As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q2. Today, we are looking at electrical systems stocks, starting with Vertiv (NYSE:VRT).

Like many equipment and component manufacturers, electrical systems companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include Internet of Things (IoT) connectivity and the 5G telecom upgrade cycle, which can benefit companies whose cables and conduits fit those needs. But like the broader industrials sector, these companies are also at the whim of economic cycles. Interest rates, for example, can greatly impact projects that drive demand for these products.

The 15 electrical systems stocks we track reported a slower Q2. As a group, revenues beat analysts’ consensus estimates by 1.6% while next quarter’s revenue guidance was 2.1% below.

Stocks, especially growth stocks with cash flows further into the future, had a good end of 2023. On the other hand, this year has seen more volatile stock market swings due to mixed inflation data, and electrical systems stocks have had a rough stretch. On average, share prices are down 6.6% since the latest earnings results.

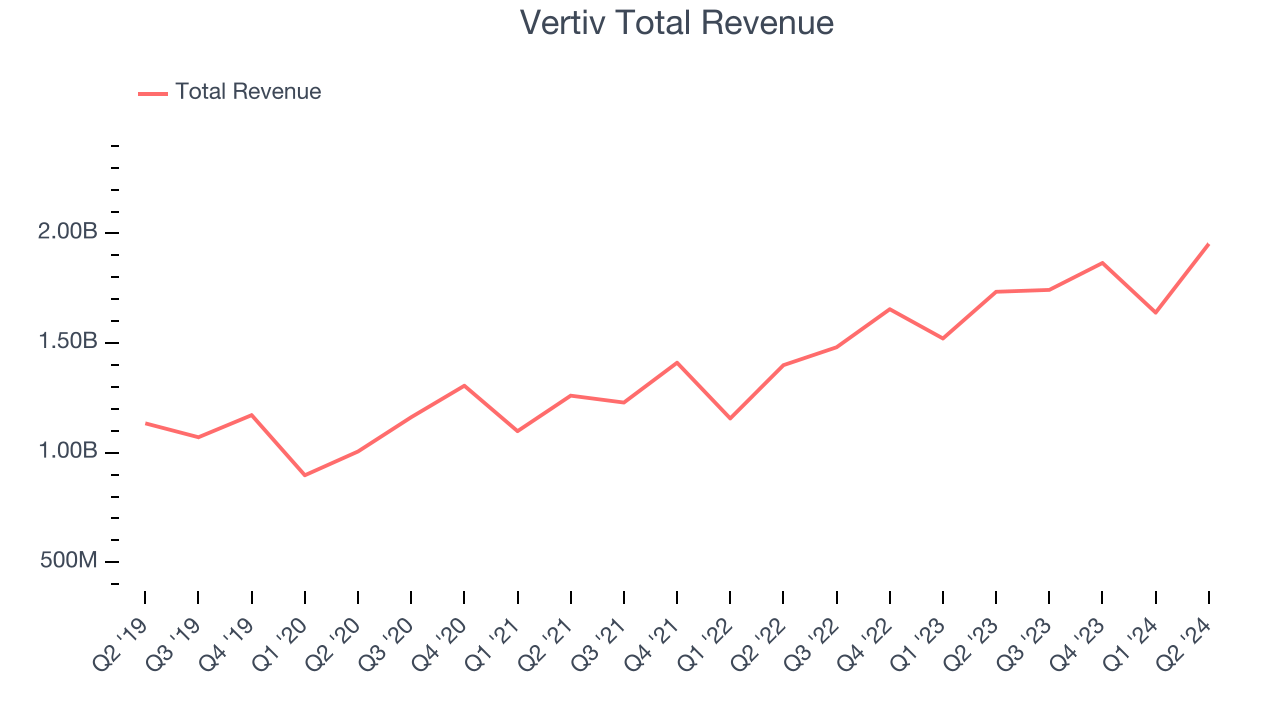

Vertiv (NYSE:VRT)

Formerly part of Emerson Electric, Vertiv (NYSE:VRT) manufactures and services infrastructure technology products for data centers and communication networks.

Vertiv reported revenues of $1.95 billion, up 12.6% year on year. This print was in line with analysts’ expectations, and overall, it was a strong quarter for the company with a solid beat of analysts’ earnings estimates.

“Vertiv delivered another strong performance in the second quarter with order growth again exceeding our expectations, rising 57% year-over-year and increasing 10% sequentially over an exceptional first quarter,” said Giordano Albertazzi, Vertiv’s Chief Executive Officer.

Unsurprisingly, the stock is down 18.3% since reporting and currently trades at $74.33.

Read why we think that Vertiv is one of the best electrical systems stocks, our full report is free.

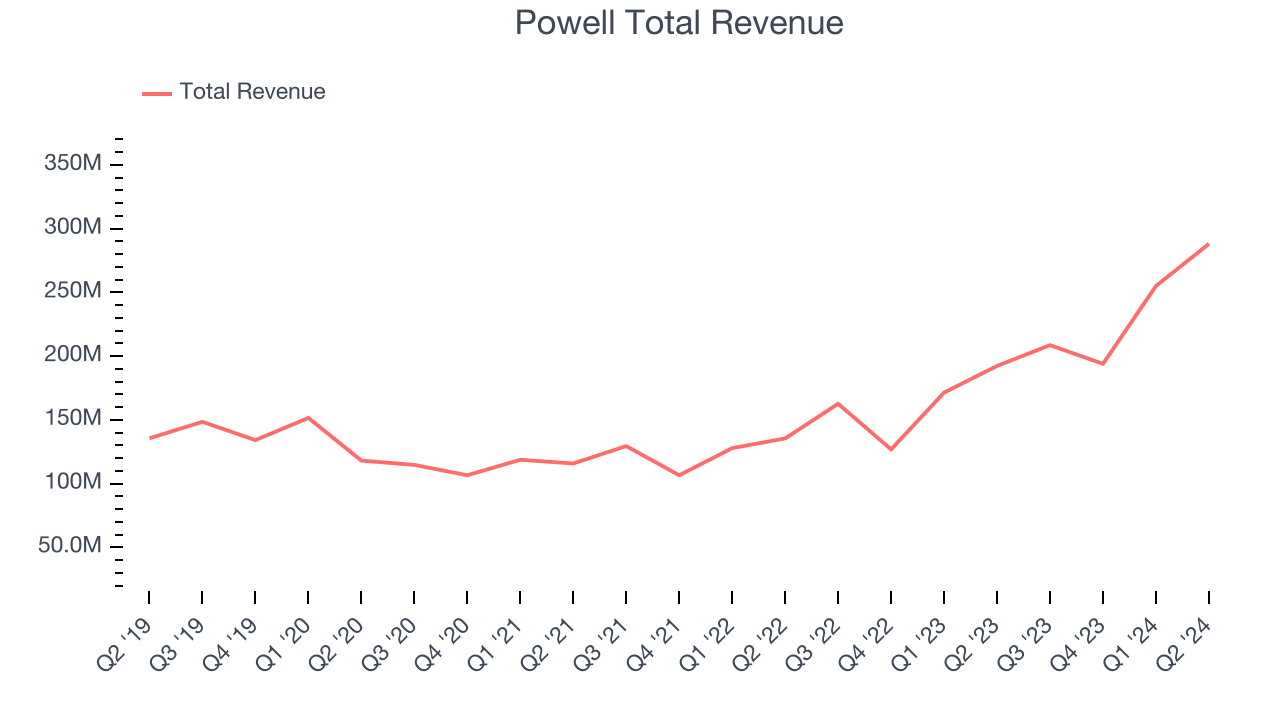

Best Q2: Powell (NASDAQ:POWL)

Originally a metal-working shop supporting local petrochemical facilities, Powell (NYSE:POWL) has grown from a small Houston manufacturer to a global provider of electrical systems.

Powell reported revenues of $288.2 million, up 49.8% year on year, outperforming analysts’ expectations by 29.7%. The business had an incredible quarter with an impressive beat of analysts’ earnings estimates.

Powell delivered the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 16% since reporting. It currently trades at $154.70.

Is now the time to buy Powell? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Kimball Electronics (NASDAQ:KE)

Founded in 1961, Kimball Electronics (NYSE:KE) is a global contract manufacturer specializing in electronics and manufacturing solutions for automotive, medical, and industrial markets.

Kimball Electronics reported revenues of $430.2 million, down 13.3% year on year, falling short of analysts’ expectations by 3.6%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations.

Kimball Electronics delivered the weakest performance against analyst estimates and weakest full-year guidance update in the group. As expected, the stock is down 16.7% since the results and currently trades at $17.03.

Read our full analysis of Kimball Electronics’s results here.

Hubbell (NYSE:HUBB)

A respected player in the electrical segment, Hubbell (NYSE:HUBB) manufactures electronic products for the construction, industrial, utility, and telecommunications markets.

Hubbell reported revenues of $1.45 billion, up 6.3% year on year. This result came in 2.1% below analysts' expectations. It was a slower quarter as it also recorded a miss of analysts’ organic revenue estimates.

The stock is up 3% since reporting and currently trades at $378.12.

Read our full, actionable report on Hubbell here, it’s free.

OSI Systems (NASDAQ:OSIS)

With a name reflecting its initial focus on optical sensors, OSI Systems (NASDAQ:OSIS) is a designer and manufacturer of specialized electronic systems and components.

OSI Systems reported revenues of $480.9 million, up 16.8% year on year. This result surpassed analysts’ expectations by 2.9%. Overall, it was a very strong quarter as it also provided full-year revenue guidance exceeding analysts’ expectations.

OSI Systems pulled off the highest full-year guidance raise among its peers. The stock is down 4% since reporting and currently trades at $138.81.

Read our full, actionable report on OSI Systems here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.