Looking back on vertical software stocks' Q4 earnings, we examine this quarter's best and worst performers, including Veeva Systems (NYSE:VEEV) and its peers.

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, there are industries that have very specific needs. Whether it is life-sciences, education or banking, the demand for so called vertical software, addressing industry specific workflows, is growing, fueled by the pressures on improving productivity and quality of offerings.

The 17 vertical software stocks we track reported a mixed Q4; on average, revenues beat analyst consensus estimates by 2.94%, while on average next quarter revenue guidance was 3.73% under consensus. Tech stocks have been hit the hardest as investors start to value profits over growth, but vertical software stocks held their ground better than others, with share prices down 3.02% since the previous earnings results, on average.

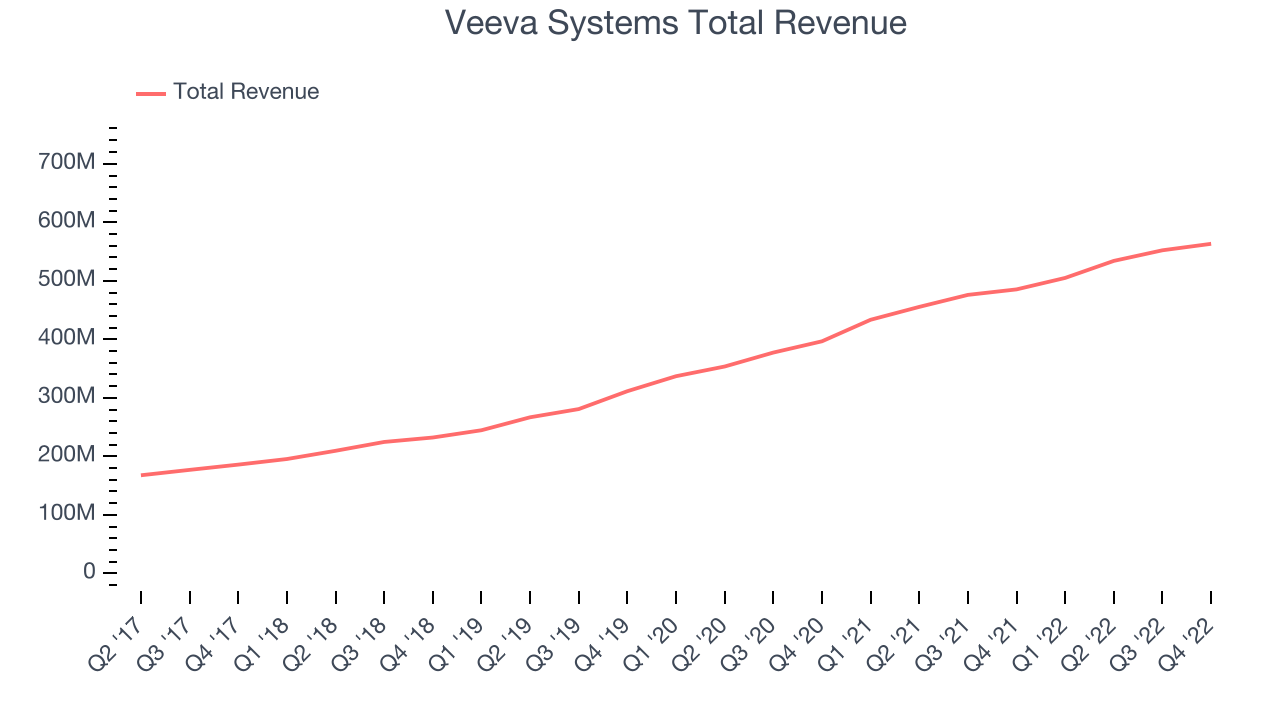

Veeva Systems (NYSE:VEEV)

Built on top of Salesforce as one of the first vertical-focused cloud platforms, Veeva (NYSE:VEEV) provides data and customer relationship management (CRM) software for organizations in the life sciences industry.

Veeva Systems reported revenues of $563.4 million, up 16% year on year, beating analyst expectations by 1.97%. It was a weak quarter for the company, with revenue guidance for the next quarter and the full year missing analysts' expectations.

"Our partnership with the industry strengthened in all customer segments and geographies this year as we build a durable, growth business for the long term," said CEO Peter Gassner.

The stock is up 10.2% since the results and currently trades at $183.14.

Read our full report on Veeva Systems here, it's free.

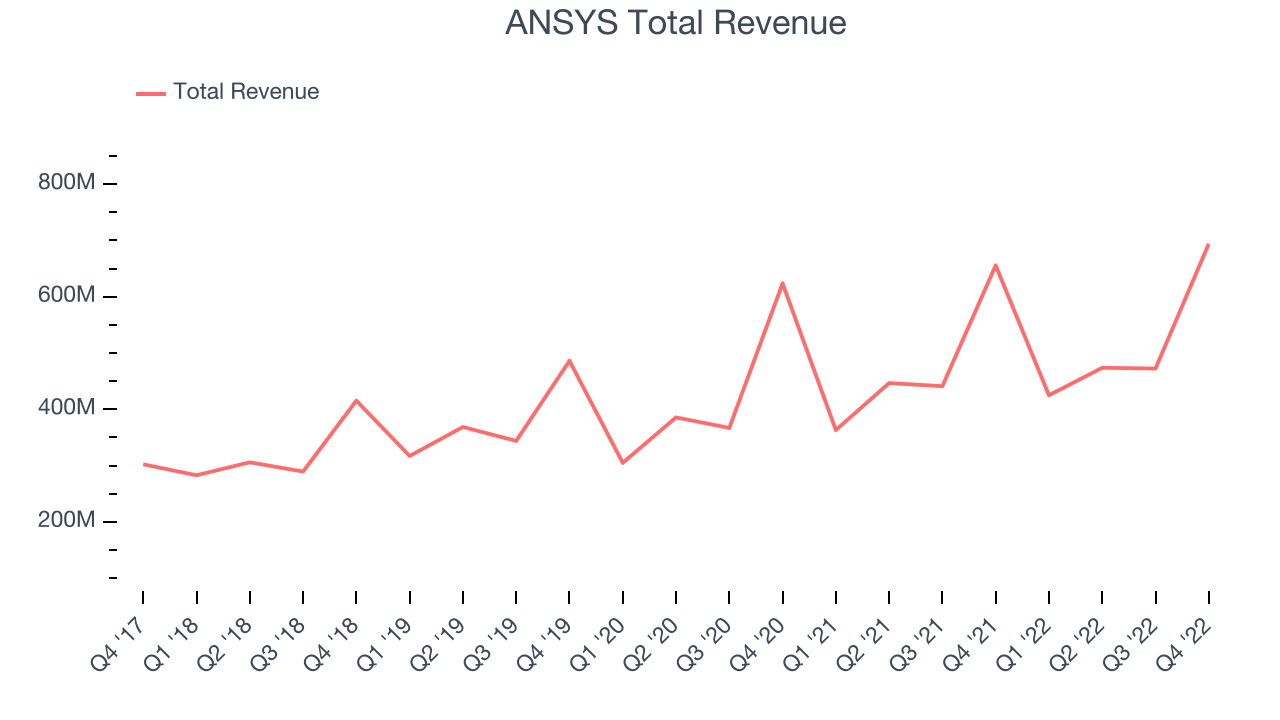

Best Q4: ANSYS (NASDAQ:ANSS)

Used to help design the Mars Rover, Ansys (NASDAQ:ANSS) offers a software-as-a-service platform that enables simulation for engineering and design.

ANSYS reported revenues of $694.1 million, up 5.86% year on year, beating analyst expectations by 6.87%. It was a very strong quarter for the company, with very optimistic guidance for the next quarter and full year.

ANSYS scored the highest full year guidance raise among its peers. The stock is up 24.6% since the results and currently trades at $333.02.

Is now the time to buy ANSYS? Access our full analysis of the earnings results here, it's free.

Slowest Q4: Q2 Holdings (NYSE:QTWO)

Founded in 2004 by Hank Seale, Q2 (NYSE:QTWO) offers software as a service that enables small banks provide online banking and consumer lending services to their clients.

Q2 Holdings reported revenues of $146.5 million, up 11.1% year on year, missing analyst expectations by 1.87%. It was a weak quarter for the company, with revenue guidance for the next quarter and the full year guidance missing analysts' expectations.

Q2 Holdings had the weakest performance against analyst estimates in the group. The stock is down 22.4% since the results and currently trades at $24.62.

Read our full analysis of Q2 Holdings's results here.

Autodesk (NASDAQ:ADSK)

Founded in 1982 by John Walker and growing into one of the industry's behemoths, Autodesk (NASDAQ:ADSK) makes computer-aided design (CAD) software for engineering, construction, and architecture companies.

Autodesk reported revenues of $1.32 billion, up 8.78% year on year, in line with analyst expectations. It was a weak quarter for the company, with a full year guidance missing analysts' expectations.

The stock is down 5.72% since the results and currently trades at $208.5.

Read our full, actionable report on Autodesk here, it's free.

Procore Technologies (NYSE:PCOR)

Used to manage the multi-year expansion of the Panama Canal that began in 2007, Procore Technologies (NYSE:PCOR) offers a software-as-service project, finance and quality management platform for the construction industry.

Procore Technologies reported revenues of $186.4 million, up 41.2% year on year, beating analyst expectations by 5.94%. It was a strong quarter for the company, with exceptional revenue growth.

The company added 683 customers to a total of 14,086. The stock is up 24.9% since the results and currently trades at $62.63.

Read our full, actionable report on Procore Technologies here, it's free.

The author has no position in any of the stocks mentioned