Quarterly earnings results are a good time to check in on a company’s progress, especially compared to other peers in the same sector. Today we are looking at Veeva Systems (NYSE:VEEV), and the best and worst performers in the vertical software group.

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, there are industries that have very specific needs. Whether it is life-sciences, education or banking, the demand for so called vertical software, addressing industry specific workflows, is growing, fueled by the pressures on improving productivity and quality of offerings.

The 8 vertical software stocks we track reported a a solid Q2; on average, revenues beat analyst consensus estimates by 5.6%, while on average next quarter revenue guidance was 5.5% above consensus. The market rewarded the results with the average return the day after earnings coming in at 3.07%.

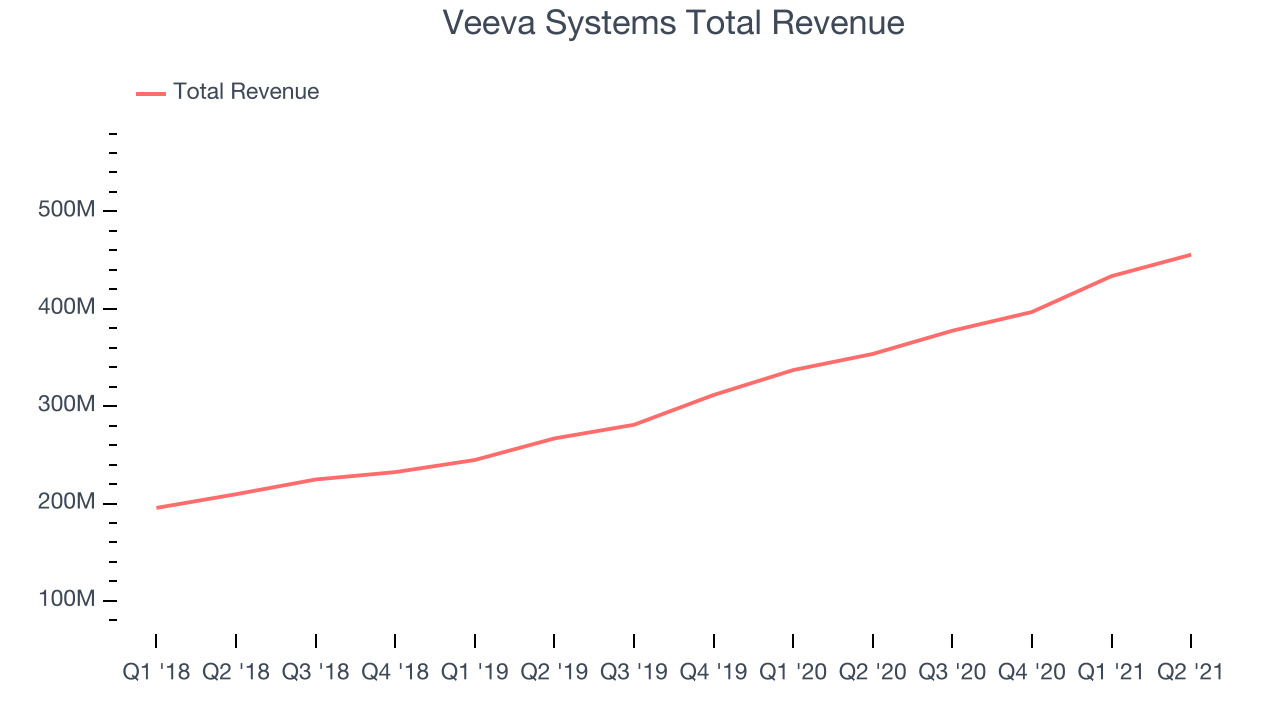

Veeva Systems (NYSE:VEEV)

Founded in 2007, Veeva provides data and customer relationship management (CRM) software for organizations in the life sciences industry.

Veeva Systems reported revenues of $455.5 million, up 28.8% year on year, beating analyst expectations by 1.03%. It was a decent quarter for the company, with a strong top line growth but decelerating customer growth.

"Thanks to the team and the trust of our customers, it was another great quarter," said CEO Peter Gassner.

The stock is down 14.9% since the results and currently trades at $284.20.

Is now the time to buy Veeva Systems? Access our full analysis of the earnings results here, it's free.

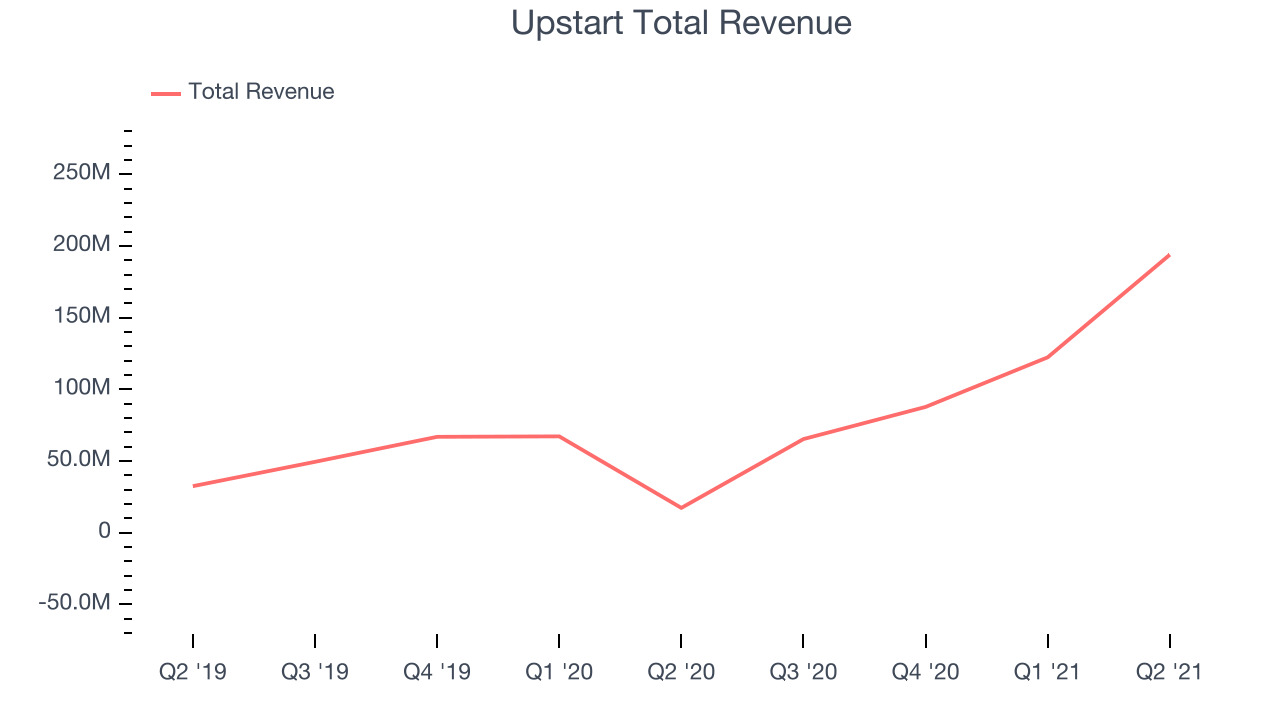

Best Q2: Upstart (NASDAQ:UPST)

Founded in 2012, Upstart (NASDAQ:UPST) is an AI-powered lending platform that helps banks better evaluate the risk of lending money to a person and provide loans to more customers.

Upstart reported revenues of $193.9 million, up more than 10x year on year, beating analyst expectations by 22.9%. It was an exceptional quarter for the company, with an impressive beat of analyst estimates and an incredible revenue growth.

Upstart achieved the strongest analyst estimates beat and fastest revenue growth among its peers. The stock is up 129% since the results and currently trades at $311.10.

Is now the time to buy Upstart? Access our full analysis of the earnings results here, it's free.

Weakest Q2: 2U (NASDAQ:TWOU)

Founded in 2008 by John Katzman and Jeremy Johnson, 2U provides software for universities and colleges to deliver online degree programs and courses.

2U reported revenues of $237.2 million, up 29.8% year on year, beating analyst expectations by 1.54%. It was a weaker quarter for the company, with a strong top line growth but a full year guidance missing analysts' expectations.

2U had the weakest full year guidance update in the group. The stock is down 27.4% since the results and currently trades at $33.40.

Read our full analysis of 2U's results here.

nCino (NASDAQ:NCNO)

Founded in 2011 in North Carolina, nCino makes cloud-based operating systems for banks and provides that software as a service.

nCino reported revenues of $66.5 million, up 36.4% year on year, beating analyst expectations by 4.39%. It was a strong quarter for the company, with a significant improvement in gross margin.

The stock is up 8.34% since the results and currently trades at $68.29.

Read our full, actionable report on nCino here, it's free.

Unity (NYSE:U)

Founded in 2004 as a game studio by three friends in a Copenhagen apartment, Unity (NYSE:U) is a software as a service platform that makes it easier to develop and monetize new games and other visual digital experiences.

Unity reported revenues of $273.5 million, up 48.4% year on year, beating analyst expectations by 12.6%. It was a very strong quarter for the company, with an impressive beat of analyst estimates and an exceptional revenue growth.

The stock is up 26.6% since the results and currently trades at $135.71.

Is now the time to buy Unity? Access our full analysis of the earnings results here, it's free.

The author has no position in any of the stocks mentioned