Lifestyle clothing conglomerate VF Corp (NYSE:VFC) missed analysts' expectations in Q3 FY2024, with revenue down 16.2% year on year to $2.96 billion. It made a non-GAAP profit of $0.57 per share, down from its profit of $1.12 per share in the same quarter last year.

VF Corp (VFC) Q3 FY2024 Highlights:

- Revenue: $2.96 billion vs analyst estimates of $3.25 billion (8.9% miss)

- EPS (non-GAAP): $0.57 vs analyst expectations of $0.78 (27.1% miss)

- Free Cash Flow of $1.10 billion is up from -$217.4 million in the previous quarter

- Gross Margin (GAAP): 55.1%, in line with the same quarter last year

- Market Capitalization: $6.43 billion

Owner of The North Face, Vans, and Supreme, VF Corp (NYSE:VFC) is a clothing conglomerate specializing in branded lifestyle apparel, footwear, and accessories.

Its brands cater to different lifestyles and consumer segments, and some notable names under the VF Corp umbrella include The North Face, a top brand for outdoor apparel, gear, and footwear; Vans, a leading brand known for its skate-culture-inspired shoes and apparel; Supreme, a well-known streetwear brand; and others (Timberland, Dickies, JanSport).

VF Corp's target consumer base is as diverse as its brand portfolio, ranging from outdoor enthusiasts and athletes to fashion-conscious individuals and professionals needing workwear. Its products can be found at various retailers, department stores, and e-commerce websites.

Apparel, Accessories and Luxury Goods

Within apparel and accessories, not only do styles change more frequently today than decades past as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel, accessories, and luxury goods companies have made concerted efforts to adapt while those who are slower to move may fall behind.

VF Corp's primary competitors include Nike, Inc. (NYSE:NKE), Adidas (OTCMKTS:ADDYY), Columbia Sportswear (NASDAQ:COLM), Lululemon (NASDAQ:LULU), and Levi (NYSE:LEVI).Sales Growth

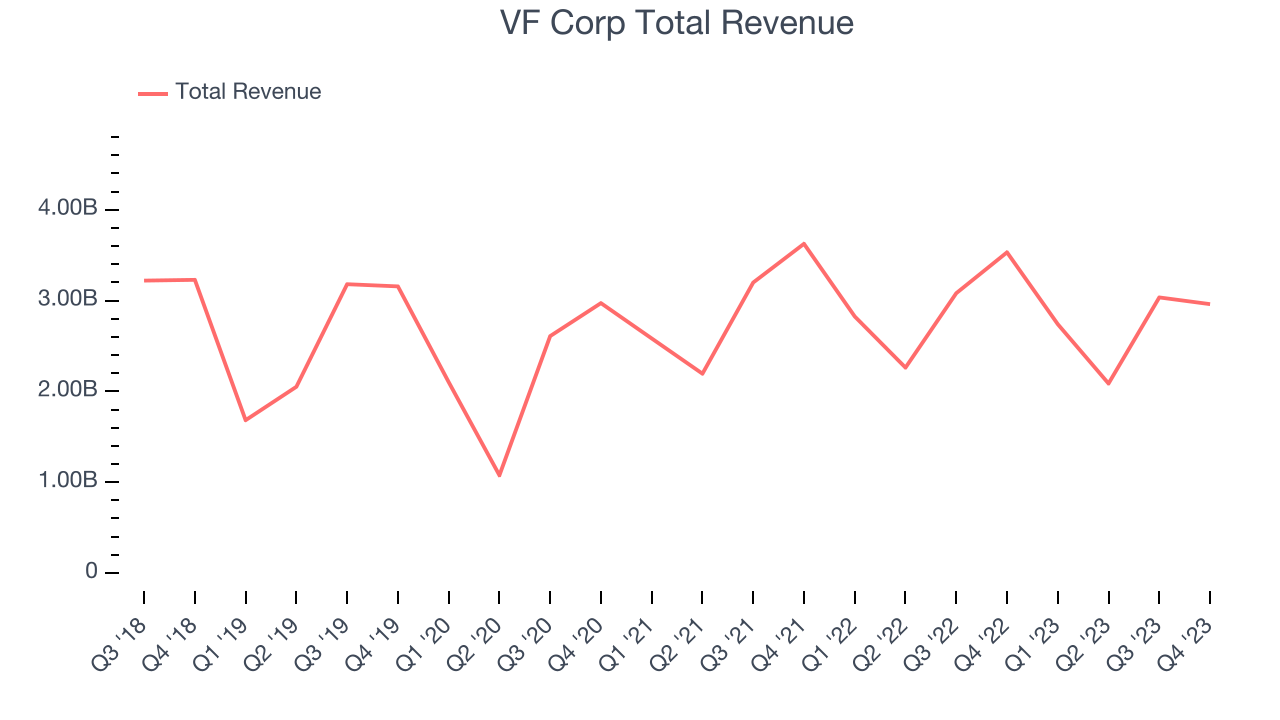

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one may grow for years. VF Corp's revenue was flat over the last 5 years.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. VF Corp's recent history shows a reversal from its 5-year trend, as its revenue has shown annualized declines of 3.4% over the last 2 years.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. VF Corp's recent history shows a reversal from its 5-year trend, as its revenue has shown annualized declines of 3.4% over the last 2 years.

VF Corp also reports sales performance excluding currency movements, which are outside the company’s control and not indicative of demand. Over the last 2 years, its constant currency sales were flat. Because this number is higher than its revenue growth during the same period, we can see that macroeconomic challenges hindered VF Corp's top-line performance.

This quarter, VF Corp missed Wall Street's estimates and reported a rather uninspiring 16.2% year-on-year revenue decline, generating $2.96 billion of revenue. Looking ahead, Wall Street expects sales to grow 2.9% over the next 12 months, an acceleration from this quarter.

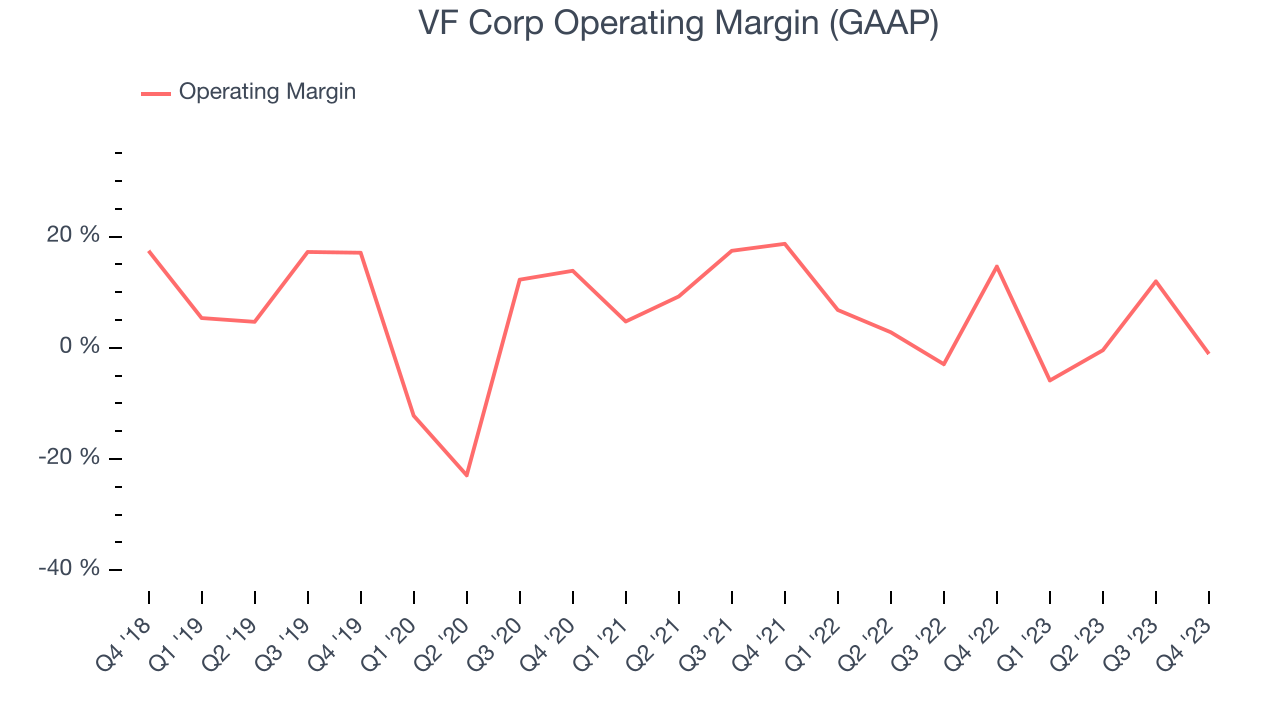

Operating Margin

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

VF Corp was profitable over the last two years but held back by its large expense base. Its average operating margin of 3.2% has been paltry for a consumer discretionary business.

This quarter, VF Corp generated an operating profit margin of negative 1.1%, down 15.7 percentage points year on year. This reduction indicates the company was less efficient with its expenses over the last year, spending more money in areas like corporate overhead and advertising.

Over the next 12 months, Wall Street expects VF Corp to become more profitable. Analysts are expecting the company’s LTM operating margin of 1.5% to rise to 9.2%, certainly a welcome development.EPS

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Over the last 5 years, VF Corp's EPS dropped 57.3%, translating into 15.6% annualized declines. We tend to steer our readers away from companies with falling EPS, especially in the consumer discretionary sector, where diminishing earnings could imply changing secular trends or consumer preferences. If there's no earnings growth, it's difficult to build confidence in a business's underlying fundamentals, leaving a low margin of safety around the company's valuation (making the stock susceptible to large downward swings).

In Q3, VF Corp reported EPS at $0.57, down from $1.12 in the same quarter a year ago. This print unfortunately missed analysts' estimates, but we care more about long-term EPS growth rather than short-term movements. Over the next 12 months, Wall Street expects VF Corp to grow its earnings. Analysts are projecting its LTM EPS of $1.23 to climb by 43.1% to $1.76.

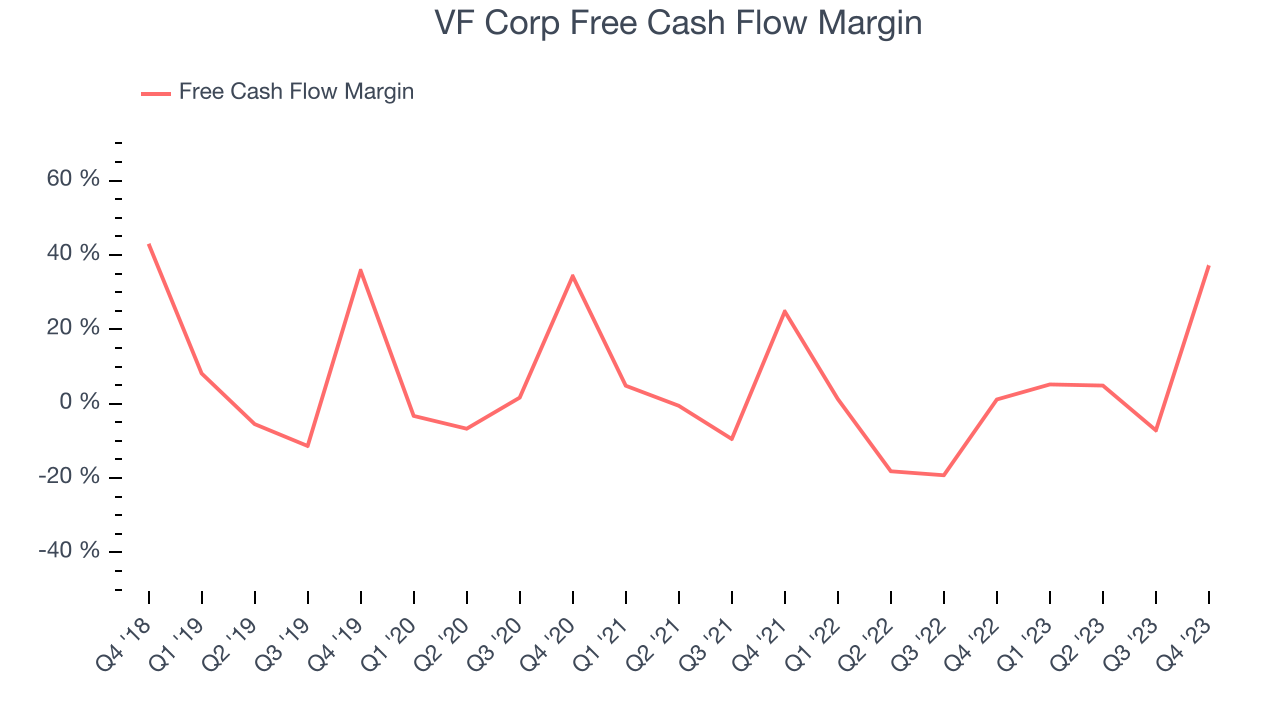

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, VF Corp broke even from a free cash flow perspective, subpar for a consumer discretionary business.

VF Corp's free cash flow came in at $1.10 billion in Q3 equivalent to a 37.2% margin, up 2,639% year on year. The gain was so large because VF Corp is a seasonal business, and during 2023, it was in a slump.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company's revenue growth was profitable. But was it capital-efficient? If two companies had equal growth, we’d prefer the one with lower reinvestment requirements.

Understanding a company’s ROIC (return on invested capital) gives us insight into this because it factors the total debt and equity needed to generate operating profits. This metric is a proxy for not only the capital efficiency of a business but also a management team's ability to allocate limited resources.

VF Corp's five-year average return on invested capital was 8.5%, somewhat low compared to the best consumer discretionary companies that pump out 25%+. Its returns suggest it historically did a subpar job investing in profitable growth initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, over the last two years, VF Corp's ROIC has averaged a 10 percentage point decrease each year. In conjunction with its already low returns, these suggest the company's profitable investment opportunities are slim.

Key Takeaways from VF Corp's Q3 Results

We struggled to find many strong positives in these results. Its revenue, operating margin, and EPS unfortunately missed analysts' expectations. This underperformance was driven by declines at The North Face ($1.2 billion of revenue vs estimates of $1.3 billion) and Vans ($668 million of revenue vs estimates of $720 million). Overall, the results could have been better. The company is down 6.1% on the results and currently trades at $15.93 per share.

Is Now The Time?

VF Corp may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of VF Corp, we'll be cheering from the sidelines. Its revenue growth has been weak over the last five years, but at least growth is expected to increase in the short term. And while its projected EPS growth for the next year implies the company's fundamentals will improve, the downside is its constant currency sales performance has been subpar over the last two years. On top of that, its declining EPS over the last five years makes it hard to trust.

VF Corp's price-to-earnings ratio based on the next 12 months is 9.7x. While we've no doubt one can find things to like about VF Corp, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.