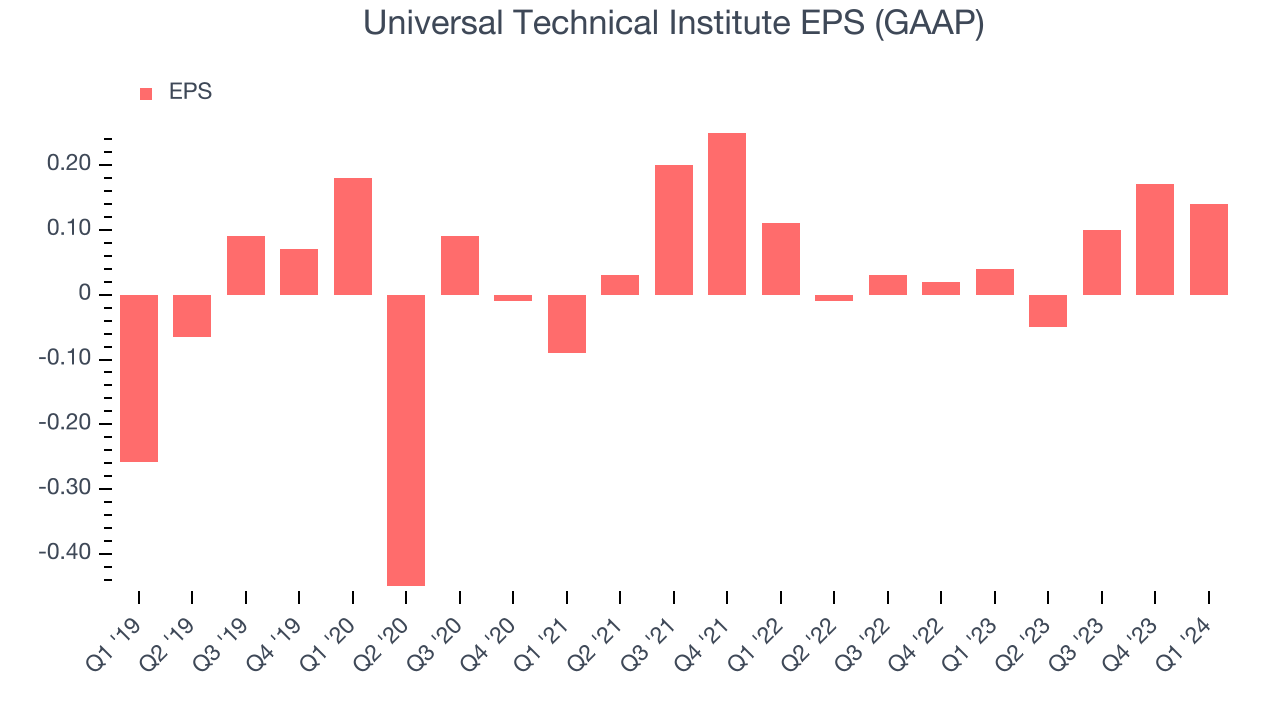

We track the long-term growth in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Universal Technical Institute's full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it's at a critical moment in its life.

In Q1, Universal Technical Institute reported EPS at $0.14, up from $0.04 in the same quarter last year. Despite growing year on year, this print missed analysts' estimates. But we care more about long-term EPS growth rather than short-term movements. Over the next 12 months, Wall Street expects Universal Technical Institute to grow its earnings. Analysts are projecting its EPS of $0.36 in the last year to climb by 118% to $0.79.

Cash Is King

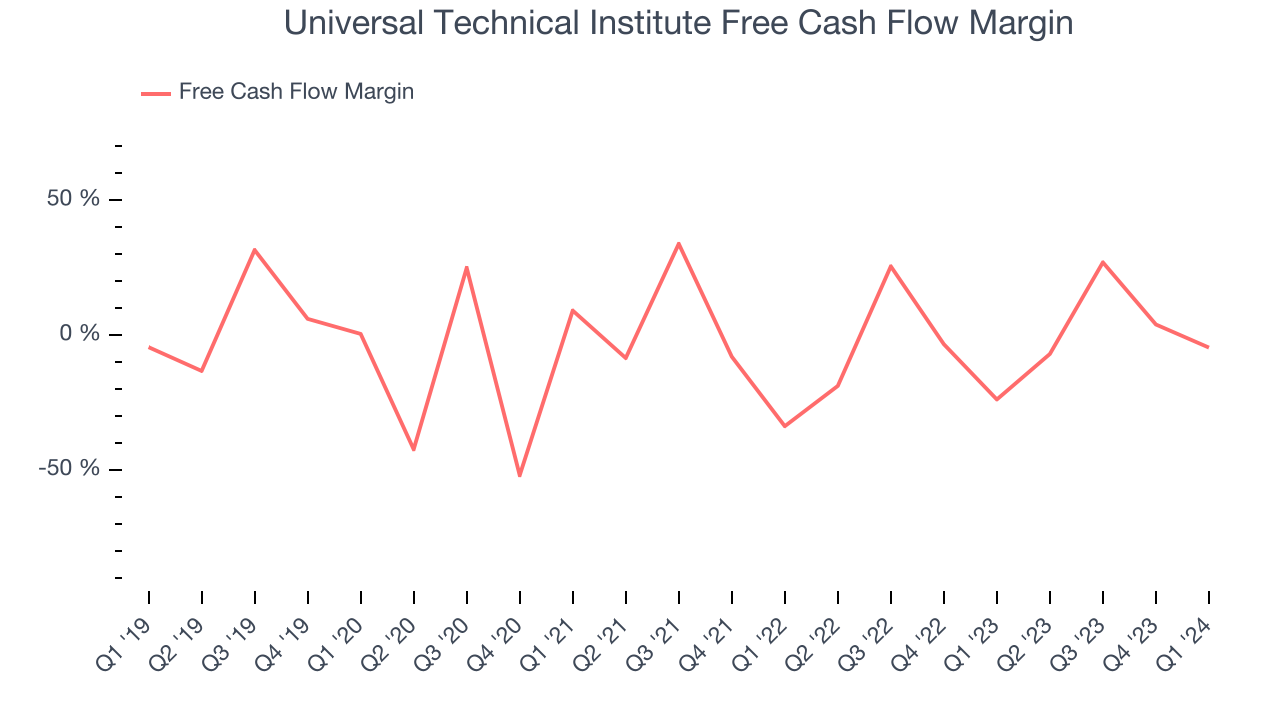

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Universal Technical Institute broke even from a free cash flow perspective over the last two years, subpar for a consumer discretionary business.

Universal Technical Institute burned through $8.40 million of cash in Q1, equivalent to a negative 4.6% margin. The company's cash burn increased by 78.4% year on year while its free cash flow margin climbed 19.2 percentage points. This dynamic shows that while Universal Technical Institute's management team spent more cash this quarter, it was more efficient at generating sales with that cash. Over the next year, analysts predict Universal Technical Institute's cash profitability will improve. Their consensus estimates imply its free cash flow margin of 5% for the last 12 months will increase to 7.7%, giving it more money to invest.

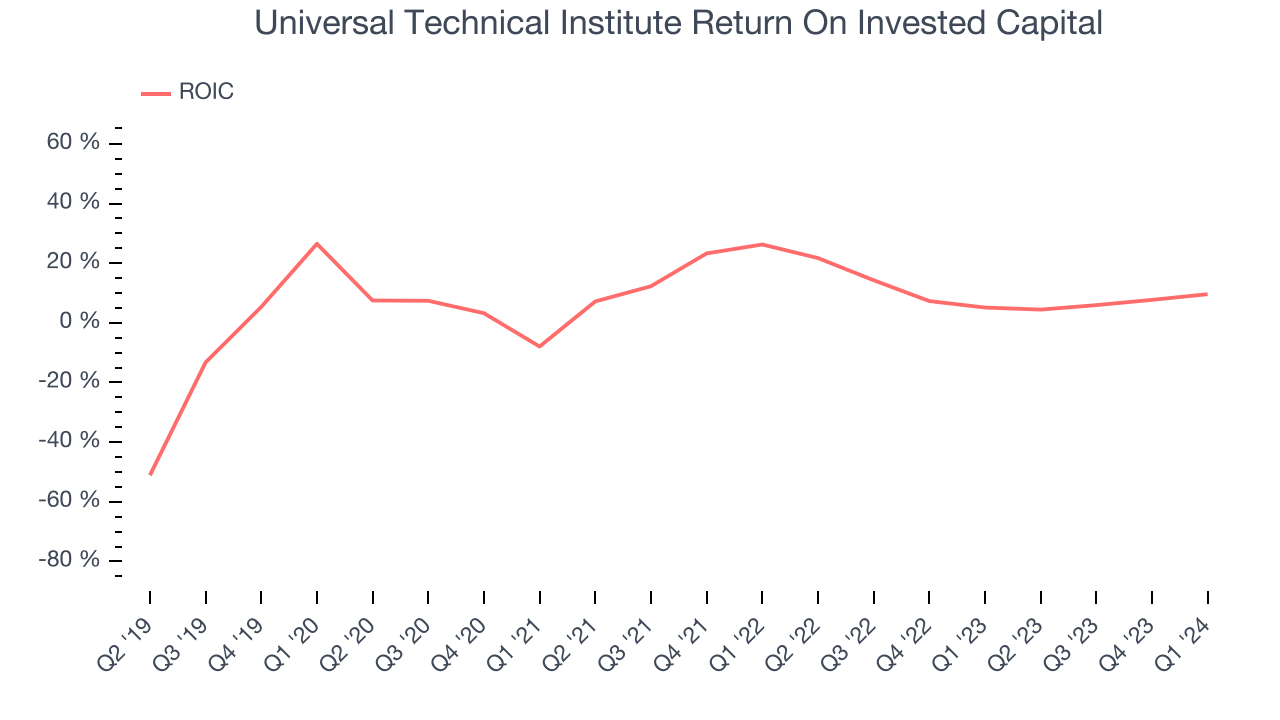

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money it has raised (debt and equity).

Universal Technical Institute's five-year average ROIC was 11.9%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+. Its returns suggest it was mediocre at investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Universal Technical Institute's ROIC averaged 1.9 percentage point decreases over the last few years. Paired with its already low returns, these declines suggest the company's profitable business opportunities are few and far between.

Key Takeaways from Universal Technical Institute's Q1 Results

It was good to see Universal Technical Institute beat analysts' revenue estimates this quarter as it added more new students than expected. We were also glad it lifted its full-year revenue guidance, which came in higher than Wall Street's projections. On the other hand, this quarter's EPS and operating margin fell short. Zooming out, we think this was still a decent, albeit mixed, quarter, showing that the company is staying on track. Investors were likely expecting more, and the stock is down 4.1% after reporting, trading at $16 per share.

Is Now The Time?

Universal Technical Institute may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

Universal Technical Institute isn't a bad business, but it probably wouldn't be one of our picks. Although its revenue growth has been solid over the last five years, its low free cash flow margins give it little breathing room. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its operating margins reveal poor profitability compared to other consumer discretionary companies.

Universal Technical Institute's EV-to-EBITDA ratio based on the next 12 months is 8.4x. In the end, beauty is in the eye of the beholder. While Universal Technical Institute wouldn't be our first pick, if you like the business, the shares are trading at a pretty interesting price.

Wall Street analysts covering the company had a one-year price target of $17.60 per share right before these results (compared to the current share price of $16).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.

Is Now The Time?

Universal Technical Institute may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

Universal Technical Institute isn't a bad business, but it probably wouldn't be one of our picks. Although its revenue growth has been solid over the last five years, its low free cash flow margins give it little breathing room. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its operating margins reveal poor profitability compared to other consumer discretionary companies.

In the end, beauty is in the eye of the beholder. While Universal Technical Institute wouldn't be our first pick, if you like the business, the shares are trading at a pretty interesting price right now.

Wall Street analysts covering the company had a one-year price target of $17.60 per share right before these results (compared to the current share price of $16).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.