Intimatewear and beauty retailer Victoria’s Secret (NYSE:VSCO) reported results in line with analysts' expectations in Q4 FY2023, with revenue up 3% year on year to $2.08 billion. On the other hand, the company's full-year revenue guidance of $6 billion at the midpoint came in 3.2% below analysts' estimates. It made a non-GAAP profit of $2.58 per share, improving from its profit of $2.47 per share in the same quarter last year.

Victoria's Secret (VSCO) Q4 FY2023 Highlights:

- Revenue: $2.08 billion vs analyst estimates of $2.08 billion (small miss)

- EPS (non-GAAP): $2.58 vs analyst estimates of $2.46 (4.7% beat)

- Management's revenue guidance for the upcoming financial year 2024 is $6 billion at the midpoint, missing analyst estimates by 3.2% and implying -2.9% growth (vs -3.1% in FY2023) (operating income guidance for the year also missed)

- Gross Margin (GAAP): 39.7%, down from 61.1% in the same quarter last year

- Same-Store Sales were down 6% year on year (miss vs. expectations of down 3.7% year on year)

- Store Locations: 1,370 at quarter end, increasing by 12 over the last 12 months

- Market Capitalization: $2.06 billion

Spun off from L Brands in 2020, Victoria’s Secret (NYSE:VSCO) is an intimate clothing and beauty retailer that sells its own brands of lingerie, undergarments, and personal fragrances.

Earlier in its history, the company targeted males who wanted to buy lingerie for their partners without feeling uncomfortable in traditional department stores. Victoria's Secret has pivoted to targeting the wearers of these garments themselves, which tends to be a woman between 18 and 45 who feels empowered by sexy and fashion forward intimate apparel, sleepwear, and personal care products.

The company built its brand by hosting the extravagant Victoria's Secret Fashion Show featuring top supermodels. This show aired annually from 1995 to 2018 and was a much-talked-about event attracting millions of television viewers. In the subsequent years, though, the company faced criticism for its lack of inclusivity (race, body types, etc.), which led to more diversity in the company’s image and go-to-market approach.

The average size of a Victoria's Secret store is around 10,000 square feet and typically located in high-traffic shopping malls and strip centers alongside other retailers. In the Fashion Show days, stores were dark and adorned with lace and chandeliers to resemble a boudoir. After the revamping of brand image, stores became brighter and more inviting, with organized sections for undergarments, sleepwear, swimwear, and personal care.

Apparel Retailer

Apparel sales are not driven so much by personal needs but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

Retailers offering intimates, undergarments, and sleepwear for women include American Eagle’s (NYSE:AEO) Aerie brand and LVMH’s (ENXTPA:MC) La Perla brand as well as private companies ThirdLove and Adore Me.Sales Growth

Victoria's Secret is larger than most consumer retail companies and benefits from economies of scale, giving it an edge over its competitors.

As you can see below, the company's revenue has declined over the last four years, dropping 4.7% annually as its store count and sales at existing, established stores have both shrunk.

This quarter, Victoria's Secret's revenue grew 3% year on year to $2.08 billion, falling short of Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 1.1% over the next 12 months, a deceleration from this quarter.

Number of Stores

When a retailer like Victoria's Secret keeps its store footprint steady, it usually means that demand is stable and it's focused on improving operational efficiency to increase profitability. At the end of this quarter, Victoria's Secret operated 1,370 total retail locations, in line with its store count 12 months ago.

Taking a step back, the company has kept its physical footprint more or less flat over the last two years while other consumer retail businesses have opted for growth. A flat store base means that revenue growth must come from increased e-commerce sales or higher foot traffic and sales per customer at existing stores.

Same-Store Sales

Victoria's Secret's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 8.5% year on year. The company has been reducing its store count as fewer locations sometimes lead to higher same-store sales, but that hasn't been the case here.

In the latest quarter, Victoria's Secret's same-store sales fell 6% year on year. This performance was more or less in line with the same quarter last year.

Gross Margin & Pricing Power

Victoria's Secret has good unit economics for a retailer, giving it the opportunity to invest in areas such as marketing and talent to stay competitive. As you can see below, it's averaged a healthy 40.3% gross margin over the last two years. This means the company makes $0.40 for every $1 in revenue before accounting for its operating expenses.

Victoria's Secret produced a 39.7% gross profit margin in Q4, marking a 21.4 percentage point decrease from 61.1% in the same quarter last year. Although the company could've performed better, we care more about its long-term trends rather than just one quarter. Additionally, a retailer's gross margin can often change due to factors outside its control, such as product discounting and dynamic input costs (think distribution and freight expenses to move goods). We'll keep a close eye on this.

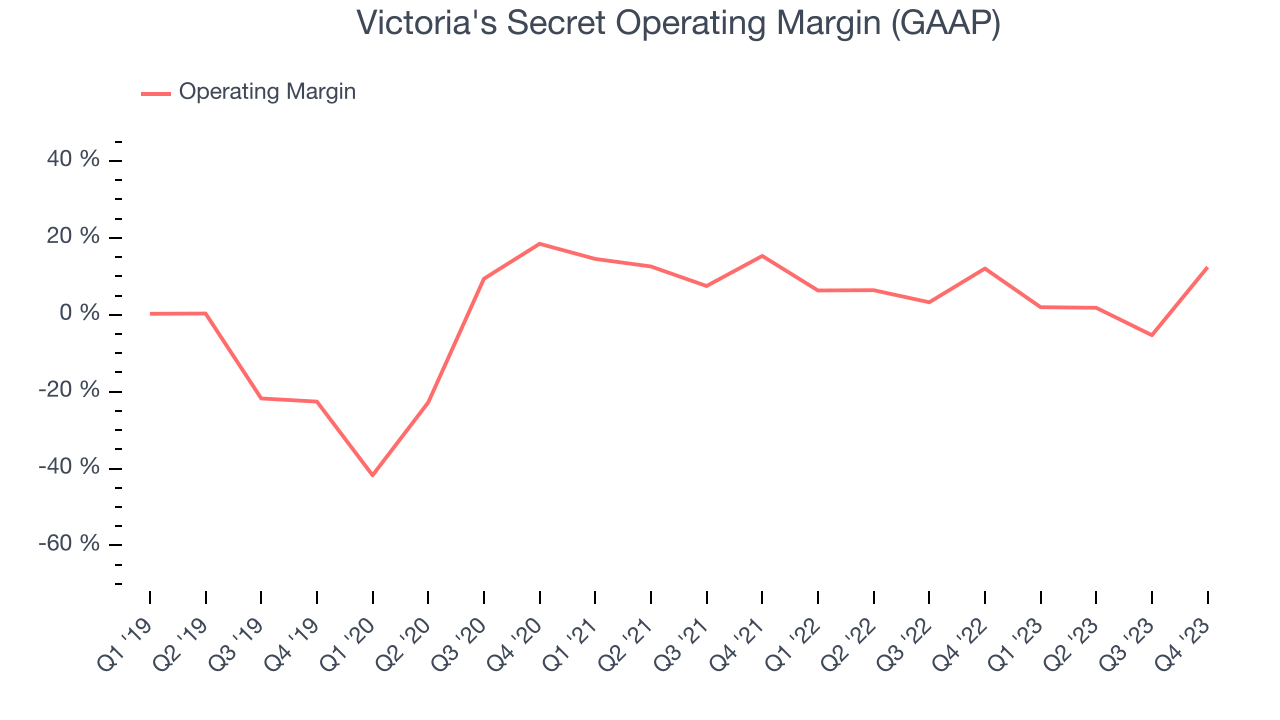

Operating Margin

Operating margin is a key profitability metric for retailers because it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

This quarter, Victoria's Secret generated an operating profit margin of 12.4%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Zooming out, Victoria's Secret was profitable over the last eight quarters but held back by its large expense base. It's demonstrated subpar profitability for a consumer retail business, producing an average operating margin of 5.8%. On top of that, Victoria's Secret's margin has declined, on average, by 3.6 percentage points year on year. This shows the company is heading in the wrong direction, and investors were likely hoping for better results.

Zooming out, Victoria's Secret was profitable over the last eight quarters but held back by its large expense base. It's demonstrated subpar profitability for a consumer retail business, producing an average operating margin of 5.8%. On top of that, Victoria's Secret's margin has declined, on average, by 3.6 percentage points year on year. This shows the company is heading in the wrong direction, and investors were likely hoping for better results.EPS

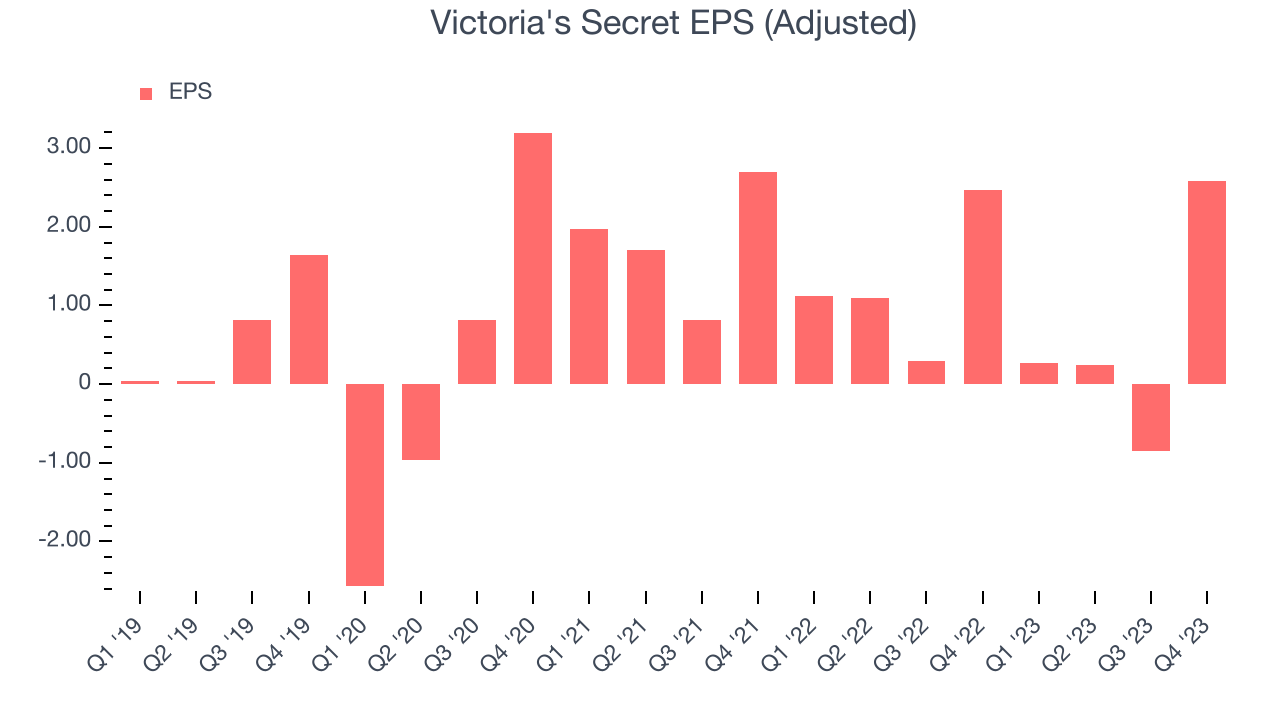

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

In Q4, Victoria's Secret reported EPS at $2.58, up from $2.47 in the same quarter a year ago. This print beat Wall Street's estimates by 4.7%.

Between FY2019 and FY2023, Victoria's Secret's adjusted diluted EPS dropped 12%, translating into 3.2% annualized declines. In a mature sector such as consumer retail, we tend to steer our readers away from companies with falling EPS. If there's no earnings growth, it's difficult to build confidence in a business's underlying fundamentals, leaving a low margin of safety around the company's valuation (making the stock susceptible to large downward swings).

On the bright side, Wall Street expects the company's earnings to grow over the next 12 months, with analysts projecting an average 10.3% year-on-year increase in EPS.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Victoria's Secret's five-year average ROIC was negative 8.1%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer retail sector.

Key Takeaways from Victoria's Secret's Q4 Results

While same store sales and revenue missed, gross margin outperformed and led to a narrow EPS beat vs Wall Street's estimates. On the other hand, its full-year revenue and operating income guidance missed analysts' expectations, with the latter quite a large amount below expectations. Overall, this was a mixed quarter for Victoria's Secret with the guidance surely dragging shares down. The company is down 15.3% on the results and currently trades at $21.68 per share.

Is Now The Time?

When considering an investment in Victoria's Secret, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We cheer for all companies serving consumers, but in the case of Victoria's Secret, we'll be cheering from the sidelines. Its revenue has declined over the last four years, but at least growth is expected to increase in the short term. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its relatively low ROIC suggests it has struggled to grow profits historically. On top of that, its shrinking same-store sales suggests it'll need to change its strategy to succeed.

Victoria's Secret's price-to-earnings ratio based on the next 12 months is 10.4x. While we've no doubt one can find things to like about Victoria's Secret, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $27.18 per share right before these results (compared to the current share price of $21.68).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.