Healthcare software provider Veeva Systems (NASDAQ:VEEV) reported Q4 FY2024 results exceeding Wall Street analysts' expectations, with revenue up 11.9% year on year to $630.6 million. On the other hand, the company expects next quarter's revenue to be around $641.5 million, slightly below analysts' estimates. It made a non-GAAP profit of $1.38 per share, improving from its profit of $1.15 per share in the same quarter last year.

Veeva Systems (VEEV) Q4 FY2024 Highlights:

- Revenue: $630.6 million vs analyst estimates of $621.1 million (1.5% beat)

- EPS (non-GAAP): $1.38 vs analyst estimates of $1.30 (6.2% beat)

- Revenue Guidance for Q1 2025 is $641.5 million at the midpoint, below analyst estimates of $647 million

- Management's revenue guidance for the upcoming financial year 2025 is $2.73 billion at the midpoint, missing analyst estimates by 0.6% and implying 15.6% growth (vs 9.6% in FY2024)

- Free Cash Flow of $50.03 million, down 34.8% from the previous quarter

- Gross Margin (GAAP): 72.4%, up from 70.8% in the same quarter last year

- Market Capitalization: $36.29 billion

Built on top of Salesforce as one of the first vertical-focused cloud platforms, Veeva (NYSE:VEEV) provides data and customer relationship management (CRM) software for organizations in the life sciences industry.

It was built as a cloud software platform that enables the sales reps of pharmaceutical companies to manage interactions with healthcare professionals. The platform took off around the time the iPad was launched as the portable device made it easier for pharmaceutical salespeople to keep track of doctor visits and other clinical information.

Veeva was founded by former Salesforce executive Peter Gassner, who saw the opportunity to develop a CRM solution for the healthcare space. The company has since expanded its offerings to meet growing trends in the healthcare sector. While the CRM product remains the biggest revenue driver, it also offers Veeva Vault, a data and content management software for managing drug development and clinical trials. Today, Veeva is investing in modern cloud-based products like Nitro, which is a data warehouse for the life sciences industry.

Healthcare And Life Sciences Software

The coronavirus pandemic has underscored the importance of high-quality health infrastructure in times of crisis. Coupled with intense competition between drugmakers and the growing volume of data in the health care sector, demand for data management solutions in the healthcare space is expected to remain strong in the years ahead.

Veeva is competing with companies like IQVIA, Dassault Systèmes, OpenText Corporation (NASDAQ: OTEX), and Oracle Corporation (NYSE:ORCL).

Sales Growth

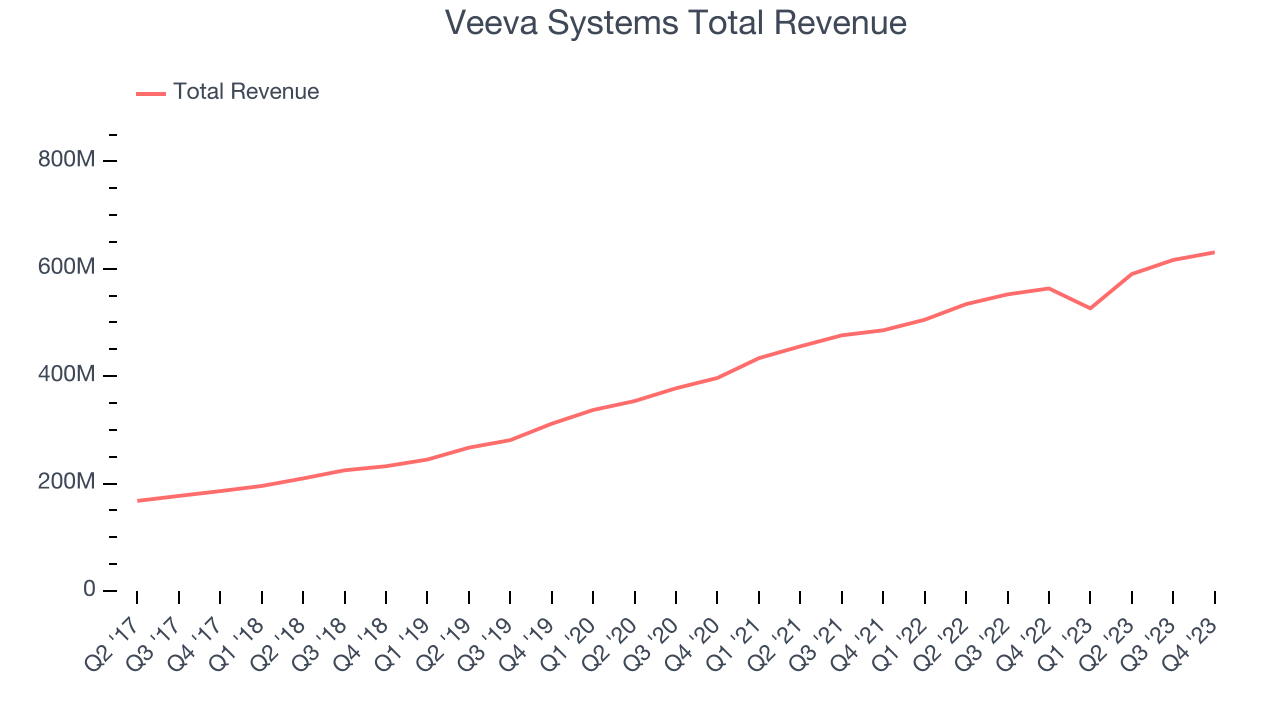

As you can see below, Veeva Systems's revenue growth has been mediocre over the last two years, growing from $485.5 million in Q4 FY2022 to $630.6 million this quarter.

This quarter, Veeva Systems's quarterly revenue was once again up 11.9% year on year. However, its growth did slow down compared to last quarter as the company's revenue increased by just $14.11 million in Q4 compared to $26.28 million in Q3 2024. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that Veeva Systems is expecting revenue to grow 21.9% year on year to $641.5 million, improving on the 4.2% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $2.73 billion at the midpoint, growing 15.6% year on year compared to the 9.7% increase in FY2024.

Profitability

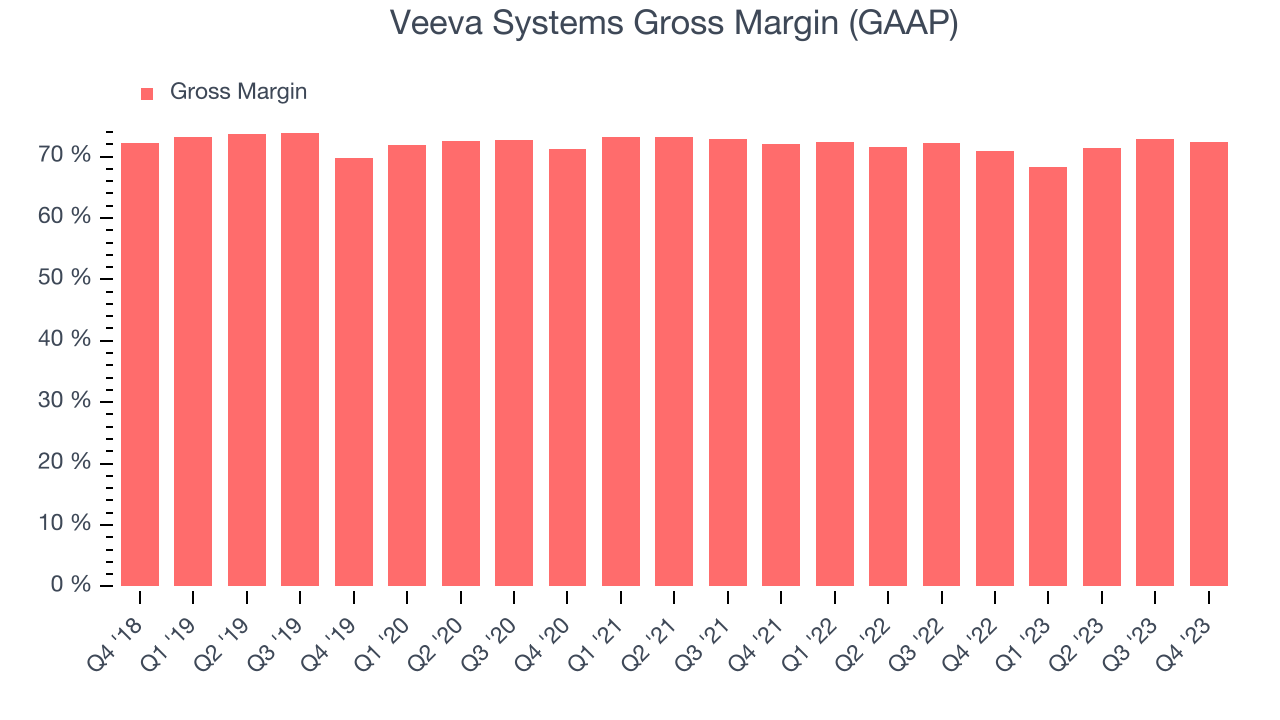

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Veeva Systems's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 72.4% in Q4.

That means that for every $1 in revenue the company had $0.72 left to spend on developing new products, sales and marketing, and general administrative overhead. Veeva Systems's gross margin is lower than that of a typical SaaS businesses. Gross margin has a major impact on a company’s ability to develop new products and invest in marketing, which may ultimately determine the winner in a competitive market. This makes it a critical metric to track for the long-term investor.

Cash Is King

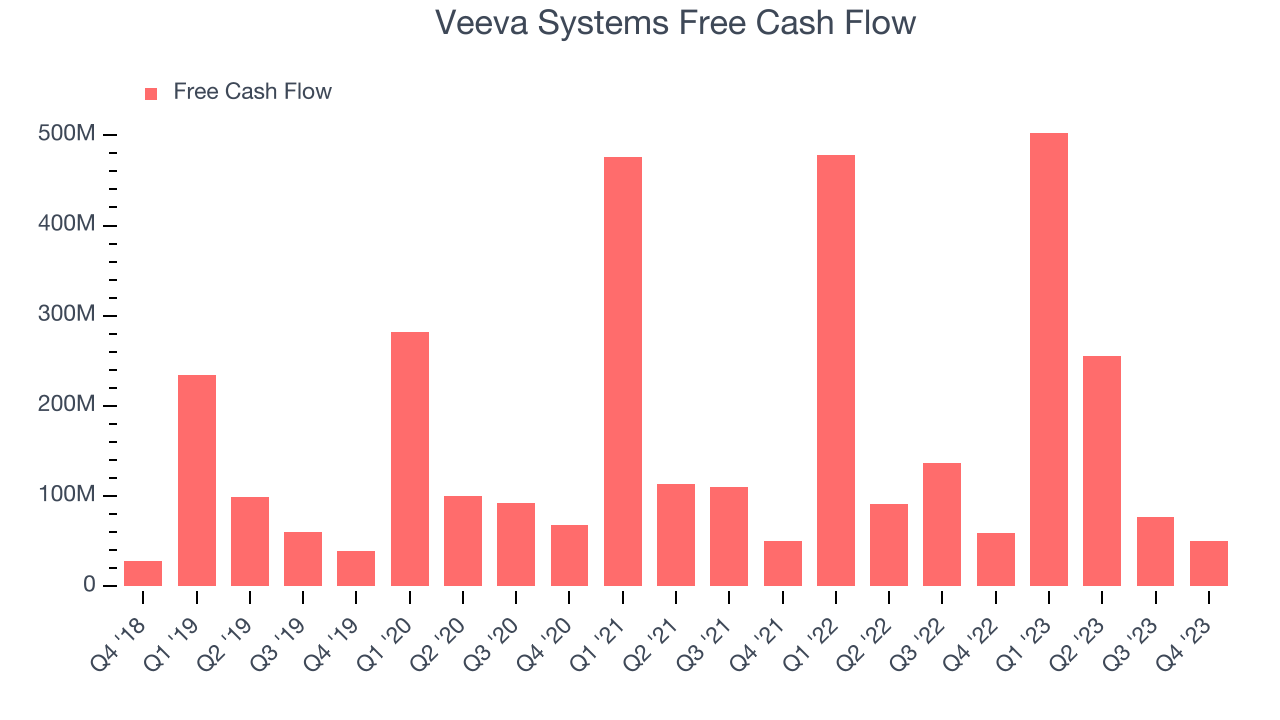

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Veeva Systems's free cash flow came in at $50.03 million in Q4, down 15.8% year on year.

Veeva Systems has generated $885.1 million in free cash flow over the last 12 months, an eye-popping 37.4% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Key Takeaways from Veeva Systems's Q4 Results

It was great to see Veeva Systems beat analysts' revenue and EPS expectations, driven by strong outperformance in its subscription services. We were also happy its EPS guidance for the full year 2024 topped Wall Street's estimates, though its revenue forecast did slightly miss.

In January 2024, the company announced the launch of its commercial data product, Veeva Compass. Compass "uniquely supports the needs of today's medicines because it includes projected data for both retail products and complex in-office therapies".

We thought this was a mixed quarter because its revenue guidance could have been better, but the stock is up 4.7% after reporting. It currently trades at $235.7 per share.

Is Now The Time?

Veeva Systems may have had a bad quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We think Veeva Systems is a good business. Although its revenue growth is mediocre, its bountiful generation of free cash flow empowers it to invest in growth initiatives.

Veeva Systems's price-to-sales ratio based on the next 12 months of 13.4x indicates that the market is certainly optimistic about its growth prospects. There are definitely a lot of things to like about Veeva Systems and looking at the tech landscape right now, it seems that the company trades at a pretty interesting price point.

Wall Street analysts covering the company had a one-year price target of $217.39 per share right before these results (compared to the current share price of $235.70).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.